Economy

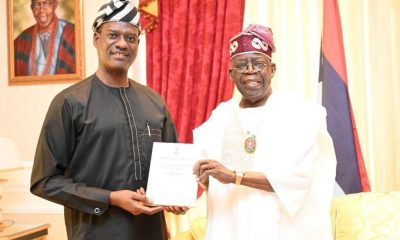

Zero Tax on Gifts, Salaries, Insurance as Oyedele Reels Out Benefits

By Adedapo Adesanya

Ahead of the January 2026 implementation of Nigeria’s new tax laws, the Chairman of the Presidential Fiscal Policy and Tax Reforms Committee, Mr Taiwo Oyedele, has continued to reel out the benefits of the expected changes.

According to the tax titan, the new tax laws will provide many reliefs and exemptions for low-income earners, average taxpayers, and small businesses in the country.

In an update on his X handle on Monday, Mr Oyedele noted that small businesses, including individuals earning the national minimum wage or less, and those earning annual gross income up to N1,200,000 (translating to about N800,000 taxable income) will benefit from the tax relief.

There will also be reduced PAYE tax for those earning annual gross income up to N20 million.

He also disclosed that gifts will also be exempt from being taxed.

Mr Oyedele further listed items to benefit from the tax relief as:

Allowable Deduction & Reliefs For Individuals

5. Pension contribution to PFA

6. National Health Insurance Scheme

7. National Housing Fund contributions

8. Interest on loans for owner-occupied residential housing

9. Life insurance or annuity premiums

10. Rent relief – 20 per cent of annual rent (up to N500,000)

Pensions & Gratuities – Exempt

11. Pension funds and assets under the Pension Reform Act (PRA) are tax-exempt.

12. Pension, gratuity or any retirement benefits granted in line with the PRA.

13. Compensation for loss of employment up to N50 million.

Capital Gains Tax (CGT) – Exempt

14. Sale of an owner-occupied house

15. Personal effects or chattels worth up to N5 million

16. Sale of up to two private vehicles per year

17. Gains on shares below N150 million per year or gains up to N10 million

18. Gains on shares above exemption threshold if the proceeds are reinvested

19. Pension funds, charities, and religious institutions (non-commercial)

Companies Income Tax (CIT) – Exempt

20. Small companies (turnover not more than N100 million and total fixed assets not more than N250 million) will pay 0 per cent tax.

Business Post reports that small business represent a huge chunk of employers of labour with data from National Bureau of Statistics (NBS) showing that the country has around 41.5 million micro, small, and medium-enterprises, contributing about 48 per cent of gross domestic product (GDP).

21. Eligible (labelled) startups are exempt

22. Compensation relief – 50 per cent additional deduction for salary increases, wage awards, or transport subsidies for low-income workers

23. Employment relief – 50 per cent deduction for salaries of new employees hired and retained for at least three years

24. Tax holiday for the first 5-years for agricultural businesses (crop production, livestock, dairy etc)

25. Gains from investment in a labeled startup by venture capitalists, private equity funds, accelerators, or incubators

Development Levy – Exempt

27. Small companies are exempt from 4 per cent development levy

Withholding Tax – Exempt

28. Small companies, manufacturers and agric businesses are exempt from withholding tax deduction on their income

29. Small companies are exempt from deduction on their payments to suppliers

Value Added Tax (VAT) – 0% or Exempt

30. Basic food items – 0 per cent VAT

31. Rent – Exempt

32. Education services and materials – 0 per cent VAT

33. Health and medical services

34. Pharmaceutical products – 0 per cent VAT

35. Small companies (≤ N100m turnover) are exempt from charging VAT

36. Diesel, petrol, and solar power equipment – VAT suspended or exempt

Refund of VAT on assets and overheads to produce VATable or 0 per cent VAT goods and services

37. Agricultural inputs – fertilizers, seeds, seedlings, feeds, and live animals

38. Purchase, lease, or hire of equipment for agric purposes

39. Disability aids – hearing aids, wheelchairs, braille materials

40. Transport – shared passenger road transport (non-charter)

Electric vehicles and parts – exempt

41. Humanitarian supplies – exempt

42. Baby products

43. Sanitary towels, pads or tampons

44. Land and building

Stamp Duties – Exempt

45. Electronic money transfers below N10,000

46. Salary payments

47. Intra-bank transfers

48. Transfers of government securities or shares

49. All documents for transfer of stocks and shares.

Economy

Naira Closes Flat at N1,393/$1 at Official Market

By Adedapo Adesanya

The Naira halted two consecutive weeks of depreciation in the Nigerian Autonomous Foreign Exchange Market (NAFEX) on Monday, March 9, by remaining unchanged at N1,393.26/$1.

However, against the Pound Sterling, it further depreciated by N3.07 yesterday to trade at N1,863.06/£1 compared with last Friday’s value of N1,859.99/£1, and lost 65 Kobo against the Euro to close at N1,612.14/€1 versus the preceding session’s rate of N1,611.49/€1.

In the black market, the Nigerian Naira crashed against the Dollar yesterday by N10 to quote at N1,415/$1 compared with the N1,405/$1 it was exchanged in the previous trading session, and at the GTBank FX desk, it weakened by N9 to sell for N1,419/$1 versus the previous value of N1,410/$1.

The Naira’s performance comes as rising demand for foreign payments is outpacing supply, heightening worries that the domestic currency is entering the threshold it hasn’t traded in over two months.

Despite this, there appears to be a rise in foreign exchange inflows into the country’s currency market, with data from Coronation Merchant Bank showing that in the past week, FX inflows into the market have strengthened. As of the end of last week, total FX inflows into the Nigerian market settled at $1.26 billion, representing an increase of 17.76 per cent compared with $1.07 billion recorded in the previous week.

In the cryptocurrency market, tensions that have spurred higher energy prices and reignited inflation fears, which could potentially delay Federal Reserve rate cuts, eased after US President Donald Trump said the war with Iran could be over soon. This led to crypto and equity markets adding to gains following the comments.

Solana (SOL) appreciated by 5.6 per cent to $86.05, Ethereum (ETH) expanded by 5.5 per cent to $2,024.18, Bitcoin (BTC) added 4.6 per cent to sell for $68,802.86, Binance Coin (BNB) gained 4.1 per cent to trade at $639.78, and Cardano (ADA) jumped 3.3 per cent to $0.2582.

Further, Dogecoin (DOGE) grew by 2.9 per cent to $0.0914, Litecoin (LTC) went up by 2.8 per cent to $54.10, and Ripple (XRP) improved by 2.4 per cent to $1.37, while the US Dollar Tether (USDT) and the US Dollar Coin (USDC) traded flat at $1.00 each.

Economy

Petrol Sells N1,230 Per Litre in Lagos After Surge in Crude Oil Prices

By Dipo Olowookere

The rise in the prices of crude oil grades on the global market as a result of the attacks on Iran by the duo of the United States and Israel has triggered an increase in the price of premium motor spirit (PMS), otherwise known as petrol, in Nigeria.

This reporter observed that some petrol stations dispensing the product to consumers were selling above N1,200 on Monday evening.

In the areas monitored by Business Post yesterday in the Alimosho area of Lagos State, most of the fuel stations selling PMS did so at between N1,200 and N1,230 per litre.

A retailer around Jendol Superstores on Ipaja Road, dispensing at N1,020 to motorists, witnessed a long queue on Monday evening, causing traffic gridlock that stretched to Abesan Roundabout.

But the others selling at N1,230, especially in the Okunola area of Alimosho, had few vehicles, while many others shut their gates and were not selling.

It was gathered that the pump price rose to N1,230 per litre yesterday evening, as many of them sold at N1,050 per litre in the morning.

“The situation is crazy,” a motorist, who spoke with the newspaper, lamented.

“But why is petrol very expensive in Nigeria when we were not bombed like Saudi Arabia?” another consumer, who identified himself as Mr Tayo Goriola, queried.

An analyst speaking on Nigeria Info 99.3 FM Lagos on Monday, Mr Majeed Dahiru, said it was wrong for the government to hand off subsidy on energy because of situations like this.

“This was what some of us foresaw when we said the government cannot remove a safety net called a subsidy on energy because of times like this.

“As we speak, all others have triggered their safety mechanisms to stabilise prices, including in the UAE and Saudi Arabia, which have come under attack, unlike Nigeria, which has not been attacked,” he said on Dailies Today with Kofi Bartels yesterday.

Petrol prices went up on Monday after the crude oil hit $105 per barrel, and there are fears that the war could jack prices up to $150 per barrel, which could raise PMS to N1,500 or N2,000 per litre in Nigeria.

Meanwhile, Dangote Refinery has assured Nigerians of sufficient supply of PMS during this period, saying, “With government support and steady access to domestic crude, Dangote Refinery will continue to meet all of Nigeria’s refined fuel requirements.”

Economy

NNPC Grows Profit to N385bn Amid 46.7% Fall in January Revenue

By Aduragbemi Omiyale

In January 2026, the Nigerian National Petroleum Company (NNPC) Limited recorded a 9.69 per cent rise in profit after tax amid a 46.70 per cent decline in revenue.

According to its latest monthly report summary for the first month of this year, the net profit for the period under consideration stood at N385 billion compared with the N351 billion recorded in December 2025.

The state-owned oil firm disclosed that in January 2026, it generated a revenue of N2.571 trillion, in contrast to the N4.824 trillion achieved a month earlier.

The NNPC also revealed that in the month, the crude oil and condensate production stood at 1.64 million barrels per day, higher than the 1.54 million barrels per day in the preceding month.

Also, the natural gas output increased in the month under review to 7,283 mmscf/d versus 6,914 mmscf/d in December 2025, as the upstream pipeline availability dipped to 96 per cent from 100 per cent a month earlier.

The surge in production was attributed to the completion of Turn Around Maintenance (TAM) at Agbami and Renaissance (Estuary Area – EA), though planned deliveries for January were reduced due to bad weather, evacuation, and asset integrity challenges.

As for the Ajaokuta-Kaduna-Kano (AKK) gas pipeline, the NNPC said pre-commissioning activities continued while significant progress was reported in the construction of the Block Valve Stations (BVS) and Intermediate Pigging Stations (IPS). The project is 92 per cent completed.

Giving an update on the Obiafu-Obrikom-Oben (OB3) gas pipeline, it said the drilling activities progressed as scheduled in the OB3 River Niger crossing.

The company also said the Financial Literacy Program for 2026 Batch A, Stream 1 NYSC Corps Members was successfully conducted on Sunday, January 25, 2026, via online streaming. The session reached 79,657 participants across the 36 states and the FCT, bringing the cumulative number of corps members trained under the program to 1,231,081.

-

Feature/OPED6 years ago

Feature/OPED6 years agoDavos was Different this year

-

Travel/Tourism10 years ago

Lagos Seals Western Lodge Hotel In Ikorodu

-

Showbiz3 years ago

Showbiz3 years agoEstranged Lover Releases Videos of Empress Njamah Bathing

-

Banking8 years ago

Banking8 years agoSort Codes of GTBank Branches in Nigeria

-

Economy3 years ago

Economy3 years agoSubsidy Removal: CNG at N130 Per Litre Cheaper Than Petrol—IPMAN

-

Banking3 years ago

Banking3 years agoSort Codes of UBA Branches in Nigeria

-

Banking3 years ago

Banking3 years agoFirst Bank Announces Planned Downtime

-

Sports3 years ago

Sports3 years agoHighest Paid Nigerian Footballer – How Much Do Nigerian Footballers Earn