Media OutReach

Golden Bull Award 2025 Winners Revealed

For the winners of the 2025 Golden Bull Award, the answer is clear: vision, agility, and a drive to challenge the norm.

KUALA LUMPUR, MALAYSIA – Media OutReach Newswire – 10 July 2025 – These are high-performing companies and trailblazers. This year’s winners are leading the way through innovation, from adopting AI and strengthening cybersecurity to integrating ESG values into their core operations. They show us that profitability and purpose can, and should, go hand in hand.

Recent data from SME Corp Malaysia backs this up. According to its latest performance report, over half (55.6%) of Malaysian SMEs are prioritising innovation, nearly 40% are forming strategic alliances, and a third are actively pursuing international markets. These are dynamic, forward-looking businesses shaping the future economy.

The Golden Bull Award goes beyond celebrating success to enabling growth. As 80.7% of SMEs ramp up marketing efforts and 64.5% plan to scale their operations, the Award opens doors, connecting ambitious businesses with the networks, platforms, and partnerships they need to thrive.

Organised by Business Media International with the support of the Small and Medium Enterprises Association of Malaysia (SAMENTA) since 2003, the Golden Bull Award stands as Asia’s longest-running and most respected recognition platform for SMEs. Its footprint spans Malaysia, Singapore, mainland China, and Taiwan, and continues to grow across the region.

This year saw a record 19% increase in nominations, to over 1,700 companies. This highlights the rising aspirations of Malaysian SMEs. With SMEs contributing 39.1% to Malaysia’s GDP in 2023 and national targets aiming for 45% by 2025, their contribution is more critical than ever.

“This year’s Golden Bull Award is a testament not just to business success, but to business evolution,” said Datuk William Ng, National President of SAMENTA. “Our winners reflect the best of Malaysia’s entrepreneurial spirit: resilient, bold, and future-ready. With stronger government backing, they’re will be able reach even greater heights.”

The awards span three categories:

- Emerging Bull Award,

- Outstanding Bull Award, and

- Super Golden Bull Award for elite-level achievers

A special Distinguished Bull Award was also presented to ten outstanding businesses that have previously won and continued to grow and expand their reach.

Throughout the selection process, integrity and transparency remain paramount. Baker Tilly Malaysia served as the official auditor, while CTOS Data Systems Sdn Bhd acted as the independent credit report and data provider.

Since its founding in 2003, the Golden Bull Award has stood as a benchmark of SME excellence across Asia. With expansion into new Asia Pacific markets on the horizon for 2025, it continues to spotlight the region’s most inspiring business stories.

Ready to be inspired? Explore the full list of winners and learn more at

https://goldenbullaward.asia/

LIST OF WINNERS OF THE GOLDEN BULL AWARD 2025 IN ALPHABETICAL ORDER

SUPER GOLDEN BULL CATEGORY

- Advantage Marine Services (Malaysia) Sdn Bhd

- Gaido (M) Sdn Bhd

- Golden Destinations

- Hong Seng Power Sdn Bhd

- Master-Pack Group Berhad

- OSADI Commercial Supplies Sdn Bhd

- Parkson Credit Sdn Bhd

- Saint-Gobain Malaysia Sdn Bhd

- Siacon Technology Sdn Bhd

- Sri Perkasa Trading (M) Sdn Bhd

- ST Rosyam Mart Sdn Bhd

- Syarikat Perumahan Negara Berhad

- Tan Boon Ming Sdn Bhd

- Terberg Tractors Malaysia Sdn Bhd

- Vape Empire Distribution Sdn Bhd

OUTSTANDING BULL AWARD

- Adamas Contracts Sdn Bhd

- AESD International (M) Sdn Bhd

- Akaido Marketing Sdn Bhd

- Alam-Con Sdn Bhd

- Allied Forklift (M) Sdn Bhd

- Altus Oil & Gas Malaysia Sdn Bhd

- Aluspace Sdn Bhd

- Animal Medical Centre Sdn Bhd

- ATEK Technology Sdn Bhd

- Benz Auto Service (M) Sdn Bhd

- BP Chiropractic Sdn Bhd

- Cangkat Bayu Maju Sdn Bhd

- Ceres Nutrition Sdn Bhd

- Cert Academy Sdn Bhd

- CID Realtors Sdn Bhd

- Contacthings Solution Sdn Bhd

- E Mark Global Trade Sdn Bhd

- Essential Engineering Solution Sdn Bhd

- Estream Software Sdn Bhd

- Eternalgy Sdn Bhd

- Evertools Industrial Supply Sdn Bhd

- Fiskal Jitu Sdn Bhd

- Fong Hong (M) Sdn Bhd

- Foo Hing Dim Sum Sdn Bhd

- Fuyu Dezain Sdn Bhd

- Gee Seng Industrial Parts & Hoist Supply Sdn Bhd

- GFS Technology Sdn Bhd

- GME Greentech Sdn Bhd

- HBT Food & Beverage Sdn Bhd

- HFC Tech Sdn Bhd

- Hock Lian Hin Sdn Bhd

- Hon Engineering Sdn Bhd

- IDMS Technologies Sdn Bhd

- Ins Tech International Sdn Bhd

- IP Logistics (M) Sdn Bhd

- ISEP (M) Sdn Bhd

- Itech System Engineering Sdn Bhd

- JBR Hardware & Trading Sdn Bhd

- Jo Mama Online Shop Sdn Bhd

- JV Global Event Sdn Bhd

- Kibaru Manufacturing Sdn Bhd

- KMB Resources Sdn Bhd

- Kwang Tai Refrigerators & Electrical Sdn Bhd

- Kymm Seng Trading (Kulim) Sdn Bhd

- Leaderland Era Sdn Bhd

- Lian Heng M&E Sdn Bhd

- Liconlite Engineering Sdn Bhd

- LifeWave (M) Sdn Bhd

- LINGTEC Instruments Sdn Bhd

- LM Equipment Sdn Bhd

- LMS Education Holdings Sdn Bhd

- M Summit Group

- Mana Mana Suites Sdn Bhd

- Mapo Industries Sdn Bhd

- Max Star Project Management Sdn Bhd

- MCDS Bhd

- Ming Supply Sdn Bhd (Ming Lighting)

- MM Network Sdn Bhd

- Monzone Air-Conditioning Sdn Bhd

- MR Academy International Sdn Bhd

- Multiworld Freight (M) Sdn Bhd

- My Flavor Food Sdn Bhd

- Nero Chemical Sdn Bhd

- Nursery Hong Soon Sdn Bhd

- Ometick Tooling Sdn Bhd

- One Union Group Sdn Bhd

- Oxwise (M) Sdn Bhd

- Paramount Premix Sdn Bhd

- Pasaraya T.S. Mega (Cheras) Sdn Bhd

- Perniagaan Yik Sing Sdn Bhd

- PMX Delight Holding Sdn Bhd

- Print Expert Sdn Bhd

- Pro E Sdn Bhd

- Pro Life Medical Supplies Sdn Bhd

- R-Tech Global (Malaysia) Sdn Bhd

- Raddish Technology Sdn Bhd

- Raiden M & E Sdn Bhd

- REDBOX

- Rezo Group Sdn Bhd

- Risguard Sdn Bhd

- Rohe Interior Sdn Bhd

- SF Techlogis Sdn Bhd

- Shimlen Sdn Bhd

- Sin Soon Fa Fruits Sdn Bhd

- SKA Transport (M) Sdn Bhd

- SKN Industrial Supplies Sdn Bhd

- Sri Maju Cergas Logistics Sdn Bhd

- SRKK Technology Sdn Bhd

- SSH Manufacturing Sdn Bhd

- Straits Commnet Solutions Sdn Bhd

- Super Power Supply (M) Sdn Bhd

- Surian Creations Sdn Bhd

- Swee Seng Electrical Engineering Sdn Bhd

- Tay Motors (M) Sdn Bhd

- Tayopack Sdn Bhd

- Tian Siang BP (Ipoh) Sdn Bhd

- TIP Design (M) Sdn Bhd

- TLH Solution (M) Sdn Bhd

- TNS Shipping Sdn Bhd

- TP Power (M) Sdn Bhd (TP TEC Holding Berhad)

- UKM Pakarunding Sdn Bhd

- VHL Logistics Sdn Bhd

- Vision Mission Cleaning Sdn Bhd

- Visko Industries Sdn Bhd

- YLI Industry Sdn Bhd

- YPS Technology Sdn Bhd

EMERGING BULL AWARD

- ACS Project Management Sdn Bhd

- Alphas Estate Solutions Sdn Bhd

- ALW Technology Sdn Bhd

- Astra Online Sdn Bhd

- AVS Integrators Sdn Bhd

- BENJ Design Sdn Bhd

- Best Sewing World (M) Sdn Bhd

- Centrionics Sdn Bhd

- Chmiel Global Advisory Sdn Bhd

- CPT Training Development Sdn Bhd

- Dang Foods Trading

- Dream Home Structural Works Sdn Bhd

- Eaglesview Group Sdn Bhd

- Ecobex Resources Sdn Bhd

- EF Store Sdn Bhd

- Epro Precision Engineering Sdn Bhd

- Evoway Sdn Bhd

- Evrypawdy Sdn Bhd

- Excel Test Sdn Bhd

- FDCV Group Sdn Bhd

- Fuwave Design Sdn Bhd

- Goflex Events

- H & H First Consultancy Group Sdn Bhd

- H&H Health Group Sdn Bhd

- Happy Plantations (Kota Marudu) Sdn Bhd

- High Pines Training And Consultancy Sdn Bhd

- Inhome Solar Sdn Bhd

- Journal Multi Media Sdn Bhd

- Lee Sportswear International Sdn Bhd (Spin Sportswear)

- Livinghome Furniture Design Sdn Bhd

- Monogram Concepts Sdn Bhd

- My Wealth Capital Sdn Bhd

- Nexxg Worldwide Sdn Bhd

- One Search Pro Marketing Sdn Bhd

- Pi Interactive Sdn Bhd

- Red Abstract Hair Studio Sdn Bhd

- Seamarine Frozen Food & Supply

- Seng Seng Hardware Sdn Bhd

- Solid Real Estate Consultants Sdn Bhd

- Spartan Ives Capital Sdn Bhd

- TCW Solomon Realty Sdn Bhd

- Technics Minerals Resources Sdn Bhd

- Topkrete Sdn Bhd

- Trading Castle PLT

- Usahamaju Magnet Sdn Bhd

- Vanta Capital Sdn Bhd

- Various Intelligence Sdn Bhd

DISTINGUISHED BULL AWARDS

- Always Marketing (M) Sdn Bhd

- Cabe (M) Sdn Bhd

- Chinhan Tech Sdn Bhd

- Gold Key FNB Sdn Bhd

- Green Island Feed Mills Sdn Bhd

- INK Marketing Sdn Bhd

- Precious Precious Sdn Bhd

- Realux Sdn Bhd

- Teamplete Sdn Bhd

- Worldwise Freight (M) Sdn Bhd

DIGITAL 50 AWARDS

- Always Marketing (M) Sdn Bhd

- Golden Destinations

- HFC Tech Sdn Bhd

- IDMS Technologies Sdn Bhd

- Parkson Credit Sdn Bhd

- Pi Interactive Sdn Bhd

- Swee Seng Electrical Engineering Sdn Bhd

- Tan Boon Ming Sdn Bhd

- Tian Siang BP (Ipoh) Sdn Bhd

- Various Intelligence Sdn Bhd

GOLDEN BULL INSPIRATIONAL ENTREPRENEUR AWARDS

- Mr. Lim Ann Shen – Alphas Estate Solutions Sdn Bhd

- Mr. Patrick Goh – Always Marketing (M) Sdn Bhd

- Dr. Hii Ding Ong – Ceres Nutrition Sdn Bhd

- Ms. Christine Tan – Estream Software Sdn Bhd

- Mr. Lim Boon Hoe – Gaido (M) Sdn Bhd

- Mr. Eric Yap – GME Greentech Sdn Bhd

- Mr. Mita Lim – Golden Destinations

- Ms. Kristy Liew – INK Marketing Sdn Bhd

- Mr. Jenson Heng Kheng Hong – Mapo Industries Sdn Bhd

- Mr. Teoh Beng Swee – Pasaraya T.S. Mega (Cheras) Sdn Bhd

- Mr. Benjamin Ku – SSH Manufacturing Sdn Bhd

- Mr. Eric Mong – TNS Shipping Sdn Bhd

- Mr. Zac Oh – Vape Empire Distribution Sdn Bhd

- Mr. Andrew Teow – Advantage Marine Services (Malaysia) Sdn Bhd

- Mr. Nga Hock Ee – Aluspace Sdn Bhd

- Mr. Georg Chmiel – Chmiel Global Advisory Sdn Bhd

- Mr. George Wong Wei Hong – Gold Key FNB Sdn Bhd

- Mr. Allen Goh Soo Loon – Green Island Feed Mills Sdn Bhd

- Dr. Hiew Boon Thong – Happy Plantations (Kota Marudu) Sdn Bhd

- Mr. Noel Chuah Chong Tatt – IDMS Technologies Sdn Bhd

- Ms. Josephine Quay Huei Ming – Jo Mama Online Shop Sdn Bhd

- Mr. Andy Cheong Kah Yee – Raiden M & E Sdn Bhd

- Mr. Ooi Chi Yang – Raiden M & E Sdn Bhd

- Datin Pang Mei Mei – Risguard Sdn Bhd

- Dr. Sia Tian Poh – Siacon Technology Sdn Bhd

- Mr. Khoo Sze Chyuan – Sri Maju Cergas Logistics Sdn Bhd

- Datin Sri Jenny Hing Puey Ling – Sri Perkasa Trading (M) Sdn Bhd

- Datuk Lawrence Leow Fong Peng – Teamplete Sdn Bhd

Hashtag: #goldenbullaward

The issuer is solely responsible for the content of this announcement.

About SAMENTA

Established in 1986, SAMENTA is Malaysia’s oldest and largest association of SMEs, with over 5,500 members across the country. A multi-racial, multi-sector association, SAMENTA has been at the forefront of championing a SME-friendly business environment and connecting SMEs to regional and global opportunities.

About Business Media International

Business Media International is a subsidiary of Audience Analytics Limited (1AZ.SG), a regional leader in promoting growth for companies in Asia through data-driven brands and initiatives. BMI owns renowned media brands such as SME Magazine, HR Asia, Capital Asia, Energy Asia, Logistics Asia, TruthTV, and CXP Asia as well as business impact assessment brands such as SME100, HR Asia Best Companies to Work for in Asia, Golden Bull Awards and CXP Asia Best Customer Experience Awards. BMI also organises various exhibitions and has the proprietary software-as-a-service — Total Engagement Assessment Model – in its portfolio.

Media OutReach

XTransfer Joins Forum Ekonomi Malaysia 2026

Signals Plan to Make Malaysia Regional Compliance Hub

KUALA LUMPUR, MALAYSIA – Media OutReach Newswire – 11 February 2026 – XTransfer, the world’s leading B2B cross-border financial platform, was honoured to be invited to join the Malaysia Economic Forum (Forum Ekonomi Malaysia 2026). Bill Deng, Founder and CEO of XTransfer, shared insights on how Malaysia can accelerate technology application and innovation to help micro, small and medium enterprises (MSMEs) scale exports under the 13th Malaysia Plan (13MP), during FEM 2026’s panel discussion, “Made by Malaysia: Accelerating Technology Applications & Innovation”.

Bill was honoured to join YB Tuan Liew Chin Tong, Deputy Minister of Finance of Malaysia, and Mr Ooi Ching Liang, Senior Director of Engineering at SkyeChip, for a discussion focused on strengthening high-growth, high-value industries, advancing R&D commercialisation, increasing productivity and competitiveness, and supporting MSMEs in global value chains.

Drawing on XTransfer’s work with MSMEs across markets, Bill noted that many Malaysian businesses are “able to export,” but face persistent barriers to scaling exports. The most common issues are trust, compliance, and scale, which often surface as payment delays, repeated documentation requests, FX uncertainty, and working capital pressure as orders grow.

“For B2B SMEs in foreign trade, the biggest constraint isn’t demand. It’s the operational complexity behind cross-border payments, foreign exchange, and compliance,” Bill said. “In particular, AML requirements can be difficult for both traditional banks and SMEs to manage efficiently, creating friction that slows down legitimate trade.”

Bill highlighted a structural shift in global trade flows from a single dominant corridor to non-U.S., intra-Asia, and broader South–South routes. This trend is increasingly clear in real SME transaction patterns. Bill shared, “In 2025, XTransfer’s average collection amount from Asia, Africa, and Latin America grew by 106% year-on-year, with Africa exceeding 270%, Latin America reaching 94%, and ASEAN reaching 82%.” YB Liew noted the trend and thinks it is a direction Malaysia should pursue.

XTransfer also said it plans to establish Malaysia as its regional compliance centre, citing Malaysia’s strong geographic and time-zone advantages, a mature regulatory environment, availability of talent in compliance and risk operations, and cost efficiency. “Malaysia gives us the talent, governance environment, and regional proximity to scale compliance as intra-Asia and emerging-market trade accelerates,” Bill added.

Hashtag: #XTransfer #Malaysia #SMEs #13MP #FEM2026

![]() https://www.xtransfer.com

https://www.xtransfer.com![]() https://www.linkedin.com/company/xtransfer.cn

https://www.linkedin.com/company/xtransfer.cn![]() https://x.com/xtransferglobal

https://x.com/xtransferglobal![]() https://www.facebook.com/XTransferGlobal/

https://www.facebook.com/XTransferGlobal/

The issuer is solely responsible for the content of this announcement.

Media OutReach

CGTN: Little Chinese New Year opens big window to China’s soul

As the lunar calendar turns its final pages, China enters a period of joyful anticipation known as Xiaonian, or Little Chinese New Year. Often celebrated as the Festival of the Kitchen God, it marks the official start of the “busy year” – a traditional term for the intense, joyful period of preparing food, cleaning homes, and shopping for the upcoming Spring Festival.

The Spring Festival is a deeply significant time for family reunion. In 2024, UNESCO inscribed the “Spring Festival, social practices of the Chinese people in celebration of the traditional Chinese New Year” onto the Representative List of the Intangible Cultural Heritage of Humanity.

While daily routines continue to evolve, they remain anchored in rituals that provide a sense of normalcy and meaning. It is perhaps no wonder that in a climate of uncertainty, traditional Chinese lifestyles are finding a new audience beyond the country’s borders, with the Spring Festival chief among those unique traditions that are fast becoming a shared human experience.

Diverse traditions, shared aspirations

In a prelude to the broader celebrations, Xiaonian, observed on February 10 and 11 this year, kickstarts a focused period of preparation. According to ancient lore, families offer Zaotang, or sticky “Kitchen Candy,” to the Kitchen God to ensure he delivers a favorable report on the household’s conduct before he ascends to the heavens. This lighthearted tradition marks the beginning of several symbolic rituals aimed at welcoming a fresh start.

A key element of this transition is donning new clothes. In Chinese culture, the New Year represents a moment when “all things are renewed,” and wearing new garments symbolizes shedding the “dust” or misfortunes of the past to embrace auspicious energy for the year ahead. Alongside this personal renewal, families nationwide engage in “sweeping the dust,” a deep-cleaning ritual to purify the home and prepare it for new blessings.

Whereas these practices are universal, celebratory flavors vary by geography. In the north, families traditionally gather over steaming plates of dumplings, whereas in the south, the menu often features sweet rice cakes (Niangao) and glutinous rice balls (Tangyuan).

As Mao Qiaohui, a researcher at the Institute of Ethnic Literature at the Chinese Academy of Social Sciences, explains, these variations highlight the inclusive nature of Chinese civilization.

“Although folk customs differ between different regions across China, this diversity reflects the cultural pluralism within the Spring Festival tradition,” she notes. “Different regional identities contribute to a shared pursuit of harmony and reunion.”

The vitality of these traditions is also evident in local craftsmanship. In northern regions like Shandong and Henan, artisans are currently making Huamo, decorated steamed buns, featuring horse designs for the upcoming zodiac year. Meanwhile, in Shuozhou, Shanxi Province, intangible heritage inheritors are carving spirited stallions onto traditional gourds. These creations reflect the regional diversity of the festival and a collective desire for progress in the year ahead.

Cultural dialogue: From global stage to daily life

The festive atmosphere is reflected further in preparations for the Spring Festival Gala (Chunwan), produced by China Media Group.

Recent rehearsals show performances meshing traditional Chinese culture with international artistry. One performance piece combines the wooden clog dance of the Hani and Lisu ethnic groups with the rhythmic tap of Spanish Flamenco and Hungarian folk dance. And with global stars like Jackie Chan and Lionel Richie on the bill, the Gala’s stage is set to become a stage for the world to come together.

The reach of the gala has expanded far beyond a domestic audience. Through the “Spring Festival Gala Prelude” events held in the United States, Russia, France, Italy, and several African nations, the program has become a gateway to Chinese New Year customs and cultural exchange.

This interest extends beyond art and into the lives of people worldwide, as seen in the #BecomingChinese trend. This phenomenon features international social media users adopting elements of Chinese daily life – such as keeping a thermos of hot water handy, wearing quilted indoor slippers or practicing mindful movement with Baduanjin exercises.

The festival is no longer a distant event but a gateway to Chinese lifestyle, rooted in ancient wellness wisdom and constantly updated by modern convenience, and the first step to a journey of exploration into a culture that values ritual, safety and hospitality.

Whether through global broadcasts or shared daily habits, the Spring Festival increasingly strengthens a sense of cultural empathy between China and the rest of the world.

For more information, please click here:

Hashtag: #CGTN

The issuer is solely responsible for the content of this announcement.

Media OutReach

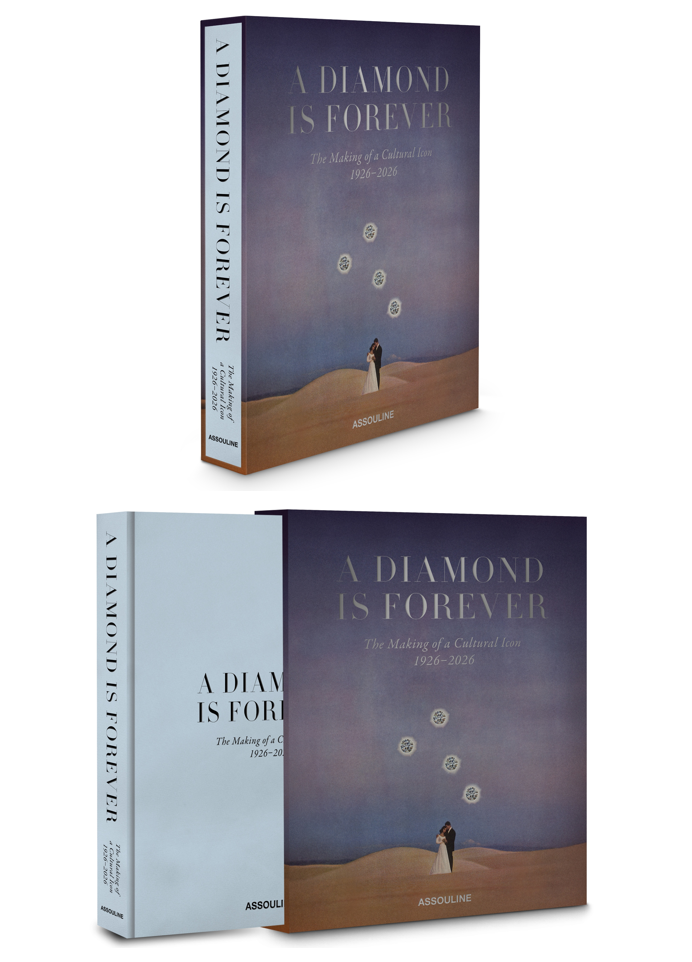

De Beers Group and Assouline Celebrate the Launch of “A Diamond Is Forever: The Making of A Cultural Icon 1926-2026”

Hashtag: #DeBeersGroup #NaturalDiamonds #diamonds #ADiamondIsForever #Assouline

![]() https://www.debeersgroup.com/

https://www.debeersgroup.com/![]() https://www.linkedin.com/company/debeersgroup/posts/?feedView=all

https://www.linkedin.com/company/debeersgroup/posts/?feedView=all![]() https://www.facebook.com/DeBeersGroupOfCompanies

https://www.facebook.com/DeBeersGroupOfCompanies![]() https://www.instagram.com/debeersgroup/

https://www.instagram.com/debeersgroup/

The issuer is solely responsible for the content of this announcement.

About De Beers Group

Established in 1888, De Beers Group is the world’s leading diamond company with expertise in the exploration, mining, marketing and retailing of diamonds. Together with its joint venture partners, De Beers Group employs more than 20,000 people across the diamond pipeline and is the world’s largest diamond producer by value, with diamond mining operations in Botswana, Canada, Namibia and South Africa. Innovation sits at the heart of De Beers Group’s strategy as it develops a portfolio of offers that span the diamond value chain, including its jewellery houses, De Beers Jewellers and Forevermark, and other pioneering solutions such as diamond sourcing and traceability initiatives Tracr and GemFair. De Beers Group also provides leading services and technology to the diamond industry in the form of education and laboratory services via De Beers Institute of Diamonds and a wide range of diamond sorting, detection and classification technology systems via De Beers Group Ignite. De Beers Group is committed to ‘![]() Building Forever,’ a holistic and integrated approach for creating a better future – where safety, human rights and ethical integrity continue to be paramount; where communities thrive and the environment is protected; and where there are equal opportunities for all. De Beers Group is a member of the Anglo American plc group. For further information, visit

Building Forever,’ a holistic and integrated approach for creating a better future – where safety, human rights and ethical integrity continue to be paramount; where communities thrive and the environment is protected; and where there are equal opportunities for all. De Beers Group is a member of the Anglo American plc group. For further information, visit ![]() www.debeersgroup.com.

www.debeersgroup.com.

-

Feature/OPED6 years ago

Feature/OPED6 years agoDavos was Different this year

-

Travel/Tourism10 years ago

Lagos Seals Western Lodge Hotel In Ikorodu

-

Showbiz3 years ago

Showbiz3 years agoEstranged Lover Releases Videos of Empress Njamah Bathing

-

Banking8 years ago

Banking8 years agoSort Codes of GTBank Branches in Nigeria

-

Economy3 years ago

Economy3 years agoSubsidy Removal: CNG at N130 Per Litre Cheaper Than Petrol—IPMAN

-

Banking3 years ago

Banking3 years agoSort Codes of UBA Branches in Nigeria

-

Banking3 years ago

Banking3 years agoFirst Bank Announces Planned Downtime

-

Sports3 years ago

Sports3 years agoHighest Paid Nigerian Footballer – How Much Do Nigerian Footballers Earn