Jobs/Appointments

Onyeali-Ikpe to Replace Okonkwo as Fidelity Bank MD/CEO

By Dipo Olowookere

In compliance with its succession policy, the board of Fidelity Bank Plc has announced that Mrs Nneka Onyeali-Ikpe will replace the current Managing Director/Chief Executive Officer of the bank, Mr Nnamdi Okonkwo, when the latter retires at the end of this year.

Mr Okonkwo is expected to leave the position on December 31, 2020, upon completion of his contract tenure and in line with the bank’s governance policies.

To fill the post, the board has approved the appointment of the present Executive Director of Fidelity Bank in charge of Lagos and South West Directorate. Her appointment has also been authorised by the Central Bank of Nigeria (CBN).

“To ensure a smooth and successful transition, Nnamdi Okonkwo will continue in his role as the MD/CEO until December 31, 2020, while Nneka Onyeali-Ikpe will assume office as the substantive MD/CEO by January 1, 2021,” Chairman of the board, Mr Ernest Ebi, was quoted as saying in a statement on Monday.

Mr Ebi commended the MD/CEO for his significant contributions to the growth and development of the bank, confessing that, “Fidelity Bank has enjoyed a very stable leadership since inception.”

“These appointments underscore the bank’s robust human capital capabilities, governance and succession policies.

“We thank Nnamdi not only for his sterling performance but also for nurturing the new team and current crop of leaders to continue to steer the bank on its growth trajectory,” he stated.

Mr Okonkwo was appointed to the board of Fidelity Bank in April 2012 as an Executive Director and was subsequently appointed the MD/CEO on January 01, 2014.

He implemented a digital-led strategy which led to significant growth across key performance matrix and increased market share, with the bank currently ranked 6th amongst Nigerian Banks on most performance indices.

Some of his key achievements include PBT growth of 236 per cent from N9.0 billion to N30.4 billion; RoE increase from 5.5 per cent to 13.3 per cent; customer deposits growth of 68 per cent from N806.3 billion to N1.4 trillion and savings deposit growth of 275 per cent from N83.3 billion to N312.1 billion.

Other notable achievements include net loans and advances growth of 174 per cent from N426.1 billion to N1.2 trillion; customer base increase by 121 per cent from 2.4 million to 5.3 million and digital banking penetration improvement from 1.0 per cent to 50.1 per cent, accounting for 28.4 per cent of total fee income.

In addition, the bank successfully accessed the local and international markets through the issuance of N30 billion corporate bonds in 2015 and $400 million Eurobonds in 2017 under his leadership.

For the incoming MD/CEO, Mrs Nneka Onyeali-Ikpe, she was appointed to the board of Fidelity Bank in 2015 as an Executive Director and currently oversees the Lagos and Southwest Directorate.

She led the transformation of the Directorate to profitability and sustained its impressive year-on-year growth across key performance metrics.

Mrs Onyeali-Ikpe has been an integral part of the current management team, responsible for the remarkable increase in the bank’s performance in the last 5 years, with the area under her direct responsibility, contributing over 28 per cent of the bank’s PBT, deposits and loans.

She has over 30 years of experience across various banks including Standard Chartered Bank Plc, Zenith Bank Plc and Citizens International Bank/Enterprise Bank, where she held several management positions in Legal, Treasury, Investment Banking, Retail/Commercial Banking and Corporate Banking.

As an Executive Director at legacy Enterprise Bank Plc, she received formal commendation from the Asset Management Corporation of Nigeria (AMCON), as a member of the management team, that successfully turned around Enterprise Bank Plc.

She holds Bachelor of Laws (LLB) degree from the University of Nigeria, Nsukka; a Master of Laws (LLM) degree from Kings College, London and has attended executive training programs at notable global institutions including; Harvard Business School; The Wharton School University of Pennsylvania; INSEAD School of Business; Chicago Booth School of Business; London Business School and IMD amongst others.

Meanwhile, the board has also approved the appointment of Mr Kevin Ugwuoke, the current Chief Risk Officer of the bank, as Executive Director, Chief Risk Officer, subject to the approval of the CBN.

Mr Ugwuoke joined Fidelity Bank in 2015 as General Manager, Chief Risk Officer.

Under his supervision, the bank’s total loan book has grown by a Compound Annual Growth Rate (CAGR) of 17 per cent from N559.1 billion to N1.2 trillion with Cost of Risk averaging 0.7 per cent within the period and Non-Performing Loans ratio below the regulatory threshold at 4.8 per cent in Q1 2020.

He has over 29 years of banking experience across various banks namely Citi Bank, Access Bank Plc, United Bank for Africa Plc and legacy Mainstreet Bank Limited, where he worked in various capacities in Banking Operations, Commercial Banking, Corporate Banking and Risk Management.

Prior to joining Fidelity Bank, he was Chief Risk Officer at United Bank for Africa Plc and Mainstreet Bank Limited.

He holds a First Class Honours degree in Civil Engineering from the University of Nigeria, Nsukka and a Post Graduate Diploma in Management from Edinburgh Business School of Herriot-Watt University.

He has attended several executive trainings at Harvard Business School and other world-class institutions of learning.

Jobs/Appointments

Court Sanctions CHI Limited for Wrongful Employment Termination

By Modupe Gbadeyanka

The termination of the employment of one Mr Bodunrin Akinsuroju by CHI Limited has been declared as unlawful by the National Industrial Court of Nigeria.

Delivering judgment on the matter, Justice Sanda Yelwa of the Lagos Judicial Division of the court held that the sacking of Mr Akinsuroju did not comply strictly with the provisions of the contract of employment and the Employee Handbook.

Consequently, the company was directed to pay him the sum of N2 million as general damages for wrongful termination and N200,000 as costs of action, while Mr Akinsuroju was ordered to return the company’s properties in his possession or pay their assessed market value.

Justice Yelwa found that the contract agreement between both parties clearly required either party to give 30 days’ notice or payment in lieu of notice after confirmation of appointment, and there was no evidence that the employee was given the required notice or paid salary in lieu of notice.

The judge held that failure to comply with this fundamental term amounted to a breach of the contract of employment, thereby rendering the termination wrongful.

Mr Akinsuroju had claimed that the allegation of misconduct against him was unfounded and not established, maintaining that the disciplinary committee proceedings were prejudicial and that the termination of his employment was without justifiable cause and without compliance with the agreed terms of his employment.

In defence, CHI Limited contended that it had the right to terminate the employment of Mr Akinsuroju and that the termination was lawful and in accordance with the contract of employment and the Code of Conduct.

In opposition, counsel to Mr Akinsuroju submitted that the alleged breaches were not proved and that the termination letter took immediate effect without the requisite 30 days’ notice or payment in lieu of notice as stipulated in the letter of appointment and the Employee Handbook, urging the court to hold that the termination was wrongful and to grant the reliefs sought.

Jobs/Appointments

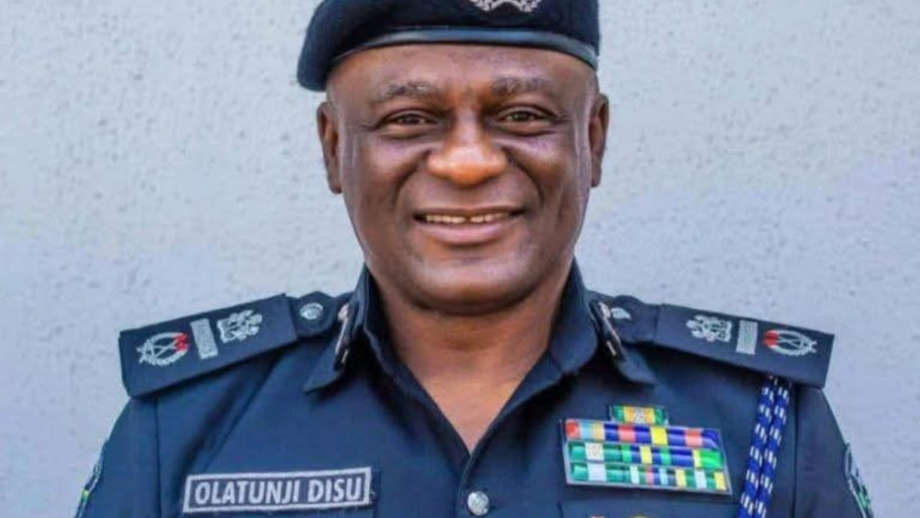

Tinubu Appoints Tunji Disu as Acting Inspector General of Police

By Modupe Gbadeyanka

President Bola Tinubu on Tuesday appointed Mr Tunji Disu as the acting Inspector General of Police (IGP), following the resignation of Mr Kayode Egbetokun.

Mr Disu, an Assistant Inspector General of Police (AIG), was recently moved to the Force Criminal Investigation Department (FCID) Annex, Alagbon, Lagos.

A statement today by the Special Adviser to the President on Information and Strategy, Mr Bayo Onanuga, disclosed that the President would convene a meeting of the Nigeria Police Council shortly to formally consider the appointment of Mr Disu as substantive IGP, after which his name will be transmitted to the Senate for confirmation.

Mr Tinubu expressed confidence that Mr Disu’s experience, operational depth, and demonstrated leadership capacity would provide steady and focused direction for the Nigeria Police Force during this critical period.

He reiterated his administration’s unwavering commitment to enhancing national security, strengthening institutional capacity, and ensuring that the Nigeria Police Force remains professional, accountable, and fully equipped to discharge its constitutional responsibilities.

Mr Egbetokun was said to have resigned from the position due to pressing family considerations.

President Tinubu, who accepted the resignation letter, expressed his profound appreciation for Mr Egbetokun’s decades of distinguished service to the Nigeria Police Force and the nation. He acknowledged his dedication, professionalism, and steadfast commitment to strengthening internal security architecture during his tenure.

Appointed in June 2023, Mr Egbetokun was serving a four-year term scheduled to conclude in June 2027, in line with the amended provisions of the Police Act.

The statement disclosed that his replacement was in view of the current security challenges confronting the nation, and acting in accordance with extant laws and legal guidance.

Jobs/Appointments

Tunji Disu to Become New IGP as Egbetokun Quits

By Adedapo Adesanya

Mr Tunji Disu, an Assistant Inspector General of Police (AIG), has reportedly replaced Mr Kayode Egbetokun as the new Inspector General of Police (IGP).

Mr Egbetokun resigned from the position on Tuesday after he was said to have held a meeting with President Bola Tinubu on Monday night at the Presidential Villa in Abuja.

President Tinubu appointed Mr Egebtokun as the 22nd IGP on June 19, 2023, with his appointment confirmed by the Nigeria Police Council on October 31, 2023.

Appointed as IGP at the age of 58, Mr Egbetokun was due for retirement on September 4, 2024, upon reaching the mandatory age of 60, but his tenure was extended by the President, creating controversies, which trailed him until his exit from the force today.

Although the police authorities are yet to comment on the matter or issue an official statement about his resignation, the move came amid reports suggesting that Mr Egbetokun has left the position.

Mr Egbetokun’s tenure was marred by a series of controversies; he recently initiated multiple charges against activist Mr Omoyele Sowore and his publication, SaharaReporters, after Mr Sowore publicly described him as an “illegal IGP.”

The dispute escalated into protracted legal battles, with the Federal High Court issuing injunctions restricting further publications relating to the former police chief and members of his family. Critics interpreted these court actions as attempts to stifle dissent and weaken press freedom.

His replacement, Mr Disu, was posted to oversee the Force Criminal Investigation Department (FCID) Annex, Alagbon, Lagos, some days ago.

-

Feature/OPED6 years ago

Feature/OPED6 years agoDavos was Different this year

-

Travel/Tourism10 years ago

Lagos Seals Western Lodge Hotel In Ikorodu

-

Showbiz3 years ago

Showbiz3 years agoEstranged Lover Releases Videos of Empress Njamah Bathing

-

Banking8 years ago

Banking8 years agoSort Codes of GTBank Branches in Nigeria

-

Economy3 years ago

Economy3 years agoSubsidy Removal: CNG at N130 Per Litre Cheaper Than Petrol—IPMAN

-

Banking3 years ago

Banking3 years agoSort Codes of UBA Branches in Nigeria

-

Banking3 years ago

Banking3 years agoFirst Bank Announces Planned Downtime

-

Sports3 years ago

Sports3 years agoHighest Paid Nigerian Footballer – How Much Do Nigerian Footballers Earn