General

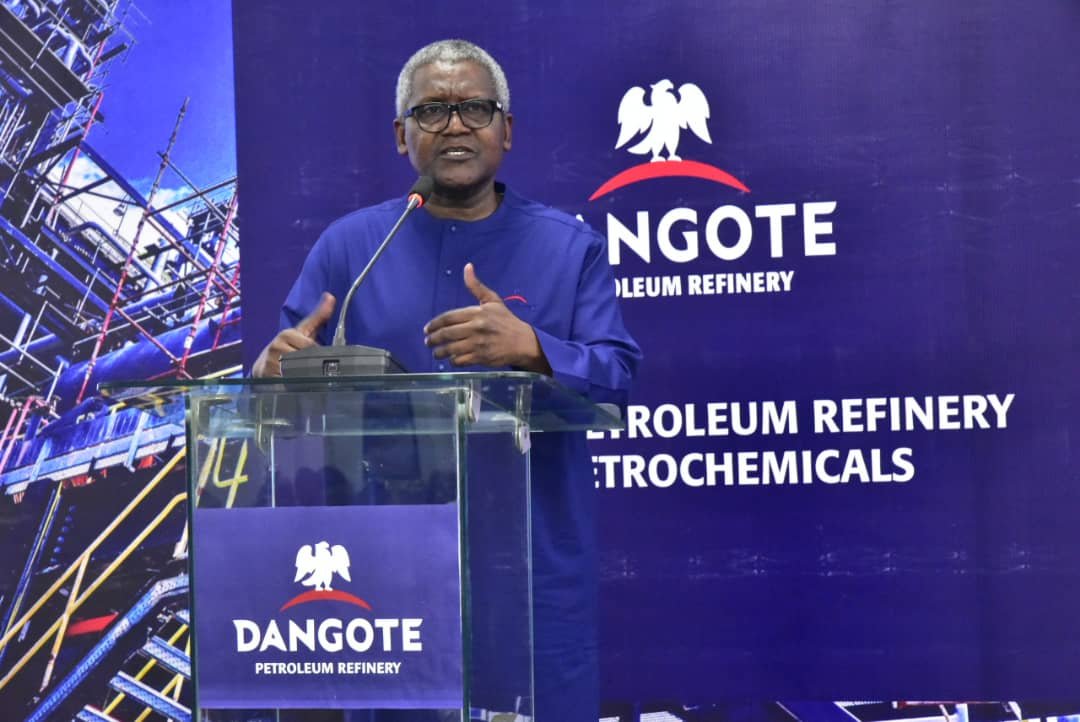

Dangote Denies Getting 10-Year Tax Holiday from FG

By Dipo Olowookere

The management of Dangote Group has refuted reports making the rounds that its Chairman, Mr Aliko Dangote, has secured a 10-year tax holiday from the Federal Government after he agreed to rehabilitate the 35km Apapa to Oworonshoki highway end of the Lagos-Ibadan Expressway.

Speaking on Monday at the Ikoyi head office of the firm, the Group Executive Director, Strategy, Portfolio Development and Capital Projects, Dangote Industries Limited, Mr Devakumar Edwin, disclosed that the company has never benefited any tax waivers or credits in its entire history except when it is industry based and same applies to all industry players.

Mr Edwin described as “painful” reports claiming that Dangote Group has been given 10-year tax holiday by the government.

According to him, the company volunteered to repair the Apapa road at no cost to the Federal Government as part of its Corporate Social Responsibility (CSR) initiative.

He noted that the construction of the Apapa to Oworonshoki long highway would be done at 15 to 25 percent less than the lowest bid.

“It is very painful when some people accuse our company of benefitting 10 years’ tax rebate from the government. There is nothing like tax credit in all these.

“We volunteered to construct the Apapa to Oworonshoki long highway at a cost that will be about 15 to 25 percent less than the lowest bid on the road.

“We hope to get back our money after three years by removing the sum from the tax we are supposed to pay,” Mr Edwin said on Monday.

He further explained that the company proposed to the government to reduce 50 percent of the total cost of the road, from its proposed tax, on its first year after completion and 25 percent of the costs respectively for two years from its proposed tax.

“…the government came forward and said, good enough your company is repairing a road that is very important to all Nigerians…is it possible to help us do proper road construction of 35 kilometres from Apapa to Oworonshoki?

“We advised the government to go for a competitive bidding and also that we will take it up at a costs that will be lower than the lowest bid received by the government.

“Since the government may not be handy with cash, we proposed that we will recover our money over three years in instalments against our future tax.

“The reality is the government will not pay us for the construction, but we will only offset our costs against our three years tax,” he added.

It would be recalled that the federal government said it would give tax relief to private sectors that invest in road construction in the country.

Speaking at the Road Construction Summit 2017 organised by Lafarge and Business Day at the weekend in Lagos, the Minister of Power, Works and Housing, Mr Babatunde Fashola said that there are a lot of possibilities that lie ahead when private capital comes into road construction under the tax relief order as proposed to be amended and complements government spending.

According to him, the government has just concluded an agreement using the tax incentive order to hand over the Apapa area comprising Creek Road, Liverpool Road, Marine Beach to Mile 2, Oshodi, Oworonshoki to the Lagos end of the Toll Gate on the Ibadan Expressway to Dangote Group.

Also, he said the government has signed an agreement with NLNG to construct the Bodo-Bonny Bridge at the cost of N120.6 billion with NLNG and federal government sharing the cost.

“We have identified 28 toll plazas out of the old toll plazas, on roads where construction work is currently going on, at which we propose to restore toll plazas.

“We have also concluded traffic surveys on 51 major highways and now have current traffic data on these roads and we can project vehicular traffic movement for tolling and concession purposes,” Mr Fashola said.

Going by the recent second quarter GDP report, the Minister said, “With respect to construction and related activities, GDP in the sector had been negative since Q2 2015, but turned positive for the first time in Q1 2017 growing by 0.15 per cent and continued to positive growth into Q2 2017 by growing by 0.13 per cent. The reversal in construction has to do with civil works especially due to FGN capital expenditure.”

Chairman, Lafarge Africa, Mr Mobolaji Balogun noted that with the federal and respective state governments grappling with dwindling resources, it has become crucial that the ecosystem of public and private sector players brainstorm on issues of funding, partnerships, design, and quality of roads in Nigeria, as for sure government can no longer do it alone.

General

NIMASA Rallies Stakeholders’ to Develop National Action Plan

By Adedapo Adesanya

The Nigerian Maritime Administration and Safety Agency (NIMASA) has pledged its commitment to provide the regulatory leadership, technical coordination, and stakeholder engagement required to successfully develop and implement a robust National Action Plan on maritime decarbonization in Nigeria.

The Director General of the agency, Mr Dayo Mobereola, made this known during the National Stakeholders’ workshop on the development of a National Maritime Decarbonization Action Plan, further describing the workshop as a critical step in actualising the Federal Government’s blue economy and climate objectives.

Represented by the Executive Director, Operations, Mr Fatai Taiye Adeyemi, the NIMASA DG underscored the significance of the IMO GreenVoyage2050 Project, a technical cooperation initiative /designed to support developing countries in implementing the IMO GHG Strategy.

According to him, the National Action Plan being developed will reflect national realities, leverage existing capacities, address identified gaps, and align with broader economic and environmental priorities of the federal government.

Mr Mobereola stressed that “this transition is not merely about compliance with international obligations, it is about safeguarding our marine environment, protecting public health, strengthening the blue economy, and ensuring that our maritime industry remains competitive and future-ready”, the DG said.

Also speaking at the event was the Technical Manager of the IMO GreenVoyage2050 Project, Ms Astrid Dispert, who highlighted that the overarching objective of the initiative is to advance a coherent and globally aligned regulatory framework to accelerate maritime decarbonization.

She also emphasised that NIMASA plays a pivotal role in driving the project at the national level.

The IMO GreenVoyage2050 Project provides technical expertise and institutional support to assist countries in developing and implementing National Action Plans that promote sustainable shipping practices, encourage investment in clean technologies, and strengthen capacity for long-term emissions reduction.

Through this collaboration, the federal government is advancing deliberate steps towards maritime decarbonization, reinforcing its commitment to global climate goals and ensuring a cleaner, greener, and more sustainable future for the sector.

General

BPP Mandates Digital Submission for MDAs From March 1

By Adedapo Adesanya

The Bureau of Public Procurement (BPP) has directed all Ministries, Departments and Agencies (MDAs) to comply with its digital submission process effective March 1.

The directive was contained in a circular signed by the Director-General of the Bureau, Mr Adebowale Adedokun, noting that the move was part of the bureau’s commitment to digital transformation and paperless governance.

It explained that the transition followed an earlier circular of Aug. 4, 2025, which introduced electronic submission procedures.

According to the bureau, it has successfully moved from physical filings to a dedicated e-mail service for document submissions and is now advancing to a more robust and integrated system.

The circular announced the inauguration of the BPP Digital Submission Portal, a web-based platform designed to enable MDAs submit procurement-related documents directly to the Bureau.

It stated that the automated platform would streamline the submission process, enhance transparency and ensure accelerated tracking of procurement-related documents and petitions.

“With effect from March 1, all MDAs will be required to use the portal to submit requests for ‘No Objection’ Certificates, approvals for ‘No Objection’ for special procurements, clarifications and status updates on submissions,” the bureau said.

It added that the portal would be hosted on the Bureau’s official website and would become fully operational from the effective date.

The bureau warned that physical submissions or manual hand-deliveries would no longer be prioritised and would eventually be rejected following the full transition to the digital platform.

It urged accounting officers to brief their procurement departments and ICT units on the development to ensure seamless processing of procurement activities from March 1.

It further advised MDAs to contact the Bureau via its official email for information on the onboarding process and integration into the portal.

The bureau emphasised that full compliance by all MDAs was required to ensure a smooth transition and avoid delays in the implementation of the 2026 fiscal year procurement processes.

General

Senate Seeks Removal of CAC Boss Hussaini Magaji

By Adedapo Adesanya

The Senate has asked President Bola Tinubu to remove the Registrar General of the Corporate Affairs Commission (CAC), Mr Hussaini Ishaq Magaji, from office.

The Senate Committee on Finance, while passing a resolution in Abuja on Thursday, accused Mr Magaji, a Senior Advocate of Nigeria (SAN), of failing to honour the Senate’s invitations to account for the finances of his agency.

“He refused on so many occasions to honour our invitation to appear before this committee.

“We have issues with the reconciliation of the revenue of CAC.

“Each time we invite him, he gives us excuses,” the Chairman of the committee, Mr Sani Musa, said as the committee passed the resolution.

CAC was part of a group of agencies that the House of Representatives Public Accounts Committee (PAC) recommended zero allocation for the year 2026, for allegedly failing to account for public funds appropriated to them.

The committee, at an investigative hearing held two weeks ago, accused CAC and some other ministries, departments and agencies (MDAs) of shunning invitations to respond to audit queries contained in the Auditor-General for the Federation’s annual reports for 2020, 2021 and 2022.

The PAC chairman, Mr Bamidele Salam, stated that the National Assembly should not continue to appropriate public funds to institutions that disregard accountability mechanisms, saying this will create fiscal discipline and strengthen transparency across federal institutions and conform with extant financial regulations and the oversight powers of the parliament.

“Public funds are held in trust for the Nigerian people. Any agency that fails to account for previous allocations, refuses to submit audited accounts, or ignores legislative summons cannot, in good conscience, expect fresh budgetary provisions. Accountability is not optional; it is a constitutional obligation,” he said.

-

Feature/OPED6 years ago

Feature/OPED6 years agoDavos was Different this year

-

Travel/Tourism10 years ago

Lagos Seals Western Lodge Hotel In Ikorodu

-

Showbiz3 years ago

Showbiz3 years agoEstranged Lover Releases Videos of Empress Njamah Bathing

-

Banking8 years ago

Banking8 years agoSort Codes of GTBank Branches in Nigeria

-

Economy3 years ago

Economy3 years agoSubsidy Removal: CNG at N130 Per Litre Cheaper Than Petrol—IPMAN

-

Banking3 years ago

Banking3 years agoSort Codes of UBA Branches in Nigeria

-

Banking3 years ago

Banking3 years agoFirst Bank Announces Planned Downtime

-

Sports3 years ago

Sports3 years agoHighest Paid Nigerian Footballer – How Much Do Nigerian Footballers Earn