General

Ventures Platform Advocates Creation of Inclusive Climate Fund

By Adedapo Adesanya

Early-stage venture capital fund, Ventures Platform, which invests in innovative startups across Africa, has called for the establishment of an inclusive climate innovation fund to support underrepresented groups in climate entrepreneurship.

This is part of recommendations made in its recently published climate tech whitepaper entitled Innovating for a Sustainable Future: Leveraging Venture Capital and Startup Innovation to Combat Climate Change in Africa.

The white paper outlines key goals, strategies, challenges, and ecosystem support needed to enhance the impact of African climate tech startups, providing a comprehensive guide for non-climate VCs and entrepreneurs in the technology sector. It also proposes a framework for a coordinated climate response in the African tech sector.

Formally launched at the recently held Africa Prosperity Summit in Lagos, the paper explores how the agility and innovation of startups, combined with the strategic deployment of venture capital, can catalyse the development and scaling of climate-smart solutions tailored to the specific needs and challenges of African communities and ecosystems.

Furthermore, the paper offers insights to climate tech startups on how to secure and maintain venture capital support, while providing an in-depth analysis of how venture capital and startup ecosystems can act as powerful engines of progress in the face of environmental adversity.

Other recommendations made include the need to develop Africa-specific metrics for measuring the success and impact of climate-focused startups, considering both environmental and socio-economic factors.

Since launching in 2016, Ventures Platform has funded over 90 startups, with at least one in every region of the continent and across various sectors including climate tech. Many of its startups are category leaders in fintech, healthtech, and insurtech, including Moniepoint, Mdaas Global and Tanel Health.

While not primarily a climate fund, Ventures Platform understands the importance of sustainable investments for long-term prosperity and has factored this into its investment guidelines by prioritising businesses that implement sustainable practices, reduce environmental impact and drive long-term ecological benefits.

Drawing from its learnings as a key player in Africa’s tech ecosystem and from broader research, Ventures Platform has published this climatetech white paper to better equip non-climate Venture Capitalists (VCs) and startups with insights and tools to support Africa’s climate resilience through strategic investments and operational choices.

The fund also called for the facilitation of cross-border collaborations between different types of VCs through networking events, joint investment programmes, and knowledge-sharing platforms.

According to the United Nations, Africa contributes under 4 per cent of the global greenhouse gas emissions yet suffers disproportionately from climate change.

Ventures Platform, through the white paper, proposed a simplified framework focusing on adaptation, mitigation and enablers, to guide the African VC and startup ecosystem in addressing climate challenges.

It examined that adaptation strategies include developing climate-resilient infrastructure and agricultural practices. Mitigation efforts focus on reducing greenhouse gas emissions through renewable energy adoption and sustainable land use while ‘enablers’ encompass financing mechanisms, policy frameworks, educational programs, and technological innovations.

It also recommended the conduction of sector-specific climate opportunity assessments to identify and prioritise high-potential sectors for climate innovation in Africa.

Presenting the white paper at the Africa Prosperity Summit, Mr Dotun Olowoporoku, Managing Partner, Ventures Platform, shared, “African VCs often prioritise impact and livelihoods along with traditional metrics, but there is an urgent need to focus on climate-resilient business models”

Mr Olowoporoku also noted that climate change poses formidable threats with potential for severe impacts across multiple sectors, and noted that,”building climate-resilient business models can unlock business, societal and environmental sustainability.”

“As Venture Capitalists, we can drive change in Africa’s climate action by providing funds, encouraging innovation, and scaling climate-smart solutions. Startups like MAX, Rana Energy, and ThriveAgric, which were recognised in the 2024 TIME 100 Climate list, show how tech-driven solutions can address local issues and help global climate efforts.

“At Ventures Platform, we are deeply committed to investing in companies that are not only commercially successful but also actively contribute to solving some of society’s collective challenges”.

Commenting further on the landmark paper, Mr Dolapo Morgan, Senior Investment Associate at Ventures Platform, shared, “Africa is at the receiving end of the world’s climate disaster and it is important for us to turn this challenge into opportunities. It is time for entrepreneurs to focus on building climate-resilient business models for long-term sustainability while creating innovative climate solutions to tackle climate challenges.

“We are already beginning to see some startups and investors move in this direction and that is a good start. This white paper is a call for a coordinated African response towards scaling the opportunities that climate change presents to our technology sector, emphasizing the pivotal role non-climate funds can play in complementing and amplifying the efforts of climate-focused investments,”

General

Traders Shut Down Lagos International Trade Fair Complex

By Modupe Gbadeyanka

The Lagos International Trade Fair Complex in the Ojo area of Lagos State was shut down on Wednesday by traders protesting the proposed takeover of the facility by state and local government authorities.

The aggrieved demonstrators emphasised that the complex belongs to the federal government, and if there is a transfer of ownership to the state and local governments, then stakeholders should be carried along.

They expressed concerns that handing over the trade fair complex to the duo could be disruptive, and traders may have to pay more taxes and levies, which will, in turn, result in higher prices of goods.

In protest of the planned takeover, the traders yesterday locked up their shops, especially those in the ASPANDA Market segment within the facility, where spare parts are sold.

Apparently worried about the situation, the Minister of Industry, Trade and Investment, Ms Jumoke Oduwole, visited the market to talk to the traders.

She urged them to reopen the complex, as efforts are being made by the federal government to resolve the issue amicably.

General

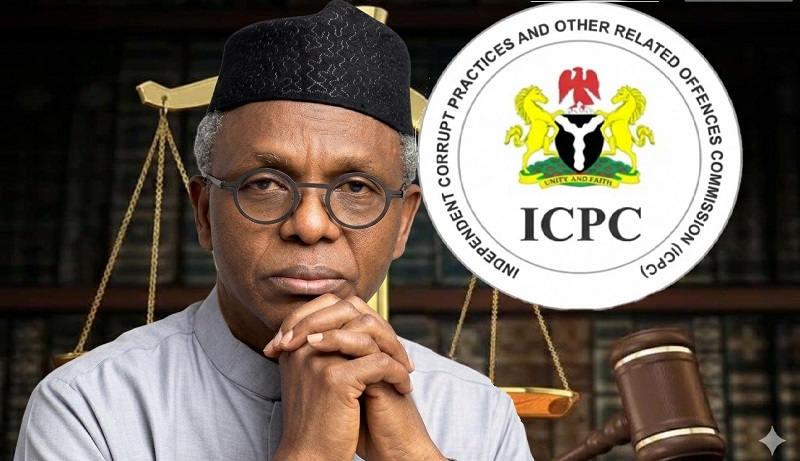

ICPC Secures Court Order to Extend El-Rufai’s Detention

By Adedapo Adesanya

The Independent Corrupt Practices and Other Related Offences Commission (ICPC) has secured a court order to extend the detention of former Governor of Kaduna State, Mr Nasir El-Rufai.

This order gives the anti-graft agency ample time to finalise its investigation into allegations against the former governor, which has now deepened as a result of some new findings.

Subsequently, the new order, which was granted on Tuesday in the presence of Mr El-Rufai’s lawyer, will expire on Thursday, March 19.

However, Mr El-Rufai’s lawyer, whose application to quash the first remand order was declined by a Chief Magistrate Court in Bwari, has returned to the same court to nullify the latest order.

Justice Okechukwu John Akweke has fixed March 17 to decide whether or not he should set aside the latest detention order.

He said, “Upon hearing and listening to the prosecuting counsel, Dr Osuobeni Ekoi Akponimisingha Esq., praying this Honourable court for the following orders:

“An order of this Honourable Court issuing a remand warrant against the Respondent (NASIR AHMAD EL-RUFAI) in favour of the Applicant, i.e. Independent Corrupt Practices and other Related Offences Commission (ICPC), to detain the Respondent (NASIR AHMAD EL-RUFAI) in its custody for another fourteen (14) days pending conclusion of investigation activities on allegations of Money Laundering/abuse of office.

“And for such other or further order(s) as this Honourable court may deem fit to make in the circumstances. It is hereby ordered that: Application granted as prayed.

“That the Applicant, i.e. the Independent Corrupt Practices and other Related Offences Commission ICPC is hereby ordered to re-detain the Respondent (NASIR AHMAD EL-RUFAI) for an additional 14 days to enable the commission to conclude investigation activities.

“That the return date shall be the 19th day of March 2026, for the report of compliance.”

The scrutiny of Mr El-Rufai by the ICPC follows the report of the Kaduna State House of Assembly’s ad hoc committee constituted in 2024 to investigate finances, loans and contracts awarded between 2015 and 2023 under his eight-year administration of the state.

General

Nigeria Begins Evacuation of Willing Nigerians from Iran

By Adedapo Adesanya

The federal government has begun evacuating willing Nigerians in Iran, escorting them across the Armenian border to ensure their safety amid escalating tensions in the Middle East.

The evacuation follows the growing crisis that began on February 28 after coordinated military strikes on Iran by the United States and Israel.

The attacks triggered retaliatory missile and drone strikes across parts of the region, raising fears of a wider conflict.

The chief executive of the Nigerians in Diaspora Commission (NiDCOM), Mrs Abike Dabiri-Erewa, disclosed this in a post on her X handle on Tuesday.

She said officials of the Nigerian Embassy in Tehran are coordinating the evacuation of Nigerians who wish to leave the country and are facilitating their safe passage into Armenia.

Mrs Dabiri-Erewa also reassured that no Nigerian in Iran has so far been affected by the ongoing tensions, noting that embassy officials remain stationed at the border to receive and assist evacuees.

Her post read, “Willing Nigerians [are] being escorted across the Armenian border by officials of the Nigerian embassy in Iran for safe passage. No Nigerian in Iran has been affected by the war as officials remain at the border to receive all who want to leave.”

The development comes as tensions in parts of the Middle East continue to raise concerns over the safety of foreign nationals residing in affected areas.

For repatriation flights, the NiDCOM chair said the airspace is currently unsafe but assured Nigerians in the Middle East that the Federal Government team is on standby to evacuate them.

“And as for repatriation flights, the skies are currently unsafe to fly. Luckily, a flight came in from the UAE to Lagos two days ago, just before another strike and the closure of the airspace.

“Once the airspace opens, the multi-agency FG team on crisis and evacuation is on standby. Our prayers are with you and all our people in affected countries,” she said.

-

Feature/OPED6 years ago

Feature/OPED6 years agoDavos was Different this year

-

Travel/Tourism10 years ago

Lagos Seals Western Lodge Hotel In Ikorodu

-

Showbiz3 years ago

Showbiz3 years agoEstranged Lover Releases Videos of Empress Njamah Bathing

-

Banking8 years ago

Banking8 years agoSort Codes of GTBank Branches in Nigeria

-

Economy3 years ago

Economy3 years agoSubsidy Removal: CNG at N130 Per Litre Cheaper Than Petrol—IPMAN

-

Banking3 years ago

Banking3 years agoSort Codes of UBA Branches in Nigeria

-

Banking3 years ago

Banking3 years agoFirst Bank Announces Planned Downtime

-

Sports3 years ago

Sports3 years agoHighest Paid Nigerian Footballer – How Much Do Nigerian Footballers Earn