Jobs/Appointments

Banking, Real Estate Executives Undergo Training

By Roger A. Agana

After decades of efforts, a standard document to regulate the activities of the building and construction industry in Ghana has been instituted.

The comprehensive Building Code, GS1207 of 2018, encompasses requirements and recommendations for efficiency and standards for Residential and Non-Residential buildings and as well cover planning, management and practices in the construction of buildings.

The document also covers the smooth and safe operation of the building and construction industry such as Occupancy Classification and Use, Site Development and Land Use, General Building Heights and Areas. It also includes types of Construction, Fire and Smoke Protection Features, Interior Furnishes, Energy efficiency and Sustainability, Soils and Foundations, Electrical Systems and Allied Installations, Plumbing Systems, Lift and Conveying Systems, Safeguards during Construction and Green Building Requirements.

In the backdrop of setting standards to ensure that Ghana’s building environment is safe and meets international standards, Stanbic Bank has signed an MOU with the International Finance Corporation (IFC), a member of the World Bank Group, to train 18 staff of Stanbic Bank as certified Edge Experts, to support developers to be able to go green.

According to Mr Stanislaus Deh, head of product personal and business banking at Stanbic Bank Ghana, in an interview with Newsghana.com.gh at the training, on Thursday February 28, 2019, at the World Bank Office in Accra, he said, “What we are doing as a bank in spearheading this project is to make sure that every project that we finance, that is building, we go green with the people.”

“And the good thing is that, when you go green, it benefits you, it increases your profile, it prepares you for the regulations that are going to hit us very soon from 2020,” he added.

In an answer to the question, as to whether the people will be willing to adopt green buildings, he said, “For me, a lot of people will be more than willing to adopt it. What we have to do to scale up more now is together with the international community educate people quickly, so they know why we are doing what we are doing now.”

Mr Deh, expatiated that, the Sustainable Principles Committee of Ghana, has for the past three years been developing the sustainable principles for the banks. Saying, “Basically, like we all know that sustainability has got to do with meeting the needs of the present generation without compromising that of the future. So, looking at the fact that, in the past three years we as a world have agreed to deal with climate change. The country as a whole is doing what they can do to deal with mitigation and adoption.”

According to him, one of the low hanging fruits when it comes to climate change has to do with the issue of green buildings and built environments. “So for us in Stanbic Bank, apart from the Ghana Home Loans, we are one of the biggest in terms of providing built environments for the country. So, as the team in Stanbic, we thought that it is time to lead the crusade for green buildings with energy efficiency, water efficiency, and making sure that material embodiments are also good to be yoked with the regulations for the buildings to be certified as green.”

On his part in an interview, Mr Dennis Papa Odenyi Quansah, Program Lead for IFC EDGE Green Building Market Transformation Program in Ghana and Nigeria, explained that, “It is important to invest in green buildings, because it will minimize the use of water and electricity in buildings.

Green building structures are energy efficient, environmentally friendly and use resources wisely as well.”

He said, it wasn’t for nothing that the government of Ghana instituted the Ghana Building Code. That it was set up to champion efficient usage of scarce resources including energy and water

According to him, Green building is a step in the right direction towards conserving global energy because, energy consumption is predicted to grow by 37% by 2035 and 96% of this expected growth will be attributable to developing nations. Mr Quansah said, there is the need for green construction which offers a chance to secure emission cuts at a low cost.

A section of the trainees commended the authorities of Stanbic Bank and IFC, for the great opportunity to train them as certified Edge Experts, to support developers to be able to go green. They however called for more of such trainings in order to get more experts to help in the education.

Jobs/Appointments

Olaniyan to Serve as NGX Group Chief Strategy Officer

By Aduragbemi Omiyale

Ms Jumoke Olaniyan has been appointed as the Chief Strategy Officer of the Nigerian Exchange (NGX) Group Plc.

In her new role, Ms Olaniyan will lead enterprise-wide strategy formulation and execution across the organisation, driving initiatives aligned with its ambition to deepen market liquidity, expand product innovation, broaden investor participation, and enhance long-term stakeholder value.

The role is central to strengthening cross-functional alignment and organisational effectiveness as NGX Group continues to evolve its integrated market infrastructure model.

NGX Group, in a statement, said it strengthened its executive leadership with the appointment of Ms Olaniyan to advance its next phase of strategic growth, digital transformation, product innovation and market development.

Her appointment underscores the company’s continued focus on disciplined strategy execution, strong governance and sustainable value creation.

It also reflects the group’s deliberate effort to strengthen its leadership structure through broader representation at the executive level, ensuring that women continue to play influential roles in shaping the evolution of Nigeria’s capital markets while contributing meaningfully to national economic development.

Before joining NGX Group, Ms Olaniyan held senior leadership roles at FMDQ Group Plc and FDHL Group, where she played key roles in business development, market expansion, and product innovation across the fixed income, currencies and derivatives markets.

With over two decades of experience spanning financial markets, strategy, consulting, and banking, she brings extensive expertise in market structure, stakeholder engagement, and enterprise transformation.

She holds a degree in Accounting as well as an MBA from INSEAD Business School and has built a reputation for driving growth, strengthening market participation, and delivering innovative financial market solutions that enhance transparency, efficiency, and market resilience.

Jobs/Appointments

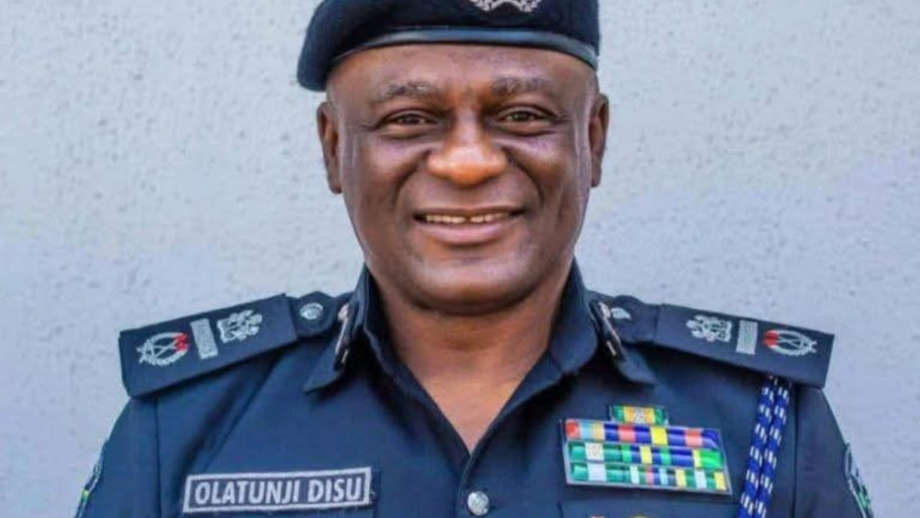

Tinubu to Swear in Tunji Disu as IGP Wednesday After Police Council’s Nod

By Modupe Gbadeyanka

The appointment of Mr Tunji Disu as the substantive Inspector-General of Police (IGP) has been ratified by the Nigeria Police Council (NPC).

The endorsement of the acting police chief was done on Monday at the council’s meeting held at the State House in Abuja, and chaired by President Bola Tinubu.

In attendance were Vice President Kashim Shettima, state governors and the Chairman of the Police Service Commission, Mr Hashimu Argungu.

Others in attendance were the Secretary to the Government of the Federation, Mr George Akume; the National Security Adviser, Mr Nuhu Ribadu; the Chief of Staff to the President, Mr Femi Gbajabiamila; the Minister of Police Affairs, Mr Ibrahim Gaidam; the FCT Minister, Mr Nyesom Wike; and the head of service, Mrs Esther Didi Walson-Jack.

Mr Disu was praised for his outstanding service to the nation through various means. He has held critical operational, investigative, and strategic command positions nationwide. His last position was as Assistant Inspector-General of Police (AIG) in charge of the Special Protection Unit and the Force CID Annex, Lagos.

The endorsement of his appointment on Monday paves the way for his swearing-in by Mr Tinubu on Wednesday. The ceremony will take place during the Federal Executive Council (FEC) meeting, scheduled for the same day.

The President appointed Mr Disu as the new police chief, following the resignation of the former occupier of the seat, Mr Kayode Egbetokun.

Mr Disu was born on April 13, 1966, in Lagos State and joined the Nigeria Police Force on May 18, 1992, as a Cadet Assistant Superintendent.

He rose through the ranks with multiple qualifications in public administration, forensic investigation, criminology, security, legal psychology, and entrepreneurship-credentials that reflect his commitment to knowledge-driven, modern policing.

His state governor, Mr Babajide Sanwo-Olu, lauded Mr Disu for his exemplary services as a policeman, especially when he served as the Commander of the Rapid Response Squad (RRS) in Lagos State between 2015 and 2021, where his tenure earned him and the RRS recognition for excellence in crime control.

Jobs/Appointments

Court Sanctions CHI Limited for Wrongful Employment Termination

By Modupe Gbadeyanka

The termination of the employment of one Mr Bodunrin Akinsuroju by CHI Limited has been declared as unlawful by the National Industrial Court of Nigeria.

Delivering judgment on the matter, Justice Sanda Yelwa of the Lagos Judicial Division of the court held that the sacking of Mr Akinsuroju did not comply strictly with the provisions of the contract of employment and the Employee Handbook.

Consequently, the company was directed to pay him the sum of N2 million as general damages for wrongful termination and N200,000 as costs of action, while Mr Akinsuroju was ordered to return the company’s properties in his possession or pay their assessed market value.

Justice Yelwa found that the contract agreement between both parties clearly required either party to give 30 days’ notice or payment in lieu of notice after confirmation of appointment, and there was no evidence that the employee was given the required notice or paid salary in lieu of notice.

The judge held that failure to comply with this fundamental term amounted to a breach of the contract of employment, thereby rendering the termination wrongful.

Mr Akinsuroju had claimed that the allegation of misconduct against him was unfounded and not established, maintaining that the disciplinary committee proceedings were prejudicial and that the termination of his employment was without justifiable cause and without compliance with the agreed terms of his employment.

In defence, CHI Limited contended that it had the right to terminate the employment of Mr Akinsuroju and that the termination was lawful and in accordance with the contract of employment and the Code of Conduct.

In opposition, counsel to Mr Akinsuroju submitted that the alleged breaches were not proved and that the termination letter took immediate effect without the requisite 30 days’ notice or payment in lieu of notice as stipulated in the letter of appointment and the Employee Handbook, urging the court to hold that the termination was wrongful and to grant the reliefs sought.

-

Feature/OPED6 years ago

Feature/OPED6 years agoDavos was Different this year

-

Travel/Tourism10 years ago

Lagos Seals Western Lodge Hotel In Ikorodu

-

Showbiz3 years ago

Showbiz3 years agoEstranged Lover Releases Videos of Empress Njamah Bathing

-

Banking8 years ago

Banking8 years agoSort Codes of GTBank Branches in Nigeria

-

Economy3 years ago

Economy3 years agoSubsidy Removal: CNG at N130 Per Litre Cheaper Than Petrol—IPMAN

-

Banking3 years ago

Banking3 years agoSort Codes of UBA Branches in Nigeria

-

Banking3 years ago

Banking3 years agoFirst Bank Announces Planned Downtime

-

Sports3 years ago

Sports3 years agoHighest Paid Nigerian Footballer – How Much Do Nigerian Footballers Earn