Jobs/Appointments

Experts Brainstorm on Future Work Template at Stanbic IBTC Bank Forum

By Olubori Oduntan

In a rapidly changing world, more so in the digital space, finding the right models to anchor human capital development will remain a paramount determinant of corporate success. This thinking underscores the Workplace Banking Seminar’ organized by Stanbic IBTC Bank PLC, a member of Stanbic IBTC Holdings PLC, in Lagos, recently.

The seminar, with the theme, ‘The Future of Work and the Role of Human Capital’, attracted participants from both the public and private sectors, including Human Resources Managers , Financial Service Institutions, Insurers, Fintechs, Government Agencies, Regulators, Private Equity and Venture Capital firms, amongst other players from diverse fields.

In his opening comments, Chief Executive, Stanbic IBTC Bank PLC, Dr. Demola Sogunle, said by settling for a theme that seeks to unravel the future of work, the organization aims to prepare and equip its clientele for future success. Employee experience, just like customer experience, is imperative to drive corporate success. Therefore, workers must be sufficiently motivated, engaged and empowered, he stated.

This objective underlines the numerous stakeholder engagements organized by the Stanbic IBTC Group to provide a platform to connect with clients and avail them with information to make informed decisions. As an institution designed to meet the financial needs of customers at every phase in life, Dr. Sogunle said the group would continuously offer value propositions to move people and businesses forward.

Guest speaker, Mr Boye Ademola, noted that the whole essence of digital application is to create intrinsic value. Any technology that does not generate value is worthless. Besides, value cannot be created without commensurate talent.

Mr Ademola, who is Partner & Lead for Digital Transformation Technology at KPMG, stated that the future of work has three crucial dimensions: workforce, workspace and work culture. These three elements are critical to attract the millennials, who would constitute the bulk of the future workforce. Nigeria for instance, has over 90 million of its population under 30 years of age and as the population increases, they would naturally trigger change. Already, the average age of millennial CEOs is in the 30s. In meeting the demands of the future, there is the need for a paradigm shift from today’s work structure. Critical factors to drive this change include focus on value creation, agility, co-creation, co-option of millennials and appropriate operating models.

The session also had a panel discussion that featured Usen Udoh, Group Chief, Human Resources, Dangote Group; Alero Onosode, General Manager, Human Resources, Seplat Petroleum Plc; Abudullahi Jubril Saba, Human Resources Director, IHS Towers; Country Head, Human Capital, Stanbic IBTC, Olufunke Amobi; and Boye Ademola. They highlighted other factors pivotal to the future of work as education, mining ecosystems, life-long learning, breaking of hierarchies and silos, challenging leadership and unrelenting value creation.

Another highlight of the event was the question and answer session which was very interactive and engaging. Major talking points included creating an engaged workforce by fusing learning and talent management, using technology to leapfrog, ensuring inclusion, participation in activities and initiatives as well as using meritocracy as a yardstick for appraisal.

The ‘Workplace Banking Seminar’, now in its fourth edition, comes on the heels of the Bank’s hugely successful financial planning sessions for Enterprises. The seminar hosts HR Heads drawn from various sectors and focuses on topical HR issues with a view to equipping the audience with vital skills and knowledge aimed at impacting Employee/Business efficiency, productivity, profitability, continuity, growth and sustainability.

Head, Personal Banking, Stanbic IBTC Bank PLC, Nkolika Okoli, said the Bank is constantly trying to add value, which goes beyond providing banking services to its customers. By looking at the whole spectrum of financial literacy drawn from the Stanbic IBTC Group expertise, Ms. Okoli stated that Stanbic IBTC Personal Banking business aims to equip Individuals with the knowledge required to attain financial freedom before retirement.

Executive Director, Personal & Business Banking, Stanbic IBTC Bank PLC, Mr. Babatunde Macaulay, who gave the vote of thanks, said as a member of the Standard Bank Group, Africa’s largest bank by assets and earnings, Stanbic IBTC will continue to leverage on the 155-year experience, expertise and strong financial clout of the mother brand to deliver superior sustainable shareholder value by meeting the needs of its clientele. “Our main goal is to continue to render best-in-class service to our customers who cut right across Nigeria’s socio-economic spectrum and play a leading role in supporting individuals, businesses and the Nigerian economy,”

Stanbic IBTC Holdings PLC, a member of Standard Bank Group, is a full service financial services group with a clear focus on three main business pillars – Corporate and Investment Banking, Personal and Business Banking and Wealth Management. Standard Bank Group is the largest African bank by assets and market capitalization. It is rooted in Africa with strategic representation in 20 countries on the African continent. Standard Bank has been in operation for over 155 years and is focused on building first-class, on-the-ground financial services institutions in chosen countries in Africa; and connecting selected emerging markets to Africa by applying sector expertise, particularly in natural resources, power and infrastructure.

Jobs/Appointments

Court Sanctions CHI Limited for Wrongful Employment Termination

By Modupe Gbadeyanka

The termination of the employment of one Mr Bodunrin Akinsuroju by CHI Limited has been declared as unlawful by the National Industrial Court of Nigeria.

Delivering judgment on the matter, Justice Sanda Yelwa of the Lagos Judicial Division of the court held that the sacking of Mr Akinsuroju did not comply strictly with the provisions of the contract of employment and the Employee Handbook.

Consequently, the company was directed to pay him the sum of N2 million as general damages for wrongful termination and N200,000 as costs of action, while Mr Akinsuroju was ordered to return the company’s properties in his possession or pay their assessed market value.

Justice Yelwa found that the contract agreement between both parties clearly required either party to give 30 days’ notice or payment in lieu of notice after confirmation of appointment, and there was no evidence that the employee was given the required notice or paid salary in lieu of notice.

The judge held that failure to comply with this fundamental term amounted to a breach of the contract of employment, thereby rendering the termination wrongful.

Mr Akinsuroju had claimed that the allegation of misconduct against him was unfounded and not established, maintaining that the disciplinary committee proceedings were prejudicial and that the termination of his employment was without justifiable cause and without compliance with the agreed terms of his employment.

In defence, CHI Limited contended that it had the right to terminate the employment of Mr Akinsuroju and that the termination was lawful and in accordance with the contract of employment and the Code of Conduct.

In opposition, counsel to Mr Akinsuroju submitted that the alleged breaches were not proved and that the termination letter took immediate effect without the requisite 30 days’ notice or payment in lieu of notice as stipulated in the letter of appointment and the Employee Handbook, urging the court to hold that the termination was wrongful and to grant the reliefs sought.

Jobs/Appointments

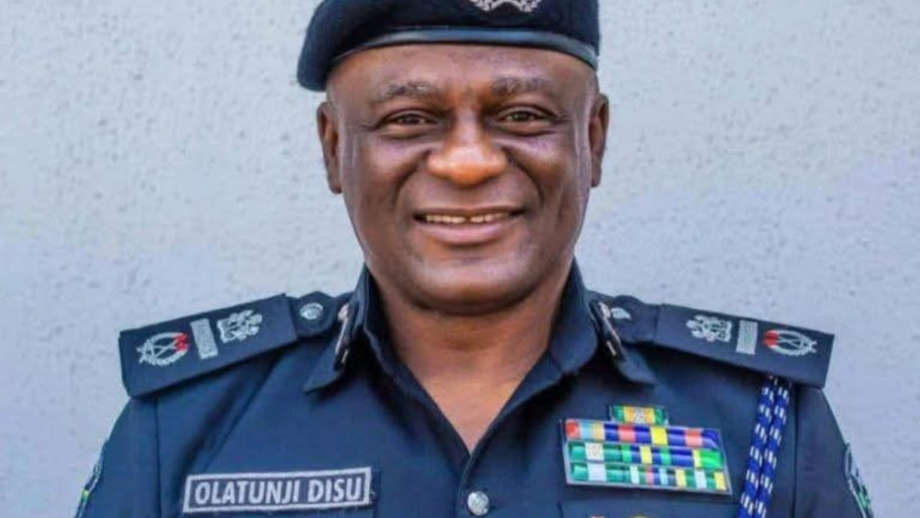

Tinubu Appoints Tunji Disu as Acting Inspector General of Police

By Modupe Gbadeyanka

President Bola Tinubu on Tuesday appointed Mr Tunji Disu as the acting Inspector General of Police (IGP), following the resignation of Mr Kayode Egbetokun.

Mr Disu, an Assistant Inspector General of Police (AIG), was recently moved to the Force Criminal Investigation Department (FCID) Annex, Alagbon, Lagos.

A statement today by the Special Adviser to the President on Information and Strategy, Mr Bayo Onanuga, disclosed that the President would convene a meeting of the Nigeria Police Council shortly to formally consider the appointment of Mr Disu as substantive IGP, after which his name will be transmitted to the Senate for confirmation.

Mr Tinubu expressed confidence that Mr Disu’s experience, operational depth, and demonstrated leadership capacity would provide steady and focused direction for the Nigeria Police Force during this critical period.

He reiterated his administration’s unwavering commitment to enhancing national security, strengthening institutional capacity, and ensuring that the Nigeria Police Force remains professional, accountable, and fully equipped to discharge its constitutional responsibilities.

Mr Egbetokun was said to have resigned from the position due to pressing family considerations.

President Tinubu, who accepted the resignation letter, expressed his profound appreciation for Mr Egbetokun’s decades of distinguished service to the Nigeria Police Force and the nation. He acknowledged his dedication, professionalism, and steadfast commitment to strengthening internal security architecture during his tenure.

Appointed in June 2023, Mr Egbetokun was serving a four-year term scheduled to conclude in June 2027, in line with the amended provisions of the Police Act.

The statement disclosed that his replacement was in view of the current security challenges confronting the nation, and acting in accordance with extant laws and legal guidance.

Jobs/Appointments

Tunji Disu to Become New IGP as Egbetokun Quits

By Adedapo Adesanya

Mr Tunji Disu, an Assistant Inspector General of Police (AIG), has reportedly replaced Mr Kayode Egbetokun as the new Inspector General of Police (IGP).

Mr Egbetokun resigned from the position on Tuesday after he was said to have held a meeting with President Bola Tinubu on Monday night at the Presidential Villa in Abuja.

President Tinubu appointed Mr Egebtokun as the 22nd IGP on June 19, 2023, with his appointment confirmed by the Nigeria Police Council on October 31, 2023.

Appointed as IGP at the age of 58, Mr Egbetokun was due for retirement on September 4, 2024, upon reaching the mandatory age of 60, but his tenure was extended by the President, creating controversies, which trailed him until his exit from the force today.

Although the police authorities are yet to comment on the matter or issue an official statement about his resignation, the move came amid reports suggesting that Mr Egbetokun has left the position.

Mr Egbetokun’s tenure was marred by a series of controversies; he recently initiated multiple charges against activist Mr Omoyele Sowore and his publication, SaharaReporters, after Mr Sowore publicly described him as an “illegal IGP.”

The dispute escalated into protracted legal battles, with the Federal High Court issuing injunctions restricting further publications relating to the former police chief and members of his family. Critics interpreted these court actions as attempts to stifle dissent and weaken press freedom.

His replacement, Mr Disu, was posted to oversee the Force Criminal Investigation Department (FCID) Annex, Alagbon, Lagos, some days ago.

-

Feature/OPED6 years ago

Feature/OPED6 years agoDavos was Different this year

-

Travel/Tourism10 years ago

Lagos Seals Western Lodge Hotel In Ikorodu

-

Showbiz3 years ago

Showbiz3 years agoEstranged Lover Releases Videos of Empress Njamah Bathing

-

Banking8 years ago

Banking8 years agoSort Codes of GTBank Branches in Nigeria

-

Economy3 years ago

Economy3 years agoSubsidy Removal: CNG at N130 Per Litre Cheaper Than Petrol—IPMAN

-

Banking3 years ago

Banking3 years agoSort Codes of UBA Branches in Nigeria

-

Banking3 years ago

Banking3 years agoFirst Bank Announces Planned Downtime

-

Sports3 years ago

Sports3 years agoHighest Paid Nigerian Footballer – How Much Do Nigerian Footballers Earn