General

FG Launches Central Database for Stolen Asset Tracing

By Adedapo Adesanya

The federal government has launched a Central Database under the Asset Tracing, Recovery and Management Regulations (ARTM), 2019 and the Central Criminal Justice Information System (CCJIS) under the National Anti-Corruption Strategy (NACS) 2017 – 2011 to assist in the fight against corruption.

This was launched by the Attorney-General of the Federation (AGF) and Minister of Justice, Mr Abubakar Malami, on Thursday in Abuja.

Mr Malami said the database will ensure uniformity of process, access and information feeding to deepen transparency and accountability in the management of recovered assets.

To ensure compliance, he said his office is developing legislation for the full implementation and operation of the CCJIS.

“We will work together to establish and re-enact transparency and accountability in governance and management of our resources which we have committed to do by way of strengthening International Cooperation of our membership of Open Government Partnership,” he said.

In his speech, the Speaker of the House of Representatives, Mr Femi Gbajabiamila, represented by the Chairman, House Committee on Justice, Mrs Ugonna Ozurigbo, said the regulation on Asset Tracing, Recovery and proper management of proceeds of crime was signed on October 24, 2019, and took effect from November 1, 2019, replaced the proceeds of Crime Regulation of 2012.

The new regulation titled Asset Tracing, Recovery and Management Regulations 2019 empowers the AGF to take charge of the custody and management of all final forfeited assets, approval and appointment of asset managers and operating and maintaining a database for the records of all recovered assets within and outside Nigeria.

He said, the AGF’s office, under the new regulation, is also required to coordinate inter-agency investigations into recovery matters within and outside Nigeria from all law enforcement agencies whose law empowers them to undertake recoveries and maintaining a depository for all forfeiture orders issued by the Nigeria courts and courts outside Nigeria.

Asset Tracing, Recovery and Management, according to the Speaker, is a core value of good governance and its effective management will serve as a deterrent to would-be fraudulent minded individuals who may find themselves in public offices.

According to him, states resources must not be allowed to be stolen but if that happened by fraudulent individuals, efforts must be taken to trace the proceed, recover same and manage for the interest of the generality of the people.

“When the proceeds of crime are traced and recovered but again looted by government officials, I dare to say such act amounts to the crime of tertiary capacity and must be avoided.

“Assets not accounted for are assets lost; loss of assets undervalues the economic potential of a country and will negatively impact on the net worth of a country. Accordingly, Asset Tracing Recovery and Management is a panacea to rekindling of the value system of a nation,” the Speaker noted.

He disclosed that the United Nations Office on Drugs and Crime (UNODC) reported that about $ 110 billion was being looted annually from the Nigerian treasury and that stolen money stashed in foreign accounts by corrupt Nigeria public office holders increased from $50 billion in 1999 to $170 billion in 2003.

While pointing out that the figure has increased over the years, he said it must not be allowed to continue.

Mr Gbajabiamila said asset tracing, recovery and management of central database will help in addressing asset repatriation to the country of origin through effective coordination of various anti-corruption bodies in the country.

The launch was witnessed by officials from government agencies including the Economic and Financial Crimes Commission (EFCC), Independent Corrupt Practices Commission (ICPC) and the Federal Inland Revenue Service (FIRS).

In his remark ICPC Chairman, Mr Bolaji Owasanoye said all anti-corruption agencies should be digitised and integrated for easy access.

This is coming a day after the FEC approved transmission of a bill titled Proceeds of Crime Recovery and Management Agency Bill, which will establish an agency that would see to proper documentation and management of recovered assets and thereby guarantee transparency and accountability.

General

FG Sues El-Rufai Over Alleged Interception of NSA Ribadu’s Communications

By Adedapo Adesanya

The federal government has filed a three-count charge against former governor of Kaduna State, Mr Nasir El-Rufai, over an alleged interception of communications belonging to Nigeria’s National Security Adviser (NSA), Mr Nuhu Ribadu.

Last week, Mr El-Rufai claimed in an interview that he and other unnamed individuals listened to conversations from Mr Ribadu’s phone after it was tapped by a third party. While acknowledging that such interception is technically unlawful, he argued that illegal surveillance was not unusual.

However, the federal government, through the Department of State Services (DSS), filed charges against Mr El-Rufai at the Federal High Court in Abuja.

The government stated that Mr El-Rufai admitted that he and his cohorts allegedly intercepted the NSA’s phone conversations.

In count one, the accused was alleged to have disclosed on Arise TV’s Prime Time Programme in Abuja that he and his associates unlawfully intercepted the phone communications of the National Security Adviser, which is an offence contrary to and punishable under Section 12(1) of the Cybercrimes (Prohibition, Prevention, etc.) Amendment Act, 2024.

The second charge alleged that the accused knowingly maintained a relationship with an individual who unlawfully intercepted the phone communications of Mr Ribadu, without reporting such individual to the appropriate security agencies, an offence contrary to and punishable under Section 27(b) of the Cybercrimes (Prohibition, Prevention, etc.) Amendment Act, 2024.

In the last charge, Mr El Rufai, together with others presently at large, is also alleged to have, sometime in 2026 in Abuja within the jurisdiction of this Court, utilised technical equipment or systems in a manner that compromised public safety and national security, thereby instilling reasonable apprehension of insecurity among Nigerians through the unlawful interception of the phone communications of the National Security Adviser, Nuhu Ribadu. The charge further relies on his admission during the February 13 interview. These acts are alleged to constitute an offence contrary to and punishable under Section 131(2) of the Nigerian Communications Act 2003.

General

Nigerian Bottling Company Bridges Education, Employability Gap

By Modupe Gbadeyanka

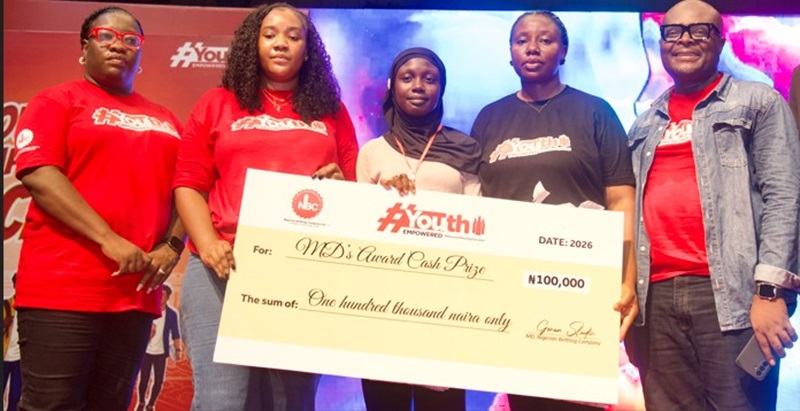

The Nigerian Bottling Company (NBC) has reaffirmed its determination to bridge the gap between education and employability in the country by sustaining its flagship Youth Empowered (YE) programme.

This initiative provides hands-on learning, real-world insights, and access to career-shaping opportunities to young Nigerians.

The 2026 edition of the scheme commenced on February 2 at the University of Lagos (UNILAG), with participants mainly young people between the ages of 16 and 35.

A statement from the organisation said this year’s rollout will expand to more tertiary institutions, including the Federal University of Technology, Akure (FUTA). This follows a successful 2025 tour that reached seven cities across the country, including Makurdi, Jos, Benin, Kaduna, Asaba, Akure, and Port Harcourt.

Participants in the 2026 programme will receive training across key modules designed to support personal, professional, and business growth, including Business Life Skills, Adaptability and Resilience, Financial Literacy, Customer Service and Communication, Sales and Negotiation Skills, and Workplace Ethics.

The sessions will also feature breakout workshops on Business Planning, Project Management, and Time Management, alongside the Director’s Grant Pitch Competition, where participants can pitch their ideas for a chance to win business funding.

In addition to skills development, NBC’s People and Culture team will be present throughout the programme to identify outstanding talent for future opportunities within the organisation, further strengthening the connection between learning, employment, and long-term career growth.

One of the participants at the UNILAG training, Waliat Adedogun, who received a cash grant through the Director’s Grant Pitch Competition to support her small business, said: “Youth Empowered gave me more than training; it gave me clarity and confidence. Winning the grant means I can finally take my business idea from a dream into something real. I now feel prepared to build, grow, and create opportunities not just for myself, but for others too.”

Since its launch in 2017, the scheme has impacted more than 70,000 young Nigerians, equipping participants with practical skills, confidence, and exposure needed to succeed in today’s dynamic workplace and entrepreneurial landscape.

This year’s programme is being delivered in collaboration with Fate Foundation as the implementing partner, with funding support from The Coca-Cola HBC Foundation.

Last year, 10 beneficiaries were selected for six-month paid internships across NBC locations in Lagos, Ibadan, Asejire, and Challawa, gaining direct industry exposure.

Additionally, three outstanding participants received sponsorship for an all-expenses-paid intensive culinary training programme and were awarded N1 million each to support the launch of their businesses.

General

INEC Fixes February 20 for 2027 Presidential, NASS Elections

By Modupe Gbadeyanka

The 2027 presidential and National Assembly elections will take place on Saturday, February 20, the Independent National Electoral Commission (INEC) has revealed.

In a notice for the 2027 general polls issued on Friday, the electoral umpire also disclosed that the governorship and state assembly elections for next year would be on Saturday, March 6.

Speaking at a news briefing in Abuja today, the chairman of INEC, Mr Joash Amupitan, expressed the readiness of the commission to conduct the polls next year, which is 12 months away.

The timetable issued by the organisation for the polls comes when the federal parliament has yet to transmit the amended electoral bill to President Bola Tinubu for assent.

This week, the Senate passed the electoral bill, reducing the notice of elections from 360 days to 180 days, while the transmission of results was mandated with a proviso.

Recall that on February 4, INEC said it was ready to go ahead with preparations for the elections despite the delay in the passage of the amended electoral law of 2022.

-

Feature/OPED6 years ago

Feature/OPED6 years agoDavos was Different this year

-

Travel/Tourism10 years ago

Lagos Seals Western Lodge Hotel In Ikorodu

-

Showbiz3 years ago

Showbiz3 years agoEstranged Lover Releases Videos of Empress Njamah Bathing

-

Banking8 years ago

Banking8 years agoSort Codes of GTBank Branches in Nigeria

-

Economy3 years ago

Economy3 years agoSubsidy Removal: CNG at N130 Per Litre Cheaper Than Petrol—IPMAN

-

Banking3 years ago

Banking3 years agoSort Codes of UBA Branches in Nigeria

-

Banking3 years ago

Banking3 years agoFirst Bank Announces Planned Downtime

-

Sports3 years ago

Sports3 years agoHighest Paid Nigerian Footballer – How Much Do Nigerian Footballers Earn