Media OutReach

Grade A Offices: Tenant Advantages Deepen with Greater Flexibility and Choice Greater China Top Office Supply/Demand Trends

HONG KONG SAR – Media OutReach Newswire – 28 August 2025 – Cushman & Wakefield, a leading global real estate services firm, today released its annual Greater China Top Office Supply/Demand Trends report. According to the report, at the end of Q2 2025, the total Grade A office inventory in the core markets of the 20 major cities in Greater China we track totaled 72.1 million sq m. In the meantime, total premium core city office net absorption across the Greater China market for the H1 2025 period reached 0.76 million, a 5.5% y-o-y increase.

Of the six major cities in the region — comprising the tier-1 city group, Hong Kong, and Taipei — Taipei registered the lowest vacancy rate at 7.9%. As for the tier-2 city group, Qingdao recorded the lowest vacancy rate at 24.7%.

The supply/demand rundown for 20 city core area-level markets in Greater China (Q2 2025)

Source: Cushman & Wakefield Research

Shaun Brodie, Head of Research Content, Greater China, Cushman & Wakefield said, “For tenants, the Grade A office market continues to present opportunities, with vacancy rates and rental levels remaining favorable. With landlords adopting a more flexible approach amid the gradual economic recovery, occupiers can continue to benefit from attractive leasing terms and greater choice in the market.”

Jonathan Wei, President, Project and Occupier Services, China, Cushman & Wakefield, commented: “In the next two or three years, there will be a peak in supply in most of the major cities in the Chinese mainland region. Landlords will need to continue to strengthen their market competitiveness to attract tenants.”

Beijing

New Grade A office supply in Beijing in 2024 reached 273,000 sq m, a 55% decrease compared with the full-year 2023, making it the lowest new supply level of the past decade. No new supply entered the Beijing office market in H1 2025, with total Grade A office stock unchanged at 13.68 million sq m for the first half of 2025.

From 2024 to H1 2025, softening rental levels, large leasing deals, and pre-leasing at new entrants boosted citywide net absorption to surpass the previous period performance, reaching 511,967 sq m, up 51.9% y-o-y. The overall office market vacancy rate trended down 1.8 percentage points from the Q4 2023 level to 16.87%.

No new supply is scheduled to enter the Grade A office market in H2 2025. We expect the market to continue to digest existing stock, in turn further pulling down the overall vacancy rate. Landlords’ room for rent concessions is approaching a limit, and the overall market is now in a bottoming-out phase. We expect overall office rents to stabilize by the end of 2025.

Shanghai

From 2024 to H1 2025, approximately 1.34 million sq m of high-quality office space launched in the Shanghai Grade A office market, with 56% of the area located in emerging districts.

Over the past six quarters, the Shanghai Grade A office market recorded average quarterly net absorption of 132,266 sq m. The professional services, retail & trade, and TMT sectors were active in leasing, accounting for the top three sectors for leased area. As at Q2 2025, the vacancy rate rose to 23.6%. In turn, the average monthly rental level fell 8.2% y-o-y to RMB 212.6 per sq m.

From H2 2025 to 2027, Shanghai will see 2.58 million sq m of new supply enter the market, representing 14.6% of current stock, with emerging business districts becoming the main supply hubs. Additionally, favorable policy measures for both demand and supply are being implemented, accelerating innovation in strategic emerging industry fields such as integrated circuits, biomedicine, and AI, optimizing spatial layouts, and injecting new momentum into the office market.

Shenzhen

Shenzhen’s Grade A office market welcomed 516,000 sq m of new supply from Q1 2024 through to Q2 2025, bringing citywide total stock to 8.60 million sq m. The new supply was distributed in Qianhai, Luohu and Futian.

Citywide net absorption for 2024 contracted 57.9% y-o-y to record 165,000 sq m. Citywide net absorption in H1 2025 expanded y-o-y but remained at the similarly low level for the same period in the past decade. The citywide overall vacancy rate has risen 1.7 percentage points since the end of 2023 to reach 27.8%. The Q2 2025 monthly average rental level dropped 14.1% from Q4 2023 to record RMB160.1 sq m.

Approximately 1.2 million sq m of new supply is scheduled to enter the market in the H2 2025 period. The overall vacancy rate is expected to continue to rise, and rents will face downwards pressure in the short- term. With the ongoing development of AI, we anticipate that the Grade A office market will see incremental demand growth driven by the further emergence of high-quality technology sector firms.

Guangzhou

From the beginning of 2024 to the second quarter of 2025, new office projects totaling 441,713 sq m of space were completed. Citywide total stock then expanded to 6.94 million sq m. Delayed deliveries have reduced supply in 2024 compared to 2023, although accelerated construction in the Financial City district led to a resurgence of supply in the first half of 2025.

Compared to the end of 2023, the market has experienced a rise in lease inquiries. Occupiers continue to view renovation and fit-out expense incentives as key factors when looking to sign a new lease. Domestic enterprises remain the key drivers of transaction activity, with TMT, professional services, and finance firms, the top three sectors for leased area citywide.

Ahead, 2.39 million sq m of new space is expected to enter the market by 2027. Headquarter-type properties will account for more than half of the new supply. Market demand continues to evolve, with vacancy rates and rental levels remaining under pressure amid fierce competition.

Chengdu

From 2024 through to H1 2025, Chengdu saw 287,554 sq m of new Grade A office space enter the market, expanding citywide total stock to 3.38 million sq m.

Grade A office net absorption reached 67,468 sq m for the 2024 to H1 2025 period. The TMT, professional services, and finance sectors accounted for 26.4%, 19.6% and 16.8% of total leasing transaction volume by area, respectively. From the end of 2023, new supply combined with weakening leasing demand have now pushed up the citywide vacancy rate by 4.4 percentage points to reach 28.8%, while the average monthly rental level has dropped to RMB89.5 per sq m.

Nearly 1.0 million sq m of new supply is expected to enter the market from H2 2025 to 2027. The supply influx, combined with tenants’ cost reductions, is expected to elevate vacancy and exert downwards pressure on rents. Tenants are likely to seize further opportunities for upgrades, renewals, and consolidation.

Hong Kong

More than 194,000 sq m of new supply entered the market from 2024 through to H1 2025, with 44,900 sq m in H1 2025, distributed approximately equally in core and non-core areas. We forecast upcoming new supply to reach 264,300 sq m in H2 2025.

The average quarterly new leased area reached 84,900 sq m in the 2024 to H1 2025 period, 19% higher than the quarterly average for 2020–2023, with the finance sector primarily driving demand. Net absorption recorded 122,000 sq m for the 2024 to H1 2025 period, excluding pre-lease activities at new project developments.

The recovery of the Hong Kong IPO market should help support market sentiment and downstream office demand, particularly from finance and professional services firms. However, the high availability and ample new supply pipeline, with occupiers still cost-conscious, dictates our forecast for overall office rents to drop by 7% to 9% through the full-year 2025.

Taipei

From 2024 through to the first half of 2025, the Taipei market welcomed seven new Grade A office properties contributing approximately 195,700 sq m of new supply — double the figure seen in 2023. This brought the city’s total Grade A stock to 2.80 million sq m.

Net absorption for 2024 to H1 2025 reached approximately 161,400 sq m, primarily driven by the consolidation and relocation of self-use headquarters in the financial and insurance sectors. Multinational corporations accounted for around 80.9% of total leasing demand, up from 51.6% in 2023, indicating a higher proportion of foreign occupier activity during the period.

Over the next three years, Taipei will add around 968,000 sq m of new Grade A supply. With major completions slated from mid-2025, competition will intensify. In response, some landlords are upgrading facilities and offering flexible lease terms, while developers may adjust timelines based on absorption trends.

Please click here to download the full report

Hashtag: #RealEstate #CommercialProperty #OfficeLeasing #GreaterChina #MarketTrends #CushmanWakefield #PropertyReport #UrbanDevelopment

The issuer is solely responsible for the content of this announcement.

About Cushman & Wakefield

Cushman & Wakefield (NYSE: CWK) is a leading global commercial real estate services firm for property owners and occupiers with approximately 52,000 employees in nearly 400 offices and 60 countries. In Greater China, a network of 23 offices serves local markets across the region. In 2024, the firm reported revenue of $9.4 billion across its core services of Valuation, Consulting, Project & Development Services, Capital Markets, Project & Occupier Services, Industrial & Logistics, Retail, and others. Built around the belief that Better never settles, the firm receives numerous industry and business accolades for its award-winning culture. For additional information, visit www.cushmanwakefield.com.hk or follow us on LinkedIn (![]() https://www.linkedin.com/company/cushman-&-wakefield-greater-china).

https://www.linkedin.com/company/cushman-&-wakefield-greater-china).

Media OutReach

XTransfer Joins Forum Ekonomi Malaysia 2026

Signals Plan to Make Malaysia Regional Compliance Hub

KUALA LUMPUR, MALAYSIA – Media OutReach Newswire – 11 February 2026 – XTransfer, the world’s leading B2B cross-border financial platform, was honoured to be invited to join the Malaysia Economic Forum (Forum Ekonomi Malaysia 2026). Bill Deng, Founder and CEO of XTransfer, shared insights on how Malaysia can accelerate technology application and innovation to help micro, small and medium enterprises (MSMEs) scale exports under the 13th Malaysia Plan (13MP), during FEM 2026’s panel discussion, “Made by Malaysia: Accelerating Technology Applications & Innovation”.

Bill was honoured to join YB Tuan Liew Chin Tong, Deputy Minister of Finance of Malaysia, and Mr Ooi Ching Liang, Senior Director of Engineering at SkyeChip, for a discussion focused on strengthening high-growth, high-value industries, advancing R&D commercialisation, increasing productivity and competitiveness, and supporting MSMEs in global value chains.

Drawing on XTransfer’s work with MSMEs across markets, Bill noted that many Malaysian businesses are “able to export,” but face persistent barriers to scaling exports. The most common issues are trust, compliance, and scale, which often surface as payment delays, repeated documentation requests, FX uncertainty, and working capital pressure as orders grow.

“For B2B SMEs in foreign trade, the biggest constraint isn’t demand. It’s the operational complexity behind cross-border payments, foreign exchange, and compliance,” Bill said. “In particular, AML requirements can be difficult for both traditional banks and SMEs to manage efficiently, creating friction that slows down legitimate trade.”

Bill highlighted a structural shift in global trade flows from a single dominant corridor to non-U.S., intra-Asia, and broader South–South routes. This trend is increasingly clear in real SME transaction patterns. Bill shared, “In 2025, XTransfer’s average collection amount from Asia, Africa, and Latin America grew by 106% year-on-year, with Africa exceeding 270%, Latin America reaching 94%, and ASEAN reaching 82%.” YB Liew noted the trend and thinks it is a direction Malaysia should pursue.

XTransfer also said it plans to establish Malaysia as its regional compliance centre, citing Malaysia’s strong geographic and time-zone advantages, a mature regulatory environment, availability of talent in compliance and risk operations, and cost efficiency. “Malaysia gives us the talent, governance environment, and regional proximity to scale compliance as intra-Asia and emerging-market trade accelerates,” Bill added.

Hashtag: #XTransfer #Malaysia #SMEs #13MP #FEM2026

![]() https://www.xtransfer.com

https://www.xtransfer.com![]() https://www.linkedin.com/company/xtransfer.cn

https://www.linkedin.com/company/xtransfer.cn![]() https://x.com/xtransferglobal

https://x.com/xtransferglobal![]() https://www.facebook.com/XTransferGlobal/

https://www.facebook.com/XTransferGlobal/

The issuer is solely responsible for the content of this announcement.

Media OutReach

CGTN: Little Chinese New Year opens big window to China’s soul

As the lunar calendar turns its final pages, China enters a period of joyful anticipation known as Xiaonian, or Little Chinese New Year. Often celebrated as the Festival of the Kitchen God, it marks the official start of the “busy year” – a traditional term for the intense, joyful period of preparing food, cleaning homes, and shopping for the upcoming Spring Festival.

The Spring Festival is a deeply significant time for family reunion. In 2024, UNESCO inscribed the “Spring Festival, social practices of the Chinese people in celebration of the traditional Chinese New Year” onto the Representative List of the Intangible Cultural Heritage of Humanity.

While daily routines continue to evolve, they remain anchored in rituals that provide a sense of normalcy and meaning. It is perhaps no wonder that in a climate of uncertainty, traditional Chinese lifestyles are finding a new audience beyond the country’s borders, with the Spring Festival chief among those unique traditions that are fast becoming a shared human experience.

Diverse traditions, shared aspirations

In a prelude to the broader celebrations, Xiaonian, observed on February 10 and 11 this year, kickstarts a focused period of preparation. According to ancient lore, families offer Zaotang, or sticky “Kitchen Candy,” to the Kitchen God to ensure he delivers a favorable report on the household’s conduct before he ascends to the heavens. This lighthearted tradition marks the beginning of several symbolic rituals aimed at welcoming a fresh start.

A key element of this transition is donning new clothes. In Chinese culture, the New Year represents a moment when “all things are renewed,” and wearing new garments symbolizes shedding the “dust” or misfortunes of the past to embrace auspicious energy for the year ahead. Alongside this personal renewal, families nationwide engage in “sweeping the dust,” a deep-cleaning ritual to purify the home and prepare it for new blessings.

Whereas these practices are universal, celebratory flavors vary by geography. In the north, families traditionally gather over steaming plates of dumplings, whereas in the south, the menu often features sweet rice cakes (Niangao) and glutinous rice balls (Tangyuan).

As Mao Qiaohui, a researcher at the Institute of Ethnic Literature at the Chinese Academy of Social Sciences, explains, these variations highlight the inclusive nature of Chinese civilization.

“Although folk customs differ between different regions across China, this diversity reflects the cultural pluralism within the Spring Festival tradition,” she notes. “Different regional identities contribute to a shared pursuit of harmony and reunion.”

The vitality of these traditions is also evident in local craftsmanship. In northern regions like Shandong and Henan, artisans are currently making Huamo, decorated steamed buns, featuring horse designs for the upcoming zodiac year. Meanwhile, in Shuozhou, Shanxi Province, intangible heritage inheritors are carving spirited stallions onto traditional gourds. These creations reflect the regional diversity of the festival and a collective desire for progress in the year ahead.

Cultural dialogue: From global stage to daily life

The festive atmosphere is reflected further in preparations for the Spring Festival Gala (Chunwan), produced by China Media Group.

Recent rehearsals show performances meshing traditional Chinese culture with international artistry. One performance piece combines the wooden clog dance of the Hani and Lisu ethnic groups with the rhythmic tap of Spanish Flamenco and Hungarian folk dance. And with global stars like Jackie Chan and Lionel Richie on the bill, the Gala’s stage is set to become a stage for the world to come together.

The reach of the gala has expanded far beyond a domestic audience. Through the “Spring Festival Gala Prelude” events held in the United States, Russia, France, Italy, and several African nations, the program has become a gateway to Chinese New Year customs and cultural exchange.

This interest extends beyond art and into the lives of people worldwide, as seen in the #BecomingChinese trend. This phenomenon features international social media users adopting elements of Chinese daily life – such as keeping a thermos of hot water handy, wearing quilted indoor slippers or practicing mindful movement with Baduanjin exercises.

The festival is no longer a distant event but a gateway to Chinese lifestyle, rooted in ancient wellness wisdom and constantly updated by modern convenience, and the first step to a journey of exploration into a culture that values ritual, safety and hospitality.

Whether through global broadcasts or shared daily habits, the Spring Festival increasingly strengthens a sense of cultural empathy between China and the rest of the world.

For more information, please click here:

Hashtag: #CGTN

The issuer is solely responsible for the content of this announcement.

Media OutReach

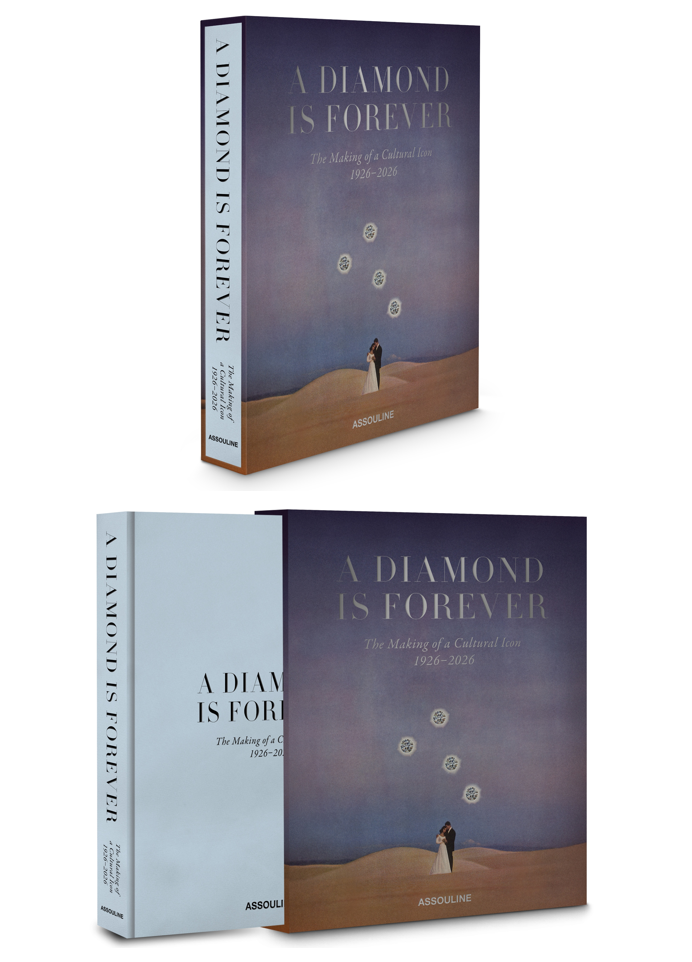

De Beers Group and Assouline Celebrate the Launch of “A Diamond Is Forever: The Making of A Cultural Icon 1926-2026”

Hashtag: #DeBeersGroup #NaturalDiamonds #diamonds #ADiamondIsForever #Assouline

![]() https://www.debeersgroup.com/

https://www.debeersgroup.com/![]() https://www.linkedin.com/company/debeersgroup/posts/?feedView=all

https://www.linkedin.com/company/debeersgroup/posts/?feedView=all![]() https://www.facebook.com/DeBeersGroupOfCompanies

https://www.facebook.com/DeBeersGroupOfCompanies![]() https://www.instagram.com/debeersgroup/

https://www.instagram.com/debeersgroup/

The issuer is solely responsible for the content of this announcement.

About De Beers Group

Established in 1888, De Beers Group is the world’s leading diamond company with expertise in the exploration, mining, marketing and retailing of diamonds. Together with its joint venture partners, De Beers Group employs more than 20,000 people across the diamond pipeline and is the world’s largest diamond producer by value, with diamond mining operations in Botswana, Canada, Namibia and South Africa. Innovation sits at the heart of De Beers Group’s strategy as it develops a portfolio of offers that span the diamond value chain, including its jewellery houses, De Beers Jewellers and Forevermark, and other pioneering solutions such as diamond sourcing and traceability initiatives Tracr and GemFair. De Beers Group also provides leading services and technology to the diamond industry in the form of education and laboratory services via De Beers Institute of Diamonds and a wide range of diamond sorting, detection and classification technology systems via De Beers Group Ignite. De Beers Group is committed to ‘![]() Building Forever,’ a holistic and integrated approach for creating a better future – where safety, human rights and ethical integrity continue to be paramount; where communities thrive and the environment is protected; and where there are equal opportunities for all. De Beers Group is a member of the Anglo American plc group. For further information, visit

Building Forever,’ a holistic and integrated approach for creating a better future – where safety, human rights and ethical integrity continue to be paramount; where communities thrive and the environment is protected; and where there are equal opportunities for all. De Beers Group is a member of the Anglo American plc group. For further information, visit ![]() www.debeersgroup.com.

www.debeersgroup.com.

-

Feature/OPED6 years ago

Feature/OPED6 years agoDavos was Different this year

-

Travel/Tourism10 years ago

Lagos Seals Western Lodge Hotel In Ikorodu

-

Showbiz3 years ago

Showbiz3 years agoEstranged Lover Releases Videos of Empress Njamah Bathing

-

Banking8 years ago

Banking8 years agoSort Codes of GTBank Branches in Nigeria

-

Economy3 years ago

Economy3 years agoSubsidy Removal: CNG at N130 Per Litre Cheaper Than Petrol—IPMAN

-

Banking3 years ago

Banking3 years agoSort Codes of UBA Branches in Nigeria

-

Banking3 years ago

Banking3 years agoFirst Bank Announces Planned Downtime

-

Sports3 years ago

Sports3 years agoHighest Paid Nigerian Footballer – How Much Do Nigerian Footballers Earn