Media OutReach

Octa broker’s take on CBDCs vs. crypto: key insights for traders in 2025

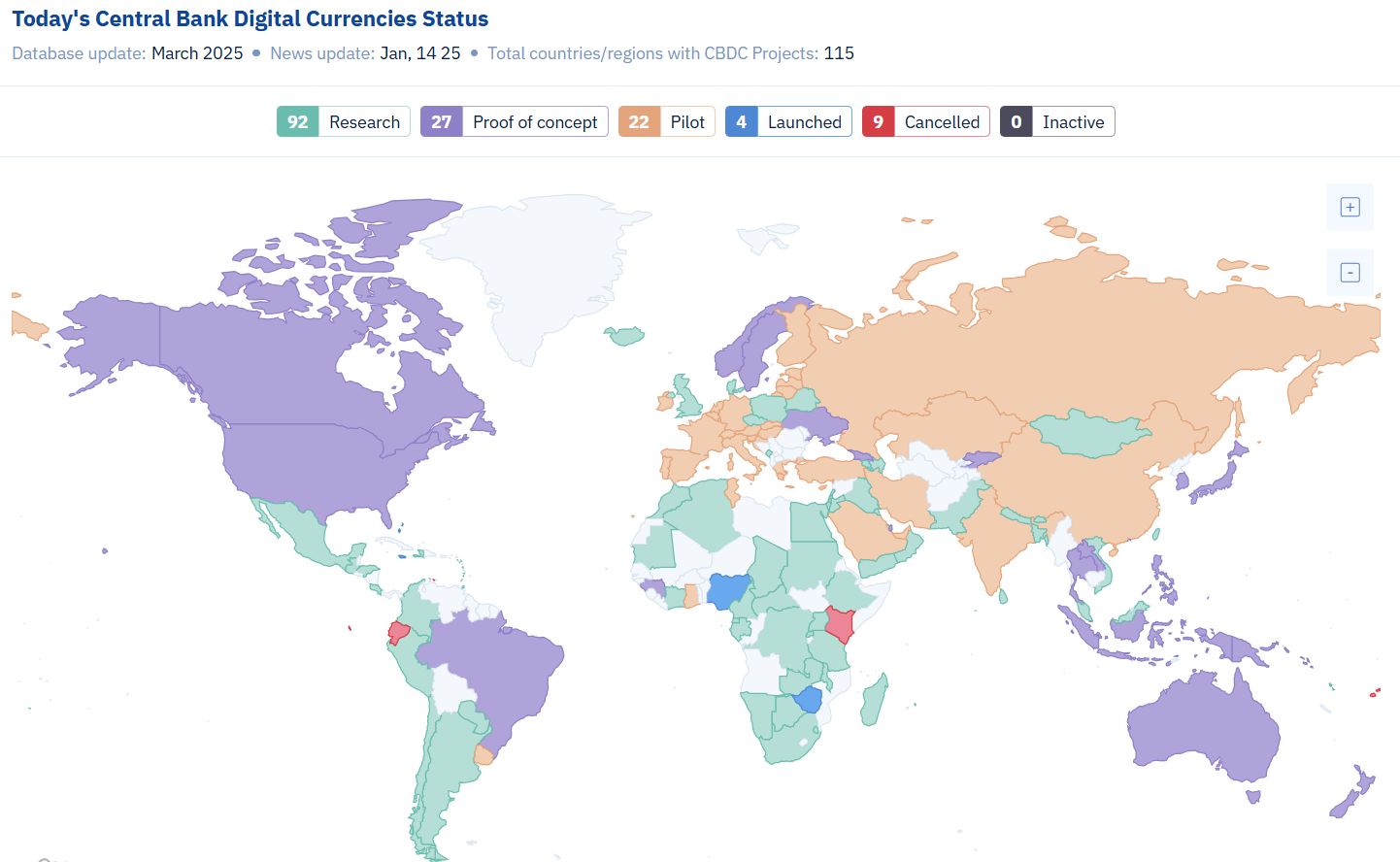

According to recent data, over 130 countries representing 98% of global GDP are now exploring CBDCs in some form, including pilots, development, or research (albeit few have fully adopted them). This rise reflects both technological momentum and regulatory intent to reclaim control over digital currency ecosystems, especially as private stablecoins and decentralised crypto assets have proliferated.

The main differences between CBDCs and cryptocurrencies

Stability and trust

While cryptocurrencies like Bitcoin or Ethereum operate in highly volatile and speculative environments, CBDCs are anchored to fiat currencies and issued by central banks. This offers higher value stability and institutional backing, reducing the risk profile for users.

Design and oversight

CBDCs are programmable but centrally managed. Governments can impose compliance measures and offer consumer protection in ways decentralised crypto systems cannot. Moreover, unlike crypto assets, CBDCs are not mined or privately issued, ensuring state control over monetary supply and transaction oversight.

Kar Yong Ang, financial market analyst at Octa, notes: ‘CBDCs offer a new model of digital liquidity—blending state trust and legal tender with tech efficiency. For traders, this opens doors to a more secure and transparent digital finance ecosystem.’

The global race to develop CBDCs and the drivers behind it

Here are three key reasons why central banks invest resources in CBDSs:

- The decline of cash and rise of digital payments. As societies increasingly favour digital over physical money, central banks face pressure to modernise public currency formats. In Sweden, for example, cash transactions make up less than 10% of payments. CBDCs are seen as a public alternative to private payment apps and platforms, ensuring monetary sovereignty in the digital realm.

- Controlling private stablecoin risks. Private stablecoins like USDT and USDC have raised concerns over systemic risk and shadow banking practices. A CBDC can serve as a stable counterbalance to these instruments, offering liquidity and legal clarity in fast-evolving financial markets.

- Financial inclusion and transparency. CBDCs can increase financial inclusion by offering digital wallets to unbanked populations, especially in developing economies. They also offer governments more visibility into money flows, enhancing tax collection and curbing illicit finance—though this has sparked debate around surveillance and privacy.

Pros and cons of CBDCs

CBDCs offer notable advantages: their value is typically pegged to fiat currencies, ensuring greater price stability than most cryptocurrencies. With full state backing, they function as legal tender and may include programmable features like conditional payments. For underbanked populations, they also present a path toward improved financial access.

However, concerns remain. Privacy is a major issue, as CBDCs could give governments visibility into personal transactions. They also pose cybersecurity risks, potentially becoming targets for large-scale attacks. Moreover, they could interfere with traditional monetary policy and financial market dynamics if not carefully designed. For instance, commercial banks could experience deposit runs if individuals perceive CBDCs as a safer alternative to traditional money for savings.

Real-world cases

Although the majority of countries still research CBDC and their application in the economy, some have already implemented them.

- Bahamas. The Sand Dollar became the first nationwide CBDC in 2020. It now serves all islands through a network of mobile-based wallets.

- Nigeria. The eNaira, launched in 2021, has seen a slow adoption of less than 0.5% as of 2025. The government continues to offer incentives to boost usage.

- China. The e-CNY has been piloted in over 25 cities and integrated into public transit and e-commerce platforms. Its scale makes it the most advanced major-economy CBDC.

Looking ahead: the road to adoption

While CBDCs promise greater efficiency and offer more tools for governments to implement social objectives, they also pose new governance challenges. To thrive, states will have to balance innovation with civil liberties, infrastructure resilience, and global interoperability. As the world of digital currencies continues to develop, CBDCs are increasingly important for progressive traders to grasp. Keeping up with developments can give a vital advantage in understanding the future of money.

___

Disclaimer: This content is for general informational purposes only and does not constitute investment advice, a recommendation, or an offer to engage in any investment activity. It does not take into account your investment objectives, financial situation, or individual needs. Any action you take based on this content is at your sole discretion and risk. Octa and its affiliates accept no liability for any losses or consequences resulting from reliance on this material.

Trading involves risks and may not be suitable for all investors. Use your expertise wisely and evaluate all associated risks before making an investment decision. Past performance is not a reliable indicator of future results.

Availability of products and services may vary by jurisdiction. Please ensure compliance with your local laws before accessing them.

Hashtag: #Octa

The issuer is solely responsible for the content of this announcement.

Octa

![]() Octa is an international CFD broker that has been providing online trading services worldwide since 2011. It offers commission-free access to financial markets and various services used by clients from 180 countries who have opened more than 52 million trading accounts. To help its clients reach their investment goals, Octa offers free educational webinars, articles, and analytical tools.

Octa is an international CFD broker that has been providing online trading services worldwide since 2011. It offers commission-free access to financial markets and various services used by clients from 180 countries who have opened more than 52 million trading accounts. To help its clients reach their investment goals, Octa offers free educational webinars, articles, and analytical tools.

The company is involved in a comprehensive network of charitable and humanitarian initiatives, including the improvement of educational infrastructure and short-notice relief projects supporting local communities.

In Southeast Asia, Octa received the ‘Best Trading Platform Malaysia 2024’ and the ‘Most Reliable Broker Asia 2023’ awards from Brands and Business Magazine and International Global Forex Awards, respectively.

Media OutReach

AECOM supports CEDD and AFCD of HKSAR Government in launching Hong Kong’s first comprehensive nature-based solutions guidelines to advance sustainable urban development

Developed through multidisciplinary expertise in ecology, landscape architecture, engineering, climate resilience and urban planning, the HKNbSDG provides a practical blueprint for designing, implementing, sustainably managing, and evaluating NbS across diverse environmental contexts — from rivers and wetlands to coastlines and high-density urban districts.

Factoring in the characteristics of Hong Kong’s natural ecology and urban development, the HKNbSDG is built on three core principles that outline a holistic approach to promoting ecosystem diversity at multiple scales, embracing human-nature coexistence for mutual benefits, and improving resilience through NbS. It also includes a performance evaluation framework to support evidence-based decision-making and features local case studies, including Long Valley Nature Park and Tung Chung East Eco-shoreline.

“The HKNbSDG reflects our commitment to advancing nature‑positive design and supporting Hong Kong’s journey toward climate resilience and sustainable growth,” said Dr. Johnny Cheuk, senior vice president and Hong Kong executive leader at AECOM. “By integrating ecological science into design practice, we aim to empower practitioners to harness nature’s potential in building climate-resilient infrastructure.”

The HKNbSDG was officially launched at the Promulgation Ceremony held on March 3, 2026, at Long Valley Nature Park. The event was officiated by Miss. Diane Wong Shuk-han, JP, Under Secretary for Environment and Ecology; Mr. David Lam Chi-man, JP, Under Secretary for Development; Mr. Charles Karangwa, Global Head of Nature-based Solutions Centre of the International Union for Conservation of Nature (IUCN); Ir Michael Fong Hok-shing, JP, Director of Civil Engineering and Development; and Mr. Mickey Lai Kin-ming, JP, Director of Agriculture, Fisheries and Conservation.

The ceremony featured an introduction to the HKNbSDG by Stephen Suen, director of landscape architecture at AECOM, followed by a panel discussion on building cross-sector partnerships to reverse nature and biodiversity loss through NbS.

Panelists included:

- Mr. Charles Karangwa, Global Head, Nature-based Solutions Centre, IUCN

- Ir. Michael Fong Hok‑shing, JP, Director of Civil Engineering and Development

- Mr. Mickey Lai Kin Ming, JP, Director of Agriculture, Fisheries and Conservation

- Ms. Frances Chen, Director, Sustainability & Climate Change, North Asia, HSBC

- Mr. Benny Au, Senior Manager, Sustainable Development, Swire Properties Limited

The release of the HKNbSDG supports Hong Kong’s key policy commitments, including the Climate Action Plan 2050 and its biodiversity conservation targets, by providing a practical roadmap for enhancing urban resilience and expanding green infrastructure. This publication equips practitioners with essential tools — from integrating ecology into early planning to designing for multifunctional benefits — grounded in Hong Kong-specific experience. It also serves as a central resource for advancing the Northern Metropolis development strategy, where NbS is helping to drive urban-rural integration and foster the co-existence of urban development and ecological conservation.

The HKNbSDG forms part of AECOM’s broader mission to help cities adapt to climate risks while enhancing quality of life. By bringing together global best practices and local ecological insights, AECOM aims to strengthen industry-wide capability in implementing NbS at scale.

Learn more about the Hong Kong Nature-based Solutions Design Guidelines here.

Download high-resolution images here.

Hashtag: #AECOM #NatureBasedSolutions #NaturePositive #ClimateResilience #Biodiversity

The issuer is solely responsible for the content of this announcement.

About AECOM

AECOM is the global infrastructure leader, committed to delivering a better world. As a trusted professional services firm powered by deep technical abilities, we solve our clients’ complex challenges in water, environment, energy, transportation and buildings. Our teams partner with public- and private-sector clients to create innovative, sustainable and resilient solutions throughout the project lifecycle – from advisory, planning, design and engineering to program and construction management. AECOM is a Fortune 500 firm that had revenue of US$16.1 billion in fiscal year 2025. Learn more at AECOM.

Media OutReach

Asian Computer Industry Online Exhibition 2026: A Global Hub for Technology Industry Collaboration

Since its launch in 2022, the exhibition has been jointly organized by AsianNet and TradeAsia (www.e-tradeasia.com). The event has supported numerous companies in expanding into overseas markets and has earned strong industry recognition for high-quality buyers, efficient matchmaking, and measurable order results.

In 2026, ACI 2026 will expand in scale and be held concurrently with leading international technology trade shows, including Embedded World, Display Week (SID), COMPUTEX TAIPEI, and ISC High Performance. By aligning with major global exhibitions, the event creates a strong time-synergy effect, enabling international buyers to efficiently compare products, evaluate suppliers, and complete procurement decisions within a concentrated timeframe. This strategic alignment enhances purchasing efficiency and maximizes cross-exhibition business opportunities.

ACI 2026 features a robust lineup of respected Taiwanese manufacturers, including industry leaders such as HIGHGRADE TECH, OKAYO ELECTRONICS, BIPOLAR ELECTRONIC, YNG WEI, YNG YUH ELECTRONIC, ESMT, GOOD OPPORTUNITY ELECTRONIC, MSTRONIC, SUN RISE EXACT, AIRWAVE TECHNOLOGIES, KING DESGIN INDUSTRIAL, CLEVER INTELLIGENCE UNITY, YO-TRONICS TECHNOLOGY, DORIS INDUSTRIAL, REUEX INDUSTRIAL, ARIOSE ELECTRONICS, UNITEX NUNG LAI BUTTON and many more. These companies will present thousands of the latest computer industry products and technologies, covering a wide array of sectors crucial to modern manufacturing and production.

Comprehensive Coverage Across the Entire Industry Chain

The Asian Computer Industry Online Exhibition 2026 brings together dozens of premium suppliers from the global computer manufacturing and electronic components sectors, showcasing over a thousand innovative products and forward-looking technologies. The exhibits are strategically structured around the core value of the industry supply chain, comprehensively covering key system-level products such as desktop computers, laptops and accessories, tablets and accessories, industrial computers and embedded systems, gaming and e-sports equipment, as well as computer software, IT, and internet services.

The ACI 2026 also highlights critical communications infrastructure, including networking equipment, wireless communication devices, telecommunications and fiber access equipment, landline and VoIP systems, and antennas. In terms of key components and supply chain solutions, the showcased products include computer components, storage and memory devices, active components, power supply units, connectors and terminals, cables and cable assemblies, wiring accessories, transformers, batteries, and charging equipment.

In addition, the ACI 2026 features monitors, computer accessories and peripherals, input devices, point-of-sale (POS) systems, printers, plotters and scanners, printer consumables and parts, as well as broadcast and professional AV equipment, audio and video components, consumer electronics accessories and components, and electronic materials and supplies.

Together, these comprehensive categories fully demonstrate the complete ecosystem of the computer industry, spanning system integration, communications infrastructure, core components, and end-use applications. Combining technological depth with product breadth, the exhibition stands as a premier international trade event for efficient business matchmaking and global market expansion among professional buyers and industry stakeholders worldwide.

ACI 2026 Online Exhibition:

https://www.etradeasia.com/online-show/43/Asian-Computer-Industry-Online-Exhibition-2026.html

Innovative Online Exhibition Model

The Asian Computer Industry Online Exhibition 2026 features dedicated online showrooms, digital catalogs, and virtual exhibition halls fully integrated with the TradeAsia platform. Buyers worldwide can browse exhibitor information, submit quotation requests, and conduct procurement evaluations in real time, thereby facilitating efficient, cost-effective, and results-driven global business connections.

Hashtag: #TradeAsia

The issuer is solely responsible for the content of this announcement.

About TradeAsia

TradeAsia (![]() www.e-tradeasia.com) is a well-established global B2B trade platform with millions of members and over 600,000 suppliers worldwide. The platform facilitates efficient matchmaking between buyers and sellers and maintains strategic partnerships with hundreds of trade organizations and exhibition entities globally. Through cross-platform marketing and integrated exposure, TradeAsia provides suppliers with expanded international visibility and multi-channel promotion opportunities. For ACI 2026, the organizers will implement a comprehensive global marketing campaign to support exhibitors in expanding overseas markets, enhancing brand presence, and maximizing business opportunities.

www.e-tradeasia.com) is a well-established global B2B trade platform with millions of members and over 600,000 suppliers worldwide. The platform facilitates efficient matchmaking between buyers and sellers and maintains strategic partnerships with hundreds of trade organizations and exhibition entities globally. Through cross-platform marketing and integrated exposure, TradeAsia provides suppliers with expanded international visibility and multi-channel promotion opportunities. For ACI 2026, the organizers will implement a comprehensive global marketing campaign to support exhibitors in expanding overseas markets, enhancing brand presence, and maximizing business opportunities.

Media OutReach

ABP Securite Announces Strategic Partnership With Rapid7 to Enhance Cybersecurity in Asia Pacific

The collaboration marks an important step in enabling enterprises to strengthen their security posture amid the region’s rapidly expanding digital landscape. With evolving hybrid infrastructures, accelerated cloud transformation, and increasing threat complexity, organisations across Asia Pacific are seeking more comprehensive ways to gain visibility, prioritise risk, and streamline response.

Under this partnership, ABP Securite will distribute and support Rapid7’s cybersecurity portfolio across Asia Pacific— including the Rapid7 Command Platform covering exposure management, SIEM and XDR, cloud security, application security, automation, and external threat intelligence.

Closing the Cyber Visibility Gap

“As the cybersecurity threat surface in Asia Pacific continues to grow, visibility and control have become mission critical,” said Joyce Ng, Chief Executive Officer of ABP Securite. “At ABP Securite, our role is to help customers turn complexity into clarity. Partnering with Rapid7 brings a best-in-class platform that empowers security teams to quantify and reduce risk more effectively. Together, we can help organisations operationalise cyber resilience and protect their most valuable assets.”

Jason Heng, Regional Sales Director, ASEAN at Rapid7, added, “ABP Securite has built a strong reputation for enabling regional partners and customers with advanced cybersecurity technologies. Through this collaboration, Rapid7 gains a powerful ally to extend our reach and help organisations in Asia Pacific gain real-time insight into their exposure, simplify operations, and respond faster to emerging threats.”

Hashtag: #ABPSecurite

The issuer is solely responsible for the content of this announcement.

About ABP Securite Pte Ltd

ABP Securite Pte Ltd is a leading cybersecurity and network-performance Value-Added Distributor (VAD), incorporated in 2015 and headquartered in Singapore, with regional offices across Asia Pacific. The company delivers a comprehensive portfolio of advanced security technologies and professional services — including architecture advisory, solution integration, after-sales support, and cloud-managed services. ABP Securite collaborates with a broad ecosystem of partners to help organisations strengthen cyber resilience, secure infrastructure, and protect critical assets across cloud, network, and data environments.

Website: www.abpsecurite.com

About Rapid7

Rapid7, Inc. (NASDAQ: RPD) is a global leader in AI-powered managed cybersecurity operations, trusted to advance organizations’ cyber resilience. Open and extensible, the Rapid7 Command Platform integrates security data, enriching it with AI, threat intelligence, and 25 years of expertise and innovation to reduce risk and disrupt attackers. As a recognized leader in preemptive managed detection and response (MDR), Rapid7 unifies exposure and detection to transform the cybersecurity operations of more than 11,500 customers worldwide. For more information, visit our website, check out our blog, or follow us on ![]() LinkedIn or

LinkedIn or ![]() X.

X.

-

Feature/OPED6 years ago

Feature/OPED6 years agoDavos was Different this year

-

Travel/Tourism10 years ago

Lagos Seals Western Lodge Hotel In Ikorodu

-

Showbiz3 years ago

Showbiz3 years agoEstranged Lover Releases Videos of Empress Njamah Bathing

-

Banking8 years ago

Banking8 years agoSort Codes of GTBank Branches in Nigeria

-

Economy3 years ago

Economy3 years agoSubsidy Removal: CNG at N130 Per Litre Cheaper Than Petrol—IPMAN

-

Banking3 years ago

Banking3 years agoSort Codes of UBA Branches in Nigeria

-

Banking3 years ago

Banking3 years agoFirst Bank Announces Planned Downtime

-

Sports3 years ago

Sports3 years agoHighest Paid Nigerian Footballer – How Much Do Nigerian Footballers Earn