Media OutReach

Cyberport Venture Capital Forum 2025 Grand Opening

Cyberport Welcomed 10 Listed Companies and 2 Unicorns over the past year Cyberport Investors Network (CIN) Celebrates 8th Anniversary with a Yearly Threefold Growth Cumulative Funds Surpassed HK$4.2 Billion

HONG KONG SAR – Media OutReach Newswire – 6 November 2025 – The annual flagship event Cyberport Venture Capital Forum 2025 (CVCF) officially opened today at Hong Kong Cyberport. The two-day forum, themed “The Innovation-Venture Nexus: Igniting Transformative Success”, brings together nearly 100 influential global venture capital experts, entrepreneurs, and industry leaders to explore the evolving global venture capital landscape driven by Artificial Intelligence (AI). The forum highlights practical applications and investment opportunities in AI, blockchain, and digital assets, alongside announcements of Cyberport start-ups’ latest funding achievements.

The forum was inaugurated by Professor Sun Dong, Secretary for Innovation, Technology and Industry of the HKSAR Government, with a welcome remarks by Simon Chan, Chairman of Cyberport. Hendrick Sin, Chairman of Cyberport Investors Network (CIN) Steering Group; Co–Founder of CMGE Technology Group Limited; Chairman of China Prosperity Capital, shared the impressive journey and achievements of CIN over the past eight years. Together with our other distinguished guests, they have officiated the opening ceremony, marking the official start of this global forum.

Professor Sun Dong, Secretary for Innovation, Technology and Industry, stated in his speech, “Hong Kong has climbed three places to rank 4th globally in the latest World Digital Competitiveness Ranking 2025, reflecting our determination and capability to become an international I&T centre. Recognising the potential of AI as a key driver for our future growth, the HKSAR Government continues to strengthen the community’s AI, from upgrading digital infrastructure to establishing our own AI research institute and grooming talents on the AI front. Last year, Cyberport has attracted around 470 enterprises to land here which resonates strongly with Hong Kong’s vision. Beyond merely providing a starting point for start-ups, the Cyberport Macro Fund leverages private capital at a scale of 1:9, connecting Cyberport’s digital entrepreneurs with market capital, enabling projects with potentials to expand by turning R&D breakthroughs into commercial successes. CVCF 2025 also showcases the dynamic lineup of high-potential start-ups within the Cyberport community and demonstrates how Hong Kong stands at the forefront of creativity and technology. This is a launchpad for ventures that aspire not just to succeed locally, but to make waves internationally.”

Simon Chan, Chairman of Cyberport, stated in his speech, “Hong Kong is on track to lead the global IPO market by the end of 2025. As Hong Kong’s digital tech hub, AI accelerator and key incubator, Cyberport continues to strengthen homegrown entrepreneurs and landing enterprises by enhancing their dealmaking capabilities. Through our key investment instruments such as Cyberport Investors Network and Cyberport Macro Fund, alongside signature initiatives like CVCF and comprehensive entrepreneurship programmes, Cyberport has driven pivotal capital from global investors to springboard high-potential start-ups to success. Despite a challenging global investment environment over the past year, our start-ups raised HK$3.4 billion over the past year. This year’s CVCF will focus on thriving VC markets, such as the Middle East, ASEAN, and Chinese Mainland, leveraging opportunities arising from the Belt and Road countries and regions, to play the important roles as a “super-connector” and “super value-adder” in connecting the Chinese Mainland and the global markets.”

Strong Fundraising Performance by Cyberport Start-ups, AI, Blockchain, and Digital Assets in the Spotlight

Despite global challenges in the venture capital environment over the past year, Cyberport companies have performed impressively in fundraising. From October 2024 to September 2025, they have raised nearly HK$3.4 billion, bringing the cumulative total to HK$46 billion. m. Recent high-value fundraising rounds include Klook, Bowtie, KPay, KUN, Hashkey Group, DigiFT, LeapXpert, and Animoca Brands, and more, many of which leverage AI, blockchain, and digital assets, reflecting the market’s focus on AI and Web3.0, underscoring Cyberport’s success in fostering the development of these industries.

This year, Cyberport welcomed 10 listed companies, including Mininglamp Technology, Yunji Technology, and Xunfei Healthcare, all of which listed soon after joining Cyberport, alongside Cyberport incubatees Diginex and Real Messenger. Additionally, Cyberport welcomed two unicorns, Qiangnao Technology, valued at US$1.3 billion, and Inspur Cloud, valued at US$2.5 billion, injecting powerful momentuminto the I&T ecosystem.

Hendrick Sin, Chairman of Cyberport Investors Network (CIN) Steering Group; Co–Founder of CMGE Technology Group Limited , stated, “Despite ongoing global economic challenges, Cyberport community has continued to demonstrate remarkable resilience, with cumulative funding reaching HK$46 billion. Several Cyberport companies have also secured substantial financing rounds worth tens of millions of US dollars. Serving as a vital bridge, the Cyberport Investors Network achieved a threefold year-on-year growth over the past year. The strength of our network lies in its international reach, now comprising over 220 investment entities. To capture global technology investment trends, we have launched the ‘AI Investors Circle’ this year, dedicated to precise matching for AI companies with strong and sustainable fundraising potential. Looking ahead, as the HKSAR Government deepens its global connectivity, particularly with high-growth Belt and Road markets such as the Middle East and ASEAN, Cyberport will actively attract more influential global investors and facilitate greater investment matching with our high-potential companies, further amplifying the global impact of Hong Kong’s start-up ecosystem.”

CIN Celebrates 8th Anniversary, Launches “AI Investors Circle” to Connect High-Potential AI Start-ups

As Hong Kong’s digital tech hub, AI accelerator and key incubator, Cyberport actively connects global investors with start-ups through diverse funding channels to foster the robust growth of Cyberport enterprises.

Cyberport leverages the Cyberport Investors Network (CIN) as a strategic bridge to attract global capital and continuously support high-potential enterprises. Since its inception in 2017, CIN has facilitated over HK$4.258 billion in cumulative funding, a year-on-year increase of over HK$1.66 billion, representing a threefold growth, accounted for nearly half of the annual fundraising total by Cyberport companies. CIN has facilitated a cumulative total of 109 projects, up by 13 from last year. CIN’s investment units have also grown by over 20, now exceeding 220, with 15% from the Greater Bay Area and Chinese Mainland, 14% from Asia-Pacific and ASEAN, and an expanding presence in the Middle East, Europe and the America, effectively aggregating global venture capital resources.

To capture global tech investment trends, Cyberport continues to establish focused investment communities, with a particular focus on AI and blockchain which are driving global capital flows. The “Web3.0 Investors Circle” established last year, bringing together nearly 50 investors and has already facilitated 9 projects, with cumulative funding exceeding HK$260 million. Cyberport has launched the “AI Investors Circle” this year, aimed at creating an efficient matching platform for high-potential AI start-ups and connecting them with the investors to accelerate the growth of the AI ecosystem and industry development.

Another key platform, the Cyberport Macro Fund (CMF), continues to invest in high-potential start-ups, helping them attract external capital and enhance market fundraising capabilities. As of October 2025, CMF has invested in 29 start-up projects, including co-investments, exceeding HK$1.989 billion, with a co-investment ratio of 1:9.3. This reflects Cyberport’s strong fundraising capacity and the investor confidence in its ecosystem.

Strategic Partnerships to Advance Blockchain Applications and Talent Development

At the event, Cyberport signed a Memorandum of Understanding (MoU) with Forms HK to establish Blockchain Valley@Cyberport, a collaborative initiative promoting innovation in on-chain finance, enhancing public awareness of blockchain and digital assets, and nurturing tech talent. Cyberport also formed a strategic partnership with The Education University of Hong Kong, focusing on three core areas, namely Educational Technology, Art Technology, and Digital Technology. This collaboration aims to accelerate the application and commercialisation of university research outcomes and explore the joint launch of micro-credential programmes to cultivate the next generation of I&T talent.

Exploring Venture Capital Trends, Unlocking New Perspectives in Tech and Investment

This year’s forum features keynote speeches and panel discussions by leading venture capitalists on global investment trends and how frontier technologies such as AI, blockchain, and digital assets are reshaping markets and driving innovation. Industry experts include Wensheng Cai, Director of Longling Capital Ltd, who shared the potential synergistic between AI and Web3.0, Jerry Liang, Partner of Cyber Creation Ventures (CCV), who shared practical strategies for identifying high-potential local opportunities and designing globally scalable solutions. Additionally, Nicolas du Cray, Partner at Cathay Innovation, alongside David Chen, Operating Partner at Hongshan CBC Cross-border Digital Fund, also joined the panel who joined the panel “AI’s Global Shake-Up” to analyse the dynamics between investors, entrepreneurs, and industry leaders. The forum also spotlighted high-growth markets and strategies, with Soumaya Ben Beya Dridje, Partner at Rasmal Ventures, and other distinguished guests exploring the Middle East’s emerging role as a global innovation hub.

Top investors also shared insights on scaling start-ups into unicorns. Thomas Tsao, Co-founder and Chair of Gobi Partners shared strategies for early-stage companies to expand successfully, including expansion strategies and fundraising solutions.

“Web3.0 Innovation Expo” Launches Tomorrow, AI and Web3.0 Highlights Ahead

Day two will focus on practical innovation and deep tech exchanges, featuring the “Web3.0 Innovation Expo” and the “AI Start-up Workshop”. At the “Web3.0 Innovation Expo”, attendees will explore Cyberport’s “Blockchain & Digital Asset Pilot Subsidy Scheme” and global use cases, gaining insights into how the first batch of projects are applying innovative solutions across diverse scenarios such as tokenised assets, payments, Regulatory Technology (RegTech). The forum will also focus on global digital asset trends and ecosystem development through fireside chats and keynotes.

For details on Day Two and the Web3.0 Innovation Expo, please refer to the attached agenda. For more information on Cyberport Venture Capital Forum 2025 and the speaker line-up, please visit http://cvcf.cyberport.hk/.

Click here to download high-resolution news images and videos; click here to download images and videos of the Cyberport campus.

Appendix: Agenda of the Second Day and the “Web3.0 Innovation Expo”

Main Stage: Cyberport Blockchain and Digital Asset Pilot Subsidy Scheme @ Function Room

Day 2 – 7 Nov (Fri) 14:00 – 19:00

| Time | Programme & target speakers |

| 09:30 – 09:40 | Welcome Remarks

|

Opening Remarks

|

|

| 09:40 – 10:00 | Keynote: Navigating the Future of Digital Asset Markets – Regulatory Landscape & The Road to Mass Adoption

|

| 10:00 – 12:00 | Cyberport Blockchain & Digital Asset Pilot Subsidy Scheme: Use Case Sharing

Use Case Sharing 1: NextGen Onchain Infra (DTA) for Web3 Finance

Use Case Sharing 2: Bridging Traditional Card Payments with Stablecoin Settlement: A Pilot Initiative by Payment Cards Group

Use Case Sharing 3: From Pilot to Platform: Building the Infrastructure for Institutional RWA Tokenisation in Hong Kong

Use Case Sharing 4: Next Generation of Financial Infrastructure: RYT and Realgate

Use Case Sharing 5: Blockchain Ticketing: Transparent & Secure

Use Case Sharing 6: Redefining Private Markets: Asseto Leading Compliant Tokenization in Asia

Use Case Sharing 7: Unlocking Liquidity and Composability with RWAs

|

| Cyberport Blockchain & Digital Asset Pilot Subsidy Scheme: Global Use Case Sharing

Global Use Case Sharing 1: How Polkadot Helps Shape the Digital Economy in Hong Kong

Global Use Case Sharing 2: Stablecoins and Tokenization: Real World Use Cases

Global Use Case Sharing 3: The Future of Sports x RWA

|

|

| 12:00 – 14:00 | Networking Lunch |

| Global Digital Asset Trends & Ecosystem | |

| 14:00 – 14:20 | Keynote 1: Bridging East and West: Digital Asset Markets in the US, Hong Kong and Beyond

|

| 14:20 – 14:40 | Fireside Chat: Backing the Next Web3.0 Breakthroughs: Global VC Strategies in a Regulated Digital Asset World

Moderator: Ir Eric Chan, Chief Public Mission Officer, Hong Kong Cyberport Speaker:

|

| 14:40 – 14:55 | Keynote 2: Scaling for the Real World: Infrastructure for the Future of Finance and the Digital Economy

|

| 14:55 – 15:25 | Panel 1: Stablecoin from a User Perspective: Unlocking New Business Opportunities

Moderator: Ms Rachel Lee, Director of Blockchain & Digital Asset, Hong Kong Cyberport Panelists:

|

| 15:25 – 15:55 | Panel 2: Real-World Asset Beyond Hype: Short-Term and Long-Term Opportunities

Moderator: Ms. Bobo Lee, Manager of Blockchain and Digital Asset, Hong Kong Cyberport Panelists:

|

| 15:55 – 16:25 | Panel 3: From Hype to Holdings: Where Smart Money Goes in Digital Assets 2025–2027

Moderator: Ms Kris Fok, Head of Venture & Partnerships, Finoverse Panelists:

|

| 16:25 – 16:55 | Panel 4: Unlocking the Future of Digital Asset Management with Web3

Moderator: Ms Jessica Yang, CEO of ME Group Panelists:

|

| 16:55 – 17:25 | Panel 5: Powering Machine-to-Machine Transactions with DID & Web3 Payment

Moderator: Ms. Alisha Li, Co-Founder of AllScale & Co-Founding Partner of Fenghou Capital Panelists:

|

| 17:25 – 18:30 | Networking Cocktail |

Hashtag: #Cyberport

The issuer is solely responsible for the content of this announcement.

About Hong Kong Cyberport

Wholly owned by the Hong Kong Special Administrative Region (HKSAR) Government, Cyberport is Hong Kong’s digital tech hub and AI accelerator, with a vision to empower industry digitalisation and intelligent transformation, to promote digital economy and AI development, and to foster Hong Kong to be an international AI, innovation and technology (I&T) hub. Cyberport gathers over 2,300 companies, including 13 listed companies and 10 unicorns. One-third of onsite companies’ founders come from 26 countries and regions, while Cyberport companies have expanded to over 35 global markets.

Cyberport, with Hong Kong’s largest AI Supercomputing Centre and AI Lab as the engine, has been building the AI ecosystem with industry-leading AI companies and over 400 AI and data science start-ups. Through development of tech clusters, namely AI, data science, blockchain and cybersecurity, Cyberport empowers industries across smart city and government, banking and finance, digital entertainment, culture and tourism, healthcare, education and training, property management, construction, transportation and logistics, green environment and more, while hosting Hong Kong’s largest FinTech community. Commissioned by the HKSAR Government, Cyberport has implemented proof-of-concept and sandbox schemes, subsidisation for digital tech adoption, industry tech training and start-up incubation, to drive technology R&D, translation and commercialisation, thus propelling digital transformation and intelligent upgrade across industry and society.

Also as “State-level Scientific and Technological Enterprise Incubator” and Hong Kong’s key incubator, Cyberport supports entrepreneurs with funding and office space, extensive networks of enterprises, investors, technology corporations and professional services for business growth and expansion to Chinese Mainland and overseas markets, all-round facilitation for landing in Hong Kong, talent attraction and cultivation, ready as a launchpad to take start-ups in any stages of development to the next level.

For more information, please visit ![]() https://www.cyberport.hk/en.

https://www.cyberport.hk/en.

Media OutReach

Money20/20 Asia Report: APAC Fintech Ecosystem Shifts from Experimentation to Scale as AI and Digital Assets Drive Regional Leadership

Based on insights from over 130 senior fintech leaders, the report highlights an industry moving beyond pilot programs toward enterprise-scale solutions that prioritize collaboration, digital trust, and financial inclusion as core business imperatives for 2026.

Key Findings

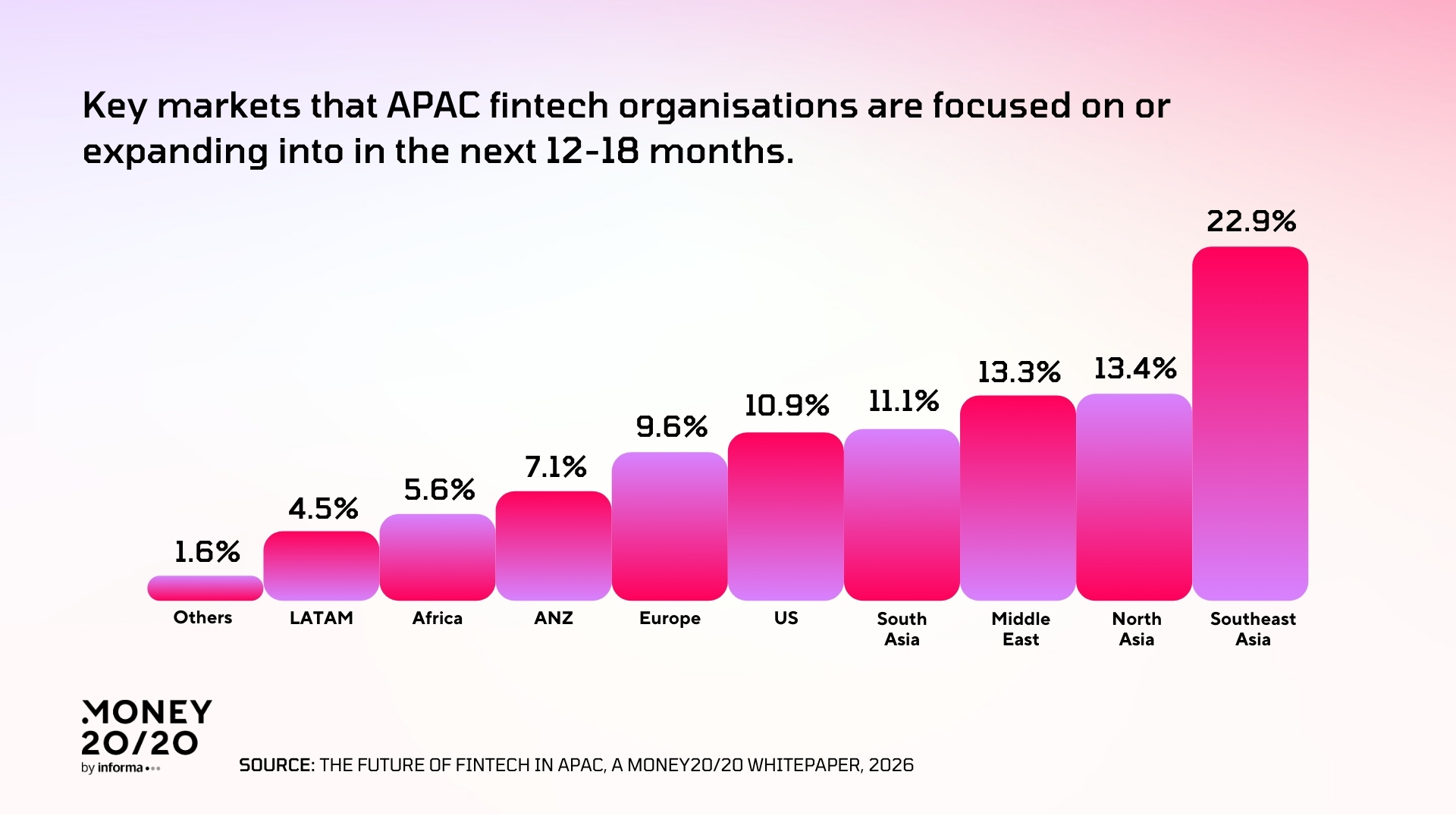

- 22.9% of respondents identify the region as their primary growth target, underscoring its continued dominance as the region’s growth engine.

- 90.6% of executives say social good initiatives are now embedded in corporate strategy — confirming impact has become a commercial imperative.

- 61.2% of organizations have already adopted AI or machine learning.

- New frameworks in Singapore, Hong Kong, and Japan are driving institutional adoption of stablecoins and tokenized assets.

- 63.5% of leaders cite fraud prevention as their highest operational priority.

“APAC is no longer experimenting — it’s executing,” said Ian Fong, VP of Content at Money20/20 Asia. “The region is building financial infrastructure that is faster, safer, and more inclusive than ever before. What happens here will influence the future of money globally.”

Digital Trust Becomes the New Currency

With digital adoption accelerating, 63.5% of leaders identify fraud prevention as their top priority. Regulators and industry players are now pivoting toward real-time risk intelligence and AI-driven security.

“The speed of digital adoption in APAC has outpaced traditional fraud models,” said Justin Lie, Founder & CEO of SHIELD. “What we’re seeing now is a shift toward real-time, device-level intelligence that operates silently in the background. Trust is the new currency of digital finance, and the companies that embed it in every interaction while delivering a frictionless experience will define the future of the industry.”

Stablecoins Move into Mainstream Financial Infrastructure

Institutional engagement with stablecoins and tokenized financial instruments has grown significantly, supported by clearer regulatory frameworks emerging across Singapore, Hong Kong, and Japan.

“Across Asia, stablecoins are already embedded in real economic activity from payments and cross-border settlements to treasury optimization,” said Yam Ki Chan, Vice President, Asia Pacific at Circle. “The region is demonstrating how digital assets can scale within financial systems, and the next phase is about interoperability and the development of an economic operating system for the internet”.

Digital Lending Expands Financial Access

The report highlights 72.9% of respondents believe SME-tailored fintech solutions are key to APAC’s economic growth, signaling a widening opportunity for inclusive financial innovation.

“Financial inclusion isn’t achieved by simply putting products online — it requires building for the realities of everyday consumers,” said Moritz Gastl, General Manager of Tala Philippines. “In markets like the Philippines, trust, transparency, and flexibility matter just as much as credit scoring. Digital lending works when it empowers people, not when it replicates old systems with new interfaces.”

Looking Ahead: Collaboration Will Define the Next Decade

As AI scales, payment rails interconnect, and digital assets enter regulated markets, APAC is emerging as a global blueprint for future financial systems.

“The next wave of fintech innovation will be defined by how well we balance technological advancement with social impact,” added Fong. “APAC markets are proving that financial innovation and inclusion can advance together.”

The Future of Fintech in APAC report can be downloaded HERE.

Hashtag: #Money20/20

The issuer is solely responsible for the content of this announcement.

Media OutReach

Huawei Highlights Digital Inclusion and Conservation Tech as AI Use Accelerates

About 80 guests attended the first day’s forum at the Leonardo Royal Hotel Barcelona Fira. In remarks published by Huawei, Yang Chaobin, CEO of Huawei ICT BG, said the digital divide “seems to be widening further” even as AI accelerates. “High-speed networks and robust computing facilities are essential foundations for an inclusive and sustainable AI era,” he said.

The International Telecommunication Union estimates about 2.2 billion people were still offline in 2025. Dr. Cosmas Zavazava, director of the ITU’s Telecommunication Development Bureau, said inclusion must be treated as a prerequisite for the AI era.

“AI must strengthen meaningful connectivity and support inclusive digital transformation. This requires responsible AI governance, investment in local talent and content, and capacity building, particularly for young girls, women, indigenous communities and marginalized groups.”

Huawei said it has fulfilled a commitment under the ITU Partner2Connect Digital Coalition to help expand connectivity in remote regions. By the end of 2025, the company said its initiatives had supported digital access for 170 million people in rural and underserved areas across more than 80 countries. In a Huawei news release, Jeff Wang, president of Huawei Public Affairs and Communications, said: “To bridge the digital skills gap, Huawei works closely with governments and partners to enhance digital access, deliver skills training, and advance STEM education for underserved communities.”

On March 2, the focus shifted to conservation with a visit to Spain’s Natural Park of Sant Llorenç del Munt i l’Obac. Here, digital monitoring tools are being used to support biodiversity protection, including efforts to safeguard the endangered Bonelli’s eagle alongside better managing potential impacts from outdoor activities like climbing on rock-dwelling birds and caving on protected bat species. The project forms part of the Tech4Nature initiative, developed with the International Union for Conservation of Nature (IUCN) to support digital tools in protected areas across 11 countries.

Sònia Llobet, the park’s director, said the project is helping managers balance visitor access with nature protection.

“As park managers, our challenge is how to make visitor access compatible with the conservation of this natural space,” she said. “This project is helping us answer some of the questions we face in balancing tourism and environmental protection.”

Hashtag: #Huawei

The issuer is solely responsible for the content of this announcement.

Media OutReach

Correcting and Replacing: Infinix NOTE 60 Ultra Ushers in New Premium Era

Thanks to powerful partnerships with industry leaders, NOTE 60 Ultra represents Infinix’s boldest entry in the flagship tier, debuting in Barcelona during MWC 2026

BARCELONA, SPAIN – Media OutReach Newswire – 5 March 2026 – Infinix is cementing its status within the premium smartphone segment in a bold new way with NOTE 60 Ultra, its landmark flagship debuting in Barcelona during Mobile World Congress 2026.

Co-developed with Italian automotive and design legend Pininfarina, NOTE 60 Ultra’s design is driven by an emotion-led aesthetic inspired by super cars. Beneath its bold design lies a fully realized flagship experience, integrating breakthrough in-house innovations with best-in-class partner technologies. A professional-grade 200MP ultra-high-definition imaging system, built-in multi-country satellite communication connectivity, and immersive audio precision-tuned by SOUND BY JBL come together to challenge expectations in the premium segment.

Supercar Design DNA in a Flagship, Shaped by Pininfarina

In the premium segment, the design language is a device’s opening statement. A user’s perception at first glance is shaped by aesthetics, long before a single specification is considered.

Drawing inspiration from the aerodynamic philosophy and pioneering spirit of high-performance sports cars, Infinix, in partnership with Pininfarina, takes a radical departure in sculpting a flagship. What stands out immediately is what’s missing: the camera bump. As premium handsets adopt larger sensors, they often sacrifice form with increasingly protruding camera modules.

True to the sports car heritage, NOTE 60 Ultra introduces a fully integrated, single-body rear: the Aluminum Unibody Design. At the heart of this craftsmanship is the World’s 1st Uni-Chassis Cam Module, formed a single, continuous sheet of CORNING® GORILLA® GLASS VICTUS that virtually conceals the presence of the camera. Much like a supercar sculpted for low-drag, the rear design maintains a smooth, uninterrupted silhouette. This also ensures a natural in-hand feel and unobtrusively slips into any pocket, while reinforcing the phone’s durability and structural integrity.

Paying homage to Italian cultural and racing heritage, NOTE 60 Ultra arrives in four striking colorways: Torino Black, Monza Red, Amalfi Blue, and Roma Silver. Each hue draws inspiration from the most iconic scenes and legends of Italy’s motorsport and cultural history, capturing the spirit of speed, lifestyle, and emotional beauty.

Just as a supercar announces its ignition through sound and light, NOTE 60 Ultra mirrors the ritual. A Floating Taillight signature spans the rear, illuminating as the device powers on. And as a final nod to automotive heritage, NOTE 60 Ultra features an Active Matrix Display reminiscent of a supercar dashboard at startup. Concealed within the rear surface, the hidden display lights up to reveal notifications, expressive icons, or a pixel-style virtual companion.

Dual Flagship Cameras for Detail, Zoom, and True-to-Life Imaging

Although discreet at first glance, Infinix makes no concessions on camera performance and earmarks a new era for Infinix’s imaging capability. Delivering performance on par with industry-leading standards, Infinix’s Dual Flagship Imaging Architecture marks several brand-first breakthroughs and improvements across three dimensions, reinforcing its position as a signature offering.

Under the hood, it’s clear that NOTE 60 Ultra refuses to settle for less. Discreetly integrated within the Uni-Chassis Cam Module is a powerful triple-camera array. Anchored by a next-generation 200MP Samsung ISOCELL HPE sensor, NOTE 60 Ultra delivers ultra-high-definition clarity. And ensuring flagship-grade versatility across focal lengths, the phone is complemented by a 50MP Samsung ISOCELL JN5 periscope telephoto lens and a 112° ultra-wide lens.

However, hardware alone does not define the full experience. For the first time, Infinix supports the XDR display standard with Ultra HDR Capture. Powered by a proprietary XDR Image Engine, Infinix’s advanced system delivers a superior dynamic range, ideal for true-to-life photos of bright lights at night or breathtaking sunset scenes.

The result is exceptional resolution that sets a higher bar for precise framing in daylight or after dark, while faithfully preserving details often lost in standard photography. Whether exploring daytime cityscapes or distant horizons, NOTE 60 Ultra excels with its advanced optical‑to‑digital zoom performance. Crisp, detailed shots are captured across a versatile zoom range, from a 2× optical crop and native 3.5× optical zoom to a 7× lossless digital zoom, extending up to 100× for extreme distances.

Expansive Satellite Calling and Messaging Coverage

Beyond what meets the eye, NOTE 60 Ultra carries a more subtle capability designed to accompany the user’s ambition, as far as and wherever the road leads. NOTE 60 Ultra is the first¹ to introduce dual-way satellite calling with expansive global coverage across a far greater number of countries¹. Powered by two-way messaging and calling beyond traditional terrestrial networks, NOTE 60 Ultra offers an added peace of mind whether navigating remote terrain beyond cellular coverage or facing large-scale network disruptions. The device bridges regional connectivity gaps to maintain communication and enables emergency location sharing when it matters most.

Ultra-Fast, Enduring Functionalities for an All-Around Flagship Experience

NOTE 60 Ultra combines category-leading performance and enduring power to support multi-sensory entertainment without interruption. Complementing this, its latest user experience delivers forward-looking innovations and AI-driven optimizations, making it more accessible and seamless for everyday use.

Impressively, Infinix debuted the Proprietary Battery Self-Healing Technology. Despite featuring a massive 7000mAh silicon-carbon battery within a slim, lightweight frame, NOTE 60 Ultra is engineered to restore up to 1%² of battery health every 200 charge cycles. Complementing this breakthrough, NOTE 60 Ultra supports wired 100W All-Around Fast Charge and 50W wireless charging, achieving a full charge from 1% to 100%² in only 48 minutes through a wired connection.

Even with a massive battery, Infinix pulls out all the stops to optimize for both speed and energy management. Featuring a 4nm all-big-core MediaTek Dimensity 8400 Ultimate chipset together with Infinix’s self-developed performance engine, NOTE 60 Ultra achieves up to 25%² faster multitasking, accelerated app responsiveness, and sustained smoothness.

NOTE 60 Ultra excels in its class with a captivating, 1.5K Ultra HDR cinematic display. Delivering fluid 144Hz responsiveness and exceptional 4500-nit peak brightness, visuals remain vibrant across most lighting conditions. Even in motion, intelligent predictive stabilization minimizes motion sickness, whether watching a film or playing games from within a car. And just as a high-performance vehicle demands calibrated acoustics, NOTE 60 Ultra doesn’t settle for less. It delivers high-fidelity audio through a stereo system with SOUND BY JBL, completing a truly compelling entertainment experience.

The NOTE 60 Ultra’s optimized performance enables its intelligent AI features to run fluidly and efficiently with minimal battery drain. Its integrated AI ecosystem focuses on practical daily-enhancing functions, including real-time vitals tracking via Advanced Health Monitor, personalized file organization and an adaptive AI-powered knowledge base, all evolving with user preferences. These AI capabilities are seamlessly woven into GlowSpace, a new interface debuting on XOS 16.³ Powered by Android 16, GlowSpace introduces a fully reimagined UI centered on fluid motion and luminous details that animate with every interaction.

Through co-engineering with leading technology and innovation partners, Infinix has aligned NOTE 60 Ultra around a unified vision of excellence. The outcome is a benchmark-setting flagship defined not by spectacle, but by deeply integrated and purposeful engineering, inside-out.

Product availability

NOTE 60 Ultra comes with a promise of 3 years of major OS updates and 5 years of security patches.

NOTE 60 Ultra is available in four colors: Torino Black, Monza Red, Amalfi Blue, and Roma Silver.

It will be available in two variants: 12GB + 256GB, 12GB + 512GB, with built-in eSIM⁴.

NOTE 60 Ultra comes with a deluxe gift box with automotive-inspired display stand design. A Supercar-Inspired MagCharge Base in Zinc Alloy, a Kevlar-Pattern MagPad, a Custom Kevlar MagCase, and a Track-Edition SIM Ejector Pin are included in the gift box.

Disclaimer

¹As of launch, this device is the first commercially available smartphone to support two‑way satellite calling across multiple countries. Feature availability, supported regions and coverage are subject to local certification, network deployment and market conditions.

²All data comes from Infinix laboratories. The testing data may vary slightly between different test versions and testing environments.

³The specific XOS upgrade plan for each model will be announced separately. Please note that availability of this upgrade may be limited in certain countries.

⁴eSIM availability is carrier and region-dependent; it may not be supported in all countries.

Hashtag: #Infinix

The issuer is solely responsible for the content of this announcement.

About Infinix

Established in 2013, Infinix is an innovation-driven brand dedicated to delivering cutting-edge technology, bold design, and outstanding performance. The brand provides smart, enjoyable mobile experiences that enhance everyday life. Beyond smartphones, Infinix has expanded its portfolio to include TWS earbuds, smartwatches, laptops, tablets, smart TVs, and more—building a comprehensive ecosystem of smart devices. Currently, Infinix products are available in over 70 countries and regions worldwide, including Africa, Latin America, the Middle East, South Asia, and Southeast Asia.

For more information, please visit: ![]() http://www.infinixmobility.com/

http://www.infinixmobility.com/

-

Feature/OPED6 years ago

Feature/OPED6 years agoDavos was Different this year

-

Travel/Tourism10 years ago

Lagos Seals Western Lodge Hotel In Ikorodu

-

Showbiz3 years ago

Showbiz3 years agoEstranged Lover Releases Videos of Empress Njamah Bathing

-

Banking8 years ago

Banking8 years agoSort Codes of GTBank Branches in Nigeria

-

Economy3 years ago

Economy3 years agoSubsidy Removal: CNG at N130 Per Litre Cheaper Than Petrol—IPMAN

-

Banking3 years ago

Banking3 years agoSort Codes of UBA Branches in Nigeria

-

Banking3 years ago

Banking3 years agoFirst Bank Announces Planned Downtime

-

Sports3 years ago

Sports3 years agoHighest Paid Nigerian Footballer – How Much Do Nigerian Footballers Earn