Jobs/Appointments

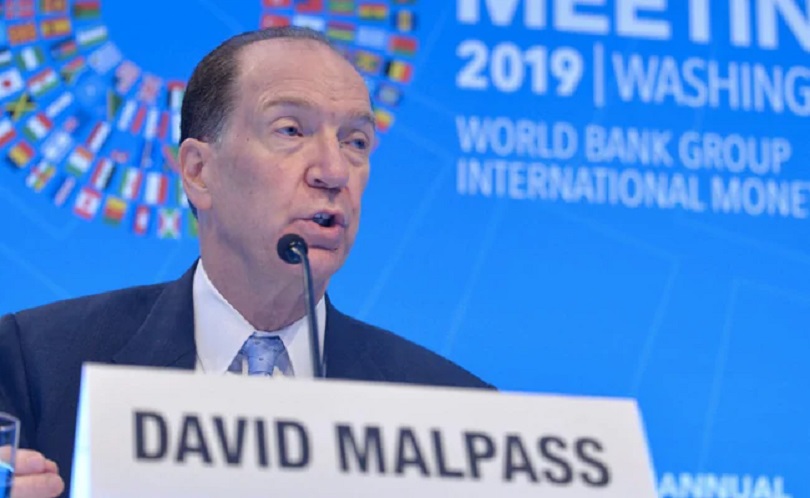

World Bank President David Malpass To Vacate Seat in June

By Adedapo Adesanya

In an unexpected turn of events, the President of the World Bank Group, Mr David Malpass, announced his intention to step down from his position by the end of the bank group’s fiscal year on June 30.

In the position he served for more than four years, he focused on seeking stronger policies to increase economic growth, alleviate poverty, improve living standards, and reduce government debt burdens.

He said, “It has been an enormous honour and privilege to serve as President of the world’s premier development institution alongside so many talented and exceptional people.”

“With developing countries facing unprecedented crises, I’m proud that the Bank Group has responded with speed, scale, innovation, and impact. The last four years have been some of the most meaningful of my career.

“Having made much progress, and after a good deal of thought, I’ve decided to pursue new challenges. I want to thank our staff and boards of directors for the privilege of working with them every day to strengthen the effectiveness of our operations in the most challenging of times,” he added.

Mr Malpass, who was recommended by former US President, Mr Donald Trump, for the position, over the last four years spearheaded the bank group’s five institutions (IBRD, IDA, IFC, MIGA, and ICSID) responses to global crises. He mobilised a record $440 billion in response to the COVID-19 pandemic, the war in Ukraine, the sharp global economic slowdown, unsustainable debt burdens, climate change, and food, fertilizer, and energy shortages.

With developing countries under severe financial pressure, Mr Malpass frequently met with world leaders to discuss supportive policies, including debt reduction, to break the cycles of unsustainable debt.

Under his leadership, the group more than doubled its climate finance to developing countries, reaching a record $32 billion last year.

Mr Malpass also led efforts to enable and increase private sector investment and trade and contributed thought leadership to the Bank Group’s analytical products on fiscal and monetary policy, currency systems, and governance reform. He also strengthened the institution’s management and personnel and will leave the Bank Group with solidified finances and fundraising to support its AAA credit rating.

“The Bank Group is fundamentally strong, financially sustainable, and well positioned to increase its development impact in the face of urgent global crises,” said Mr Malpass.

“This is an opportunity for a smooth leadership transition as the Bank Group works to meet increasing global challenges, facilitate private investment, sharpen its focus on global public goods, and maintain strong momentum on operational delivery and portfolio performance for client countries,” he added.

Among some of his achievements are – the Climate Change Action Plan to better integrate climate and biodiversity with development and growth; $30 billion in projects to address the food, fertilizer, and fuel crisis facing developing countries; and the launch of the Pandemic Fund to improve preparedness, with initial pledges of $1.6 billion from 25 countries and donors among others.

His administration has not been without pressure as Special Adviser to the United Nations Secretary-General on Climate Change, Mr Selwin Hart, in 2021, called out the World Bank for not doing enough for climate action.

Pressure on Mr Malpass was reignited last September when he did not provide the expected answer within the scientific consensus around climate change, which drew condemnation from the US government.

So far, some names have emerged to take over the position, including the head of the US Agency for International Development (USAID), Ms Samantha Power, the President of Rockfeller Foundation, Mr Rajiv Shia, and the deputy secretary of the US Treasury, Mr Wally Adeyemo.

Jobs/Appointments

Tinubu Appoints Ogunjumi Acting Accountant General as Madein Retires

By Adedapo Adesanya

President Bola Tinubu has appointed Mr Shamseldeen Babatunde Ogunjimi as the Acting Accountant General of the Federation (AGF).

This was contained in a statement on Tuesday by presidential spokesman, Mr Bayo Onanuga.

“His appointment is effective immediately following the pre-retirement leave of the incumbent AGF, Mrs Oluwatoyin Sakirat Madein,” a part of the statement read.

“In announcing Madein’s successor, President Tinubu ensures a seamless transition in the administration of Nigeria’s treasury and consolidates the implementation of the present administration’s treasury policy reforms,” the statement added.

Mr Onanuga said Mr Ogunjimi brings over 30 years of extensive experience in financial management across the public and private sectors.

He described the appointee as a career civil servant and the most senior director in the Office of the Accountant General of the Federation (OAGF),

“He has held significant positions, including Director of Funds at the OAGF and Director of Finance and Accounts at the Ministry of Foreign Affairs.

“A chartered accountant, certified fraud examiner, chartered stockbroker, and chartered security and investment specialist, Mr Ogunjimi’s academic qualifications include a Bachelor of Science (BSc) in Accountancy and a Master’s in Finance and Accounting,” the statement added.

According to Mr Onanuga, President Tinubu expressed his confidence in his appointment, saying, “The Office of the Accountant General of the Federation is pivotal to our nation’s treasury management operations. Mr Ogunjimi’s wealth of experience and notable competence will ensure the continued effectiveness of this vital institution as we advance our economic reform agenda.”

President Tinubu also commended the outgoing Accountant General of the Federation, Mrs Madein, for her dedication and selfless service to the nation.

After reaching the civil service’s statutory retirement age, Mrs Madein is retiring effective March 7, 2025.

Jobs/Appointments

CBN Denies Forceful Mass Retirement Amid Restructuring

By Adedapo Adesanya

The Central Bank of Nigeria (CBN) has dismissed claims of forced mass retirement as part of efforts by Governor Yemi Cardoso to restructure the workforce of the organisation.

In a statement released on Wednesday, the Acting Director of Corporate Communications, Mrs Hakama Sidi Ali, clarified that its Early Exit Package (EEP) is entirely voluntary and without any negative repercussions for eligible staff.

According to the statement, the decision to implement the exercise was the outcome of extensive consultations with the bank’s Joint Consultative Council (JCC), a body representing staff interests.

Mrs Sidi Ali explained that the EEP, a longstanding policy previously accorded to the executive cadre, has now been made available to eligible staff at all levels.

“For some time, staff representatives through the JCC had called on management to approve the early exit package for all cadres. Following these discussions, management decided to meet this popular demand,” she said in the statement.

Addressing concerns about potential repercussions for staff who decline the package, Mrs Sidi Ali reaffirmed management’s commitment to supporting employees’ professional growth and well-being, describing the concerns as unfounded.

She further emphasized that the initiative is an internal corporate matter designed to promote career development for staff.

According to wide spread reports, there have been plans to retire approximately 1,000 employees by the end of the year with a payoff estimated to cost over N50 billion.

The mass retirement, which was announced in a circular issued three weeks ago, mandates affected employees to apply for the Early Exit Package (EEP).

The statement allegedly warned employees with less than one year of service or unconfirmed appointments to refrain from applying for the program, noting that the application would remain open until December 7, with an effective exit date of December 31, 2024.

It was reported that the entire EEP was valued at N50 billion.

Jobs/Appointments

CBN Okays Appointment of Benson Ogundeji as Greenwich Merchant Bank CEO

By Modupe Gbadeyanka

The Central Bank of Nigeria (CBN) has approved the appointment of Mr Benson Ogundeji as the chief executive of Greenwich Merchant Bank Limited.

The board of the financial institution for businesses had picked Mr Ogundeji as its substantive CEO but awaited the authorisation of the banking sector regulator.

He brings over three decades of extensive banking experience to this role as a seasoned financial services professional, who previously served as Executive Director at Greenwich Merchant Bank from July 2020, where he played a pivotal role in the bank’s successful transition from the legacy Greenwich Trust Limited to a merchant bank.

In this capacity, he provided oversight for Corporate Banking, Treasury and Global Markets.

Throughout his career, Mr Ogundeji has demonstrated exceptional expertise in business development and operational excellence.

Before joining the firm, he held various senior leadership roles at prominent financial institutions, including Ecobank Nigeria, GTBank, and other notable banks, where he consistently displayed exceptional leadership skills.

His appointment comes at a crucial time as Greenwich Merchant Bank commences the next phase of its growth plans. Having related closely with the new CEO, as an Executive Director and acting CEO in the last four years, the board has expressed confidence about his ability to lead the bank in delivering our strategic goals.

“The board is pleased to announce the appointment of Benson Ogundeji as our Managing Director/Chief Executive Officer,” the chairman of Greenwich Merchant Bank, Mr Kayode Falowo, stated.

-

Feature/OPED5 years ago

Feature/OPED5 years agoDavos was Different this year

-

Travel/Tourism8 years ago

Lagos Seals Western Lodge Hotel In Ikorodu

-

Showbiz2 years ago

Showbiz2 years agoEstranged Lover Releases Videos of Empress Njamah Bathing

-

Banking6 years ago

Banking6 years agoSort Codes of GTBank Branches in Nigeria

-

Economy2 years ago

Economy2 years agoSubsidy Removal: CNG at N130 Per Litre Cheaper Than Petrol—IPMAN

-

Banking2 years ago

Banking2 years agoFirst Bank Announces Planned Downtime

-

Sports2 years ago

Sports2 years agoHighest Paid Nigerian Footballer – How Much Do Nigerian Footballers Earn

-

Technology4 years ago

Technology4 years agoHow To Link Your MTN, Airtel, Glo, 9mobile Lines to NIN