General

From High Finance to Financial Inclusion: Mamadou Kwidjim Toure’s Ubuntu Tribe

Mamadou Kwidjim Toure structured deals worth over $25 billion during two decades at KPMG, BNP Paribas, and IBM. Then he left it behind to sell gold tokens for 10 cents each.

His company, Ubuntu Tribe, launched its GIFT Gold token in Singapore on October 1. Each token represents one milligram of gold — like splitting a gold bar into 31,000 digital shares — stored in vaults across Switzerland, Germany, Dubai, and Singapore. The product targets people who can’t meet the minimum investments traditional gold dealers require.

The Career That Revealed the Gap

Toure’s work took him across 26 African markets over 20 years. He watched traditional finance serve corporations and governments while ignoring the populations that needed it most. “Traditional gold investment requires thousands of dollars. That excludes 360 million unbanked adults in Sub-Saharan Africa who need protection from currency devaluation most,” Toure said.

That experience showed him a problem banks wouldn’t solve: millions of people locked out of wealth preservation tools while inflation eroded their savings. Ubuntu Tribe emerged from that gap.

How Swiss Vaults Serve the Unbanked

The model addresses a straightforward problem. Gold has climbed roughly 1,000% since 2000, outpacing most emerging market currencies. But traditional dealers require minimum investments that exclude most Africans from accessing that protection.

Ubuntu Tribe uses blockchain to track fractional ownership of physical gold reserves. “When someone buys our GIFT Gold tokens, they’re not betting on algorithms or market sentiment. They’re buying actual gold stored in Swiss vaults, verified by independent auditors,” Toure explained.

The company maintains a Track-n-Trace system that lets anyone with internet access verify reserves in real time. Toure said Ubuntu Tribe selected partners based on traditional finance credentials. “Everything gets published publicly. We chose partners based on their reputation in traditional finance, not crypto,” he said.

Token holders can request physical gold delivery, though the company expects most to keep their holdings digital. The focus on transparency stems from a string of crypto blowups — projects that claimed backing by real assets but folded once auditors found the vaults empty.

Navigating Fragmented Regulation

Ubuntu Tribe falls under the EU’s Markets in Crypto-Assets framework—detailed disclosures, reserve requirements, regular audits. But that regulatory footing stops at Europe’s borders. In Nigeria and Kenya, where Ubuntu Tribe sees its main opportunities, the rules look entirely different.

Toure points to this patchwork as a drag on growth. “Unified standards would let us scale faster, reduce costs, and pass those savings to users.”

The Crowded Race to Tokenize Assets

Ubuntu Tribe isn’t the first to tokenize gold. Established players already offer regulated products in most of major markets. Financial institutions and crypto startups both race to digitize commodities, real estate, and other physical assets.

The company’s success in Africa will depend on whether it can secure regulatory approvals in key markets and convince users to trust that tokens genuinely represent gold reserves. The continent has adopted digital finance before — mobile money moved over $1 trillion in 2024, more than Kenya’s entire GDP, by filling gaps banks left open.

Toure declined to speculate on expansion timelines beyond stating a principle. “Any future expansion would need to serve the same fundamental purpose: protecting purchasing power for people who lack access to traditional wealth preservation tools,” he said.

Credentials Meet Mission

The model combines regulatory compliance, verifiable reserves, and fractional ownership to tackle barriers that have kept gold investment out of reach. Currency devaluation continues to erode savings in markets where formal financial services remain scarce.

Toure’s two decades structuring deals across African markets and Ubuntu Tribe’s early regulatory compliance provide advantages that many tokenization projects lack. Whether those credentials can bridge the gap between high finance and financial inclusion will depend on execution in markets that need the solution most.

The man who once moved billions now focuses on 10-cent tokens. The scale changed. The mission — protecting purchasing power for those traditional finance excluded — stayed the same.

General

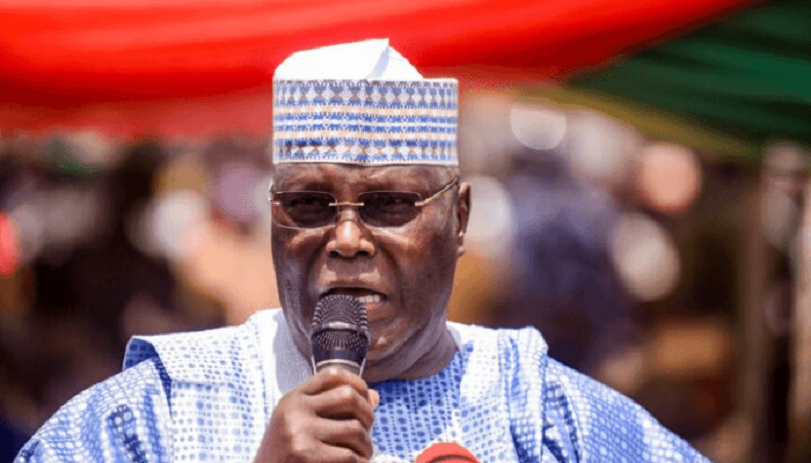

Nigeria’s Democracy Suffocating Under Tinubu—Atiku

By Modupe Gbadeyanka

Former Vice President, Mr Atiku Abubakar, has lambasted the administration of President Bola Tinubu for the turnout at the FCT Area Council elections held last Saturday.

In a statement signed by his Media Office, the Adamawa-born politician claimed that the health of Nigeria’s democracy under the current administration was under threat.

According to him, “When citizens lose faith that their votes matter, democracy begins to die. What we are witnessing is not mere voter apathy. It is a direct consequence of an administration that governs with a chokehold on pluralism. Democracy in Nigeria is being suffocated slowly, steadily, and dangerously.”

He warned that the steady erosion of participatory governance, if left unchecked, could inflict irreversible damage on the democratic fabric painstakingly built over decades.

“A democracy without vibrant opposition, without free political competition, and without public confidence is democracy in name only. If this chokehold is not released, history will record this era as the period when our hard-won freedoms were traded for fear and conformity,” he stressed.

Mr Atiku said the turnout for the poll was below 20 per cent, with the Abuja Municipal Area Council (AMAC) recording 7.8 per cent.

He noted that such civic participation in the nation’s capital, the symbolic heartbeat of the federation, is not accidental, as it is the predictable outcome of a political environment poisoned by intolerance, intimidation, and the systematic weakening of opposition voices.

The presidential candidate of the People’s Democratic Party (PDP) in the 2023 general elections stated that the ruling All Progressives Congress (APC) under Mr Tinubu has pursued a deliberate policy of shrinking democratic space, harassing dissenters, coercing defectors, and fostering a climate where alternative political viewpoints are treated as threats rather than contributions to national development.

He called on opposition parties and democratic forces across the country to urgently close ranks and forge a united front, declaring, “This is no longer about party lines; it is about preserving the Republic. The time to stand together to rescue and rebuild Nigeria is now.”

General

Nigeria Eyes Full Entry into Council of Palm Oil Producing Countries

By Adedapo Adesanya

Nigeria is set to validate a technical committee report geared towards transitioning the country from observer status to full membership of the Council of Palm Oil Producing Countries (CPOPC) in April.

Mr Abubakar Kyari, Minister of Agriculture and Food Security, said this when the council’s mission visited him over the weekend in Abuja, noting that the ministry had constituted a technical committee to consider how the country would seamlessly transit from observer country to membership in CPOPC based on its strategic importance in palm oil production.

“We are conscious of the fact that the palm oil value chain is very strategic for us and identified it as an export crop that can drive foreign exchange for the country and ensure good health in terms of consumption.

“We are conscious of the fact that we need the support of CPOPC countries to provide the country with a new variety of seeds that are climate-smart and resistant so that they can be produced by farmers in the country,” he said.

Mr Alphonsus Inyang, President, National Palm Produce Association of Nigeria (NPPAN), said being a member of CPOPC Nigeria would target over 10 million tonnes of oil palm between 2026 and 2050.

“We are also targeting 2.5 million hectares from among Nigeria households who are out to produce one hectare each, geared towards a N20 trillion annual economy within this period from among Nigeria households.

“We are working side by side with the big players who will be developing plantations,” he said.

The Secretary-General of CPOPC, Ms Izzana Salleh, said the council’s mission to Nigeria was to see how the country could transit from observer status to full membership, among others

She said that the status of the country as an observer nation since 2024 would expire by November.

Ms Salleh assured the country of the council’s readiness to support its vision to strengthen domestic production, enhance food security and build a competitive and sustainable palm oil supply chain.

The official emphasised that being a member of the council would strategically position Nigeria for a greater future regarding oil palm production.

According to her, the visit is to strengthen the council’s engagement with Nigeria, including potential membership in CPOPC.

She said: “The council’s mission to Nigeria aims to advance both Nigeria’s national ambitions and Africa’s collective voice in global agricultural discussions.

“CPOPC was established to promote cooperation among producing nations, empower smallholders, advance sustainability, and ensure fair, science-based global dialogue on vegetable oils.

She emphasised that being a member of the council would strategically position the country for greater future prospects regarding oil palm production and the value chain, as well as export.

“We are ready to support Nigeria’s vision to strengthen domestic production, enhance food security, and build a competitive and sustainable palm oil supply chain,” she said.

General

Violence Mars APC Ward Congress in Oluyole

By Modupe Gbadeyanka

The ward congress of the All Progressives Congress (APC) in Oluyole Local Government Area of Oyo State on Saturday left several party members injured after a violence clash erupted.

According to reports, one of the injured persons was Mr Idowu Oyawale, who served as the campaign Director General of a House of Representatives member in the last general elections, Ms Tolulope Akande-Sadipe.

It was disclosed that he sustained severe injuries during the exercise and is currently receiving treatment at an undisclosed hospital.

The ward congress was organised by the ruling party to elect ward executives across the local government’s wards.

However, it was disrupted at Olomi Ward 7 by suspected heavily-armed political thugs allegedly linked to a member of the party.

It was claimed that the thugs invaded the congress venue at Olomi Basic School 1, dispersing party members and officials supervising the exercise, with stones, clubs and other weapons.

Eyewitnesses said tensions escalated unprovoked over delegates’ lists and ward executive positions. The disagreement reportedly degenerated into physical altercations before the violent attacks on some party members.

It was learnt that security operatives led a tactical team to restore order, peace, and disperse the attackers.

Reacting to the incident, some party leaders and elders condemned the violence, describing it as unfortunate and capable of undermining the credibility of the internal democratic process.

The leaders have called on party chieftains and President Bola Tinubu to immediately order an investigation into the violent attacks.

-

Feature/OPED6 years ago

Feature/OPED6 years agoDavos was Different this year

-

Travel/Tourism10 years ago

Lagos Seals Western Lodge Hotel In Ikorodu

-

Showbiz3 years ago

Showbiz3 years agoEstranged Lover Releases Videos of Empress Njamah Bathing

-

Banking8 years ago

Banking8 years agoSort Codes of GTBank Branches in Nigeria

-

Economy3 years ago

Economy3 years agoSubsidy Removal: CNG at N130 Per Litre Cheaper Than Petrol—IPMAN

-

Banking3 years ago

Banking3 years agoSort Codes of UBA Branches in Nigeria

-

Banking3 years ago

Banking3 years agoFirst Bank Announces Planned Downtime

-

Sports3 years ago

Sports3 years agoHighest Paid Nigerian Footballer – How Much Do Nigerian Footballers Earn