General

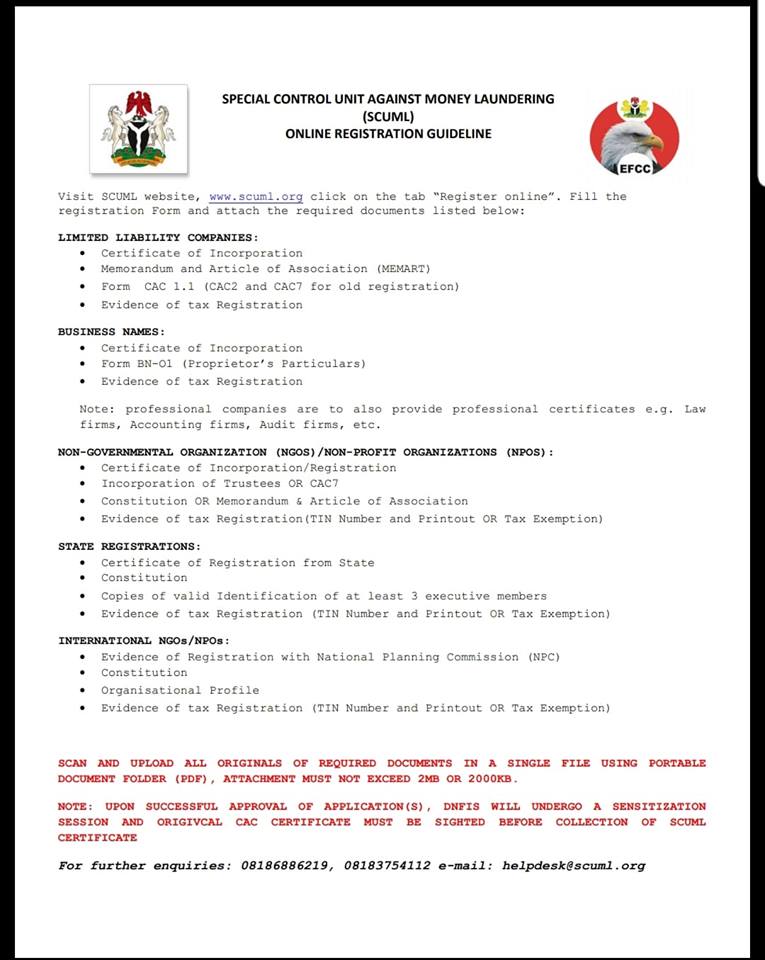

How to Obtain SCUML Registration from EFCC With Ease

By Modupe Gbadeyanka

For those who have tried to open a corporate bank account in Nigeria, they must have come across the word ‘SCUML.’ In some cases, without this document in your possession, banks cannot complete the account opening process for you.

SCUML is an acronym for Special Control Unit Against Money Laundering and it is issued by the Economic and Financial Crimes Commission (EFCC).

If someone had in the past told you that obtaining the SCUML certificate costs a lot and difficult to obtain, we are here to let you know that all you need is a computer, internet access and a scanner to scan your documents, which must be less than 2MB and merged as one file.

SCUML is charged with the responsibility of monitoring, supervising and regulating the activities of Designated Non-Financial Institutions (DNFIs) in line with the Money Laundering (Prohibition) Act ML(P)Act 2011 and the Prevention of Terrorism Act (PTA) 2011.

Who are Designated Non-Financial Institutions?

Section 25 of the ML (P) Act defines DNFIs as dealers in jewellery, cars and luxury goods, Precious stones and metals, Real estate, Estate developers, Estate surveyors and Valuers, Estate Agents, Chartered accountants, audit firms, tax consultants, clearing and settlement companies, hotels, casinos, supermarkets, Dealers in Merchanised Farming equipment and machineries, Practitioners of Mechanised farming, Non-Governmental Organisations (NGOs) or such other businesses as the Federal Ministry of Trade and Investment or appropriate regulatory authorities may from time to time designate.

Does SCUML registration attract any fee?

No! Registration can be done on the SCUML website at NO COST.

What is a suspicious transaction?

A suspicious transaction is a transaction in which a DNFI suspects that it may involve proceeds of any of the offences specified in the Money Laundering (Prohibition) Act 2011 as amended, regardless of the value involved; or

(a) Appears to be made in circumstances of unusual or unjustified complexity; or

(b) Appears to have no economic justification or lawful objective; or

(c) Gives rise to suspicion that it may involve financing of terrorism.

STR has no threshold; it could be based on any amount. This report should be submitted to the Nigeria Financial Intelligence Unit (NFIU) solely.

What is Currency Transaction Report?

A CTR is a report that Designated and Non-Financial Institutions (DNFIs) are statutorily required to file with the Nigeria Financial Intelligence Unit (NFIU) on transactions that involve amounts in excess of N10,000,000 (Ten Million Naira) and N5,000,000 (Five Million Naira) for corporate bodies and Individuals respectively. However, based on the Memoradum of Understanding between Special Control Unit against Money Laundering and the Nigerian Financial Intelligence Unit, DNFIs are to report CTRs directly to SCUML.

What is Cash Based Transaction Report? This is a report that Designated Non-financial Institutions are required to file with the Special Control Unit against Money Laundering (SCUML) for each deposit, purchase or sale and other payments , by a customer to the DNFI, which involves cash transaction in excess of $1,000 or its equivalent in Naira or other currencies.

General

Access Bank Installs Boreholes in Abaren, Omu Ishoko, Kemta, Seven Others

By Aduragbemi Omiyale

To ensure reliable access to clean and safe water for thousands of residents, Access Bank Plc has facilitated the installation of boreholes in 10 underserved communities in Nigeria.

The communities are Arogun, Omu Ishoko, Kemta, Ajibode, Aleku, Ogunrun, Oniwawa, Okeran, Abaren, and Afojupa.

This is part of the lender’s commitment to sustainable development and community well-being through its Access Clean Water Project, a transformative initiative aimed at improving access to clean water, sanitation, and hygiene (WASH).

The project, implemented in partnership with HACEY, a leading development organisation, directly supports Sustainable Development Goal 6, ensuring availability and sustainable management of water and sanitation for all.

With Nigeria’s population exceeding 200 million and access to pipe-borne water in urban households declining from 32 per cent in 1990 to just 3 per cent in 2015, the need for sustainable water solutions has never been more urgent.

The Access Clean Water Project addresses this challenge by providing functional boreholes and WASH education to communities in Obafemi Owode and Otta Local Government Areas, benefiting over 500,000 residents.

This initiative aligns with Access Bank’s broader Corporate Social Investment (CSI) strategy and reinforces its position as a leading sustainability-focused financial institution.

By supporting clean water access, the Bank is fostering community growth through improved health, education, and economic opportunities and demonstrating its commitment to inclusive development and long-term positive impact.

The Programme Officer for Health at Access Holdings Plc, Ms Esther Graham, said, “Access Bank is proud to support this vital initiative that not only improves lives but also strengthens the foundation for sustainable economic growth.”

“Our commitment to community development is unwavering, and we believe access to clean water is a fundamental right that drives progress,” she added.

In addition to infrastructure development, the Access Bank Clean Water Project includes comprehensive WASH (Water, Sanitation, and Hygiene) education, equipping community members with essential knowledge on hygiene practices and the prevention of waterborne diseases.

The impact of this initiative is far-reaching. By improving access to clean water, the project is expected to significantly reduce the incidence of waterborne illnesses, enhance hygiene standards, and promote healthier living conditions.

Ultimately, the project is expected to strengthen community resilience, drives sustainable development, and reaffirm Access Bank’s commitment to fostering inclusive growth and well-being across Nigeria.

General

FG Plans State-by-State Home Ownership Model to Meet Housing Needs

By Adedapo Adesanya

Nigeria plans to launch a state-by-state home ownership and housing development campaign as part of the Renewed Hope Housing initiative.

The Minister of Housing and Urban Development, Mr Ahmed Dangiwa, made this known at the 19th Africa International Housing Show (AIHS) in Abuja, noting that the initiative aims to address housing needs across Nigeria, regardless of income level, by providing various housing options and facilitating access to homeownership.

Mr Dangiwa said the campaign, which will be rolled out in the 36 States of the Federation and the FCT, will make housing accessible to all Nigerians

According to the Minister, the biggest gaps in housing delivery are at the sub-national level where many state governments lack technical capacity, planning systems, and financial tools to act decisively.

He said that the programme would be implemented in collaboration with state governments, private sector investors, and international development partners.

“I am pleased to announce our plan to launch a State-by-State Homeownership and Housing Development Campaign, a high-impact outreach initiative in collaboration with state governments, the private sector, and development partners.

“The goal is to bridge the gap between national housing policy and state-level execution while empowering citizens with the knowledge and tools to access affordable housing opportunities.

“As part of this initiative, we aim to embed housing reform champions as Special Advisers to State Governors, convene State Housing Roundtables to review existing housing development plans.

“We will also provide technical advisory, develop actionable roadmaps, and offer hands-on support to structure viable projects and unlock financing.”

Mr Dangiwa said that the campaign would also ensure alignment with federal programmes, thereby enabling states to access funding and technical support from institutions.

The institutions include the Federal Mortgage Bank of Nigeria (FMBN), Nigeria Mortgage Refinance Company (NMRC), Family Homes Funds, the MoFI Real Estate Investment Fund (MREIF), Shelter Afrique Development Bank, and others.

“I therefore call on our development partners, DFIs, donor agencies, and private sector leaders to support this initiative.

“Let us take the knowledge we share in conferences like this and transform it into concrete action in our communities.”

Mr Dangiwa also said that to underscore the government’s renewed political will to housing delivery, plans have been finalised to establish an Experts-led National Housing Policy Coordination and Monitoring Committee.

He said this was to evaluate, and report on the implementation of the National Housing Policy and related housing sector programmes.

“Housing is not a privilege, it is a right. It is not just a roof, it is the bedrock of health, dignity, productivity, and national stability. When we invest in housing, we are investing in people, in jobs, in cities, and in the future,” he said.

Mr Dangiwa also acknowledged that the government alone cannot mobilise the funding required to fix the housing need.

He said that was why the government was leveraging Public Private Partnerships (PPPs) with reputable developers to deliver Renewed Hope Cities which target mid to high income earners.

He said that so far, over N70 billion in private sector capital have been attracted by the government .

General

EFCC Nabs Seven Chinese, Four Nigerians Over Illegal Ilmenite Mining

By Adedapo Adesanya

Operatives of the Economic and Financial Crimes Commission (EFCC) have arrested 11 individuals, including seven Chinese nationals, for engaging in illegal mining of ilmenite in the Eastern Obolo Local Government Area of Akwa Ibom State.

Ilmenite, the mineral allegedly mined illegally, is a key source of titanium and is in high demand globally for use in aircraft manufacturing, paints, and electronics.

According to the EFCC, the suspects were apprehended at Emem-Asuk community, where they were reportedly operating two unauthorized mining sites.

The group was caught while setting up equipment at a second location, having already begun the illegal extraction of ilmenite, at their first site.

Those arrested included Chinese nationals Yang Chaobao (32), Zhong Dun Yi (33), Cheng Jiang (35), Zhong Dun Long (37), Pan Peiming (33), Lai Yiping (37), and Zhu Lekun (35). Their Nigerian collaborators are David Israel (18), Jonah Bartholomew Jim (24), Samuel Samuel Timothy (20), and a female interpreter, Comfort Gabriel Ajaga (23).

In her statement to investigators, Ms Ajaga, the only female suspect, claimed she had no direct role in the mining operations.

“I am a student studying Chinese language at a Learning Centre in Anambra State. I only work with them as a translator,” she told EFCC operatives.

Preliminary findings indicate the suspects lacked the requisite permits or licences to carry out mining operations at either location.

The EFCC says the arrests are part of its ongoing efforts to clamp down on economic sabotage and environmental crimes in Nigeria’s extractive industries.

“The suspects will be charged to court upon conclusion of investigation,” the EFCC said in a statement posted on X.

This development underscores growing concerns over the influx of illegal mining operations in Nigeria, often run by foreign syndicates with local collaborators, leading to revenue losses and ecological degradation.

The EFCC has stepped up efforts to enforce the laws against illegal mining as part of a wider national effort to curb the activity.

-

Feature/OPED5 years ago

Feature/OPED5 years agoDavos was Different this year

-

Travel/Tourism9 years ago

Lagos Seals Western Lodge Hotel In Ikorodu

-

Showbiz3 years ago

Showbiz3 years agoEstranged Lover Releases Videos of Empress Njamah Bathing

-

Banking7 years ago

Banking7 years agoSort Codes of GTBank Branches in Nigeria

-

Economy2 years ago

Economy2 years agoSubsidy Removal: CNG at N130 Per Litre Cheaper Than Petrol—IPMAN

-

Banking2 years ago

Banking2 years agoFirst Bank Announces Planned Downtime

-

Sports2 years ago

Sports2 years agoHighest Paid Nigerian Footballer – How Much Do Nigerian Footballers Earn

-

Technology5 years ago

Technology5 years agoHow To Link Your MTN, Airtel, Glo, 9mobile Lines to NIN

19 Comments