Jobs/Appointments

DBN Reorganises Board to Achieve Core Mandate

By Modupe Gbadeyanka

In order to achieve its core mandate of providing sustainable financing to Micro, Small, and Medium Enterprises (MSMEs) across the country, the Development Bank of Nigeria (DBN) has reorganised its board.

The nation’s primary wholesale development finance institution has added two experts to its board and they are Mrs Ijeoma Ozulumba and Mr Kyari Abba Kyari, who will serve as executive director and independent non-executive director respectively.

Chairman of the board, Mr Shehu Yahaya, explained that the appointments of the duo would further strengthen DBN’s vision, maintaining that the bank would continually uphold the highest standards of corporate governance, which have kept the Bank on a steady trajectory of progress.

“We are thrilled to have Ijeoma and Kyari join the Board and we look forward to them applying their knowledge, experience, and expertise in helping to deliver DBN’s core mandate as Nigeria’s primary wholesale development finance institution, providing sustainable financing to MSMEs across the nation,” Mr Yahaya, stated.

Also, the Managing Director of the DBN, Mr Tony Okpanachi, stated that “I am particularly excited by the depth and quality that both appointees are bringing to the Board and ultimately, the institution.

“Together, they bring a combined reservoir of knowledge and expertise in the financial services sector that will add immense value to the Bank and significantly contribute to the Bank’s development impact,” he added.

Mrs Ozulumba once served as Financial Controller at Continental Trust Bank Ltd (now part of UBA Plc) and MBC International Bank Ltd (now part of First Bank).

She was Chief Financial Officer at FinBank Plc and Basel Risk Consultant and Finance Manager at Bank of Montreal and Scotia Bank, both in Toronto, Canada.

Mrs Ozulumba also managed corporate budgeting and management reporting for Seplat Petroleum Development Company Plc, the largest independent E&P company in Nigeria.

A graduate of the University of Benin, Nigeria, and an alumnus of the Lagos Business School, Mrs Ozulumba is a fellow of the Institute of Chartered Accountants of Nigeria and a Certified Professional Accountant of Canada. She holds an MBA in International Business from Royal Holloway, University of London, and is a Project Management Professional. She was until her appointment the Chief Financial Officer at the Development Bank of Nigeria.

Mr Kyari, on his part, is the Managing Director/Co-Founder of Trans Sahara Investment Corporation, a Private Equity firm based in Lagos, Nigeria.

He had an outstanding career in Engineering and Technology serving as the former Managing Director/CEO at Central Securities Clearing System Plc, Lagos and ValuCard Nigeria (Unified Payments Ltd), Lagos, respectively. He has also served as an Executive Director in charge of Information Technology at FSB International Bank Plc.

Before joining FSB International Bank Plc, he served in various roles as Manufacturing Development Engineer, Marketing Program Manager, Senior IT Consultant, and as Manager in various sectors of the Hewlett Packard Corporation in the United States of America.

Mr Kyari Bukar was the former Chairman of the Board of Directors of the Nigerian Economic Summit Group (NESG) and currently serves on several other Boards.

He holds a bachelor’s degree in Physics from Ahmadu Bello University Zaria, Nigeria, and a master’s degree in Nuclear Engineering from Oregon State University, Corvallis, Oregon, USA.

Jobs/Appointments

Court Sanctions CHI Limited for Wrongful Employment Termination

By Modupe Gbadeyanka

The termination of the employment of one Mr Bodunrin Akinsuroju by CHI Limited has been declared as unlawful by the National Industrial Court of Nigeria.

Delivering judgment on the matter, Justice Sanda Yelwa of the Lagos Judicial Division of the court held that the sacking of Mr Akinsuroju did not comply strictly with the provisions of the contract of employment and the Employee Handbook.

Consequently, the company was directed to pay him the sum of N2 million as general damages for wrongful termination and N200,000 as costs of action, while Mr Akinsuroju was ordered to return the company’s properties in his possession or pay their assessed market value.

Justice Yelwa found that the contract agreement between both parties clearly required either party to give 30 days’ notice or payment in lieu of notice after confirmation of appointment, and there was no evidence that the employee was given the required notice or paid salary in lieu of notice.

The judge held that failure to comply with this fundamental term amounted to a breach of the contract of employment, thereby rendering the termination wrongful.

Mr Akinsuroju had claimed that the allegation of misconduct against him was unfounded and not established, maintaining that the disciplinary committee proceedings were prejudicial and that the termination of his employment was without justifiable cause and without compliance with the agreed terms of his employment.

In defence, CHI Limited contended that it had the right to terminate the employment of Mr Akinsuroju and that the termination was lawful and in accordance with the contract of employment and the Code of Conduct.

In opposition, counsel to Mr Akinsuroju submitted that the alleged breaches were not proved and that the termination letter took immediate effect without the requisite 30 days’ notice or payment in lieu of notice as stipulated in the letter of appointment and the Employee Handbook, urging the court to hold that the termination was wrongful and to grant the reliefs sought.

Jobs/Appointments

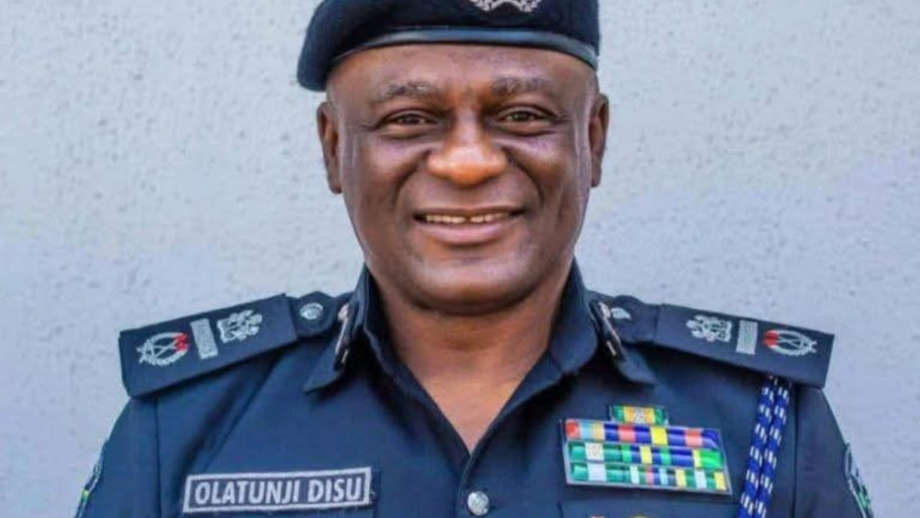

Tinubu Appoints Tunji Disu as Acting Inspector General of Police

By Modupe Gbadeyanka

President Bola Tinubu on Tuesday appointed Mr Tunji Disu as the acting Inspector General of Police (IGP), following the resignation of Mr Kayode Egbetokun.

Mr Disu, an Assistant Inspector General of Police (AIG), was recently moved to the Force Criminal Investigation Department (FCID) Annex, Alagbon, Lagos.

A statement today by the Special Adviser to the President on Information and Strategy, Mr Bayo Onanuga, disclosed that the President would convene a meeting of the Nigeria Police Council shortly to formally consider the appointment of Mr Disu as substantive IGP, after which his name will be transmitted to the Senate for confirmation.

Mr Tinubu expressed confidence that Mr Disu’s experience, operational depth, and demonstrated leadership capacity would provide steady and focused direction for the Nigeria Police Force during this critical period.

He reiterated his administration’s unwavering commitment to enhancing national security, strengthening institutional capacity, and ensuring that the Nigeria Police Force remains professional, accountable, and fully equipped to discharge its constitutional responsibilities.

Mr Egbetokun was said to have resigned from the position due to pressing family considerations.

President Tinubu, who accepted the resignation letter, expressed his profound appreciation for Mr Egbetokun’s decades of distinguished service to the Nigeria Police Force and the nation. He acknowledged his dedication, professionalism, and steadfast commitment to strengthening internal security architecture during his tenure.

Appointed in June 2023, Mr Egbetokun was serving a four-year term scheduled to conclude in June 2027, in line with the amended provisions of the Police Act.

The statement disclosed that his replacement was in view of the current security challenges confronting the nation, and acting in accordance with extant laws and legal guidance.

Jobs/Appointments

Tunji Disu to Become New IGP as Egbetokun Quits

By Adedapo Adesanya

Mr Tunji Disu, an Assistant Inspector General of Police (AIG), has reportedly replaced Mr Kayode Egbetokun as the new Inspector General of Police (IGP).

Mr Egbetokun resigned from the position on Tuesday after he was said to have held a meeting with President Bola Tinubu on Monday night at the Presidential Villa in Abuja.

President Tinubu appointed Mr Egebtokun as the 22nd IGP on June 19, 2023, with his appointment confirmed by the Nigeria Police Council on October 31, 2023.

Appointed as IGP at the age of 58, Mr Egbetokun was due for retirement on September 4, 2024, upon reaching the mandatory age of 60, but his tenure was extended by the President, creating controversies, which trailed him until his exit from the force today.

Although the police authorities are yet to comment on the matter or issue an official statement about his resignation, the move came amid reports suggesting that Mr Egbetokun has left the position.

Mr Egbetokun’s tenure was marred by a series of controversies; he recently initiated multiple charges against activist Mr Omoyele Sowore and his publication, SaharaReporters, after Mr Sowore publicly described him as an “illegal IGP.”

The dispute escalated into protracted legal battles, with the Federal High Court issuing injunctions restricting further publications relating to the former police chief and members of his family. Critics interpreted these court actions as attempts to stifle dissent and weaken press freedom.

His replacement, Mr Disu, was posted to oversee the Force Criminal Investigation Department (FCID) Annex, Alagbon, Lagos, some days ago.

-

Feature/OPED6 years ago

Feature/OPED6 years agoDavos was Different this year

-

Travel/Tourism10 years ago

Lagos Seals Western Lodge Hotel In Ikorodu

-

Showbiz3 years ago

Showbiz3 years agoEstranged Lover Releases Videos of Empress Njamah Bathing

-

Banking8 years ago

Banking8 years agoSort Codes of GTBank Branches in Nigeria

-

Economy3 years ago

Economy3 years agoSubsidy Removal: CNG at N130 Per Litre Cheaper Than Petrol—IPMAN

-

Banking3 years ago

Banking3 years agoSort Codes of UBA Branches in Nigeria

-

Banking3 years ago

Banking3 years agoFirst Bank Announces Planned Downtime

-

Sports3 years ago

Sports3 years agoHighest Paid Nigerian Footballer – How Much Do Nigerian Footballers Earn