Jobs/Appointments

Dele Alake Re-elected as Chairman of Africa Minerals Strategy Group

By Adedapo Adesanya

Nigeria’s Minister of Solid Minerals Development, Mr Dele Alake, has been re-elected as the Chairman of Africa Minerals Strategy Group (AMSG).

Mr Alake was first unanimously elected as the pioneer Chairman of AMSG in 2024 on the sidelines of Future Minerals Forum (FMF).

He was re-elected at the 2026 Annual General Meeting (AGM) of the group, held on the sidelines of the same conference in Riyadh, Saudi Arabia.

The continental ministerial forum of African ministers is responsible for minerals and mining, committed to coordinated action aimed at maximising value addition and beneficiation from Africa’s vast mineral resources.

A statement issued on Sunday in Abuja by the Special Assistant on Media to the Minister of Solid Minerals Development, Mr Segun Tomori, noted that the move is part of efforts to strengthen its institutional framework.

AMSG approved the creation of additional leadership positions, including Vice Chairman, Deputy Secretary-General, and Financial Secretary.

The forum further resolved that those positions be equitably distributed across Africa’s sub-regions to promote inclusion and regional balance.

While the positions of Chairman and Vice Chairman are elective and reserved for serving ministers, other positions are appointed by member states to which they are zoned.

Under the new leadership structure, Mr Alake continued as Chairman of the 24-member forum, representing West Africa.

The Minister of Mines of the Democratic Republic of Congo (DRC), Mr Louis Watum Kabamba, was elected Vice Chairman, representing Central Africa.

The position of Secretary-General remained with Uganda (East Africa), Mauritania was appointed Deputy Secretary-General (North Africa), while South Africa was assigned the position of Financial Secretary.

The AGM also ratified a two-year tenure for the newly elected executive committee and agreed that zoned positions belong to member countries, such that where a serving minister is replaced, the successor automatically assumes the role.

In his acceptance speech, Alake expressed gratitude to his colleagues for the renewed confidence reposed in him, stressing the urgent need for African nations to work collaboratively to unlock the continent’s economic potential through solid minerals development.

He called on member states to agree on minimum financial contributions and to refine the group’s budgeting framework to strengthen its operational effectiveness.

“Once member states contribute, accountability will naturally follow. This will enhance transparency and strengthen the credibility of the AMSG before the global community,” Mr Alake stated.

The AGM further resolved to hold quarterly ministerial meetings and ratified the establishment of standing committees, including those for Legal, Institutional Affairs and Human Resources; Sustainability and Responsible Mining; Finance, Budget and Resource Mobilisation, among others.

It was also agreed that steps be taken towards hosting a global minerals conference in Africa, similar to FMF.

Speaking earlier at a Leadership Roundtable, Mr Alake emphasised that mineral production alone could not deliver lasting economic transformation without reliable infrastructure, coordinated policies, and deliberate value-addition strategies.

Mr Alake cited the Lobito Corridor as a model of what was achievable when rail, ports, energy systems, and policy alignment worked in synergy. He stated that similar opportunities existed across the continent, including the Lagos–Abidjan Corridor linking Nigeria, Benin, Togo, Ghana, and Côte d’Ivoire; Walvis Bay Corridor connecting Southern Africa’s mining regions to global markets; Dar es Salaam and Central Corridors serving East and Central Africa, among others.

“The real question is not whether Africa has corridors, but whether these corridors are being financed, governed and structured to support industrial growth, regional integration and long-term stability.

“What matters is how financing is designed to reduce risk, attract private capital, and sustain commercial viability while advancing national and regional development objectives,” he said.

Mr Alake emphasised that unlocking capital required addressing issues, such as bankable and enforceable offtake arrangements; predictable and harmonised cross-border regulatory frameworks; alignment of rail, port, power, and industrial planning; and clear pathways for processing, smelting, logistics services, and industrial clusters along the corridors.

He added that the broader vision of AMSG was to ensure that Africa’s mineral infrastructure was strategically designed, responsibly financed, and efficiently managed in a rapidly evolving global environment, not to discourage investment, but to ensure it aligned with long-term stability, transparency, and shared economic prosperity.

Jobs/Appointments

Court Sanctions CHI Limited for Wrongful Employment Termination

By Modupe Gbadeyanka

The termination of the employment of one Mr Bodunrin Akinsuroju by CHI Limited has been declared as unlawful by the National Industrial Court of Nigeria.

Delivering judgment on the matter, Justice Sanda Yelwa of the Lagos Judicial Division of the court held that the sacking of Mr Akinsuroju did not comply strictly with the provisions of the contract of employment and the Employee Handbook.

Consequently, the company was directed to pay him the sum of N2 million as general damages for wrongful termination and N200,000 as costs of action, while Mr Akinsuroju was ordered to return the company’s properties in his possession or pay their assessed market value.

Justice Yelwa found that the contract agreement between both parties clearly required either party to give 30 days’ notice or payment in lieu of notice after confirmation of appointment, and there was no evidence that the employee was given the required notice or paid salary in lieu of notice.

The judge held that failure to comply with this fundamental term amounted to a breach of the contract of employment, thereby rendering the termination wrongful.

Mr Akinsuroju had claimed that the allegation of misconduct against him was unfounded and not established, maintaining that the disciplinary committee proceedings were prejudicial and that the termination of his employment was without justifiable cause and without compliance with the agreed terms of his employment.

In defence, CHI Limited contended that it had the right to terminate the employment of Mr Akinsuroju and that the termination was lawful and in accordance with the contract of employment and the Code of Conduct.

In opposition, counsel to Mr Akinsuroju submitted that the alleged breaches were not proved and that the termination letter took immediate effect without the requisite 30 days’ notice or payment in lieu of notice as stipulated in the letter of appointment and the Employee Handbook, urging the court to hold that the termination was wrongful and to grant the reliefs sought.

Jobs/Appointments

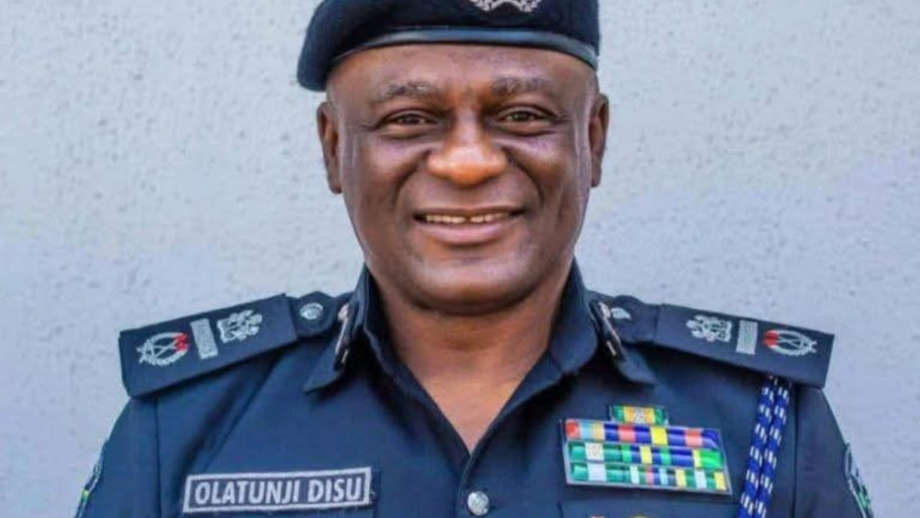

Tinubu Appoints Tunji Disu as Acting Inspector General of Police

By Modupe Gbadeyanka

President Bola Tinubu on Tuesday appointed Mr Tunji Disu as the acting Inspector General of Police (IGP), following the resignation of Mr Kayode Egbetokun.

Mr Disu, an Assistant Inspector General of Police (AIG), was recently moved to the Force Criminal Investigation Department (FCID) Annex, Alagbon, Lagos.

A statement today by the Special Adviser to the President on Information and Strategy, Mr Bayo Onanuga, disclosed that the President would convene a meeting of the Nigeria Police Council shortly to formally consider the appointment of Mr Disu as substantive IGP, after which his name will be transmitted to the Senate for confirmation.

Mr Tinubu expressed confidence that Mr Disu’s experience, operational depth, and demonstrated leadership capacity would provide steady and focused direction for the Nigeria Police Force during this critical period.

He reiterated his administration’s unwavering commitment to enhancing national security, strengthening institutional capacity, and ensuring that the Nigeria Police Force remains professional, accountable, and fully equipped to discharge its constitutional responsibilities.

Mr Egbetokun was said to have resigned from the position due to pressing family considerations.

President Tinubu, who accepted the resignation letter, expressed his profound appreciation for Mr Egbetokun’s decades of distinguished service to the Nigeria Police Force and the nation. He acknowledged his dedication, professionalism, and steadfast commitment to strengthening internal security architecture during his tenure.

Appointed in June 2023, Mr Egbetokun was serving a four-year term scheduled to conclude in June 2027, in line with the amended provisions of the Police Act.

The statement disclosed that his replacement was in view of the current security challenges confronting the nation, and acting in accordance with extant laws and legal guidance.

Jobs/Appointments

Tunji Disu to Become New IGP as Egbetokun Quits

By Adedapo Adesanya

Mr Tunji Disu, an Assistant Inspector General of Police (AIG), has reportedly replaced Mr Kayode Egbetokun as the new Inspector General of Police (IGP).

Mr Egbetokun resigned from the position on Tuesday after he was said to have held a meeting with President Bola Tinubu on Monday night at the Presidential Villa in Abuja.

President Tinubu appointed Mr Egebtokun as the 22nd IGP on June 19, 2023, with his appointment confirmed by the Nigeria Police Council on October 31, 2023.

Appointed as IGP at the age of 58, Mr Egbetokun was due for retirement on September 4, 2024, upon reaching the mandatory age of 60, but his tenure was extended by the President, creating controversies, which trailed him until his exit from the force today.

Although the police authorities are yet to comment on the matter or issue an official statement about his resignation, the move came amid reports suggesting that Mr Egbetokun has left the position.

Mr Egbetokun’s tenure was marred by a series of controversies; he recently initiated multiple charges against activist Mr Omoyele Sowore and his publication, SaharaReporters, after Mr Sowore publicly described him as an “illegal IGP.”

The dispute escalated into protracted legal battles, with the Federal High Court issuing injunctions restricting further publications relating to the former police chief and members of his family. Critics interpreted these court actions as attempts to stifle dissent and weaken press freedom.

His replacement, Mr Disu, was posted to oversee the Force Criminal Investigation Department (FCID) Annex, Alagbon, Lagos, some days ago.

-

Feature/OPED6 years ago

Feature/OPED6 years agoDavos was Different this year

-

Travel/Tourism10 years ago

Lagos Seals Western Lodge Hotel In Ikorodu

-

Showbiz3 years ago

Showbiz3 years agoEstranged Lover Releases Videos of Empress Njamah Bathing

-

Banking8 years ago

Banking8 years agoSort Codes of GTBank Branches in Nigeria

-

Economy3 years ago

Economy3 years agoSubsidy Removal: CNG at N130 Per Litre Cheaper Than Petrol—IPMAN

-

Banking3 years ago

Banking3 years agoSort Codes of UBA Branches in Nigeria

-

Banking3 years ago

Banking3 years agoFirst Bank Announces Planned Downtime

-

Sports3 years ago

Sports3 years agoHighest Paid Nigerian Footballer – How Much Do Nigerian Footballers Earn