General

World Bank Warns of Worsening Hardship in Borno, Kaduna, Five Others

By Adedapo Adesanya

The World Bank has predicted that ongoing insecurity, armed conflicts, and worsening livelihoods will have a lasting impact on seven states in Nigeria.

In the latest Food Security Update, the Bretton Wood institution said this situation is expected to persist in various local government areas within Borno, Kaduna, Katsina, Sokoto, Yobe, Zamfara states, and the northern regions of Adamawa State in Nigeria until May 2024.

The global lender also stressed that challenging macroeconomic conditions are impeding access to agricultural inputs in the country, potentially impacting cereal production.

The estimated cereal production for the 2023/24 crop year in West and Central Africa is expected to be 76.5 million tons, a 2 per cent decrease from the previous season. However, it marks a 3 per cent increase from the average over the last five years.

“Projections indicate a decline in production from last year in Chad, Mali, Niger, and Nigeria. This decrease is attributed to dry spells during the growing season and insecurity that limited access to cropland in Chad, Mali, and Niger and to poor macroeconomic conditions that have restricted access to agricultural inputs in Nigeria.”

“Over the same period (November to May 2024), Crisis (IPC Phase 3) conditions, mainly caused by persistent insecurity and armed conflict, and deteriorating livelihoods, are projected to affect the following regions,”

“Nigeria: Local government areas in Borno, Kaduna, Katsina, Sokoto, Yobe, Zamfara states, and the far north of Adamawa state,” it added.

The World Bank also said the impact will extend to locations in Burkina Faso, Cameroon, Chad, Mali, and Niger, among other areas.

Meanwhile, the December 2023 edition of the Agricultural Market Information System (AMIS) Market Monitor, which was cited in the update highlighted that the volatility in commodity markets is decreasing as the year concludes, with most grain and oilseed prices 15 per cent to 20 per cent lower than in January 2022, excluding rice, although even rice prices have declined because of improvements in global production prospects.

Despite a slowing global economy, demand for agricultural products is anticipated to reach record levels in the 2023/24 marketing season. Although lower prices pose challenges for grain and oilseed farmers, lower fuel and fertilizer costs are expected to offset some of the impacts.

General

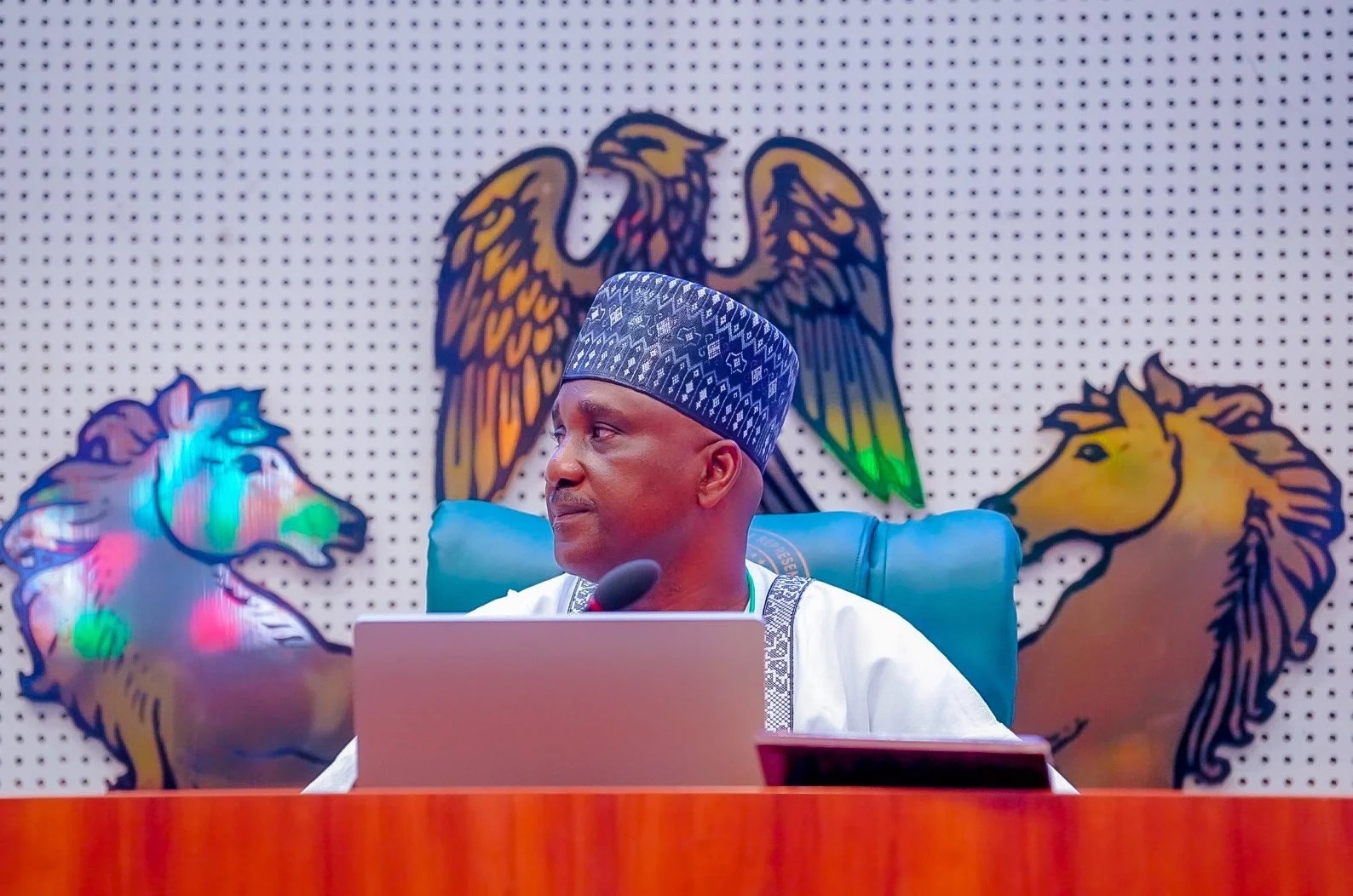

EFCC Re-Arraigns ex-AGF Malami, Wife, Son Over Alleged Money Laundering

By Adedapo Adesanya

The Economic and Financial Crimes Commission (EFCC) has re-arraigned former Attorney-General of the Federation (AGF), Mr Abubakar Malami (SAN), his wife, Mrs Asabe Bashir, and son, Mr Abdulaziz Malami, on money laundering charges.

They were brought before Justice Joyce Abdulmalik of the Federal High Court in Abuja, following the re-assignment of the case to the new trial judge.

Upon resumed hearing, EFCC’s lawyer, Mr Jibrin Okutepa (SAN), informed the court that the matter was scheduled for defendants’ re-arraignment.

“The matter is coming before your lordship this morning for the very first time. I will be applying for the plea of the defendants to be taken,” he said.

Mr Okutepa equally applied that the sums listed in Counts 11 and 12 be corrected to read N325 million instead of N325 billion for Count 11, and N120 million instead of N120 billion for Count 12.

When it was not opposed by the defence lawyer, Mr Joseph Daudu (SAN), Justice Abdulmalik granted the oral application by Mr Okutepa.

The defendants, however, pleaded not guilty to the 16 counts preferred against them by the anti-graft agency bordering on money laundering.

Justice Obiora Egwuatu had, on February 12, withdrawn from the case shortly after the civil case filed by the EFCC was brought to him.

The case was formerly before Justice Emeka Nwite, who sat as a vacation judge during the Christmas/New Year break.

After the vacation period, the CJ reassigned the cases to Justice Egwuatu, who had now recused himself, before it was reassigned to Justice Abdulmalik.

The former AGF, his wife, and son were earlier arraigned before Justice Nwite on December 30, 2025.

While Malami and his son were remanded at Kuje Correctional Centre, Asabe was remanded at Suleja Correctional Centre before they were admitted to N500 million bail each, on January 7, with two sureties each in the like sum.

General

INEC Shifts 2027 Presidential, N’Assembly Elections to January 16

By Adedapo Adesanya

Nigeria will hold next year’s presidential and National Assembly elections a month earlier than planned, after the Independent National Electoral Commission (INEC) revised the polling schedule.

The elections will be held on January 16, instead of the previously announced date of February 20, INEC said in an X post, signed by Mr Mohammed Kudu Haruna, National Commissioner and Chairman, Information and Voter Education Committee.

There were also changes to the Governorship and State Houses of Assembly elections initially fixed for Saturday, March 6 2027, in line with the Electoral Act, 2022, have now been moved to Saturday, February 6, 2027.

The electoral commission said the changes were caused by the enactment of the Electoral Act, 2026 and the repeal of the Electoral Act, 2022, which introduced adjustments to statutory timelines governing pre-election and electoral activities.

“The Commission reviewed and realigned the schedule to ensure compliance with the new legal framework,” it said.

INEC said party primaries (including resolution of disputes) will commence on April 23, 2026 and end on May 30, 2026, after which Presidential and National Assembly campaigns will begin on August 19, 2026, while Governorship and State Houses of Assembly campaigns will begin on September 9, 2026.

It noted that campaigns will end 24 hours before Election Day, and political parties have been advised to strictly adhere to the timelines.

INEC also stated it will enforce compliance with the law.

The electoral body also rescheduled the Osun Governorship election which was earlier scheduled for Saturday, August 8 2026, by a week to Saturday, August 15, 2026.

INEC noted that some activities regarding the Ekiti and Osun governorship elections have already been conducted, and the remaining activities will be implemented in accordance with the Electoral Act, 2026.

Speaking at a news briefing in Abuja two weeks ago, the chairman of INEC, Mr Joash Amupitan, expressed the readiness of the commission to conduct the polls next year.

The timetable issued by the organisation for the polls at the time came when the federal parliament had yet to transmit the amended electoral bill to President Bola Tinubu for assent.

Later that week, the Senate passed the electoral bill, reducing the notice of elections from 360 days to 180 days, while the transmission of results was mandated with a proviso.

General

NIMASA Rallies Stakeholders’ to Develop National Action Plan

By Adedapo Adesanya

The Nigerian Maritime Administration and Safety Agency (NIMASA) has pledged its commitment to provide the regulatory leadership, technical coordination, and stakeholder engagement required to successfully develop and implement a robust National Action Plan on maritime decarbonization in Nigeria.

The Director General of the agency, Mr Dayo Mobereola, made this known during the National Stakeholders’ workshop on the development of a National Maritime Decarbonization Action Plan, further describing the workshop as a critical step in actualising the Federal Government’s blue economy and climate objectives.

Represented by the Executive Director, Operations, Mr Fatai Taiye Adeyemi, the NIMASA DG underscored the significance of the IMO GreenVoyage2050 Project, a technical cooperation initiative /designed to support developing countries in implementing the IMO GHG Strategy.

According to him, the National Action Plan being developed will reflect national realities, leverage existing capacities, address identified gaps, and align with broader economic and environmental priorities of the federal government.

Mr Mobereola stressed that “this transition is not merely about compliance with international obligations, it is about safeguarding our marine environment, protecting public health, strengthening the blue economy, and ensuring that our maritime industry remains competitive and future-ready”, the DG said.

Also speaking at the event was the Technical Manager of the IMO GreenVoyage2050 Project, Ms Astrid Dispert, who highlighted that the overarching objective of the initiative is to advance a coherent and globally aligned regulatory framework to accelerate maritime decarbonization.

She also emphasised that NIMASA plays a pivotal role in driving the project at the national level.

The IMO GreenVoyage2050 Project provides technical expertise and institutional support to assist countries in developing and implementing National Action Plans that promote sustainable shipping practices, encourage investment in clean technologies, and strengthen capacity for long-term emissions reduction.

Through this collaboration, the federal government is advancing deliberate steps towards maritime decarbonization, reinforcing its commitment to global climate goals and ensuring a cleaner, greener, and more sustainable future for the sector.

-

Feature/OPED6 years ago

Feature/OPED6 years agoDavos was Different this year

-

Travel/Tourism10 years ago

Lagos Seals Western Lodge Hotel In Ikorodu

-

Showbiz3 years ago

Showbiz3 years agoEstranged Lover Releases Videos of Empress Njamah Bathing

-

Banking8 years ago

Banking8 years agoSort Codes of GTBank Branches in Nigeria

-

Economy3 years ago

Economy3 years agoSubsidy Removal: CNG at N130 Per Litre Cheaper Than Petrol—IPMAN

-

Banking3 years ago

Banking3 years agoSort Codes of UBA Branches in Nigeria

-

Banking3 years ago

Banking3 years agoFirst Bank Announces Planned Downtime

-

Sports3 years ago

Sports3 years agoHighest Paid Nigerian Footballer – How Much Do Nigerian Footballers Earn