General

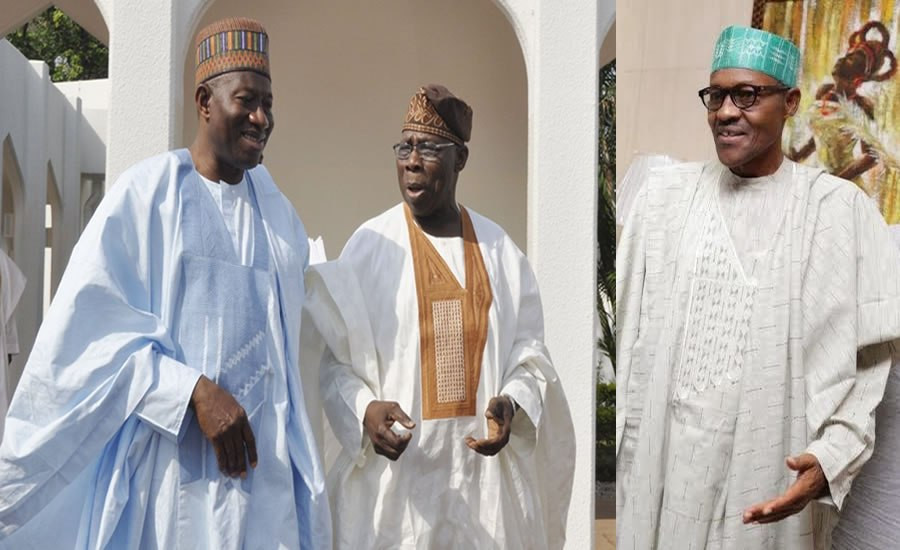

SERAP Demands Asset Declarations of Buhari, GEJ, OBJ, Govs

By Dipo Olowookere

A Freedom of Information (FoI) request has been sent to the Chairman of Code of Conduct Bureau (CCB), Mr Muhammed Isah, by a prominent anti-corruption group known as Socio-Economic Rights and Accountability Project (SERAP).

The group wants Mr Isah to use his “good offices and leadership position to urgently provide information on specific details of asset declarations submitted to the CCB by successive presidents and state governors since the return of democracy in 1999.”

According to SERAP, it is seeking information on “details of asset declarations by successive presidents and state governors between 1999 and 2019, including details of declarations made immediately after taking offices and thereafter, and for those who have left public offices, at the end of their term of office.”

The group also said it wants information “on the number of asset declarations so far verified by the CCB and the number of those declarations found to be false and deemed to be in breach of the Code of Conduct for Public Officers, by the Bureau.”

In the FOI request dated April 18, 2019, and signed by SERAP deputy director, Mr Kolawole Oluwadare, the organisation said, “While we welcome the judgment by the Code of Conduct Tribunal on Justice Walter Onnoghen, we now urge the CCB to extent its mandates to enforce constitutional provisions on asset declarations by public officers to cover elected officers and to vigorously pursue the prosecution of any such officers who use their powers either as presidents or state governors over public funds to enrich themselves.”

According to SERAP, “While judicial corruption is bad, the level of corruption involving many politicians since 1999 and the entrenched culture of impunity of perpetrators is equally appalling. Publishing the asset declarations of elected public officers since the return of democracy in 1999 to date would improve public trust in the ability of the Bureau to effectively discharge its mandates. This would in turn put pressure on public officers like presidents and state governors to make voluntary public declaration of their assets.”

The FOI request read in part: “SERAP is concerned that many politicians hide behind the fact that members of the public do not have access to their asset declarations to make false declarations, and to cover up assets illegally acquired in corruption or abuse of office. The CCB can use the opportunity presented by the Onnoghen judgment to increase the accountability of politicians through the asset declaration provisions if it is not to be accused of witch-hunting the judiciary.

“The grim condition of many of our citizens since 1999 has been worsened by the deterioration of public services whereby access to clean water and affordable health-care has become a pipe dream and the supply of electricity became epileptic and irregular due to years of grand corruption by many politicians at the highest level of government.

“We would be grateful if the requested information is provided to us within 14 days of the receipt and/or publication of this letter. If we have not heard from you by then, the Registered Trustees of SERAP shall take all appropriate legal action under the Freedom of Information Act to compel you to comply with our request.

“The persistent refusal by successive presidents and state governors to make public their asset declarations is entirely inconsistent with the letter and spirit of the 1999 Constitution, and has been particularly harmful to the country and its people, especially given the widespread evidence of grand corruption among politicians holding public offices in Nigeria.

“The Nigerian Constitution of 1999 (as amended) seeks to prevent corruption and abuse of office through its provisions on the declaration of assets not just by judicial officers but by all public officers including elected officers like presidents and governors.

“Nigerians can no longer accept the excuse by high-ranking government officers that declaring their assets before the CCB is enough, as such pretext is not supported by the oaths of office by elected public officers. The failure by successive presidents and state governors to voluntarily make public their asset declarations would seem to suggest that they have something to hide.

“Given that many public officers being tried for or convicted of corruption are found to have made a false declaration of their assets, the CCB should no longer allow politicians to undermine the sanctity and integrity of the asset declaration provisions of the Constitution by allowing them to continue to exploit legal gaps for illicit enrichment.

“SERAP believes that while elected public officers may not be constitutionally obliged to publicly declare their assets, the Freedom of Information Act 2011 has now provided the mechanism for the CCB to improve transparency and accountability of asset declarations by elected public officers.

“Asset declaration forms are public documents within the meaning of section 109 of the Evidence Act, and therefore, Nigerians are entitled to have access to such information. SERAP urges the CCB to vigorously push for change in law to provide penal sanctions for politicians that fail to make public their asset declarations.

“By Section 1 (1) of the Freedom of Information (FOI) Act 2011, SERAP is entitled as of right to request for or gain access to information, including information on the asset declarations by elected public officers since the return of democracy in 1999.

“SERAP notes that provisions on the declaration of assets by all public officers in Nigeria are entrenched in the Code of Conduct for Public Officers, contained in Part I of the Fifth Schedule to the 1999 Nigerian Constitution. The primary objective is to prevent corruption and abuse of office and to ensure transparency in public officers.

“SERAP also notes that public officers for the purposes of the Code include the President and the Vice-President of the Federation, state governors and their deputies; the President and Deputy-President of the Senate, the Speaker and Deputy-Speaker of the House of Representatives and Speakers, the Chief justice of Nigeria, justices of the Supreme Court, the President and justices of the Court of Appeal, and other judicial officers and all staff of courts of law.”

SERAP, therefore, urged the CCB to disclose including by publishing on a dedicated website, details of asset declarations submitted by presidents and state governors since the return of democracy in 1999; disclose details on the number of asset declarations so far verified by the CCB and the number of those declarations found to be false and deemed to be a breach of the Code of Conduct for Public Officers by the Bureau; and immediately take cases of false asset declarations to the Code of Conduct Tribunal for effective prosecution of suspects, and include banning the politicians involved from holding public offices for at least a period of 10 years and seeking refund of stolen public funds as part of the reliefs to be sought before the Tribunal.

Business Post reports that since 1999, four persons have governed Nigeria as Presidents and they are Mr Olusegun Obasanjo, late Mr Umaru Musa Yar’Adua, Mr Goodluck Ebele Jonathan and Mr Muhammadu Buhari.

General

IFMA Nigeria Gets Branch in Oyo, Picks Adejumo Olusola Babatunde as Coordinator

By Modupe Gbadeyanka

A new branch of the International Facility Management Association (IFMA) Nigeria Chapter has been established in Oyo State, with Mr Adejumo Olusola Babatunde chosen as Coordinator.

The organisation set up an arm in the South-West state in a bid to expand its footprint in the country. Mr Babatunde will be assisted by other executive committee members, including Mr Ajiboye Olusola Akeem as Secretary, and Mrs Adeniran Olaide as Treasurer.

At the inauguration of the branch at the Nigerian Society of Engineers (NSE) Secretariat in the Akobo area of Ibadan, the Oyo State capital, the president of IFMA Nigeria, Mr Sheriff Daramola, expressed delight at the successful inauguration of the branch and commended members for their commitment to the growth of facility management in Nigeria.

He highlighted IFMA’s global heritage, noting that the association is supporting over 25,000 members in more than 140 countries worldwide. Mr Daramola emphasised IFMA’s strong global network, the world’s largest and most widely recognised association for facility management professionals, headquartered in the United States and its growing influence in Africa, the Middle East and Europe.

“IFMA members have taken positions of authority across federal, state, and private institutions; IFMA Nigeria is positioned to ensure our professionals are the first choice for global investors entering the Nigerian market,” he stated.

The Legal Adviser of IFMA, Nigeria, Mr Sola Fatoki, who shared this sentiment, said, “Since 1997, when IFMA Nigeria was established, the association has equipped facility management professionals with integrated knowledge spanning human behaviour, infrastructure, and the built environment.”

He encouraged engineers, architects, surveyors, ITC, Technology innovators, data analysts and allied professionals to see IFMA as their professional home and outlined the functions and responsibilities of branch executive committees.

In his remarks, Mr Babatunde expressed gratitude to the national council for the opportunity to serve and pledged to ensure the success of the branch, focusing on unity and the professional advancement of stakeholders in the region.

General

We Didn’t Recommend Ceding Disputed Oil Wells to States—RMAFC

By Adedapo Adesanya

The Revenue Mobilisation Allocation and Fiscal Commission (RMAFC) has denied reports that some disputed crude oil and gas wells have been recommended for ceding to specific oil-producing states.

In a statement issued on Sunday, the chairman of the commission, Mr Mohammed Shehu, said the attention of RMAFC had been drawn to a “purported report allegedly issued by the Inter-Agency Committee on the Verification of Coordinates of Disputed Crude Oil and Gas Wells between States,” which was circulating in sections of the national media (excluding Business Post).

The agency described the report as “misleading, premature, and does not represent the position or conclusions of the Commission.”

“At this stage, there is no finalised recommendation or decision regarding the ceding or reallocation of any oil wells, as due institutional processes are still ongoing,” the statement read.

The organisation explained that it operates a clearly defined and transparent procedure in handling assignments of national significance, stressing that the process on the disputed oil wells had not been concluded.

It disclosed that it only received a draft report from the Federal Government’s Inter-Agency Committee on Nigeria’s Oil-Producing States on Friday, February 13, 2026, which reportedly projected Cross River State as an oil-producing state.

The report, covering the nationwide 2017–2025 verification of crude oil and gas coordinates, was presented to the Chairman of RMAFC by 10 of the 14 members of the committee.

The exercise, which ran from August 2025 to February 2026, involved extensive field verification, technical reconciliation of state submissions, and a final plenary plotting of coordinates at RMAFC headquarters between January 24 and 31, 2026.

“Consistent with established protocol, the draft document has been transmitted to relevant technical and statutory stakeholders, namely the Nigerian Upstream Petroleum Regulatory Commission, the National Boundary Commission, and the Office of the Surveyor General of the Federation, for detailed review, observations, and technical input,” the commission stated.

According to the statement, after the observations and recommendations of the agencies are received, the matter will be subjected to further scrutiny by the commission’s internal tripartite committees, comprising the Committee on Crude Oil, Gas and Investment and the Legal Matters Committee.

“These committees will undertake comprehensive technical and legal reviews before presenting their findings to the Plenary Session of RMAFC for deliberation and final recommendations,” it added.

The commission further explained that upon completion of the institutional processes, its final report would be formally transmitted to the President and the Attorney-General of the Federation for necessary consideration and further action in line with applicable laws and constitutional provisions.

General

Social Media Platform X Suffers Outages Globally

By Adedapo Adesanya

Social media platform, X, formerly known as Twitter, suffered an outage globally on Monday as millions of users could not use the service.

The widespread outages have been reported by thousands of users across several countries, including Nigeria, the United States, the United Kingdom, Turkey, and India, among others.

According to data from Downdetector, a website that tracks service disruptions based on user reports, complaints about access to X started to pick up around 1:00 p.m. local time in Nigeria.

The cause of the outage was not immediately clear, and X has not put out any comment, but users told Business Post that the platform is not loading or cannot be reached, and the pattern of complaints suggests the issue is not limited to a single region.

Its developer platform status page stated “all systems are operational” all morning despite the reports.

The outage is the latest to hit internet services. X suffered a similar outage in March 2025, while a Cloudflare service outage caused access problems and downtime for various websites, including X, last November.

Microsoft’s Azure had also faced an issue last year, while disruption at Amazon AWS caused global turmoil among thousands of websites and some of the most popular apps, such as Snapchat and Reddit in October

-

Feature/OPED6 years ago

Feature/OPED6 years agoDavos was Different this year

-

Travel/Tourism10 years ago

Lagos Seals Western Lodge Hotel In Ikorodu

-

Showbiz3 years ago

Showbiz3 years agoEstranged Lover Releases Videos of Empress Njamah Bathing

-

Banking8 years ago

Banking8 years agoSort Codes of GTBank Branches in Nigeria

-

Economy3 years ago

Economy3 years agoSubsidy Removal: CNG at N130 Per Litre Cheaper Than Petrol—IPMAN

-

Banking3 years ago

Banking3 years agoSort Codes of UBA Branches in Nigeria

-

Banking3 years ago

Banking3 years agoFirst Bank Announces Planned Downtime

-

Sports3 years ago

Sports3 years agoHighest Paid Nigerian Footballer – How Much Do Nigerian Footballers Earn