General

General Electric in Multi-Million Dollar Tax Deduction Mess

By TheCable

General Electric (GE) withheld tax in excess of $3 million from its payments to Arco Group Plc, a Nigerian oil servicing company, according to documents seen by TheCable.

There is strong evidence backing Arco’s allegation, but GE has told TheCable it would not comment “for confidentiality reasons”.

In one of the documents, Arco claimed that GE deducted 10% as withholding tax for a contract between 2006 and 2015 as against the 5% stipulated by Nigerian laws.

GE, a multinational company operating in the Nigerian oil and gas sector, had engaged Arco for the supply of local personnel.

“Our interpretation of the contract of supply is that the applicable WHT rate should be 5% in line with the Federal Inland Revenue Service Circular No. 2006/02 dated February 2006,” Arco wrote, in a letter addressed to the Federal Inland Revenue Service (FIRS) seeking clarification on the applicable withholding tax rate to the contract.

“However, the IOC insisted that the rate is 10% in line with the contract for technical services in the same circular under reference. However, section 3.5 of the circular (Lines 8-11) referred to what should be classified as technical services states: the use of industrial machinery/equipment to provide a service does not render it to be technical because industry position requires that only arrangements that involve a transfer of technology, should be classified as technical.”

In a mail dated June 21, 2017, Fasilat Ransome-Kuti of General Electric Corporate, who was subsequently introduced as a senior manager from Price Waterhouse Coopers (PwC), advised ARCO Group to seek clarification from the FIRS.

“We request you seek the clarification from the tax policy unit of FIRS in Abuja as only such clarification will suffice and give us comfort,” she wrote.

“Also, we are unable to suspend the remittance of WHT on payment to Arco as this will amount to non-compliance. There is penalty for non-compliance and this will be an additional cost to GE.”

In a letter dated November 2, 2017, and signed by Tunde Fowler, FIRS chairman, he said the only part of the contract that is subject to 10% tax is office rent which is to be deducted by Arco and remitted to FIRS.

Responding to the letter, GE said they had engaged PwC to confirm from FIRS.

It also expressed willingness to liaise with the FIRS on how the excess will be treated in the event the service upholds its position.

“This is based on the fact that the tax has already been deducted and remitted to the FIRS by GE. It is our view that the FIRS should either refund the excess WHT to Arco or apply it as a credit against Arco’s future tax liability,” GE wrote.

In a letter dated March 6, 2018, and signed by Benjamin Omotomiye, its group head of finance and admin, Arco demanded a refund of the funds deducted within the eight-year period.

He wrote: “What we are requesting now, is the refund of 50% of total WHT deducted from Arco’s invoices from the period 2006 to 2015 as earlier communicated to you in our letter dated November 6, 2017, following the FIRS’ clarification as follows:

– €56,577.61 (Fifty-six thousand, five hundred and seventy-seven euros, sixty-one cents)

– $2,923,642.36 (Two million, nine hundred and twenty-three thousand, six hundred and forty-two dollars and thirty-six cents)

– N360,482,041.19 (Three hundred and sixty million, four hundred and eighty-two thousand, forty-one naira and nineteen kobo).”

When TheCable reached out to GE for a reaction, the company refused to comment.

“On the questions raised, we can confirm the existence of a contractual relationship between Arco Group and ourselves,” Obagbemi Olusegun of BHGE Communications Sub-Saharan Africa, said.

“However, due to the confidentiality provisions governing this relationship, we are unable to disclose details of commercial dealings between both parties.

“I trust you understand our position on this.”

General

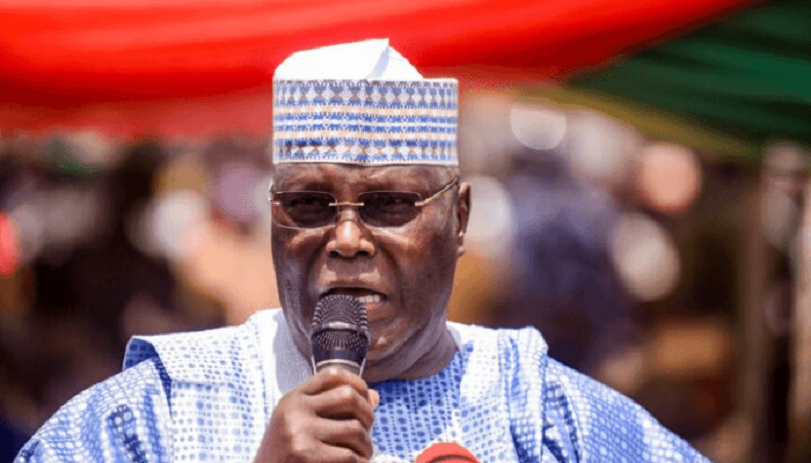

Nigeria’s Democracy Suffocating Under Tinubu—Atiku

By Modupe Gbadeyanka

Former Vice President, Mr Atiku Abubakar, has lambasted the administration of President Bola Tinubu for the turnout at the FCT Area Council elections held last Saturday.

In a statement signed by his Media Office, the Adamawa-born politician claimed that the health of Nigeria’s democracy under the current administration was under threat.

According to him, “When citizens lose faith that their votes matter, democracy begins to die. What we are witnessing is not mere voter apathy. It is a direct consequence of an administration that governs with a chokehold on pluralism. Democracy in Nigeria is being suffocated slowly, steadily, and dangerously.”

He warned that the steady erosion of participatory governance, if left unchecked, could inflict irreversible damage on the democratic fabric painstakingly built over decades.

“A democracy without vibrant opposition, without free political competition, and without public confidence is democracy in name only. If this chokehold is not released, history will record this era as the period when our hard-won freedoms were traded for fear and conformity,” he stressed.

Mr Atiku said the turnout for the poll was below 20 per cent, with the Abuja Municipal Area Council (AMAC) recording 7.8 per cent.

He noted that such civic participation in the nation’s capital, the symbolic heartbeat of the federation, is not accidental, as it is the predictable outcome of a political environment poisoned by intolerance, intimidation, and the systematic weakening of opposition voices.

The presidential candidate of the People’s Democratic Party (PDP) in the 2023 general elections stated that the ruling All Progressives Congress (APC) under Mr Tinubu has pursued a deliberate policy of shrinking democratic space, harassing dissenters, coercing defectors, and fostering a climate where alternative political viewpoints are treated as threats rather than contributions to national development.

He called on opposition parties and democratic forces across the country to urgently close ranks and forge a united front, declaring, “This is no longer about party lines; it is about preserving the Republic. The time to stand together to rescue and rebuild Nigeria is now.”

General

Nigeria Eyes Full Entry into Council of Palm Oil Producing Countries

By Adedapo Adesanya

Nigeria is set to validate a technical committee report geared towards transitioning the country from observer status to full membership of the Council of Palm Oil Producing Countries (CPOPC) in April.

Mr Abubakar Kyari, Minister of Agriculture and Food Security, said this when the council’s mission visited him over the weekend in Abuja, noting that the ministry had constituted a technical committee to consider how the country would seamlessly transit from observer country to membership in CPOPC based on its strategic importance in palm oil production.

“We are conscious of the fact that the palm oil value chain is very strategic for us and identified it as an export crop that can drive foreign exchange for the country and ensure good health in terms of consumption.

“We are conscious of the fact that we need the support of CPOPC countries to provide the country with a new variety of seeds that are climate-smart and resistant so that they can be produced by farmers in the country,” he said.

Mr Alphonsus Inyang, President, National Palm Produce Association of Nigeria (NPPAN), said being a member of CPOPC Nigeria would target over 10 million tonnes of oil palm between 2026 and 2050.

“We are also targeting 2.5 million hectares from among Nigeria households who are out to produce one hectare each, geared towards a N20 trillion annual economy within this period from among Nigeria households.

“We are working side by side with the big players who will be developing plantations,” he said.

The Secretary-General of CPOPC, Ms Izzana Salleh, said the council’s mission to Nigeria was to see how the country could transit from observer status to full membership, among others

She said that the status of the country as an observer nation since 2024 would expire by November.

Ms Salleh assured the country of the council’s readiness to support its vision to strengthen domestic production, enhance food security and build a competitive and sustainable palm oil supply chain.

The official emphasised that being a member of the council would strategically position Nigeria for a greater future regarding oil palm production.

According to her, the visit is to strengthen the council’s engagement with Nigeria, including potential membership in CPOPC.

She said: “The council’s mission to Nigeria aims to advance both Nigeria’s national ambitions and Africa’s collective voice in global agricultural discussions.

“CPOPC was established to promote cooperation among producing nations, empower smallholders, advance sustainability, and ensure fair, science-based global dialogue on vegetable oils.

She emphasised that being a member of the council would strategically position the country for greater future prospects regarding oil palm production and the value chain, as well as export.

“We are ready to support Nigeria’s vision to strengthen domestic production, enhance food security, and build a competitive and sustainable palm oil supply chain,” she said.

General

Violence Mars APC Ward Congress in Oluyole

By Modupe Gbadeyanka

The ward congress of the All Progressives Congress (APC) in Oluyole Local Government Area of Oyo State on Saturday left several party members injured after a violence clash erupted.

According to reports, one of the injured persons was Mr Idowu Oyawale, who served as the campaign Director General of a House of Representatives member in the last general elections, Ms Tolulope Akande-Sadipe.

It was disclosed that he sustained severe injuries during the exercise and is currently receiving treatment at an undisclosed hospital.

The ward congress was organised by the ruling party to elect ward executives across the local government’s wards.

However, it was disrupted at Olomi Ward 7 by suspected heavily-armed political thugs allegedly linked to a member of the party.

It was claimed that the thugs invaded the congress venue at Olomi Basic School 1, dispersing party members and officials supervising the exercise, with stones, clubs and other weapons.

Eyewitnesses said tensions escalated unprovoked over delegates’ lists and ward executive positions. The disagreement reportedly degenerated into physical altercations before the violent attacks on some party members.

It was learnt that security operatives led a tactical team to restore order, peace, and disperse the attackers.

Reacting to the incident, some party leaders and elders condemned the violence, describing it as unfortunate and capable of undermining the credibility of the internal democratic process.

The leaders have called on party chieftains and President Bola Tinubu to immediately order an investigation into the violent attacks.

-

Feature/OPED6 years ago

Feature/OPED6 years agoDavos was Different this year

-

Travel/Tourism10 years ago

Lagos Seals Western Lodge Hotel In Ikorodu

-

Showbiz3 years ago

Showbiz3 years agoEstranged Lover Releases Videos of Empress Njamah Bathing

-

Banking8 years ago

Banking8 years agoSort Codes of GTBank Branches in Nigeria

-

Economy3 years ago

Economy3 years agoSubsidy Removal: CNG at N130 Per Litre Cheaper Than Petrol—IPMAN

-

Banking3 years ago

Banking3 years agoSort Codes of UBA Branches in Nigeria

-

Banking3 years ago

Banking3 years agoFirst Bank Announces Planned Downtime

-

Sports3 years ago

Sports3 years agoHighest Paid Nigerian Footballer – How Much Do Nigerian Footballers Earn