Feature/OPED

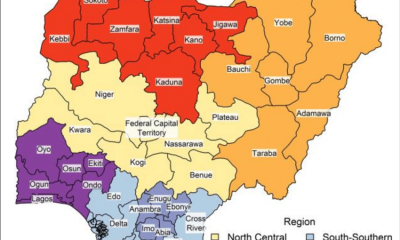

A Nation on its Path to Golgotha

By Jerome-Mario Chijioke Utomi

Even though it qualifies as a national tragedy that deserves every attention, it is important to underline that the present piece is not a direct reaction to the recently reported bombing by ‘terrorist’ of a moving train along the Abuja-Kaduna rail track- an incident that resulted in the death of some innocent Nigerians and the kidnap of many, with others sustaining varying degrees of injury.

However, in an applied sense, the ugly incident also rings a bell to the fact that when the present federal government emerged, precisely on May 29, 2015, my generation and of course Nigerians with critical minds, looking at their lavishly made promises, expected that the positive result of democratic practice as evident in other nations, would be replicated here to at the very least, assist cushion the poor electricity crisis, bring to an end the problem of galloping youth unemployment in the country, send back to school our innocent children that are out of school not because they were not willing to be educated but because their socioeconomically disempowered parents were unable to pay their school fees.

That was the hope. Never did Nigerians envisage that President Muhammadu Buhari led administration would abysmally fail in protecting lives and property and the economic welfares of Nigerians which of course are the two constitutional responsibilities of any elected president.

Today, the administration has failed to the point that terrorists/bandits are now so audacious and daring in their attacks to the nation’s major public facilities; airports, and train stations among others.

Way back in 2015, the masses never contemplated that one day, bandits/terrorists will stop a moving train in the country.

But contrary to that expectation, they are presently not only witnesses to tears occasioned by such unimagined action, rather, but the tears by Nigerians have also refused to go away because their hopes for a healthy economy have been dashed, promises made by this government at the centre recanted and chances of building a more united Nigeria waned and expectations of all now hang in the balance. What is more, less hope for the future?

The frustrations resulting from these failings, failures and disappointments gaze Nigerians on their faces, and presently manifest in challenges such as; irredeemable insecurity in the country, absence of water, no petrol, skyrocketed the price of diesel, perennial electricity crisis, outrageous number of out of school which currently stands at an all-time high of over 10.2 million with girls leading in number, and unemployment rate, going by the NBS report stands at outrageous 33%.

The pain of these tragedies is deepened by the fact that they were avoidable.

While many, going by commentaries, believe that no nation-best typifies a country in dire need of peace and social cohesion among her various sociopolitical groups in Nigeria as myriads of sociopolitical contradictions have conspired directly and indirectly to give the unenviable tag of a country in constant search of social harmony, justice, equity, equality, and peace, others believe that our country Nigeria is awash with captivating development visions, policies and plans, but impoverished leadership and corruption-induced failure of implementation of development projects on the part of the political leaders are responsible for the under-development in the country. To the rest, President Muhammadu Buhari’s below-average performance has set the nation on its path to Golgotha.

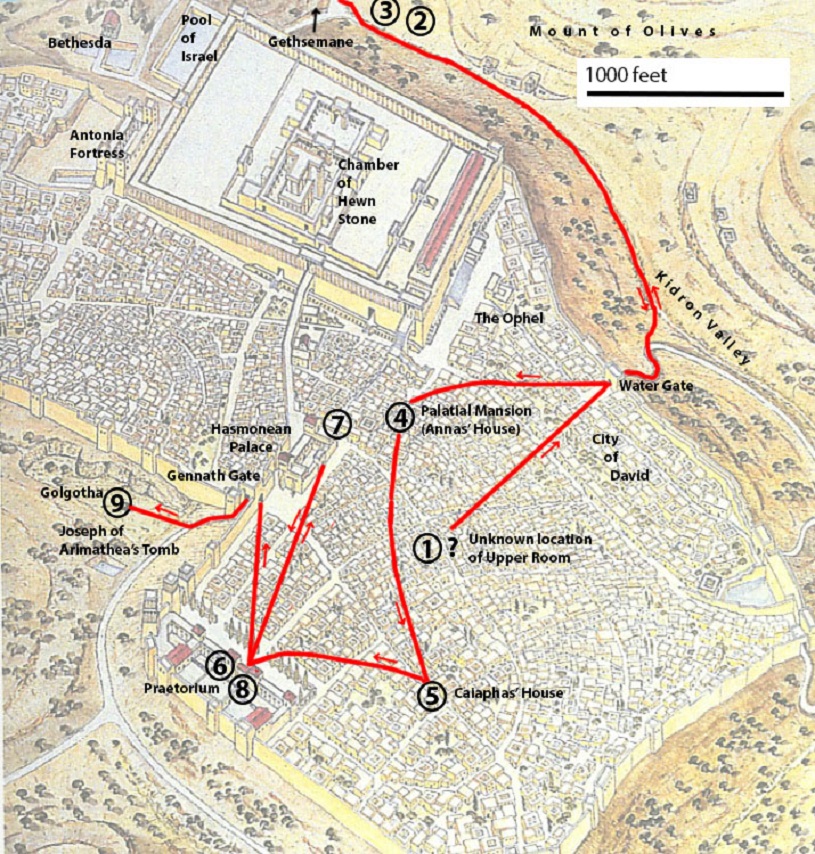

Golgotha, as we know, is the common name of the spot, a hill near Jerusalem where Jesus was crucified; it is a place of suffering, a place of burial. It is interpreted by the evangelists as meaning “the place of a skull” (Matthew 27:33; Mark 15:22; John 19:17).

Of course, Nigeria and Nigerians may not have physically gone to Golgotha to suffer, crucified, died and buried, yet, such assertion may not be wrong looking at the daily occurrence in the country. As right-thinking citizens, we stand crucified emotionally each time ‘we stand and watch the sufferings of our dear ones, the poverty of our people, their tattered clothes, malnutrition, no water, and no electricity’.

Nigerians have in the past seven years come to the sudden realization that it is harder to watch the pains of those we love than to bear our own pains.

Even more, the nation’s social and economic journey to Golgotha gets quickened when one remembers that currently, the greatest and immediate danger to the survival of the Nigerian state is the unwarranted, senseless, premeditated, well organized and orchestrated killings across the country.

What about the nation’s economy?

As noted a while ago by Raymond Anoliefo, Priest and Director, Justice Development and Peace Commission,(JDPC), Lagos, a social justice arm of the Catholic church that monitors social, economic, political and public leadership-related activities in the country, the country’s economy has shown its inability to sustain any kind of meaningful growth that promotes the social welfare of the people. The result can be seen in the grinding poverty in the land (eighty per cent of Nigerians are living on less than two dollars per day – according) to the African Development Bank (AFDB) 2018 Nigeria Economic Outlook. Nigeria is ranked among the poorest countries in the world.

Sadly, the running of our country’s economy continues to go against the provisions of our constitution which stipulates forcefully that the commanding heights of the economy must not be concentrated in the hands of a few people.

The continuous takeover of national assets through dubious (privatization) programs by politicians and their collaborators are deplorable and clearly against the people of Nigeria. The attempt to disengage governance from public sector control of the economy has only played into the hands of private profiteers of goods and services to the detriment of the Nigerian people.

Away from economy to education, evidence abounds that 10.5 million children are out of school in Nigeria, the highest in the world.

Our industries continue to bear the brunt of a negative economic environment. As a result, job losses and unemployment continue to skyrocket, creating a serious case of social dislocation for the vast majority of our people.

Academic Staff Union of Universities (ASUU) has faced unprecedented hardship as the nation continues to deprive them of legitimately earned salaries. It is quite unfortunate that as a Nation we are still debating minimum wage, and not even living wage, especially in a country where every commodity has skyrocketed save the monthly take-home of workers. And we supposedly have “leaders” who claim to have the interest of the masses at heart. Tell me another lie!!!

On social issues, Life in Nigeria, quoting Thomas Hobbs, has become nasty, brutish, and short. Nigerians have never had it so bad. Indeed, while Nigerians diminish socially and economically, the privileged political class continues to flourish in obscene splendour as they pillage and ravage the resources of our country at will.

This malfeasance at all levels of governance has led to the destruction of social infrastructure relevant to a meaningful and acceptable level of social existence for our people. Adequate investment in this area, it has been shown, is clearly not the priority of those in power.

As to the solution to these challenges, leadership, the cleric noted, holds the key to unlocking the transformation question in Nigeria, but to sustain these drives, leaders must carry certain genes and attributes that are representative of this order.

It is only a sincere and selfless leader and a politically and economically restructured polity brought about by national consensus that can unleash the social and economic forces that can ensure the total transformation of the country and propel her to true greatness.

This will help to ensure that there is the provision of adequate social infrastructures such as genuine poverty alleviation programmes and policies, healthcare, education, job provision, massive industrialization, and electricity, to mention a few.

It is critical to jettison this present socio-economic system that has bred corruption, inefficiency, primitive capital accumulation and socially excluded the vast majority of our people. The only way this can be done is to work to build a new social and political order that can mobilize the people around common interests, with visionary leadership to drive this venture. Only then can we truly begin to resolve some of the socio-economic contradictions afflicting the nation. This is the pathway to true, genuine and lasting peace.

Utomi Jerome-Mario is the Programme Coordinator (Media and Policy), Social and Economic Justice Advocacy (SEJA), Lagos. He can be reached via je*********@***oo.com/08032725374

Feature/OPED

Daniel Koussou Highlights Self-Awareness as Key to Business Success

By Adedapo Adesanya

At a time when young entrepreneurs are reshaping global industries—including the traditionally capital-intensive oil and gas sector—Ambassador Daniel Koussou has emerged as a compelling example of how resilience, strategic foresight, and disciplined execution can transform modest beginnings into a thriving business conglomerate.

Koussou, who is the chairman of the Nigeria Chapter of the International Human Rights Observatory-Africa (IHRO-Africa), currently heads the Committee on Economic Diplomacy, Trade and Investment for the forum’s Nigeria chapter. He is one of the young entrepreneurs instilling a culture of nation-building and leadership dynamics that are key to the nation’s transformation in the new millennium.

The entrepreneurial landscape in Nigeria is rapidly evolving, with leaders like Koussou paving the way for innovation and growth, and changing the face of the global business climate. Being enthusiastic about entrepreneurship, Koussou notes that “the best thing that can happen to any entrepreneur is to start chasing their dreams as early as possible. One of the first things I realised in life is self-awareness. If you want to connect the dots, you must start early and know your purpose.”

Successful business people are passionate about their business and stubbornly driven to succeed. Koussou stresses the importance of persistence and resilience. He says he realised early that he had a ‘calling’ and pursued it with all his strength, “working long weekends and into the night, giving up all but necessary expenditures, and pressing on through severe setbacks.”

However, he clarifies that what accounted for an early success is not just tenacity but also the ability to adapt, to recognise and respond to rapidly changing markets and unexpected events.

Ambassador Koussou is the CEO of Dau-O GIK Oil and Gas Limited, an indigenous oil and natural gas company with a global outlook, delivering solutions that power industries, strengthen communities, and fuel progress. The firm’s operations span exploration, production, refining, and distribution.

Recognising the value of strategic alliances, Koussou partners with business like-minds, a move that significantly bolsters Dau-O GIK’s credibility and capacity in the oil industry. This partnership exemplifies the importance of building strong networks and collaborations.

The astute businessman, who was recently nominated by the African Union’s Agenda 2063 as AU Special Envoy on Oil and Gas (Continental), admonishes young entrepreneurs to be disciplined and firm in their decision-making, a quality he attributed to his success as a player in the oil and gas sector. By embracing opportunities, building strong partnerships, and maintaining a commitment to excellence, Koussou has not only achieved personal success but has also set a benchmark for future generations of African entrepreneurs.

His journey serves as a powerful reminder that with determination and vision, success is within reach.

Feature/OPED

Pension for Informal Workers Nigeria: Bridging the Pension Gap

***The Case for Informal Sector Pensions in Nigeria

***A Crucial National Conversation

By Timi Olubiyi, PhD

In Nigeria today, the phrase “pension” evokes many different mixed reactions. For many civil servants and people in the corporate world, it conjures a bit of hope, but for the majority in the informal sector, who are in the majority in Nigeria, it is bleak. Millions of Nigerians are facing old age without any financial security due to a lack of retirement plans and a stable pension plan. Particularly, the millions who operate in markets, corner shops, transportation, agriculture, and loads of the nano and micro scale enterprises operators are without pension plans or retirement hope.

From the observation of the author and available records, staggering around 90 per cent of Nigeria’s workforce operates in the informal economy. Yet current pension coverage for this group is virtually non-existent. As observed, the absence of meaningful pension participation by this class of worker reinforces the vulnerability, intensifies poverty among older people, and puts pressure on families who are ill-equipped to shoulder the burden.

The significance of having a pension plan for informal workers in Nigeria, given the large number of people in that sector and the high level of unemployment and underemployment, cannot be overstated. As it is deeply connected to sustenance and the level of poverty in the country. Pension for informal workers in Nigeria is not just a technical policy matter; it is a story about dignity, security, and whether a lifetime of hard work ends in rest or in desperation.

Nigeria’s pension system, primarily structured around the Contributory Pension Scheme (CPS) managed by the National Pension Commission (PenCom), has made significant progress for formal sector employees, yet the large portion of the informal workforce which are traders, artisans, okada riders, small-scale farmers, domestic workers, and gig economy participants who drive the real engine of the economy.

Though the Micro Pension Plan (MPP) was launched in 2019, which is intended to provide a voluntary contributory framework for informal workers, its uptake has been underwhelming; after several years, only a fraction of the millions targeted have enrolled, and far fewer contribute actively. One big reason for this is that, unlike formal workers who receive regular salaries and have employers who deduct and remit pension contributions, informal workers face irregular incomes, a lack of documentation, limited financial literacy, and deep mistrust of government institutions, making traditional pension models ill-suited for their realities.

Moreso the informal worker most times live on day-to-day income. For instance, a motorcycle rider in Lagos who earns ₦14,000 on a good day but must pay for fuel, bike maintenance, police “settlements,” and family expenses, how can he realistically commit to a monthly pension contribution when his income fluctuates wildly? So, the Micro Pension Plan for the informal sector participation will remain low due to poor awareness, complex processes, lack of tailored contribution flexibility, and limited trust.

To truly make pensions work for informal workers, Nigeria must rethink the system from the ground up, designing it around the lived realities of its people rather than forcing them into rigid formal-sector structures. First, the government should introduce a co-contributory model where the state matches a percentage of informal workers’ savings, similar to what is practised in some European countries, turning pension contributions into a powerful incentive rather than a burdensome obligation.

Second, digital technology must be leveraged aggressively—mobile-based pension platforms linked to BVN or NIN could allow daily, weekly, or micro-contributions as small as ₦100, integrating seamlessly with fintech apps like OPay, Paga, or bank USSD services so that saving becomes as easy as buying airtime.

Third, automatic enrollment through cooperatives, trade unions, market associations, and transport unions could significantly expand coverage, with opt-out rather than opt-in mechanisms to counter human inertia.

Fourth, financial literacy campaigns in local languages via radio, community leaders, and religious institutions are essential to rebuild trust and demonstrate that pensions are not a “government scam” but a personal safety net.

Fifth, Nigeria should consider a universal social pension for elderly citizens who never participated in formal or informal schemes, modelled after systems in countries like Denmark and the Netherlands, ensuring that no Nigerian dies in poverty simply because they worked outside formal structures.

Sixth, investment strategies for pension funds must prioritise both security and development—allocating a portion to infrastructure projects that create jobs, improve power supply, and stimulate economic growth while maintaining prudent risk management.

Seventh, inflation protection should be built into pension payouts so that retirees’ purchasing power is not eroded by Nigeria’s volatile economy.

Eighth, the system must be inclusive of women, who dominate the informal sector yet often lack property rights or formal identification, by simplifying documentation requirements and providing gender-sensitive outreach.

Ninth, limited emergency withdrawal options could be introduced—strictly regulated—to help contributors handle crises without abandoning the system entirely.

Finally, transparency and accountability are non-negotiable; regular public reporting, independent audits, and user-friendly dashboards would strengthen confidence that contributions are safe and growing. If Nigeria can blend its innovative spirit with lessons from global best practices—combining Denmark’s social security ethos, Singapore’s savings discipline, and Canada’s inclusivity—it could transform the lives of millions of informal workers who currently face retirement with fear rather than hope.

Imagine Aisha, years from now, closing her market stall not in exhaustion and anxiety but in calm assurance that her pension will cover her basic needs; imagine Tunde hanging up his helmet knowing he can afford healthcare and shelter; imagine Ngozi harvesting not just crops but the fruits of a lifetime of secure savings. The suspense that hangs over the future of Nigeria’s informal workers can be resolved, but only if policymakers act boldly, creatively, and compassionately—because a nation that allows its hardest workers to age in poverty is a nation that undermines its own prosperity, while a nation that secures their retirement builds not just pensions, but peace.

Hope comes from innovation. Fintech-powered pension models that allow small, frequent contributions similar to informal savings associations like esusu offer ways to integrate pensions into existing savings cultures. Making pension contributions compatible with mobile money and agent networks could drastically reduce barriers to entry. Hope comes from public education. Building financial literacy campaigns, partnering with community leaders, marketplaces, trade associations, and digital platforms can help shift perceptions. A pension should be understood not as a distant bureaucratic programme, but as future self-insurance and dignity

The significance of having a pension plan for informal workers in Nigeria, given its large informal sector and high level of unemployment and underemployment, cannot be overstated, as it is deeply connected to social stability, economic sustainability, poverty reduction, and national development.

First, from a social protection and human dignity perspective, a pension plan for informal workers is critical because it provides a safety net for old age. Nigeria’s informal sector includes traders, artisans, mechanics, tailors, hairdressers, okada riders, gig workers, domestic workers, small-scale farmers, and street vendors, many of whom work hard throughout their lives but have no formal retirement benefits. Without a pension, these individuals often become completely dependent on their children, relatives, or charity in old age, which can strain families and increase intergenerational poverty. A well-structured pension system ensures that ageing informal workers can maintain a basic standard of living, access healthcare, and avoid extreme deprivation, thereby preserving their dignity and reducing elderly vulnerability.

Second, from an economic stability and poverty reduction standpoint, pensions play a crucial role in reducing old-age poverty. Nigeria already struggles with high poverty levels, and a large proportion of elderly citizens without income support exacerbates this problem. When informal workers lack pension savings, they continue working well into old age, often in physically demanding jobs, which reduces productivity and increases health risks. A pension system allows for smoother retirement transitions, reduces reliance on welfare, and ensures that older citizens remain consumers rather than economic burdens, thereby sustaining economic activity.

Third, pensions for informal workers are significant for financial inclusion and savings culture. Many Nigerians in the informal sector operate primarily in cash and have limited engagement with formal financial institutions. A pension plan tailored to informal workers, especially one integrated with mobile money and digital platforms, can encourage regular saving, improve financial literacy, and bring millions of people into the formal financial system. This, in turn, strengthens Nigeria’s overall financial sector and increases the pool of domestic savings available for investment in infrastructure, businesses, and development projects.

Fourth, the significance is evident in reducing dependence on government emergency support. Currently, the Nigerian government often has to intervene with ad-hoc social assistance programs, especially during crises such as the COVID-19 pandemic, inflation shocks, or economic downturns. If informal workers had functional pension savings, they would be better able to absorb economic shocks in retirement without relying heavily on government aid, reducing fiscal pressure on the state.

Fifth, pensions for informal workers contribute to intergenerational equity and family stability. In Nigeria, many elderly parents depend on their working children for survival, which places financial strain on younger generations who may already be struggling with unemployment, housing costs, and education expenses. A pension system reduces this burden, allowing younger Nigerians to invest in their own futures rather than being trapped in a cycle of supporting ageing relatives without external assistance.

Sixth, from a national development perspective, including informal workers in the pension system strengthens Nigeria’s long-term economic planning. Pension funds represent large pools of capital that can be invested in critical sectors such as housing, energy, transportation, and manufacturing. If millions of informal workers contribute even in small amounts, this could significantly expand Nigeria’s pension fund assets, providing stable, long-term financing for development projects that create jobs and stimulate growth.

Seventh, pensions for informal workers are important for gender equity, because women dominate many informal occupations in Nigeria, such as petty trading, market vending, tailoring, and caregiving roles. These women often have lower lifetime earnings, limited access to formal employment, and fewer assets. A targeted informal sector pension scheme can protect elderly women from destitution and reduce gender-based economic inequality in old age.

Eighth, the significance is also linked to public trust and governance. A transparent, accessible, and reliable pension system for informal workers can strengthen citizens’ trust in government institutions. Many informal workers currently distrust government programs due to past corruption, failed schemes, or poor implementation. A well-functioning pension plan that delivers real benefits would demonstrate that the state values all citizens, not just formal sector employees.

Lastly, given Nigeria’s demographic reality of a large and growing population, failing to integrate informal workers into a pension framework poses serious long-term risks. As life expectancy increases, the number of elderly Nigerians will rise significantly in the coming decades. Without a structured pension system for informal workers, Nigeria could face a severe old-age crisis characterised by mass poverty, social unrest, and increased pressure on healthcare and social services.

In summary, having a pension plan for informal workers in Nigeria is significant because it promotes social security, reduces poverty, enhances financial inclusion, supports economic stability, eases intergenerational burdens, strengthens national development, promotes gender equity, builds public trust, and prepares the country for its ageing population. For a nation where the majority of workers are informal, excluding them from pension coverage is not just an oversight; it is a major structural weakness that must be urgently addressed for Nigeria’s long-term prosperity and social cohesion.

Feature/OPED

Revived Argungu International Fishing Festival Shines as Access Bank Backs Culture, Tourism Growth

The successful hosting of the 2026 Argungu International Fishing Festival has spotlighted the growing impact of strategic public-private partnerships, with Access Bank and Kebbi State jointly reinforcing efforts to promote cultural heritage, tourism development, and local economic growth following the globally attended celebration in Argungu.

At the grand finale, Special Guest of Honour, Mr Bola Tinubu, praised the festival’s enduring national significance, describing it as a powerful expression of unity, resilience, and peaceful coexistence.

“This festival represents a remarkable history and remains a powerful symbol of unity, resilience, and peaceful coexistence among Nigerians. It reflects the richness of our culture, the strength of our traditions, and the opportunities that lie in harnessing our natural resources for national development. The organisation, security arrangements, and outlook demonstrate what is possible when leadership is purposeful and inclusive.”

State authorities noted that renewed institutional backing has strengthened the festival’s global appeal and positioned it once again as a major tourism and cultural platform capable of attracting international visitors and investors.

“Argungu has always been an iconic international event that drew visitors from across the world. With renewed partnerships and stronger institutional support, we are confident it will return to that global stage and expand opportunities for our people through tourism, culture, and enterprise.”

Speaking on behalf of Access Bank, Executive Director, Commercial Banking Division, Hadiza Ambursa, emphasised the institution’s long-standing commitment to supporting initiatives that preserve heritage and create economic opportunities.

“We actively support cultural development through initiatives like this festival and collaborations such as our partnership with the National Theatre to promote Nigerian arts and heritage. Across states, especially within the public sector space where we do quite a lot, we work with governments on priorities that matter to them. Tourism holds enormous potential, and while we have supported several hotels with expansion financing, we remain open to working with partners interested in developing the sector further.”

Reports from the News Agency of Nigeria indicated that more than 50,000 fishermen entered the historic Matan Fada River during the competition. The overall winner, Abubakar Usman from Maiyama Local Government Area, secured victory with a 59-kilogram catch, earning vehicles donated by Sokoto State and a cash prize. Other top contestants from Argungu and Jega also received vehicles, motorcycles and monetary rewards, including sponsorship support from WACOT Rice Limited.

Recognised by UNESCO as an Intangible Cultural Heritage of Humanity, the festival blends traditional fishing contests with boat regattas, durbar processions, performances, and international competitions, drawing visitors from across Nigeria and beyond.

With the 2026 edition concluded successfully, stakeholders say the strengthened collaboration between government and private-sector partners signals a renewed era for Argungu as a flagship cultural tourism destination capable of driving inclusive growth, preserving tradition, and projecting Nigeria’s heritage on the world stage.

-

Feature/OPED6 years ago

Feature/OPED6 years agoDavos was Different this year

-

Travel/Tourism10 years ago

Lagos Seals Western Lodge Hotel In Ikorodu

-

Showbiz3 years ago

Showbiz3 years agoEstranged Lover Releases Videos of Empress Njamah Bathing

-

Banking8 years ago

Banking8 years agoSort Codes of GTBank Branches in Nigeria

-

Economy3 years ago

Economy3 years agoSubsidy Removal: CNG at N130 Per Litre Cheaper Than Petrol—IPMAN

-

Banking3 years ago

Banking3 years agoSort Codes of UBA Branches in Nigeria

-

Banking3 years ago

Banking3 years agoFirst Bank Announces Planned Downtime

-

Sports3 years ago

Sports3 years agoHighest Paid Nigerian Footballer – How Much Do Nigerian Footballers Earn