Jobs/Appointments

Boshoro Quits as Renmoney Microfinance Bank CEO

By Dipo Olowookere

Managing Director/Chief Executive Officer of Renmoney Microfinance Bank Limited, Mrs Oluwatobi Boshoro, has resigned from the position.

A statement issued by the lender and signed by its Secretary, Ighiwi Erhahon, confirmed this information on Tuesday in Lagos.

According to the press release obtained by Business Post, Mrs Boshoro exited the company to attend to some personal issues that may not allow combine both responsibilities.

“Renmoney Microfinance Bank Limited hereby announces the resignation of its Managing Director/CEO, Mrs Oluwatobi Boshoro.

“Mrs Boshoro has resigned to attend to personal matters,” the statement said.

The firm further said, “In the meantime, Mr Kieran Donnelly, will relinquish his position as Chairman of the board of directors and lead the company as Acting CEO, until a permanent CEO is appointed.”

Formerly called RenCredit, RenMoney MFB Limited is a consumer finance organization founded in 2012. The fintech lending company in Nigeria is known to assist self-employed individuals with loan solutions.

In November 2018, Renmoney announced the appointment of Mrs Boshoro as its new CEO. Prior to her appointment, she served as the Head, Digital Strategy, Issuing and Service Management at Stanbic IBTC.

Mrs Boshoro is an innovative leader with broad-based expertise in business strategy, digital payments/strategy, marketing, brand management and business development with over 15 years of experience.

She is an alumnus of the prestigious Harvard Business School, having completed multiple Executive Management programmes, including the General Management Programme in 2013.

Jobs/Appointments

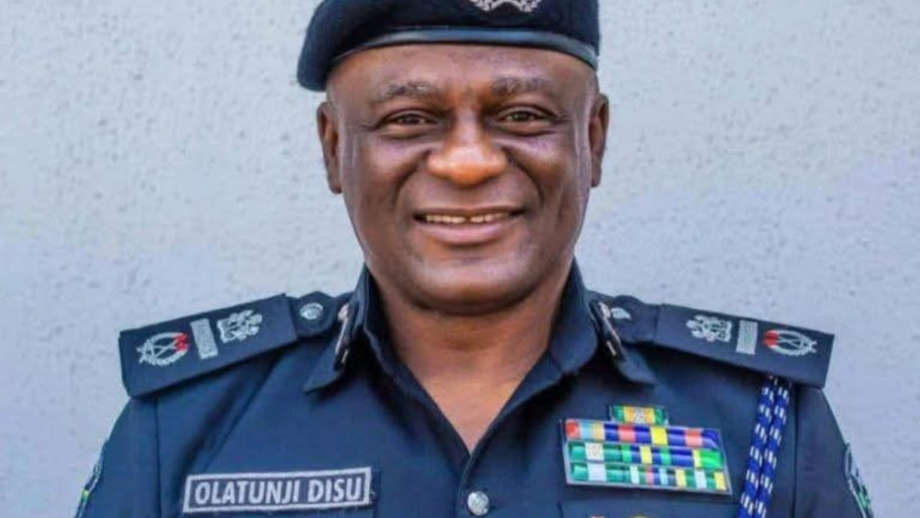

Tinubu Appoints Tunji Disu as Acting Inspector General of Police

By Modupe Gbadeyanka

President Bola Tinubu on Tuesday appointed Mr Tunji Disu as the acting Inspector General of Police (IGP), following the resignation of Mr Kayode Egbetokun.

Mr Disu, an Assistant Inspector General of Police (AIG), was recently moved to the Force Criminal Investigation Department (FCID) Annex, Alagbon, Lagos.

A statement today by the Special Adviser to the President on Information and Strategy, Mr Bayo Onanuga, disclosed that the President would convene a meeting of the Nigeria Police Council shortly to formally consider the appointment of Mr Disu as substantive IGP, after which his name will be transmitted to the Senate for confirmation.

Mr Tinubu expressed confidence that Mr Disu’s experience, operational depth, and demonstrated leadership capacity would provide steady and focused direction for the Nigeria Police Force during this critical period.

He reiterated his administration’s unwavering commitment to enhancing national security, strengthening institutional capacity, and ensuring that the Nigeria Police Force remains professional, accountable, and fully equipped to discharge its constitutional responsibilities.

Mr Egbetokun was said to have resigned from the position due to pressing family considerations.

President Tinubu, who accepted the resignation letter, expressed his profound appreciation for Mr Egbetokun’s decades of distinguished service to the Nigeria Police Force and the nation. He acknowledged his dedication, professionalism, and steadfast commitment to strengthening internal security architecture during his tenure.

Appointed in June 2023, Mr Egbetokun was serving a four-year term scheduled to conclude in June 2027, in line with the amended provisions of the Police Act.

The statement disclosed that his replacement was in view of the current security challenges confronting the nation, and acting in accordance with extant laws and legal guidance.

Jobs/Appointments

Tunji Disu to Become New IGP as Egbetokun Quits

By Adedapo Adesanya

Mr Tunji Disu, an Assistant Inspector General of Police (AIG), has reportedly replaced Mr Kayode Egbetokun as the new Inspector General of Police (IGP).

Mr Egbetokun resigned from the position on Tuesday after he was said to have held a meeting with President Bola Tinubu on Monday night at the Presidential Villa in Abuja.

President Tinubu appointed Mr Egebtokun as the 22nd IGP on June 19, 2023, with his appointment confirmed by the Nigeria Police Council on October 31, 2023.

Appointed as IGP at the age of 58, Mr Egbetokun was due for retirement on September 4, 2024, upon reaching the mandatory age of 60, but his tenure was extended by the President, creating controversies, which trailed him until his exit from the force today.

Although the police authorities are yet to comment on the matter or issue an official statement about his resignation, the move came amid reports suggesting that Mr Egbetokun has left the position.

Mr Egbetokun’s tenure was marred by a series of controversies; he recently initiated multiple charges against activist Mr Omoyele Sowore and his publication, SaharaReporters, after Mr Sowore publicly described him as an “illegal IGP.”

The dispute escalated into protracted legal battles, with the Federal High Court issuing injunctions restricting further publications relating to the former police chief and members of his family. Critics interpreted these court actions as attempts to stifle dissent and weaken press freedom.

His replacement, Mr Disu, was posted to oversee the Force Criminal Investigation Department (FCID) Annex, Alagbon, Lagos, some days ago.

Jobs/Appointments

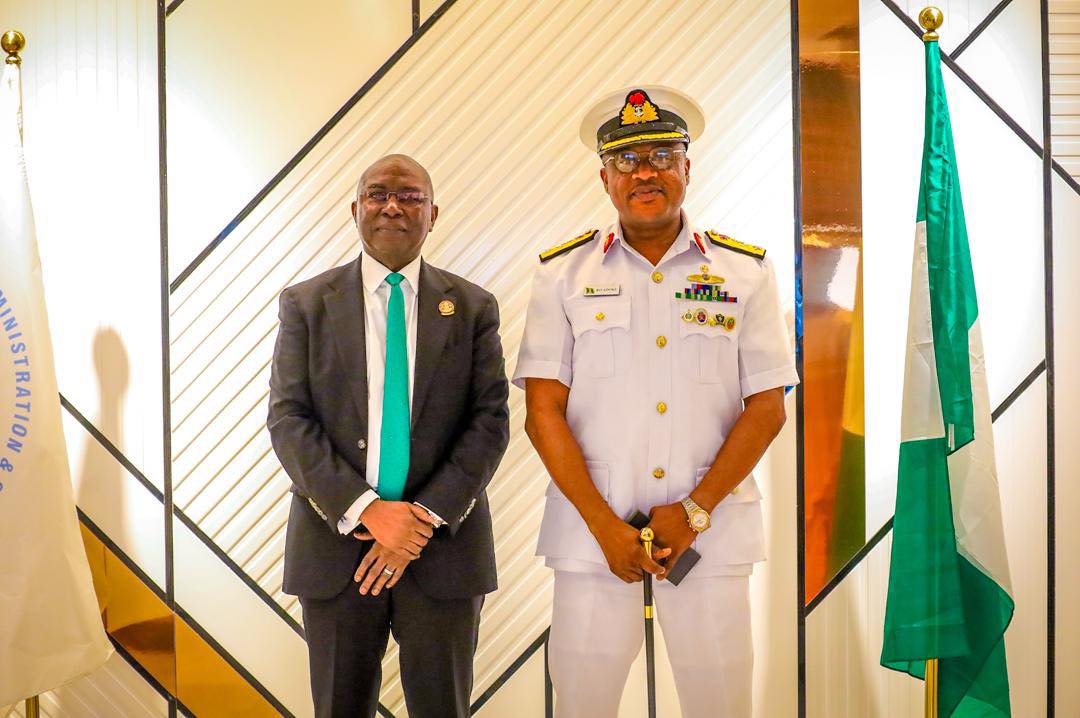

NIMASA Gets New Maritime Guard Commander

By Modupe Gbadeyanka

A new Commander of the Maritime Guard Command has been appointed for the Nigerian Maritime Administration and Safety Agency (NIMASA), and he is Commodore Reginald Odeodi Adoki.

His appointment was approved by the Chief of the Naval Staff, Vice Admiral Idi Abbas, a statement from NIMASA confirmed.

He was chosen to replace Commodore H.C Oriekeze, who has been redeployed by naval authorities.

Commodore Adoki, a principal Warfare Officer specialising in communication and intelligence, brings 25 years of experience in the Nigerian Navy covering training, staff and operations.

As a seaman, he has commanded NNS Andoni, NNS Kyanwa and NNS Kada. It was under his command that NNS Kada undertook her maiden voyage, sailing from the country of build (the United Arab Emirates) into Nigeria.

He was commissioned into the Nigerian Navy in 2000 with a BSc in Mathematics. He has since earned a Master’s in International Law and Diplomacy from the University of Lagos and an MSc in Terrorism, Security and Policing atthe University of Leicester, England.

He is currently pursuing a PhD in Defence and Security Studies at the National Defence Academy (NDA). He is a highly decorated officer with several medals for distinguished service.

Welcoming the new MGC Commander to the agency, the Director General of NIMASA, Mr Dayo Mobereola, expressed confidence in Mr Adoki’s addition to the team, emphasising that it will further strengthen the nation’s maritime security architecture given his vast experience in the industry.

The Maritime Guard Command domiciled in NIMASA was established as part of the resolutions of the Memorandum of Understanding (MoU) with the Nigerian Navy to assist NIMASA in strengthening operational efficiency in Nigeria’s territorial waters, especially through enforcement of security, safety and other maritime regulations.

-

Feature/OPED6 years ago

Feature/OPED6 years agoDavos was Different this year

-

Travel/Tourism10 years ago

Lagos Seals Western Lodge Hotel In Ikorodu

-

Showbiz3 years ago

Showbiz3 years agoEstranged Lover Releases Videos of Empress Njamah Bathing

-

Banking8 years ago

Banking8 years agoSort Codes of GTBank Branches in Nigeria

-

Economy3 years ago

Economy3 years agoSubsidy Removal: CNG at N130 Per Litre Cheaper Than Petrol—IPMAN

-

Banking3 years ago

Banking3 years agoSort Codes of UBA Branches in Nigeria

-

Banking3 years ago

Banking3 years agoFirst Bank Announces Planned Downtime

-

Sports3 years ago

Sports3 years agoHighest Paid Nigerian Footballer – How Much Do Nigerian Footballers Earn