Feature/OPED

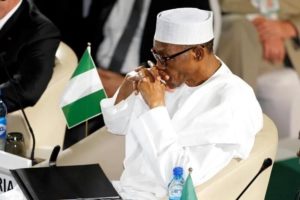

The Buhari Administration: Is Patronage Undermining Change?

By Omoshola Deji

As the four year mandate Nigerians offered President Muhammadu Buhari (PMB) approaches half time, mix reactions are trailing the performance of his administration and the efficiency of his appointees.

The robust pre-election crusade that the change agenda would transform Nigeria from wilderness to paradise leaves many wondering why Nigerians should still be drowning in poverty, unemployment and underdevelopment.

The Buhari apologists opine that the stern hardship is the aftereffect of the treasury looting and mismanagement by the Goodluck Jonathan administration.

Oppositely, the Jonathan fanatics and opposition parties orates that PMB is incompetent and his cabinet lacks the proficiency needed to revamp the economy, education, health and infrastructure. They further question whether the change PMB promised Nigerians is positive or negative.

Ignite your interest in this piece as it covers the interest of everyone, irrespective of your political opinion, social association, ethnic affiliation, economic estimation and religious devotion. Before proceeding, let’s curtail ambiguity by approving that political patronage (in-two-words-meaning) denotes – conditional support, post-election reward, unconstitutional immunity, countenancing impunity, unjust persecution, selective prosecution, vote buying, cross carpeting, partisan actions and ethno-religious favouritism.

The word ‘change’ in the theme ‘political patronage undermining change’ serves two purposes. Change connotes the PMB ‘change-agenda’ and a ‘change-in-cabinet’.

In broader terms, we are therefore exploring the extent at which political patronage is undermining the implementation of the PMB change-agenda and secondly, if political patronage is undermining a change in cabinet.

Without a doubt, if the All Progressives Congress (APC) change mantra is a saleable product, the producer’s stupendous wealth would be terribly envied by Dangote.

However, because the mantra emerged as a strategic political strategy, millions of Nigerians subscribed to it and installed Buhari; after he had failed on three attempts. These failed attempts, past leadership experience, Spartan discipline and his stance against corruption foster the selection of Buhari by the political gladiators that teamed up to establish the APC. Buhari emerged president and it soon became glaring that the political gladiators are indeed strange bedfellows.

The struggle for party control, conflicting interests and the allotment of political portfolios override the speedy kick-off of the implementation of the change agenda. The president was confused on who to work with. Cries for recognition, whispers of suggestions and songs of recommendations almost deafened his ears.

Six months after inauguration, PMB released the list of ministerial nominees and the political gladiators began to count their losses. Surprisingly, PMB jettisoned party stalwarts and appointed political inactive persons as the Chief-of-Staff and Secretary to the Government of the Federation (SGF).

One of the most acknowledged election victory determinant, Asiwaju Bola Tinubu, was least patronized by PMB. It then dawn on the widely acclaimed political genius (Tinubu) that his input to the emergence of PMB might be a destiny-shattering political error.

Rather than select Tinubu’s nominations, PMB awarded juicy ministerial portfolios to his estranging political godsons – Babatunde Fashola and Kayode Fayemi. Many wondered why? From observers lens, PMB’s nearest and dearest feels Tinubu is best tamed at the start. They cannot risk him dictating the tunes by planting his mafias in strategic government positions like he did during Fashola’s reign as Lagos governor.

Moreover, PMB’s men most likely feel that his accomplishment, authority and reputation as the former Military Governor of Northeastern State (1975) and Borno (1976), former Federal Commissioner of Petroleum (1976-78) and former Military Head of State (1983-85) would be derided should people conceive his administration is indirectly being piloted by Tinubu, a ‘mere’ elected Senator (1993) and former Lagos State Governor (1999-2007).

Many political pundits are of the opinion that PMB exploited Tinubu and other political gladiators to emerge President. Subsequently, he (PMB) acts his mind that even though Tinubu and most of the political gladiators have never been declared guilty, they are not anti-corrupt. For this reason, PMB resolved that his anti-corruption war and change agenda would be best effected if he does not patronize Tinubu and other political gladiators like Atiku Abubakar, Abubakar Baraje and Bukola Saraki. PMB was determined not to allow patronage undermine change!

Most of the political gladiators either continue lobbying or decide to start strategizing for 2019, but Saraki was distinct. He hauled the party arrangement to emerge as Senate President. One must think twice before blaming Saraki for scoring a political own-goal. Being the son of a prominent businessman and politician, Saraki is among the few who aged seeing governing Nigeria as their birth right, hence, he can only be comfortable when he is leading and not being led.

Just when Saraki thought he has successfully allotted himself Nigeria’s third most powerful position, nemesis came knocking. If political hierarchy be considered, attempts to genuinely prosecute or intentionally sledgehammer Saraki cannot proceed without the nod of PMB. Indeed, change is here! Nigeria’s incumbent Senate President is facing false asset declaration charges in court. Most Nigerians never anticipated such! Saraki is on trial and should he be found guilty, unlike Obasanjo, his own episode would be from power to prison. This clearly points out that PMB is not willing to allow patronage undermines the implementation of his change agenda that focus strongly on fighting corruption.

Let’s now shift focus from PMB’s party men to his cabinet. Just when the war against corruption was earning national applauds and international accolades, the Shehu Sani led Senate Ad-hoc Committee on Mounting Humanitarian Crisis in the North-East indicted the Secretary to the Government of the Federation (SGF), Babachir Lawal, for corruption.

Babachir was accused of awarding inflated contracts to firms he has strong stakes in. He was tackled with damning evidence of – awarding N223 million contract for the removal of invasive plant species; receiving deposits totalling N200 million into the account of Rhola Vision Engineering Limited (his firm) from the company that was awarded the contract; his non-resignation from Rhola Vision (RV) upon the assumption of public office and; him still being a signatory to RV’s account after he later resigned.

Lest I forget, whoever coined the term ‘invasive plant species’ as an alternative term for ‘grass’ is indeed a genius whose intellectualism is been devoured by political brigands to rob the displaced and vulnerable. A serious deliverance session is needed to navigate his intellectualism back to the path of compassionate public service.

After failing to honour the Senate’s invitation and the public awareness of the damning evidence, many thought the fear of being crushed by PMB’s anti-corruption sledgehammer would make Babachir recoil and tactfully articulate his defence. Rather, Babachir arrogantly dismissed the accusative report and declared that the Senate is “talking balderdash”. Nigerians were shocked at such display of confidence and were anxiously expecting PMB to fumigate his inner circle by suspending the SGF in order to pave way for a transparent probe and prosecution. Disappointingly, PMB failed the litmus test by skilfully absolving the SGF of any wrong doing.

If truth be told, the last time Nigerians were that disappointed was when Yakubu Aiyegbeni failed to score into an empty net at the 2010 World-Cup and when ex-president Jonathan increased the price of fuel (from N65-87) on 1 January, 2012.

PMB derided the anti-corruption war by writing a flimsy excuse to the Senate that the SGF was not granted fair hearing. Please be mindful that a Senate investigative hearing invitation was sent to Babachir and his name was listed among those invited by the Senate in the 2 December, 2016 publication of Daily Trust. Till date, Babachir is still occupying the SGF position in a government that her main qualification is anticorruption. Logically, the long-term patronage between Buhari and Babachir appears to be restricting the President from being decisive. Is patronage undermining change?

PMB has hesitate to change his corruption-tainted appointee(s) while opposing figures (like Reuben Abati, Olisah Metuh and Musiliu Obanikoro) with similar accusation and evidence are being subject to investigation, media trial, incarceration and prosecution. Before sentiment shroud your judgment, please imagine how Babachir’s case would have been handled if he served as SGF under ex-president Jonathan and such weighty evidence of corruption surfaced against him. Besides, If Femi Fani Kayode did not cross-carpet into the PDP and he successfully pilot PMB’s campaign to victory like he hoped to do for Jonathan, can you in good conscience vow that he would be answering corruption cases by now?

Let’s reason straight and retest this oppositely! Please take a moment to imagine the extent at which Rotimi Ameachi would have languished in anguish if GEJ had won the presidential election. Having imagined how miserable Amaechi’s life would have been, may I advise that you never brand a political cabal as a saint and taint the other? It is unfortunate that patronage-deciding-prosecution cut across boards, irrespective of political party.

The recent purported release of former Adamawa Governor, James Ngilari, after being found guilty of corruption and sentenced to five years imprisonment shows the extent at which patronage is fertilizing anarchy and deriding the war against corruption.

On the claim that Ngilari was terribly sick, his comrades cajoled the prison officials to illegally issue a letter recommending that he be released to seek medical attention abroad. In what appears conspiratorial, Justice Nathan Musa ordered Ngilari’s release without confirming the authenticity of the documents presented before him. Within an eye twinkle, Ngilari regained freedom without prison break, state pardon or a favorable appeal judgment. Sadly, other individuals convicted for lesser offences and awaiting trial inmates are dying of minor ailments daily, while Ngilari is been flown abroad for treatment with the public funds he stole. Is prisoner-Ngilari a special being?

Not many individuals are considering the irreparable damage Ngilari’s sleaze is inflicting on the Adamawa masses. A lot of women would have lost their lives to maternal mortality; lack of healthcare facilities would have made many families lose their loved ones to minor diseases; the non-motor-able roads would have consumed the lives of many and; unemployment would have frustrated many youths into crime. Most of this unemployed youths are not even employable because the educational system is rotten from nursery to tertiary. Imagine this horrible happenings befalling the Adamawa natives, and by extension Nigerians, because people like Ngilari have pocketed the commonwealth.

It is indisputable that Ngilari’s comrade won’t have the effrontery to commit such villainy if they don’t have the backing of prominent Nigerians and individuals within the corridors of power. Is patronage undermining change?

For how long will patronage continue to undermine change? Arise Buhari!

Omoshola Deji is a political and public affairs analyst. He wrote in via mo******@***oo.com

Feature/OPED

Pension for Informal Workers Nigeria: Bridging the Pension Gap

***The Case for Informal Sector Pensions in Nigeria

***A Crucial National Conversation

By Timi Olubiyi, PhD

In Nigeria today, the phrase “pension” evokes many different mixed reactions. For many civil servants and people in the corporate world, it conjures a bit of hope, but for the majority in the informal sector, who are in the majority in Nigeria, it is bleak. Millions of Nigerians are facing old age without any financial security due to a lack of retirement plans and a stable pension plan. Particularly, the millions who operate in markets, corner shops, transportation, agriculture, and loads of the nano and micro scale enterprises operators are without pension plans or retirement hope.

From the observation of the author and available records, staggering around 90 per cent of Nigeria’s workforce operates in the informal economy. Yet current pension coverage for this group is virtually non-existent. As observed, the absence of meaningful pension participation by this class of worker reinforces the vulnerability, intensifies poverty among older people, and puts pressure on families who are ill-equipped to shoulder the burden.

The significance of having a pension plan for informal workers in Nigeria, given the large number of people in that sector and the high level of unemployment and underemployment, cannot be overstated. As it is deeply connected to sustenance and the level of poverty in the country. Pension for informal workers in Nigeria is not just a technical policy matter; it is a story about dignity, security, and whether a lifetime of hard work ends in rest or in desperation.

Nigeria’s pension system, primarily structured around the Contributory Pension Scheme (CPS) managed by the National Pension Commission (PenCom), has made significant progress for formal sector employees, yet the large portion of the informal workforce which are traders, artisans, okada riders, small-scale farmers, domestic workers, and gig economy participants who drive the real engine of the economy.

Though the Micro Pension Plan (MPP) was launched in 2019, which is intended to provide a voluntary contributory framework for informal workers, its uptake has been underwhelming; after several years, only a fraction of the millions targeted have enrolled, and far fewer contribute actively. One big reason for this is that, unlike formal workers who receive regular salaries and have employers who deduct and remit pension contributions, informal workers face irregular incomes, a lack of documentation, limited financial literacy, and deep mistrust of government institutions, making traditional pension models ill-suited for their realities.

Moreso the informal worker most times live on day-to-day income. For instance, a motorcycle rider in Lagos who earns ₦14,000 on a good day but must pay for fuel, bike maintenance, police “settlements,” and family expenses, how can he realistically commit to a monthly pension contribution when his income fluctuates wildly? So, the Micro Pension Plan for the informal sector participation will remain low due to poor awareness, complex processes, lack of tailored contribution flexibility, and limited trust.

To truly make pensions work for informal workers, Nigeria must rethink the system from the ground up, designing it around the lived realities of its people rather than forcing them into rigid formal-sector structures. First, the government should introduce a co-contributory model where the state matches a percentage of informal workers’ savings, similar to what is practised in some European countries, turning pension contributions into a powerful incentive rather than a burdensome obligation.

Second, digital technology must be leveraged aggressively—mobile-based pension platforms linked to BVN or NIN could allow daily, weekly, or micro-contributions as small as ₦100, integrating seamlessly with fintech apps like OPay, Paga, or bank USSD services so that saving becomes as easy as buying airtime.

Third, automatic enrollment through cooperatives, trade unions, market associations, and transport unions could significantly expand coverage, with opt-out rather than opt-in mechanisms to counter human inertia.

Fourth, financial literacy campaigns in local languages via radio, community leaders, and religious institutions are essential to rebuild trust and demonstrate that pensions are not a “government scam” but a personal safety net.

Fifth, Nigeria should consider a universal social pension for elderly citizens who never participated in formal or informal schemes, modelled after systems in countries like Denmark and the Netherlands, ensuring that no Nigerian dies in poverty simply because they worked outside formal structures.

Sixth, investment strategies for pension funds must prioritise both security and development—allocating a portion to infrastructure projects that create jobs, improve power supply, and stimulate economic growth while maintaining prudent risk management.

Seventh, inflation protection should be built into pension payouts so that retirees’ purchasing power is not eroded by Nigeria’s volatile economy.

Eighth, the system must be inclusive of women, who dominate the informal sector yet often lack property rights or formal identification, by simplifying documentation requirements and providing gender-sensitive outreach.

Ninth, limited emergency withdrawal options could be introduced—strictly regulated—to help contributors handle crises without abandoning the system entirely.

Finally, transparency and accountability are non-negotiable; regular public reporting, independent audits, and user-friendly dashboards would strengthen confidence that contributions are safe and growing. If Nigeria can blend its innovative spirit with lessons from global best practices—combining Denmark’s social security ethos, Singapore’s savings discipline, and Canada’s inclusivity—it could transform the lives of millions of informal workers who currently face retirement with fear rather than hope.

Imagine Aisha, years from now, closing her market stall not in exhaustion and anxiety but in calm assurance that her pension will cover her basic needs; imagine Tunde hanging up his helmet knowing he can afford healthcare and shelter; imagine Ngozi harvesting not just crops but the fruits of a lifetime of secure savings. The suspense that hangs over the future of Nigeria’s informal workers can be resolved, but only if policymakers act boldly, creatively, and compassionately—because a nation that allows its hardest workers to age in poverty is a nation that undermines its own prosperity, while a nation that secures their retirement builds not just pensions, but peace.

Hope comes from innovation. Fintech-powered pension models that allow small, frequent contributions similar to informal savings associations like esusu offer ways to integrate pensions into existing savings cultures. Making pension contributions compatible with mobile money and agent networks could drastically reduce barriers to entry. Hope comes from public education. Building financial literacy campaigns, partnering with community leaders, marketplaces, trade associations, and digital platforms can help shift perceptions. A pension should be understood not as a distant bureaucratic programme, but as future self-insurance and dignity

The significance of having a pension plan for informal workers in Nigeria, given its large informal sector and high level of unemployment and underemployment, cannot be overstated, as it is deeply connected to social stability, economic sustainability, poverty reduction, and national development.

First, from a social protection and human dignity perspective, a pension plan for informal workers is critical because it provides a safety net for old age. Nigeria’s informal sector includes traders, artisans, mechanics, tailors, hairdressers, okada riders, gig workers, domestic workers, small-scale farmers, and street vendors, many of whom work hard throughout their lives but have no formal retirement benefits. Without a pension, these individuals often become completely dependent on their children, relatives, or charity in old age, which can strain families and increase intergenerational poverty. A well-structured pension system ensures that ageing informal workers can maintain a basic standard of living, access healthcare, and avoid extreme deprivation, thereby preserving their dignity and reducing elderly vulnerability.

Second, from an economic stability and poverty reduction standpoint, pensions play a crucial role in reducing old-age poverty. Nigeria already struggles with high poverty levels, and a large proportion of elderly citizens without income support exacerbates this problem. When informal workers lack pension savings, they continue working well into old age, often in physically demanding jobs, which reduces productivity and increases health risks. A pension system allows for smoother retirement transitions, reduces reliance on welfare, and ensures that older citizens remain consumers rather than economic burdens, thereby sustaining economic activity.

Third, pensions for informal workers are significant for financial inclusion and savings culture. Many Nigerians in the informal sector operate primarily in cash and have limited engagement with formal financial institutions. A pension plan tailored to informal workers, especially one integrated with mobile money and digital platforms, can encourage regular saving, improve financial literacy, and bring millions of people into the formal financial system. This, in turn, strengthens Nigeria’s overall financial sector and increases the pool of domestic savings available for investment in infrastructure, businesses, and development projects.

Fourth, the significance is evident in reducing dependence on government emergency support. Currently, the Nigerian government often has to intervene with ad-hoc social assistance programs, especially during crises such as the COVID-19 pandemic, inflation shocks, or economic downturns. If informal workers had functional pension savings, they would be better able to absorb economic shocks in retirement without relying heavily on government aid, reducing fiscal pressure on the state.

Fifth, pensions for informal workers contribute to intergenerational equity and family stability. In Nigeria, many elderly parents depend on their working children for survival, which places financial strain on younger generations who may already be struggling with unemployment, housing costs, and education expenses. A pension system reduces this burden, allowing younger Nigerians to invest in their own futures rather than being trapped in a cycle of supporting ageing relatives without external assistance.

Sixth, from a national development perspective, including informal workers in the pension system strengthens Nigeria’s long-term economic planning. Pension funds represent large pools of capital that can be invested in critical sectors such as housing, energy, transportation, and manufacturing. If millions of informal workers contribute even in small amounts, this could significantly expand Nigeria’s pension fund assets, providing stable, long-term financing for development projects that create jobs and stimulate growth.

Seventh, pensions for informal workers are important for gender equity, because women dominate many informal occupations in Nigeria, such as petty trading, market vending, tailoring, and caregiving roles. These women often have lower lifetime earnings, limited access to formal employment, and fewer assets. A targeted informal sector pension scheme can protect elderly women from destitution and reduce gender-based economic inequality in old age.

Eighth, the significance is also linked to public trust and governance. A transparent, accessible, and reliable pension system for informal workers can strengthen citizens’ trust in government institutions. Many informal workers currently distrust government programs due to past corruption, failed schemes, or poor implementation. A well-functioning pension plan that delivers real benefits would demonstrate that the state values all citizens, not just formal sector employees.

Lastly, given Nigeria’s demographic reality of a large and growing population, failing to integrate informal workers into a pension framework poses serious long-term risks. As life expectancy increases, the number of elderly Nigerians will rise significantly in the coming decades. Without a structured pension system for informal workers, Nigeria could face a severe old-age crisis characterised by mass poverty, social unrest, and increased pressure on healthcare and social services.

In summary, having a pension plan for informal workers in Nigeria is significant because it promotes social security, reduces poverty, enhances financial inclusion, supports economic stability, eases intergenerational burdens, strengthens national development, promotes gender equity, builds public trust, and prepares the country for its ageing population. For a nation where the majority of workers are informal, excluding them from pension coverage is not just an oversight; it is a major structural weakness that must be urgently addressed for Nigeria’s long-term prosperity and social cohesion.

Feature/OPED

Revived Argungu International Fishing Festival Shines as Access Bank Backs Culture, Tourism Growth

The successful hosting of the 2026 Argungu International Fishing Festival has spotlighted the growing impact of strategic public-private partnerships, with Access Bank and Kebbi State jointly reinforcing efforts to promote cultural heritage, tourism development, and local economic growth following the globally attended celebration in Argungu.

At the grand finale, Special Guest of Honour, Mr Bola Tinubu, praised the festival’s enduring national significance, describing it as a powerful expression of unity, resilience, and peaceful coexistence.

“This festival represents a remarkable history and remains a powerful symbol of unity, resilience, and peaceful coexistence among Nigerians. It reflects the richness of our culture, the strength of our traditions, and the opportunities that lie in harnessing our natural resources for national development. The organisation, security arrangements, and outlook demonstrate what is possible when leadership is purposeful and inclusive.”

State authorities noted that renewed institutional backing has strengthened the festival’s global appeal and positioned it once again as a major tourism and cultural platform capable of attracting international visitors and investors.

“Argungu has always been an iconic international event that drew visitors from across the world. With renewed partnerships and stronger institutional support, we are confident it will return to that global stage and expand opportunities for our people through tourism, culture, and enterprise.”

Speaking on behalf of Access Bank, Executive Director, Commercial Banking Division, Hadiza Ambursa, emphasised the institution’s long-standing commitment to supporting initiatives that preserve heritage and create economic opportunities.

“We actively support cultural development through initiatives like this festival and collaborations such as our partnership with the National Theatre to promote Nigerian arts and heritage. Across states, especially within the public sector space where we do quite a lot, we work with governments on priorities that matter to them. Tourism holds enormous potential, and while we have supported several hotels with expansion financing, we remain open to working with partners interested in developing the sector further.”

Reports from the News Agency of Nigeria indicated that more than 50,000 fishermen entered the historic Matan Fada River during the competition. The overall winner, Abubakar Usman from Maiyama Local Government Area, secured victory with a 59-kilogram catch, earning vehicles donated by Sokoto State and a cash prize. Other top contestants from Argungu and Jega also received vehicles, motorcycles and monetary rewards, including sponsorship support from WACOT Rice Limited.

Recognised by UNESCO as an Intangible Cultural Heritage of Humanity, the festival blends traditional fishing contests with boat regattas, durbar processions, performances, and international competitions, drawing visitors from across Nigeria and beyond.

With the 2026 edition concluded successfully, stakeholders say the strengthened collaboration between government and private-sector partners signals a renewed era for Argungu as a flagship cultural tourism destination capable of driving inclusive growth, preserving tradition, and projecting Nigeria’s heritage on the world stage.

Feature/OPED

$214Bn Missing, Institutions Silent: Is Accountability Dead in Nigeria?

By Blaise Udunze

Between 2010 and 2026, a staggering $214 billion, approximately N300 trillion in public funds, has been reported as missing, unaccounted for, diverted, unrecovered, irregularly spent, or trapped in non-transparent fiscal structures across Nigeria’s public institutions.

That figure is not speculative but a conservative estimate of unaccounted funds. It is drawn from audit reports, legislative probes, civil society litigation, executive directives, and investigative findings spanning more than a decade. If it is to go by the accurate figure, the true national loss is likely higher but difficult to quantify precisely due to data gaps, overlapping figures, and incomplete audits.

The challenge is that in many of the most prominent cases, prosecutions have stalled, hearings have dragged without resolution, investigations have gone cold, and no defining jail terms have etched accountability into Nigeria’s institutional memory. The irony is that the number is historic, the silence is louder. And the economic damage is cumulative.

The pattern stretches from the oil sector to social investment programmes, from the Nigeria Central Bank of Nigeria (CBN) interventions to ministry-level expenditures. In 2014, between $10.8 billion and $20 billion in unremitted oil revenues linked to the Nigerian National Petroleum Corporation triggered national outrage. Under the then CBN governor, Lamido Sanusi, who warned that persistent oil revenue leakages were making exchange rate stability “extremely difficult.” He cautioned that without full remittances, the alternative would be currency devaluation and financial instability. This concern spans the 2010 to 2013 oil revenue period. That warning proved prophetic.

This is because, years later, the lack of transparency in the oil industry did not disappear, but rather it festered like cancer. It further led to the elongated audit queries, which have continued to trail the Nigerian National Petroleum Company Limited, including unremitted revenues, questioned deductions, and management fee structures under the Petroleum Industry Act. With an extraordinary move aimed at blocking revenue leakages at source, President Bola Ahmed Tinubu has recently issued an Executive Order suspending certain deductions and directing direct remittance of taxes, royalties, and profit oil into the Federation Account, which involves the reassessment of NNPC’s 30 per cent management fee and 30 per cent frontier exploration deduction under the Petroleum Industry Act.

Such presidential intervention underscores the scale of concern, which means that Nigeria cannot afford a structural lack of transparency in its most strategic revenue sector. But oil is only one chapter.

The Central Bank of Nigeria has faced some of the most far-reaching audit alarms in recent years. In suit number FHC/ABJ/CS/250/2026, the Socio-Economic Rights and Accountability Project (SERAP) is asking the Federal High Court to compel the CBN to account for N3 trillion in allegedly missing or diverted public funds. The Auditor-General’s 2025 report cited failures to remit over N1.44 trillion in operating surplus to the Consolidated Revenue Fund, over N629 billion paid to “unknown beneficiaries” under the Anchor Borrowers’ Programme, and more than N784 billion in overdue, unrecovered intervention loans.

There were also N125 billion in questioned intervention expenditures, irregular contract variations exceeding N9 billion, and procurement gaps running into hundreds of billions. The Auditor-General repeatedly recommended recovery and remittance. No date has been fixed for the hearing. Meanwhile, Nigeria continues to borrow.

Elsewhere, the House of Representatives has launched a probe into over N30 billion recovered during investigations into the National Social Investment Programme Agency (NSIPA). The funds, reportedly frozen during investigation, have not been remitted back into the Treasury Single Account, stalling poverty-alleviation schemes like TraderMoni and FarmerMoni. Millions of vulnerable Nigerians remain exposed while lawmakers search for money already “recovered.” The irony is staggering as funds are found, but programmes remain frozen.

A top discovery recently that put the nation on red alert was made by the Senate committee, which claimed to have found N210 trillion in financial irregularities in NNPC accounts between 2017 and 2023, including unaccounted receivables and accrued expenses. A critical concern is that, as of early 2026, this has sparked commentary but no clear prosecutions.

Only recently, in the power sector, SERAP has urged the President to probe alleged missing or unaccounted N128 billion at the Federal Ministry of Power and the Nigerian Bulk Electricity Trading Plc. Of concern is that despite the enormous funds channelled in this sector, Nigeria’s chronic electricity instability persists, even as billions meant to stabilise the grid face audit scrutiny.

Across MDAs, audit reports between 2017 and 2022 flagged trillions in unsupported expenditures, unremitted taxes, unauthorised payments, and statutory liabilities never recovered. These sums are dizzying and are also alarming; N300 billion here, N149 billion there, N3.403 trillion across agencies, N30 trillion-plus Treasury discrepancies raised at the Senate level.

Individually, they shock. Collectively, they define a structural pattern. And patterns shape economies.

Nigeria operates with structural fiscal deficits and also lives with them routinely and comfortably. Expenditure persistently exceeds revenue. When public funds disappear, fail to be remitted, or are trapped outside constitutional channels, the deficit widens. The government must borrow to fill gaps created not only by low revenue, but by revenue leakage.

Debt servicing now consumes a disproportionate share of federal revenue. Borrowing meant for capital projects increasingly finances recurrent obligations. The country shifts from borrowing to build to borrowing to survive. Every missing naira compounds tomorrow’s liability.

The Treasury Single Account (TSA) was designed to plug such leakages. It consolidated government revenues under Section 80 of the Constitution into a unified framework. International financial institutions commended it as a landmark reform. Yet even today, the Minister of Finance, Wale Edun, has admitted that substantial government funds remain outside the TSA and outside the CBN’s consolidated visibility. Until August 1, 2024, he revealed, the federal government could not fully see its own balance sheet at the apex bank. That admission should alarm any serious economy.

Fiscal lack of transparency constrains planning. It undermines monetary coordination. It weakens debt sustainability projections. It distorts policy responses. And when systems are in flux, money vanishes more easily.

Changing or weakening the TSA in such an environment would be catastrophic. Transitions create windows of vulnerability. Old accounts close. New accounts open. Reconciliation’s lag. Ghost contractors reappear. Double payments slip through.

Albeit, the government must learn to tread with caution as Nigeria’s institutional bandwidth is already strained by simultaneous tax reforms, exchange-rate adjustments, subsidy removal, and fiscal restructuring. One truth that cannot be argued is that layering additional structural upheaval onto fragile systems risks revenue loss that the country cannot afford. Investors are watching.

Credit markets evaluate not just numbers but institutional consistency. A nation that abandons or weakens its most credible fiscal reform sends a destabilising signal. Stability lowers borrowing costs. Institutional drift raises them. But beyond markets lies the human cost.

N300 trillion represents roads not built, power plants not completed, irrigation systems not funded, schools not modernised, and hospitals not equipped. It represents jobs not created and industries not catalysed. It represents stalled productivity and deferred growth.

When intervention loans remain unrecovered, agricultural output suffers. When power sector funds are unaccounted for, electricity remains unstable. When social investment funds are frozen, poverty deepens.

Inflation then compounds the pain. Revenue gaps push borrowing. Borrowing pressures, interest rates and by extension, liquidity misalignment fuel price instability. Citizens pay through higher food costs, transport fares, and rent. The poor pay first. The middle class erodes quietly.

Perhaps most corrosive is the trust deficit. When audit queries fade without visible accountability, tax morale weakens. Compliance declines. Cynicism hardens. A nation cannot modernise where trust in fiscal integrity is fragile.

Section 15(5) of the Constitution requires the abolition of corrupt practices. Financial Regulations mandate a surcharge and referral to anti-corruption agencies where public officers fail to account for funds. The Fiscal Responsibility Act empowers citizens to enforce compliance to ensure that government officials follow fiscal rules. But enforcement defines seriousness.

Nigeria’s problem is not a lack of audit findings. It is the distance between findings and finality.

Nations do not collapse overnight due to a lack of funds. They drift. Infrastructure decays incrementally. Debt rises gradually. Growth slows subtly. Confidence erodes quietly. Then one day, stagnation feels permanent. $214 billion (N300 trillion), sixteen years of recurring audit alarms. Few conclusive accountability outcomes are proportionate to the scale. Truly, the consequences have been less strong. For the same reason, the country witnessed President Tinubu nominating ex-NIA boss Ayodele Oke as ambassador despite a $43 million loot in an Ikoyi apartment.

See the research breakdown of some of the audit figures that reveal staggering sums as enumerated above:

– $10.8 billion and separately $20 billion in unaccounted oil revenues at the NNPC in 2014

– $1.1 billion controversial Malabu Oil and Gas oil deal in 2015

– $2.2 billion arms procurement irregularities in 2015

– N3.4 billion from IMF COVID-19 financing flagged in a 2020 audit.

– N149.36 billion, N37.2 billion, and multiple irregular MDA expenditures in 2020 alone.

– N300 billion cited in public audit concerns in 2017.

– N210 trillion in financial irregularities uncovered, N103 trillion in ‘accrued expenses’, and another N107 trillion in unaccounted ‘receivables’ (2017 -2023).

– N57 billion Ministry of Humanitarian Affairs – (2021)

– N3 trillion and N1.44 trillion flagged in 2022 audit issues involving the Central Bank of Nigeria.

– Nearly N630 billion under the Anchor Borrowers Programme is reportedly unrecovered.

– N784 billion in overdue intervention loans flagged.

– Over N3.403 trillion unaccounted for across federal MDAs between 2019 and 2021.

– Roughly 30 trillion+ in Treasury Single Account and Consolidated Revenue Fund discrepancies raised at the Senate level.

– N500 billion in unremitted oil revenues between 2019 and 2024.

– N80 billion tied to alleged fictitious contracts in the Accountant-General’s office.

– N69.9 billion in uncollected statutory tax liabilities.

– Billions more in unauthorised or undocumented expenditures across ministries.

The institutions differ. The years differ. The audit language differs. The pattern does not.

Nigeria’s economic future will not be determined solely by how much oil it produces, how many reforms it announces, or how many executive orders it signs. It will be determined by whether every naira earned enters the Federation Account transparently, whether every intervention loan is tracked and recovered, whether every surplus is remitted constitutionally, and whether every diversion carries consequences. Revenue generation matters. Revenue protection is destiny. Because when government funds go missing, nations do not stand still. They move backwards.

Blaise, a journalist and PR professional, writes from Lagos and can be reached via: bl***********@***il.com

-

Feature/OPED6 years ago

Feature/OPED6 years agoDavos was Different this year

-

Travel/Tourism10 years ago

Lagos Seals Western Lodge Hotel In Ikorodu

-

Showbiz3 years ago

Showbiz3 years agoEstranged Lover Releases Videos of Empress Njamah Bathing

-

Banking8 years ago

Banking8 years agoSort Codes of GTBank Branches in Nigeria

-

Economy3 years ago

Economy3 years agoSubsidy Removal: CNG at N130 Per Litre Cheaper Than Petrol—IPMAN

-

Banking3 years ago

Banking3 years agoSort Codes of UBA Branches in Nigeria

-

Banking3 years ago

Banking3 years agoFirst Bank Announces Planned Downtime

-

Sports3 years ago

Sports3 years agoHighest Paid Nigerian Footballer – How Much Do Nigerian Footballers Earn