Economy

We Are Not Responsible for Your Woes—CBN Tells Nigerians

By Aduragbemi Omiyale

The Governor of the Central Bank of Nigeria (CBN), Mr Yemi Cardoso, has absolved the bank from the current economic hardship the citizens are going through, saying he and his team are only part of the solution and not the problem.

He said this on Tuesday while briefing newsmen on the outcome of the first Monetary Policy Committee (MPC) meeting under his leadership.

Mr Cardoso was confirmed as the substantive leader of the central bank last September by the Senate after Mr Folashodun Shonubi, who sat on the seat in an acting capacity after the removal of Mr Godwin Emefiele in June 2023, was asked to go.

The new CBN chief delayed the rate-setting gathering till this month to the dismay of some observers.

While informing journalists of the decisions of the team, he said Nigerians should perish the thoughts that the central bank put them through their current woes.

“I laugh at that question but it’s not a laughing matter and I think it is very important for Nigerians to understand that the Central Bank Governor — I and my team — are not responsible for the woes that we have today; we are part of the solution,” Mr Cardoso responded to a question from a journalist.

At the meeting today, the MPC increased the Monetary Policy Rate (MPR) by 400 basis points or 4.00 per cent to 22.75 per cent from 18.75 per cent.

It also raised the Cash Reserve Ratio (CRR) by 12.5 per cent to 45.0 per cent from 32.5 per cent, but left the liquidity ratio intact at 30.0 per cent, while the Asymmetric Corridor is at +100 basis points/-700 basis points around the MPR.

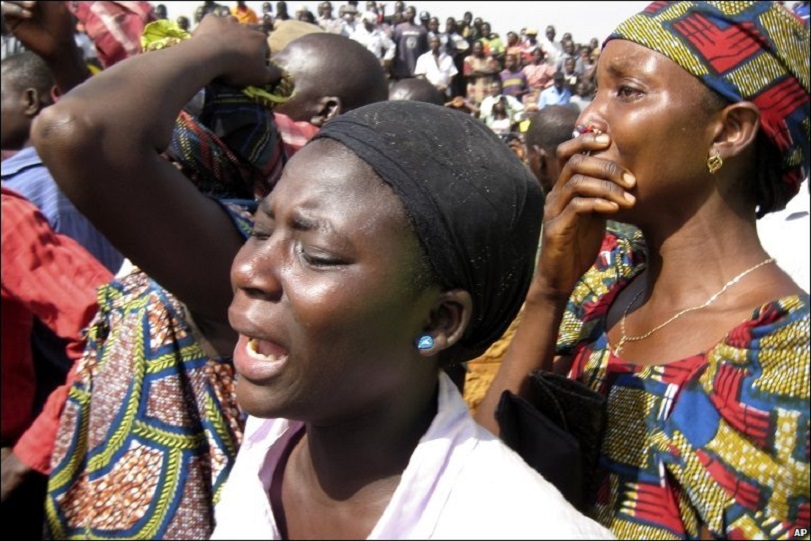

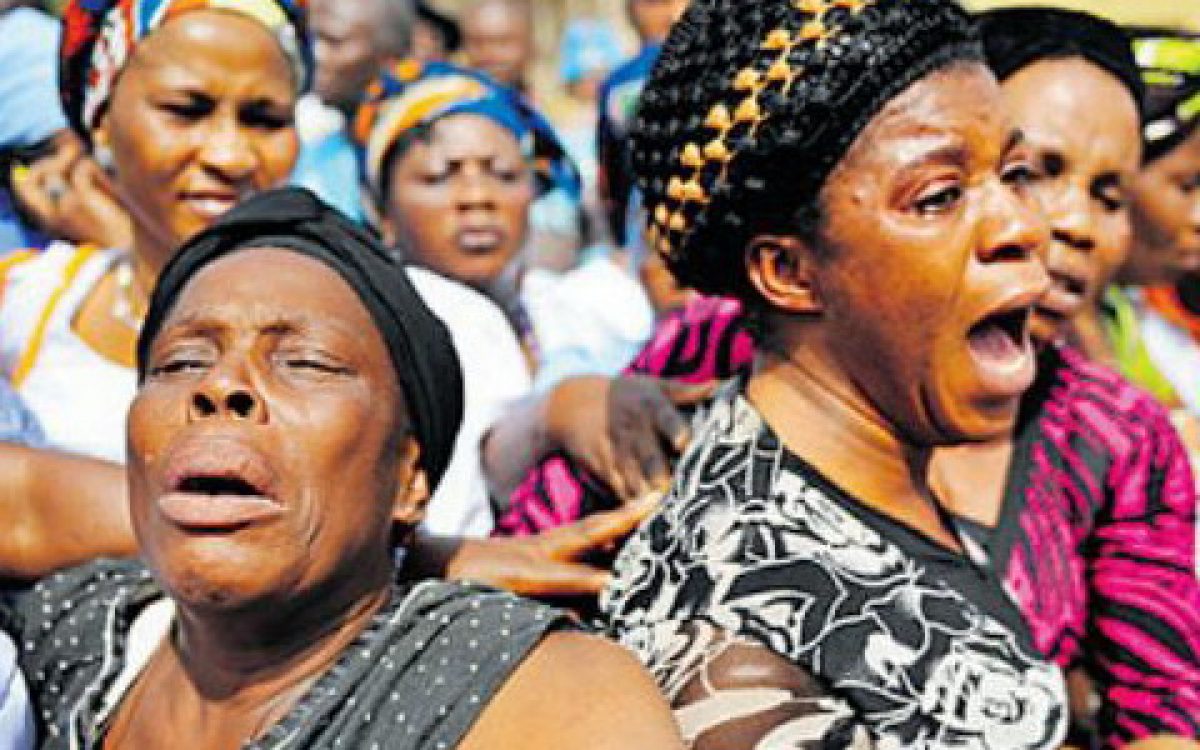

The Nigeria Labour Congress (NLC) started a two-day nationwide protest against hardship and hunger on Tuesday despite efforts by the federal government to stop it.

Nigerians across the country joined the demonstration, carrying placards with various messages, calling on the government to ease the hardship in the country.

The country is going through a tough time as a result of an end to petrol subsidy and the devaluation of the Naira triggered by the liberalisation of the exchange rates.

Economy

Unlisted Securities Market Gains 1.88%

By Adedapo Adesanya

Five price advancers buoyed the NASD Over-the-Counter (OTC) Securities Exchange by 1.88 per cent on Tuesday, March 3, as the demand for unlisted stocks continues to grow.

During the session, the market capitalisation added N46.64 billion to close at N2.524 trillion versus the Monday session’s N2.477 trillion, and the NASD Unlisted Security Index (NSI) increased by 77.94 points to finish at 4,219.47 points compared with the previous day’s 4,141.53 points.

11 Plc gained N13.23 yesterday to sell at N290.23 per share compared with the preceding session’s N277.00 per share, FrieslandCampina Wamco Nigeria Plc appreciated by N7.76 to N117.76 per unit from N110.00 per unit, Central Securities Clearing System (CSCS) Plc improved by N7.05 to N84.05 per share from N70.00 per share, First Trust Mortgage Bank Plc added 17 Kobo to close at N1.92 per unit versus N1.75 per unit, and Industrial and General Insurance (IGI) Plc advanced by 4 Kobo to settle at 49 Kobo per share versus 45 Kobo per share.

On the flip side, Food Concepts Plc dropped 37 Kobo to sell at N3.39 per unit compared with the previous day’s N3.76 per unit, and NASD Plc dipped 20 to N56.21 per share from N56.41 per share.

On Tuesday, the volume of securities went down by 19.6 per cent to 1.4 million units from 1.8 million units, but the value of securities increased by 447.2 per cent to N93.4 million from N17.1 million, and the number of deals soared by 118.5 per cent to 59 deals from 27 deals.

At the close of transactions, CSCS Plc remained the most active stock by value (year-to-date) with 35.8 million units sold for N2.2 billion, trailed by Okitipupa Plc with 6.3 million units worth N1.1 billion, and Geo-Fluids Plc exchanged 122.8 million units valued at N480.4 million.

The most active stock by volume (year-to-date) was Resourcery Plc with 1.05 billion units worth N408.7 million, followed by Geo-Fluids Plc with 122.8 million units worth N480.4 million, and CSCS Plc with 35.8 million units transacted for N2.2 billion.

Economy

Naira Depreciates at Official Market to N1,384/$1

By Adedapo Adesanya

The Naira continued to depreciate against the United States Dollar in the different segments of the foreign exchange (FX) market on Tuesday, March 4.

During the session, it lost N6.27 or 0.46 per cent in the Nigerian Autonomous Foreign Exchange Market (NAFEX) to close at N1,384.29/$1, in contrast to the previous trading day’s N1,378.02/$1.

The local currency depreciated against the Pound Sterling in the official market yesterday by N3.92 to quote at N1,842.22/£1 versus the previous day’s N1,846.14/£1, but gained N6.79 on the Euro to close at N1,606.19/€1 compared with Monday’s rate of N1,612.98/€1.

In the parallel market, the Naira further lost N10 against the Dollar during the trading day to settle at N1,375/$1 compared with the preceding session’s N1,375/$1, and at the GTBank FX desk, it was traded at N1,373/$1.

The exchange rate has been trending down for over 10 days following an unusual FX purchase activity by the Central Bank of Nigeria (CBN) at the official market in February.

However, the Naira is expected to trade with a stable bias in line with prevailing market demand and supply dynamics, supported by an improving external reserves position.

Nigeria’s strong net reserves position has been touted as enough, as it rose 50.5 per cent year-on-year to $34.8 billion in 2025 from $23.11 billion in 2024.

The Governor of the apex bank, Mr Yemi Cardoso, said that the growth in external reserves reflects stronger external sector fundamentals and sustained policy reforms.

He stated that the figures emphasised the benefits of increased transparency and credibility in foreign exchange management, boosting investor confidence, attracting stronger FX inflows, and improving reserve management practices aimed at preserving capital, ensuring liquidity, and supporting long-term sustainability.

As for the cryptocurrency market, most majors recovered from the weekend lows but couldn’t sustain it over a 24-hour trading period, leaving the market in a holding pattern while it waits for clarity on the Iran situation.

Cardano (ADA) slumped 3.5 per cent to $0.2600, Dogecoin (DOGE) dropped 2.7 per cent to trade at $0.0889, Ethereum (ETH) went down by 1.2 per cent to $1,970.48, Ripple (XRP) depreciated by 0.8 per cent to $1.35, and Solana (SOL) decreased by 0.6 per cent to sell at $85.22.

On the flip side, Litecoin (LTC) increased by 1.2 per cent to $54.60, Bitcoin (BTC) added 0.5 per cent to sell for $68,207.17, and Binance Coin (BNB) rose 0.1 per cent to $632.25, while the US Dollar Tether (USDT) and the US Dollar Coin (USDC) remained unchanged at $1.00 each.

Economy

Investors Gain N711bn Trading Nigerian Equities in One Day

By Dipo Olowookere

A 0.57 per cent growth was recorded by the Nigerian Exchange (NGX) Limited on Tuesday, resulting in the portfolios of investors swelling by N711 billion, with the market capitalisation closing at N126.199 trillion compared with the previous day’s N125.488 trillion.

In the same vein, the All-Share Index (ASI) increased at the close of transactions by 1,107.73 points to 196,621.96 points from 195,514.23 points.

Buying pressure was across the key sectors of the market yesterday, with the energy index outshining after it closed higher by 4.52 per cent. The insurance counter appreciated by 1.55 per cent, the consumer goods space improved by 0.88 per cent, the industrial goods sector gained 0.17 per cent, and the banking segment expanded by 0.04 per cent.

Investor sentiment was bullish after Customs Street finished with 39 price gainers and 35 price losers, representing a positive market breadth index.

Sunu Assurances gained 10.00 per cent to trade at N4.84, UAC Nigeria also appreciated by 10.00 per cent to N106.70, Oando grew by 9.96 per cent to N50.25, Sovereign Trust Insurance surged 9.88 per cent to N2.67, and Fortis Global Insurance rose by 9.71 per cent to N1.13.

Conversely, Fidson lost 10.00 per cent to settle at N81.00, Mecure decreased by 9,95 per cent to N68.30, Aluminium Extrusion slipped by 9.88 per cent to N15.50, McNichols gave up 8.26 per cent to quote at N7.00, and Deap Capital shed 8.17 per cent to N6.52.

A total of 880.0 million stocks worth N44.5 billion exchanged hands in 86,761 deals on Tuesday compared with the 789.9 million stocks valued at N35.1 billion traded in 84,259 deals on Monday, showing a spike in the trading volume, value, and number of deals by 11.41 per cent, 26.78 per cent, and 2.97 per cent, respectively.

Fortis Global Insurance led the activity chart with 58.4 million equities valued at N66.0 million, Sterling Holdco traded 56.8 million shares worth N461.0 million, Japaul exchanged 47.3 million stocks for N189.0 million, Zenith Bank transacted 40.9 million equities valued at N3.8 billion, and Jaiz Bank sold 38.7 million shares worth N483.7 million.

-

Feature/OPED6 years ago

Feature/OPED6 years agoDavos was Different this year

-

Travel/Tourism10 years ago

Lagos Seals Western Lodge Hotel In Ikorodu

-

Showbiz3 years ago

Showbiz3 years agoEstranged Lover Releases Videos of Empress Njamah Bathing

-

Banking8 years ago

Banking8 years agoSort Codes of GTBank Branches in Nigeria

-

Economy3 years ago

Economy3 years agoSubsidy Removal: CNG at N130 Per Litre Cheaper Than Petrol—IPMAN

-

Banking3 years ago

Banking3 years agoSort Codes of UBA Branches in Nigeria

-

Banking3 years ago

Banking3 years agoFirst Bank Announces Planned Downtime

-

Sports3 years ago

Sports3 years agoHighest Paid Nigerian Footballer – How Much Do Nigerian Footballers Earn