General

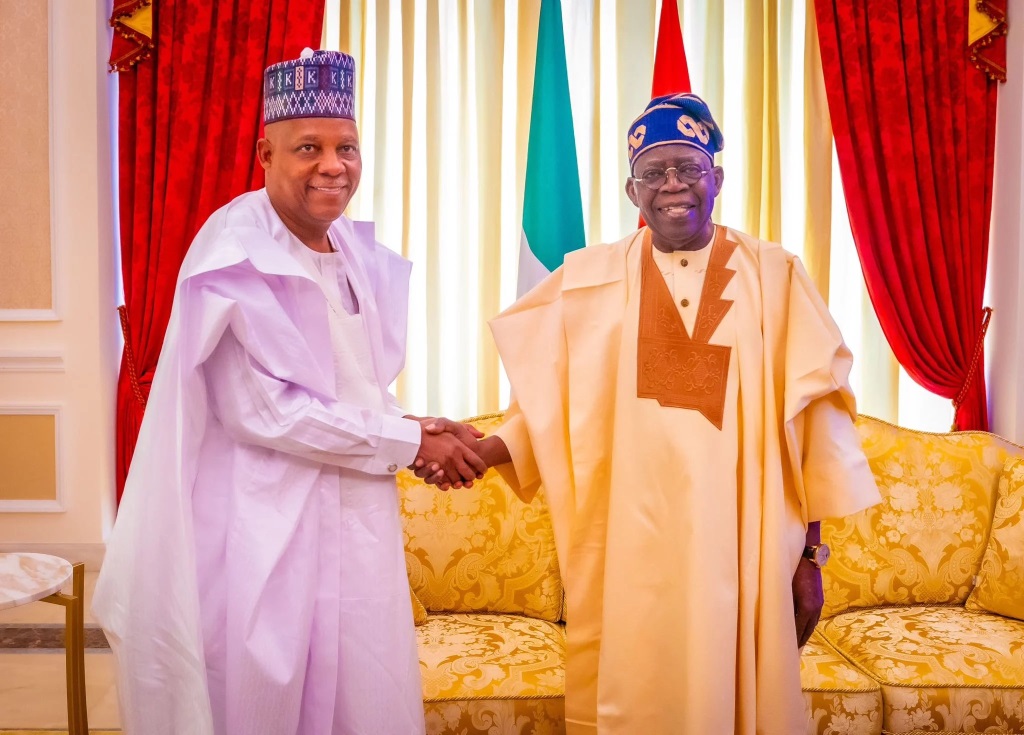

Shettima Tasks Committee on Enhancing MSMEs Financing

By Adedapo Adesanya

The Vice President, Mr Kashim Shettima, has tasked the National Council on Micro, Small and Medium Enterprises (MSMEs) to enhance financing of small businesses in Nigeria.

This came as the federal government constituted a committee to interface with the Central Bank of Nigeria (CBN). The committee was set up on Tuesday during the first meeting council for 2025 held at the Presidential Villa, Abuja.

Nigeria has over 40 million small businesses that contribute a large percentage to its economy. However, financing acts as a barrier to effective operations and growth and this committee is the latest effort to solve this issue.

The committee headed by the Minister of State for Industry, Trade and Investment, Mr John Enoh, has Ministers of Science and Technology; Women Affairs; Minister of State for Agriculture and Food Security and the Senior Special Assistant to the President on MSMEs as members.

Others include the Chief Executive Officers of Bank (CEOs) of Industry, Small and Medium Enterprises Development Agency of Nigeria (SMEDAN), Bank of Agriculture (BOI) and the Nigeria Export-Import Bank (NEXIM Bank).

Also in the committee are the CEOs of Development Bank of Nigeria (DBN), Corporate Affairs Commission (CAC), Nigerian Investment Promotion Commission (NIPC), Nigerian Export Promotion Council (NEPC), and the representative of organised private sector.

In the same vein, the council also approved a loan scheme for MSMEs known as the syndicated de-risked loans for small businesses.

The scheme will be a partnership between state governments and financial institutions aimed at enhancing access to finance for MSMEs at single-digit rates across the country.

Mr Shettima said that the federal government in collaboration with other stakeholders, would be more deliberate in ensuring growth in MSMEs space in the country.

He noted that the federal government, through its agencies and partners, has the moral burden of supporting growth in the MSME space and facilitating job creation across different sectors for Nigerians.

The Vice-President stressed the need for stakeholders, especially the private sector, to complement efforts of President Bola Tinubu’s administration in supporting small businesses.

Mr Shettima advised state governments to set up vehicles that were devoid of political interests to drive the implementation of the syndicated de-risked loans for the MSMEs scheme.

“Some of these initiatives are laudable and will need to outlive the present administrations in the states.

“Regardless of political affiliations, Nigerians must be seen to be the ultimate beneficiaries of these schemes that we are trying to put in place.”

On his part, the Senior Special Assistant to the President on MSMEs, Mr Temitola Adekunle-Johnson, presented the ‘syndicated de-risked loans’ scheme for small businesses.

Mr Adekunle-Johnson, who sought the cooperation of members, described it as a game-changing programme to provide affordable and available loans for businesses.

He said the initiative was in acknowledgement of the President’s passion and commitment to the development of small businesses and aimed at providing more jobs for Nigerians.

General

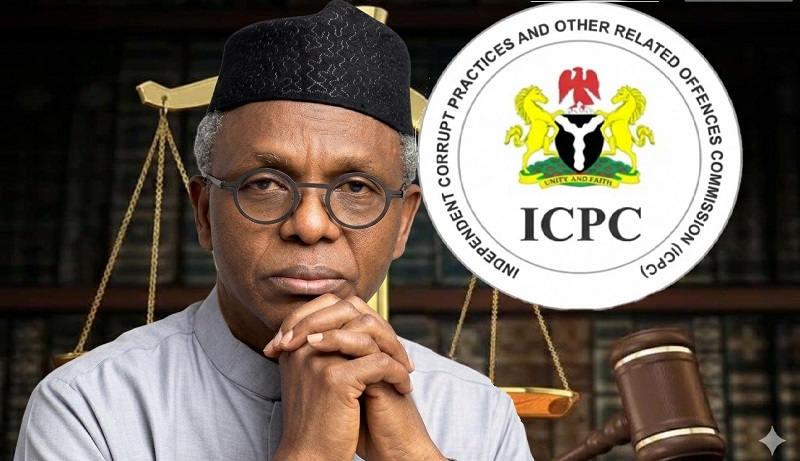

ICPC Secures Court Order to Extend El-Rufai’s Detention

By Adedapo Adesanya

The Independent Corrupt Practices and Other Related Offences Commission (ICPC) has secured a court order to extend the detention of former Governor of Kaduna State, Mr Nasir El-Rufai.

This order gives the anti-graft agency ample time to finalise its investigation into allegations against the former governor, which has now deepened as a result of some new findings.

Subsequently, the new order, which was granted on Tuesday in the presence of Mr El-Rufai’s lawyer, will expire on Thursday, March 19.

However, Mr El-Rufai’s lawyer, whose application to quash the first remand order was declined by a Chief Magistrate Court in Bwari, has returned to the same court to nullify the latest order.

Justice Okechukwu John Akweke has fixed March 17 to decide whether or not he should set aside the latest detention order.

He said, “Upon hearing and listening to the prosecuting counsel, Dr Osuobeni Ekoi Akponimisingha Esq., praying this Honourable court for the following orders:

“An order of this Honourable Court issuing a remand warrant against the Respondent (NASIR AHMAD EL-RUFAI) in favour of the Applicant, i.e. Independent Corrupt Practices and other Related Offences Commission (ICPC), to detain the Respondent (NASIR AHMAD EL-RUFAI) in its custody for another fourteen (14) days pending conclusion of investigation activities on allegations of Money Laundering/abuse of office.

“And for such other or further order(s) as this Honourable court may deem fit to make in the circumstances. It is hereby ordered that: Application granted as prayed.

“That the Applicant, i.e. the Independent Corrupt Practices and other Related Offences Commission ICPC is hereby ordered to re-detain the Respondent (NASIR AHMAD EL-RUFAI) for an additional 14 days to enable the commission to conclude investigation activities.

“That the return date shall be the 19th day of March 2026, for the report of compliance.”

The scrutiny of Mr El-Rufai by the ICPC follows the report of the Kaduna State House of Assembly’s ad hoc committee constituted in 2024 to investigate finances, loans and contracts awarded between 2015 and 2023 under his eight-year administration of the state.

General

Nigeria Begins Evacuation of Willing Nigerians from Iran

By Adedapo Adesanya

The federal government has begun evacuating willing Nigerians in Iran, escorting them across the Armenian border to ensure their safety amid escalating tensions in the Middle East.

The evacuation follows the growing crisis that began on February 28 after coordinated military strikes on Iran by the United States and Israel.

The attacks triggered retaliatory missile and drone strikes across parts of the region, raising fears of a wider conflict.

The chief executive of the Nigerians in Diaspora Commission (NiDCOM), Mrs Abike Dabiri-Erewa, disclosed this in a post on her X handle on Tuesday.

She said officials of the Nigerian Embassy in Tehran are coordinating the evacuation of Nigerians who wish to leave the country and are facilitating their safe passage into Armenia.

Mrs Dabiri-Erewa also reassured that no Nigerian in Iran has so far been affected by the ongoing tensions, noting that embassy officials remain stationed at the border to receive and assist evacuees.

Her post read, “Willing Nigerians [are] being escorted across the Armenian border by officials of the Nigerian embassy in Iran for safe passage. No Nigerian in Iran has been affected by the war as officials remain at the border to receive all who want to leave.”

The development comes as tensions in parts of the Middle East continue to raise concerns over the safety of foreign nationals residing in affected areas.

For repatriation flights, the NiDCOM chair said the airspace is currently unsafe but assured Nigerians in the Middle East that the Federal Government team is on standby to evacuate them.

“And as for repatriation flights, the skies are currently unsafe to fly. Luckily, a flight came in from the UAE to Lagos two days ago, just before another strike and the closure of the airspace.

“Once the airspace opens, the multi-agency FG team on crisis and evacuation is on standby. Our prayers are with you and all our people in affected countries,” she said.

General

Grid-Connected Private Transmission Substations Must Register—NERC

By Modupe Gbadeyanka

All private transmission connected to the national grid must register and get authorisation to operate, the Nigerian Electricity Regulatory Commission (NERC) has declared.

In a statement, the electricity regulatory body in Nigeria directed owners of private transmission substations used by bulk electricity consumers to obtain an Independent Electricity Transmission Network Operator (IETNO) Permit before operating or connecting to the grid.

It was disclosed that this latest development, which became effective March 9, 2026, is to strengthen oversight of privately owned substations connected to Nigeria’s national grid.

NERC further said the directive was introduced to improve grid reliability, safety, and operational visibility following frequent transmission line trips reported by the Nigerian Independent System Operator (NISO).

Under the order, NISO must submit to NERC a comprehensive list of all existing Private Transmission Substation Owners (PTSOs) and notify them of the provisions of the order within five days.

Existing PTSOs must apply to NERC for an IETNO permit within 45 days, while new PTSOs must obtain the permit before connecting to the grid, as non-compliance attracts regulatory sanctions.

NISO will deploy IoT-based metering systems at substation interconnection points within 120 days.

Further, operators must submit monthly operational reports, while NISO will conduct inspections to ensure compliance.

-

Feature/OPED6 years ago

Feature/OPED6 years agoDavos was Different this year

-

Travel/Tourism10 years ago

Lagos Seals Western Lodge Hotel In Ikorodu

-

Showbiz3 years ago

Showbiz3 years agoEstranged Lover Releases Videos of Empress Njamah Bathing

-

Banking8 years ago

Banking8 years agoSort Codes of GTBank Branches in Nigeria

-

Economy3 years ago

Economy3 years agoSubsidy Removal: CNG at N130 Per Litre Cheaper Than Petrol—IPMAN

-

Banking3 years ago

Banking3 years agoSort Codes of UBA Branches in Nigeria

-

Banking3 years ago

Banking3 years agoFirst Bank Announces Planned Downtime

-

Sports3 years ago

Sports3 years agoHighest Paid Nigerian Footballer – How Much Do Nigerian Footballers Earn