Economy

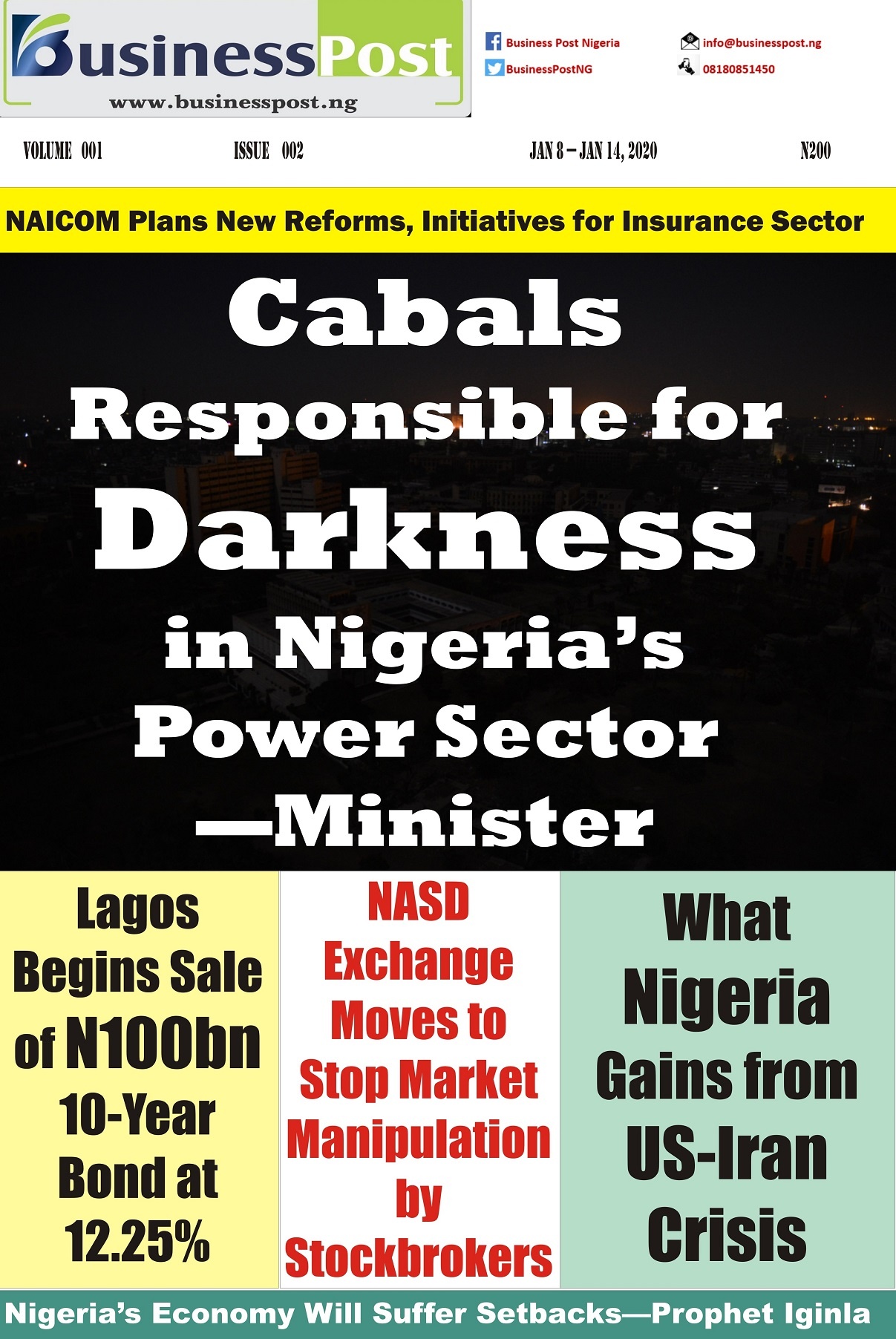

What Nigeria Gains From US-Iran Crisis

By Adedapo Adesanya

On Friday, January 3, 2020 the United States president, Mr Donald Trump, ordered an airstrike, which killed top Iranian General, Mr Qassem Soleimani, the head of Iran’s elite Quds military force and one of the most powerful figures in the country.

This spurred hike in oil prices as Brent crude oil futures, the global benchmark, coursed more than 4 percent, while the West Texas Intermediate (WTI) crude oil jumped more than 3 percent due to the escalation of the geopolitical tensions between the U.S. and Iran.

For a country like Nigeria, whose mainstay is oil, this development turned out to be a blessing because global events, which badly affect prices oil, have always been a major source of worry for government due to low revenues generated from the sale of the black gold.

But with the ongoing tensions from the assassination of the Iranian military chief, more money would continued to be raked from the sale of crude oil at higher prices.

In fact, Nigeria will like prices of oil to continue to trend higher at the global market because in the 2020 budget, the benchmark for crude oil was pegged at $60 per barrel.

Since last Friday, when the unmanned US drone attacked Mr Soleimani, prices have hovered around $70 (on Friday, January 3), $69 dollars over the weekend, and as the time of this report at $68 per barrel. This means prices are still in a safe net for the country.

By estimates, Nigeria produces over 1.5 million barrels of oil per day and at with an average increase of $69 per barrel since Friday, according to analysis by Business Post, the country has raked over $400 million so far from the sale of the commodity.

However, analysts have noted that a further escalation of the Mideast tensions could drive prices up as Iran’s Supreme Leader Ayatollah Ali Khamenei has vowed to inflict “severe retaliation” on those involved in Mr Soleimani’s death, and following this, the United States has also strengthened its military presence in and around the region.

A retaliation means that oil will rise with analysts saying that Iran’s could initiate attacks on oil tankers in the Persian Gulf, as it did in 2019 with a British tanker and a number of drones. This would provide support for oil prices but would be not hold on for much longer.

A bigger occurrence would be an attack on oil infrastructure of US allies in the Persian Gulf such as the September strikes on Saudi oil infrastructure, which led to a loss of 5.7 million barrels per day of oil production capacity when Iranian-backed Houthi rebels attacked the facilities.

The biggest would be if Iran closed off the Strait of Hormuz, which serves as a passageway for a major portion of the oil supply. Such an action would limit access to Asian markets where China, India, Japan and South Korea, some of the largest consumers are located.

However, even with the possible rise, oil prices face huge pressure from non-OPEC supplier like the United States, Brazil, and Norway, who would want to increase their output and eventually crash prices or lead the market to an oversupply which the OPEC and its allies – which includes Nigeria took a decision to curb by reducing oil production by 1.7 million barrels per day to help prices and stop oil glut this year.

But whichever way, Nigeria will continue to cash in on the crisis and use the opportunity to shore up its external reserves, which have depleted in recent times due to low prices of crude oil.

Economy

Afriland Properties Lifts NASD OTC Securities Exchange by 0.04%

By Adedapo Adesanya

Afriland Properties Plc helped the NASD Over-the-Counter (OTC) Securities Exchange record a 0.04 per cent gain on Tuesday, December 10 as the share price of the property investment rose by 34 Kobo to N16.94 per unit from the preceding day’s N16.60 per unit.

As a result of this, the market capitalisation of the bourse went up by N380 million to remain relatively unchanged at N1.056 trillion like the previous trading day.

But the NASD Unlisted Security Index (NSI) closed higher at 3,014.36 points after it recorded an addition of 1.09 points to Monday’s closing value of 3,013.27 points.

The NASD OTC securities exchange recorded a price loser and it was Geo-Fluids Plc, which went down by 2 Kobo to close at N3.93 per share, in contrast to the preceding day’s N3.95 per share.

During the trading session, the volume of securities bought and sold by investors increased by 95.8 per cent to 2.4 million units from the 1.2 million securities traded in the preceding session.

However, the value of shares traded yesterday slumped by 3.7 per cent to N4.9 million from the N5.07 million recorded a day earlier, as the number of deals surged by 27.3 per cent to 14 deals from 11 deals.

Geo-Fluids Plc remained the most active stock by volume (year-to-date) with 1.7 billion units sold for N3.9 billion, trailed by Okitipupa Plc with 752.2 million units valued at N7.8 billion, and Afriland Properties Plc with 297.5 million units worth N5.3 million.

Also, Aradel Holdings Plc remained the most active stock by value (year-to-date) with 108.7 million units worth N89.2 billion, followed by Okitipupa Plc with 752.2 million units valued at N7.8 billion, and Afriland Properties Plc with 297.5 million units sold for N5.3 billion.

Economy

Naira Trades N1,542/$1 as FX Speculators Dump Dollars in Panic

By Adedapo Adesanya

The Naira continued to appreciate on the US Dollar at the Nigerian Autonomous Foreign Exchange Market (NAFEM), gaining 0.7 per cent or N10.23 on Tuesday, December 10 to trade at N1,542.27/$1 compared with the preceding day’s N1,552.50/$1.

The Central Bank of Nigeria (CBN)-backed Electronic Foreign Exchange Matching System (EFEMS) platform introduced to tackle speculation and improve transparency in Nigeria’s FX market has been attributed as the source of the Naira’s appreciation.

Speculators holding foreign currencies, particularly the US Dollar, have seen the value of their money drastically drop due to the appreciation of the local currency. This is forcing them to dump greenback into the system and take the domestic currency alternative- a move that has seen available FX increase.

Equally, the domestic currency improved its value against the Pound Sterling in the official market during the trading day by N6.81 to sell for N1,955.12/£1 compared with Monday’s closing price of N1,961.93/£1 and against the Euro, it gained N10.84 to close at N1,613.00/€1, in contrast to the previous day’s rate of N1,623.84/€1.

Data from the FMDQ Securities Exchange showed that the value of forex transactions significantly increased yesterday by $228.85 million or 257.2 per cent to $401.17 million from the preceding session’s $112.32 million.

However, in the parallel market, the Nigerian currency weakened against the US Dollar on Tuesday by N5 to settle at N1,625/$1 compared with the previous day’s value of N1,620/$1.

In the cryptocurrency market, Dogecoin (DOGE) lost 4.8 per cent to sell at $0.39116, Litecoin (LTC) depreciated by 3.3 per cent to trade at $110.25, Binance Coin (BNB) went south by 2.3 per cent to $681.44, Ethereum (ETH) dropped 1.6 per cent to finish at $3,671.08, and Cardano (ADA) slid by 0.5 per cent to $0.8837

Conversely, Ripple (XRP) jumped by 5.4 per cent to $2.23 amid a continued shift for the coin with its parent company seeing the benefits of a crypto-friendly regulatory environment for US-based companies.

XRP is closely related to Ripple Labs, a high-profile payments company targeted by the SEC in 2020 on allegations of selling the token as a security to U.S. investors. Ripple fully cleared a long-drawn court case in 2024.

Further, Solana (SOL) expanded by 0.8 per cent to $219.75, Bitcoin (BTC) grew by 0.4 per cent to $97,446.95, while the US Dollar Tether (USDT) and the US Dollar Coin (USDC) remained unchanged at $1.00 each.

Economy

Chinese Demand, Europe, Syria Development Buoy Oil Prices

By Adedapo Adesanya

Oil prices rose on Tuesday, influenced by increasing demand in China, the world’s largest buyer, as well as developments in Europe and Syria, with Brent crude futures closing at $72.19 per barrel after chalking up 5 cents or 0.07 per cent while the US West Texas Intermediate finished at $68.59 a barrel after it gained 22 cents or 0.32 per cent.

China will adopt an “appropriately loose” monetary policy in 2025 as the world’s largest oil importer tries to spur economic growth. This would be the first easing of its stance in 14 years.

Chinese crude imports also grew annually for the first time in seven months, jumping in November on a year-on-year basis.

Speculation about winter demand in Europe also contributed to the rise in prices as the period has been known for high demand.

In Syria, rebels were working to form a government and restore order after the ousting of President Bashar al-Assad, with the country’s banks and oil sector set to resume work on Tuesday.

Although Syria itself is not a major oil producer, it is strategically located and has strong ties with Russia and Iran – two of the world’s largest oil producers.

Market analysts noted that the tensions in the Middle East seem contained, which led market participants to price for potentially low risks of a wider regional spillover leading to significant oil supply disruption.

The market is also looking forward to the US Federal Reserve, which is expected to make a 25 basis point cut to interest rates at the end of its December 17-18 meeting.

This move could improve oil demand in the world’s biggest economy, though traders are waiting to see if this week’s inflation data derails the cut.

Crude oil inventories in the US rose by 499,000 barrels for the week ending November 29, according to The American Petroleum Institute (API). Analysts had expected a draw of 1.30 million barrels.

For the week prior, the API reported a 1.232-million barrel build in crude inventories.

So far this year, crude oil inventories have fallen by roughly 3.4 million barrels since the beginning of the year, according to API data.

Official data from the US Energy Information Administration (EIA) will be released later on Wednesday.

Also, the market is getting relief from the recent decision of selected members of the Organisation of the Petroleum Exporting Countries and its allies, OPEC+ to delay the rollback of 2.2 million barrels per day of oil production cuts to April from January. Another 3.6 million barrels per day in output reductions across the OPEC+ group has been extended to the end of 2026 from the end of 2025.

-

Feature/OPED5 years ago

Feature/OPED5 years agoDavos was Different this year

-

Travel/Tourism8 years ago

Lagos Seals Western Lodge Hotel In Ikorodu

-

Showbiz2 years ago

Showbiz2 years agoEstranged Lover Releases Videos of Empress Njamah Bathing

-

Banking6 years ago

Banking6 years agoSort Codes of GTBank Branches in Nigeria

-

Economy2 years ago

Economy2 years agoSubsidy Removal: CNG at N130 Per Litre Cheaper Than Petrol—IPMAN

-

Banking2 years ago

Banking2 years agoFirst Bank Announces Planned Downtime

-

Sports2 years ago

Sports2 years agoHighest Paid Nigerian Footballer – How Much Do Nigerian Footballers Earn

-

Technology4 years ago

Technology4 years agoHow To Link Your MTN, Airtel, Glo, 9mobile Lines to NIN