Jobs/Appointments

Oando Appoints NDIC Board Chairman as Independent Director

By Dipo Olowookere

The chairman of the board of the Nigeria Deposit Insurance Corporation (NDIC), Mrs Ronke Sokefun, has been appointed to the board of Oando Plc.

The NDIC board chairman was appointed along with Mrs Nana Fatima Mede as independent non-executive directors effective December 23, 2021, a statement from the energy firm disclosed.

She was chosen to head the board of the NDIC by President Muhammadu Buhari in January 2019 after serving for two terms as Commissioner in Ogun State under the immediate past Governor Ibikunle Amosun.

Mrs Sokefun is a lawyer who has had a sterling career spanning over three decades cutting across different sectors of the economy.

She worked at Ighodalo & Associates from 1990 to 1993 before moving to Aluko & Oyebode as an Associate and became a partner in 2001. Her practice focus was Business Advisory Services and she worked with several blue-chip companies in this regard.

In 2002, she moved to the Oando Group, where within a few years she rose to the position of Chief Legal Officer and also sat on the board of Celtel/Zain (now Airtel) as an alternate director.

She served in this position until 2011 when she became a Commissioner in Ogun State.

Mrs Sokefun is a fellow of the Institute of Directors, a member of the Institute of Chartered Secretaries & Administrators, the Nigerian Bar Association, the International Bar Association, and the Association of International Petroleum Negotiators.

On her part, Mrs Mede is an Accountant by profession and also possesses a certificate in public financial management from the prestigious John F Kennedy School of Government, Harvard University.

She has a vast amount of experience spanning over three and half decades working in the Nigerian public sector in various capacities.

In 1982, after her National Youth Service Corps (NYSC), she joined the Nigerian Television Authority (NTA) Abuja and left in 1991 as a Principal Accountant.

From 1991 to 2007, she worked with the Benue State government and rose to become the Permanent Secretary Treasury/Accountant General.

Mrs Mede moved to the Office of the Accountant General of the Federation in 2007, serving as a Director of Finance and the pioneer Director/National Coordinator of the Integrated Personnel Payroll Information System (IPPIS) and in 2014, she was sworn in as a Federal Permanent Secretary in the Ministry of Environment where she coordinated the formulation of the Nigerian Intended Nationally Determined Contribution (INDC) document on GHG in relation to Climate Change – a document which was presented by the President at the Conference of Party (COP 21) in Paris, 2015.

Afterwards, Mrs Mede was transferred as a Permanent Secretary to the Ministry of Budget & National Planning before gracefully retiring after attaining the mandatory 35 years of service in 2017.

She currently serves as a Technical Consultant to the Minister of State (Budget and National Planning) where she provides high-level technical assistance on Nigeria’s developmental plans. In December 2021, Mrs Mede was appointed a member of the National Judicial Council.

Meanwhile, Oando has announced the resignation of Mr Bukar Goni Aji as a non-executive director of the company with effect from December 23, 2021, and Mr Muntari Zubairu as an executive director with effect from December 23, 2021.

Jobs/Appointments

Tinubu Appoints Ogunjumi Acting Accountant General as Madein Retires

By Adedapo Adesanya

President Bola Tinubu has appointed Mr Shamseldeen Babatunde Ogunjimi as the Acting Accountant General of the Federation (AGF).

This was contained in a statement on Tuesday by presidential spokesman, Mr Bayo Onanuga.

“His appointment is effective immediately following the pre-retirement leave of the incumbent AGF, Mrs Oluwatoyin Sakirat Madein,” a part of the statement read.

“In announcing Madein’s successor, President Tinubu ensures a seamless transition in the administration of Nigeria’s treasury and consolidates the implementation of the present administration’s treasury policy reforms,” the statement added.

Mr Onanuga said Mr Ogunjimi brings over 30 years of extensive experience in financial management across the public and private sectors.

He described the appointee as a career civil servant and the most senior director in the Office of the Accountant General of the Federation (OAGF),

“He has held significant positions, including Director of Funds at the OAGF and Director of Finance and Accounts at the Ministry of Foreign Affairs.

“A chartered accountant, certified fraud examiner, chartered stockbroker, and chartered security and investment specialist, Mr Ogunjimi’s academic qualifications include a Bachelor of Science (BSc) in Accountancy and a Master’s in Finance and Accounting,” the statement added.

According to Mr Onanuga, President Tinubu expressed his confidence in his appointment, saying, “The Office of the Accountant General of the Federation is pivotal to our nation’s treasury management operations. Mr Ogunjimi’s wealth of experience and notable competence will ensure the continued effectiveness of this vital institution as we advance our economic reform agenda.”

President Tinubu also commended the outgoing Accountant General of the Federation, Mrs Madein, for her dedication and selfless service to the nation.

After reaching the civil service’s statutory retirement age, Mrs Madein is retiring effective March 7, 2025.

Jobs/Appointments

CBN Denies Forceful Mass Retirement Amid Restructuring

By Adedapo Adesanya

The Central Bank of Nigeria (CBN) has dismissed claims of forced mass retirement as part of efforts by Governor Yemi Cardoso to restructure the workforce of the organisation.

In a statement released on Wednesday, the Acting Director of Corporate Communications, Mrs Hakama Sidi Ali, clarified that its Early Exit Package (EEP) is entirely voluntary and without any negative repercussions for eligible staff.

According to the statement, the decision to implement the exercise was the outcome of extensive consultations with the bank’s Joint Consultative Council (JCC), a body representing staff interests.

Mrs Sidi Ali explained that the EEP, a longstanding policy previously accorded to the executive cadre, has now been made available to eligible staff at all levels.

“For some time, staff representatives through the JCC had called on management to approve the early exit package for all cadres. Following these discussions, management decided to meet this popular demand,” she said in the statement.

Addressing concerns about potential repercussions for staff who decline the package, Mrs Sidi Ali reaffirmed management’s commitment to supporting employees’ professional growth and well-being, describing the concerns as unfounded.

She further emphasized that the initiative is an internal corporate matter designed to promote career development for staff.

According to wide spread reports, there have been plans to retire approximately 1,000 employees by the end of the year with a payoff estimated to cost over N50 billion.

The mass retirement, which was announced in a circular issued three weeks ago, mandates affected employees to apply for the Early Exit Package (EEP).

The statement allegedly warned employees with less than one year of service or unconfirmed appointments to refrain from applying for the program, noting that the application would remain open until December 7, with an effective exit date of December 31, 2024.

It was reported that the entire EEP was valued at N50 billion.

Jobs/Appointments

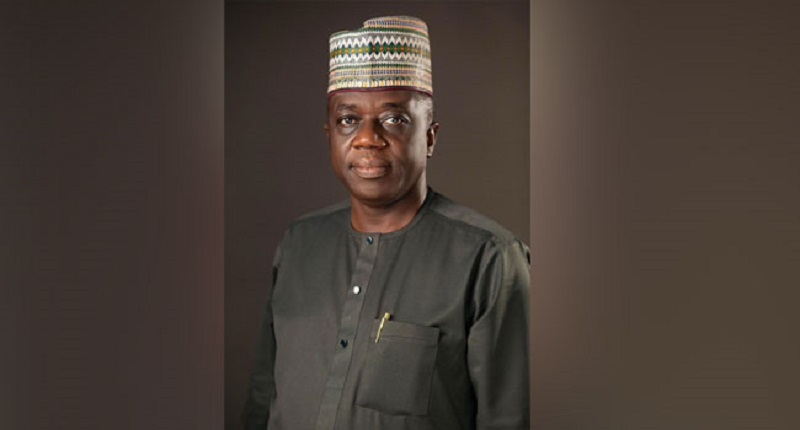

CBN Okays Appointment of Benson Ogundeji as Greenwich Merchant Bank CEO

By Modupe Gbadeyanka

The Central Bank of Nigeria (CBN) has approved the appointment of Mr Benson Ogundeji as the chief executive of Greenwich Merchant Bank Limited.

The board of the financial institution for businesses had picked Mr Ogundeji as its substantive CEO but awaited the authorisation of the banking sector regulator.

He brings over three decades of extensive banking experience to this role as a seasoned financial services professional, who previously served as Executive Director at Greenwich Merchant Bank from July 2020, where he played a pivotal role in the bank’s successful transition from the legacy Greenwich Trust Limited to a merchant bank.

In this capacity, he provided oversight for Corporate Banking, Treasury and Global Markets.

Throughout his career, Mr Ogundeji has demonstrated exceptional expertise in business development and operational excellence.

Before joining the firm, he held various senior leadership roles at prominent financial institutions, including Ecobank Nigeria, GTBank, and other notable banks, where he consistently displayed exceptional leadership skills.

His appointment comes at a crucial time as Greenwich Merchant Bank commences the next phase of its growth plans. Having related closely with the new CEO, as an Executive Director and acting CEO in the last four years, the board has expressed confidence about his ability to lead the bank in delivering our strategic goals.

“The board is pleased to announce the appointment of Benson Ogundeji as our Managing Director/Chief Executive Officer,” the chairman of Greenwich Merchant Bank, Mr Kayode Falowo, stated.

-

Feature/OPED5 years ago

Feature/OPED5 years agoDavos was Different this year

-

Travel/Tourism8 years ago

Lagos Seals Western Lodge Hotel In Ikorodu

-

Showbiz2 years ago

Showbiz2 years agoEstranged Lover Releases Videos of Empress Njamah Bathing

-

Banking6 years ago

Banking6 years agoSort Codes of GTBank Branches in Nigeria

-

Economy2 years ago

Economy2 years agoSubsidy Removal: CNG at N130 Per Litre Cheaper Than Petrol—IPMAN

-

Banking2 years ago

Banking2 years agoFirst Bank Announces Planned Downtime

-

Sports2 years ago

Sports2 years agoHighest Paid Nigerian Footballer – How Much Do Nigerian Footballers Earn

-

Technology4 years ago

Technology4 years agoHow To Link Your MTN, Airtel, Glo, 9mobile Lines to NIN