General

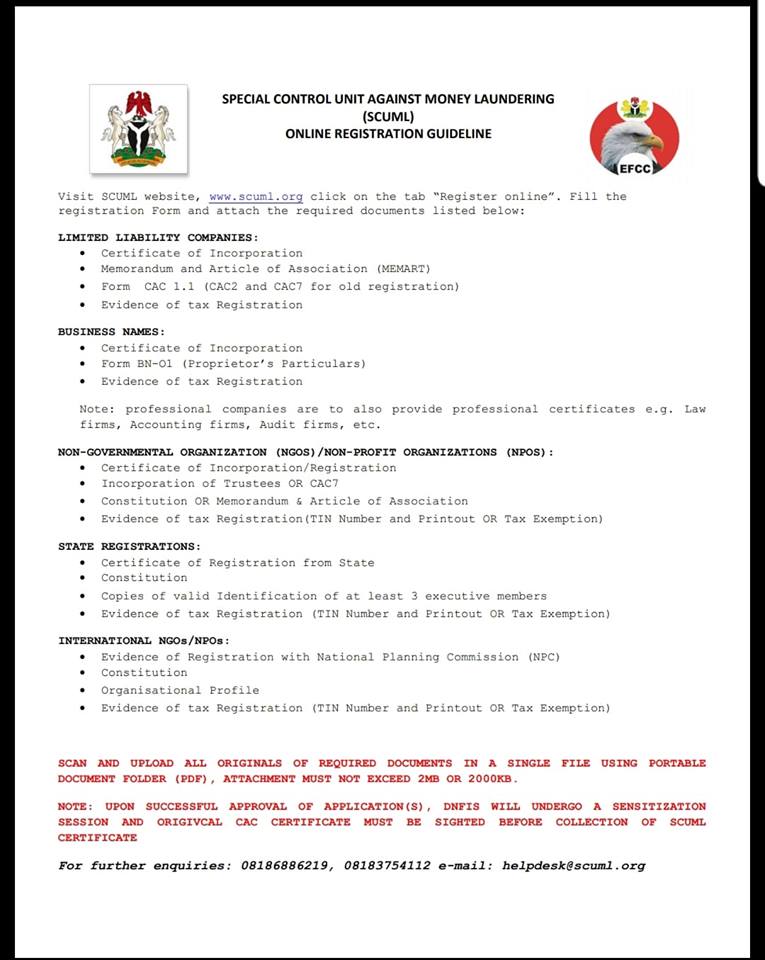

How to Obtain SCUML Registration from EFCC With Ease

By Modupe Gbadeyanka

For those who have tried to open a corporate bank account in Nigeria, they must have come across the word ‘SCUML.’ In some cases, without this document in your possession, banks cannot complete the account opening process for you.

SCUML is an acronym for Special Control Unit Against Money Laundering and it is issued by the Economic and Financial Crimes Commission (EFCC).

If someone had in the past told you that obtaining the SCUML certificate costs a lot and difficult to obtain, we are here to let you know that all you need is a computer, internet access and a scanner to scan your documents, which must be less than 2MB and merged as one file.

SCUML is charged with the responsibility of monitoring, supervising and regulating the activities of Designated Non-Financial Institutions (DNFIs) in line with the Money Laundering (Prohibition) Act ML(P)Act 2011 and the Prevention of Terrorism Act (PTA) 2011.

Who are Designated Non-Financial Institutions?

Section 25 of the ML (P) Act defines DNFIs as dealers in jewellery, cars and luxury goods, Precious stones and metals, Real estate, Estate developers, Estate surveyors and Valuers, Estate Agents, Chartered accountants, audit firms, tax consultants, clearing and settlement companies, hotels, casinos, supermarkets, Dealers in Merchanised Farming equipment and machineries, Practitioners of Mechanised farming, Non-Governmental Organisations (NGOs) or such other businesses as the Federal Ministry of Trade and Investment or appropriate regulatory authorities may from time to time designate.

Does SCUML registration attract any fee?

No! Registration can be done on the SCUML website at NO COST.

What is a suspicious transaction?

A suspicious transaction is a transaction in which a DNFI suspects that it may involve proceeds of any of the offences specified in the Money Laundering (Prohibition) Act 2011 as amended, regardless of the value involved; or

(a) Appears to be made in circumstances of unusual or unjustified complexity; or

(b) Appears to have no economic justification or lawful objective; or

(c) Gives rise to suspicion that it may involve financing of terrorism.

STR has no threshold; it could be based on any amount. This report should be submitted to the Nigeria Financial Intelligence Unit (NFIU) solely.

What is Currency Transaction Report?

A CTR is a report that Designated and Non-Financial Institutions (DNFIs) are statutorily required to file with the Nigeria Financial Intelligence Unit (NFIU) on transactions that involve amounts in excess of N10,000,000 (Ten Million Naira) and N5,000,000 (Five Million Naira) for corporate bodies and Individuals respectively. However, based on the Memoradum of Understanding between Special Control Unit against Money Laundering and the Nigerian Financial Intelligence Unit, DNFIs are to report CTRs directly to SCUML.

What is Cash Based Transaction Report? This is a report that Designated Non-financial Institutions are required to file with the Special Control Unit against Money Laundering (SCUML) for each deposit, purchase or sale and other payments , by a customer to the DNFI, which involves cash transaction in excess of $1,000 or its equivalent in Naira or other currencies.

General

NERC Unveils 3-Step Guide for Resolving Electricity Complaints

By Adedapo Adesanya

The Nigerian Electricity Regulatory Commission (NERC) has introduced a streamlined three-step process to help electricity consumers address common issues like power outages, estimated billing, faulty meters, and voltage fluctuations.

In a public advisory shared on its X handle on Tuesday, the electricity sector regulator emphasised that customers should begin by contacting their respective electricity Distribution Companies (DisCos), which serve as the primary point of contact for technical and billing problems.

Consumers are urged to secure a complaint reference number and maintain records of all interactions for efficient follow-up.

The advisory outlines the process as follows: “Contact your DisCo’s customer care – This is the first step for all technical or billing issues;

“Escalate to State Electricity Regulator (SER) – If unresolved, and the consumer is in a state that has transitioned to an SER;

“Reach NERC Call Centre – For consumers in non-transitioned states or needing further assistance. Contact options include 0201 344 4331, 0908 899 9244, or [email protected],” it said.

“We’re here to make sure your complaint is heard and addressed,” the advisory concluded, aiming to empower consumers amid ongoing challenges in Nigeria’s power sector.

This guidance comes as electricity consumers continue to grapple with service disruptions and billing disputes, highlighting NERC’s efforts to improve accountability across DisCos and state regulators.

General

Senate Passes Electoral Act Amendment Bill After Mild Row

By Adedapo Adesanya

The Senate passed the Electoral Act, 2022 (Repeal and Re-Enactment) Bill 2026 on Tuesday after overcoming a rowdy session that saw lawmakers at loggerheads.

The issue in the upper chamber stemmed from a division over Clause 60 raised by Mr Enyinnaya Abaribe, a member of the opposition party, African Democratic Congress (ADC), from Abia South.

The Senate President, Mr Godswill Akpabio, stated that he believed the demand had previously been withdrawn, but several opposition senators immediately objected to that claim.

Citing Order 52(6), the Deputy Senate President, Mr Barau Jibrin, argued that it would be out of order to revisit any provision on which the Senate President had already ruled.

This submission sparked another uproar in the chamber, during which Mr Sunday Karimi had a brief face-off with Mr Abaribe.

The Senate Leader, Mr Opeyemi Bamidele, then reminded lawmakers that he had sponsored the motion for rescission, underscoring that decisions previously taken by the Senate are no longer valid, maintaining that, consistent with his motion, Mr Abaribe’s demand was in line.

Mr Akpabio further suggested that the call for division was merely an attempt by Mr Abaribe to publicly demonstrate his stance to Nigerians. He sustained the point of order, after which the Abian lawmaker rose in protest and was urged to formally move his motion.

Rising under Order 72(1), Mr Abaribe called for a division on Clause 60(3), specifically concerning the provision that if electronic transmission of results fails, Form EC8A should not serve as the sole basis, calling for the removal of the proviso that allows for manual transmission of results in the event of network failure.

During the division, Mr Akpabio directed senators who supported the caveat to stand. He then asked those opposed to the caveat to rise, to which 15 opposition senators stood.

However, when the votes were counted, the Senate President announced that 15 senators did not support the proviso, while 55 senators voted in support.

Earlier, proceedings in the Senate were momentarily stalled as lawmakers began clause-by-clause consideration of the Electoral Act, 2022 (Repeal and Re-Enactment) Bill 2026, following a motion to rescind the earlier amendment.

The motion to rescind the bill was formally seconded on Tuesday, paving the way for the upper chamber to dissolve into the committee of the whole for detailed reconsideration and reenactment of the proposed legislation.

During the session, the Senate President, Godswill Akpabio, reeled out the clauses one after the other for deliberation.

However, the process stalled when at clause 60, Mr Abaribe raised a point of order, drawing immediate attention on the floor.

This soon caused the session to move into a closed-door session.

Before rescinding the Electoral Act, the red chamber raised concerns over the timing of the 2027 general elections and technical inconsistencies in the legislation.

Rising under Order 52(6) of the Senate Standing Orders, the Senate leader, Opeyemi Bamidele, moved the motion to reverse the earlier passage of the bill and return it to the Committee of the Whole for fresh deliberations.

He explained that the development follows the announcement by the Independent National Electoral Commission (INEC) of a timetable fixing the 2027 general elections for February 2027, after consultations with the leadership of the National Assembly.

He stated that stakeholders had raised concerns that the proposed date conflicts with the provisions of the amended law, particularly the requirement that elections be scheduled not later than 360 days before the expiration of tenure.

He further noted that upon critical review of the passed bill, the 360-day notice requirement prescribed in Clause 28 could result in the scheduling of the 2027 Presidential and National Assembly elections during the Ramadan period.

According to him, holding elections during Ramadan could negatively affect voter turnout, logistical coordination, stakeholder participation, and the overall inclusiveness and credibility of the electoral process.

The motion also highlighted discrepancies discovered in the Long Title and several clauses of the bill, including Clauses 6, 9, 10, 22, 23, 28, 29, 32, 42, 47, 51, 60, 62, 64, 65, 73, 77, 86, 87, 89, 93, and 143. The identified issues reportedly affected cross-referencing, serial numbering, and internal consistency within the legislation.

General

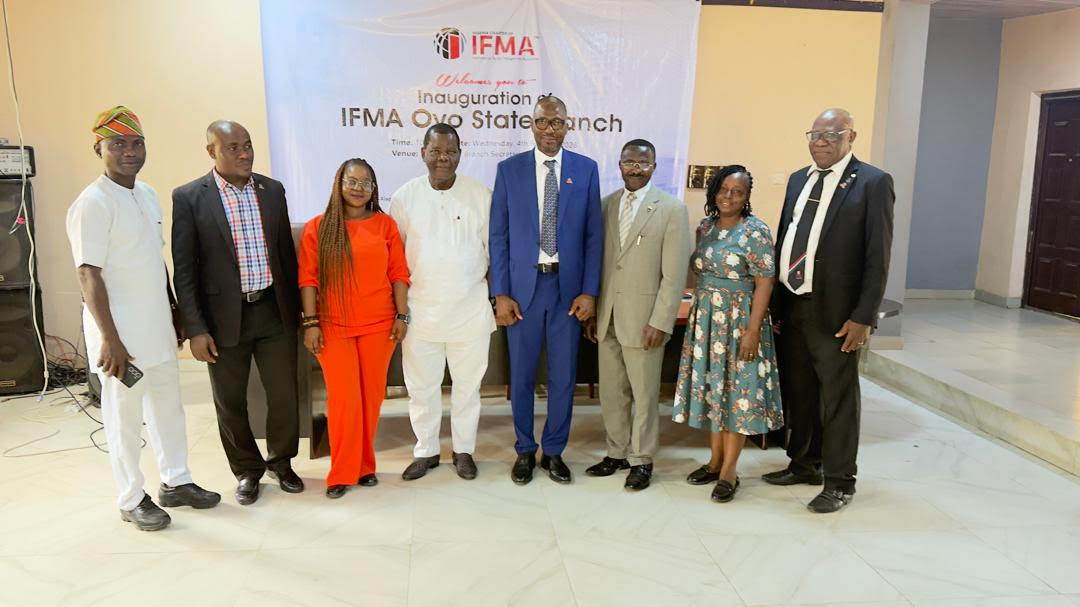

IFMA Nigeria Gets Branch in Oyo, Picks Adejumo Olusola Babatunde as Coordinator

By Modupe Gbadeyanka

A new branch of the International Facility Management Association (IFMA) Nigeria Chapter has been established in Oyo State, with Mr Adejumo Olusola Babatunde chosen as Coordinator.

The organisation set up an arm in the South-West state in a bid to expand its footprint in the country. Mr Babatunde will be assisted by other executive committee members, including Mr Ajiboye Olusola Akeem as Secretary, and Mrs Adeniran Olaide as Treasurer.

At the inauguration of the branch at the Nigerian Society of Engineers (NSE) Secretariat in the Akobo area of Ibadan, the Oyo State capital, the president of IFMA Nigeria, Mr Sheriff Daramola, expressed delight at the successful inauguration of the branch and commended members for their commitment to the growth of facility management in Nigeria.

He highlighted IFMA’s global heritage, noting that the association is supporting over 25,000 members in more than 140 countries worldwide. Mr Daramola emphasised IFMA’s strong global network, the world’s largest and most widely recognised association for facility management professionals, headquartered in the United States and its growing influence in Africa, the Middle East and Europe.

“IFMA members have taken positions of authority across federal, state, and private institutions; IFMA Nigeria is positioned to ensure our professionals are the first choice for global investors entering the Nigerian market,” he stated.

The Legal Adviser of IFMA, Nigeria, Mr Sola Fatoki, who shared this sentiment, said, “Since 1997, when IFMA Nigeria was established, the association has equipped facility management professionals with integrated knowledge spanning human behaviour, infrastructure, and the built environment.”

He encouraged engineers, architects, surveyors, ITC, Technology innovators, data analysts and allied professionals to see IFMA as their professional home and outlined the functions and responsibilities of branch executive committees.

In his remarks, Mr Babatunde expressed gratitude to the national council for the opportunity to serve and pledged to ensure the success of the branch, focusing on unity and the professional advancement of stakeholders in the region.

-

Feature/OPED6 years ago

Feature/OPED6 years agoDavos was Different this year

-

Travel/Tourism10 years ago

Lagos Seals Western Lodge Hotel In Ikorodu

-

Showbiz3 years ago

Showbiz3 years agoEstranged Lover Releases Videos of Empress Njamah Bathing

-

Banking8 years ago

Banking8 years agoSort Codes of GTBank Branches in Nigeria

-

Economy3 years ago

Economy3 years agoSubsidy Removal: CNG at N130 Per Litre Cheaper Than Petrol—IPMAN

-

Banking3 years ago

Banking3 years agoSort Codes of UBA Branches in Nigeria

-

Banking3 years ago

Banking3 years agoFirst Bank Announces Planned Downtime

-

Sports3 years ago

Sports3 years agoHighest Paid Nigerian Footballer – How Much Do Nigerian Footballers Earn

19 Comments