Media OutReach

Octa broker’s take on CBDCs vs. crypto: key insights for traders in 2025

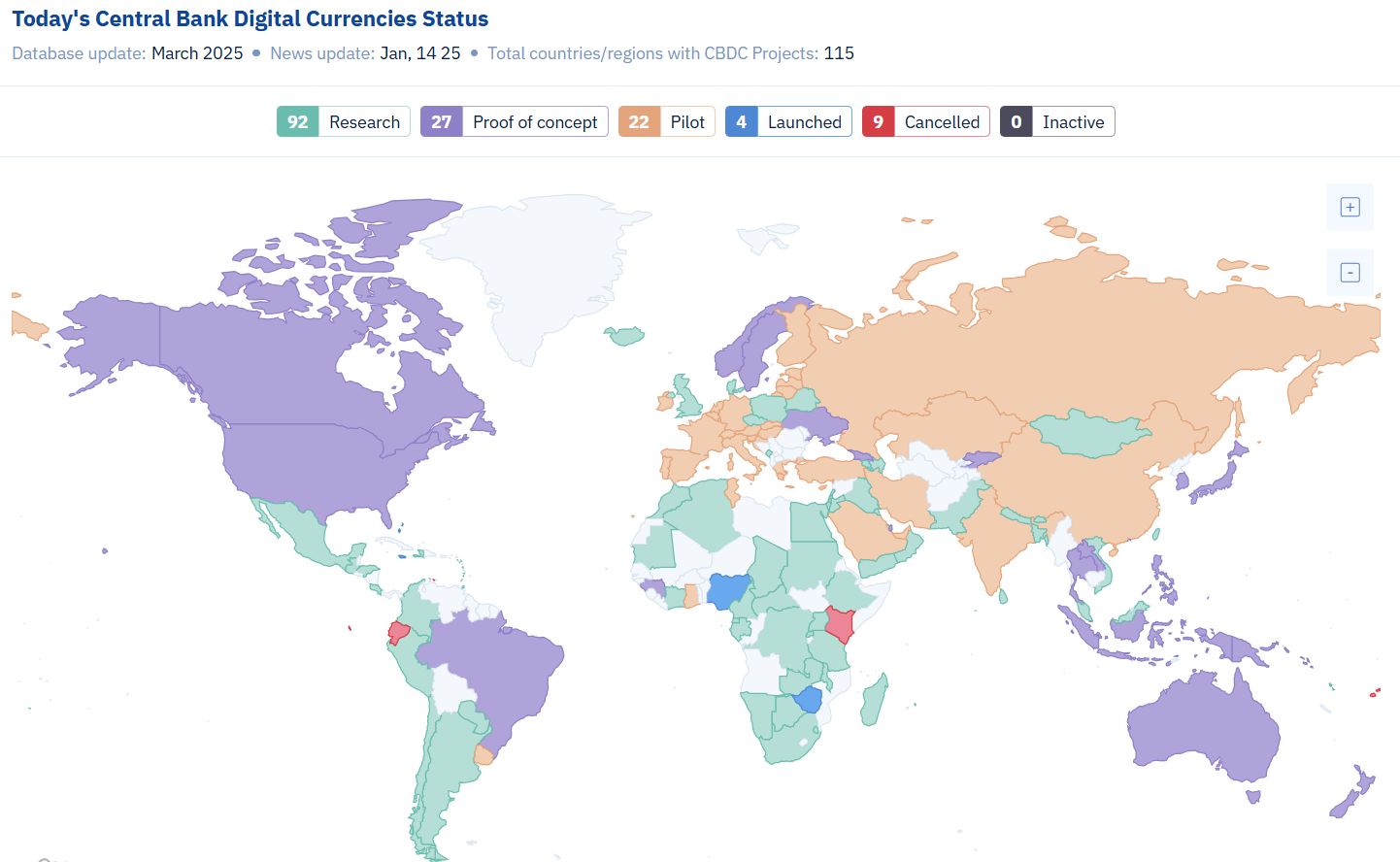

According to recent data, over 130 countries representing 98% of global GDP are now exploring CBDCs in some form, including pilots, development, or research (albeit few have fully adopted them). This rise reflects both technological momentum and regulatory intent to reclaim control over digital currency ecosystems, especially as private stablecoins and decentralised crypto assets have proliferated.

The main differences between CBDCs and cryptocurrencies

Stability and trust

While cryptocurrencies like Bitcoin or Ethereum operate in highly volatile and speculative environments, CBDCs are anchored to fiat currencies and issued by central banks. This offers higher value stability and institutional backing, reducing the risk profile for users.

Design and oversight

CBDCs are programmable but centrally managed. Governments can impose compliance measures and offer consumer protection in ways decentralised crypto systems cannot. Moreover, unlike crypto assets, CBDCs are not mined or privately issued, ensuring state control over monetary supply and transaction oversight.

Kar Yong Ang, financial market analyst at Octa, notes: ‘CBDCs offer a new model of digital liquidity—blending state trust and legal tender with tech efficiency. For traders, this opens doors to a more secure and transparent digital finance ecosystem.’

The global race to develop CBDCs and the drivers behind it

Here are three key reasons why central banks invest resources in CBDSs:

- The decline of cash and rise of digital payments. As societies increasingly favour digital over physical money, central banks face pressure to modernise public currency formats. In Sweden, for example, cash transactions make up less than 10% of payments. CBDCs are seen as a public alternative to private payment apps and platforms, ensuring monetary sovereignty in the digital realm.

- Controlling private stablecoin risks. Private stablecoins like USDT and USDC have raised concerns over systemic risk and shadow banking practices. A CBDC can serve as a stable counterbalance to these instruments, offering liquidity and legal clarity in fast-evolving financial markets.

- Financial inclusion and transparency. CBDCs can increase financial inclusion by offering digital wallets to unbanked populations, especially in developing economies. They also offer governments more visibility into money flows, enhancing tax collection and curbing illicit finance—though this has sparked debate around surveillance and privacy.

Pros and cons of CBDCs

CBDCs offer notable advantages: their value is typically pegged to fiat currencies, ensuring greater price stability than most cryptocurrencies. With full state backing, they function as legal tender and may include programmable features like conditional payments. For underbanked populations, they also present a path toward improved financial access.

However, concerns remain. Privacy is a major issue, as CBDCs could give governments visibility into personal transactions. They also pose cybersecurity risks, potentially becoming targets for large-scale attacks. Moreover, they could interfere with traditional monetary policy and financial market dynamics if not carefully designed. For instance, commercial banks could experience deposit runs if individuals perceive CBDCs as a safer alternative to traditional money for savings.

Real-world cases

Although the majority of countries still research CBDC and their application in the economy, some have already implemented them.

- Bahamas. The Sand Dollar became the first nationwide CBDC in 2020. It now serves all islands through a network of mobile-based wallets.

- Nigeria. The eNaira, launched in 2021, has seen a slow adoption of less than 0.5% as of 2025. The government continues to offer incentives to boost usage.

- China. The e-CNY has been piloted in over 25 cities and integrated into public transit and e-commerce platforms. Its scale makes it the most advanced major-economy CBDC.

Looking ahead: the road to adoption

While CBDCs promise greater efficiency and offer more tools for governments to implement social objectives, they also pose new governance challenges. To thrive, states will have to balance innovation with civil liberties, infrastructure resilience, and global interoperability. As the world of digital currencies continues to develop, CBDCs are increasingly important for progressive traders to grasp. Keeping up with developments can give a vital advantage in understanding the future of money.

___

Disclaimer: This content is for general informational purposes only and does not constitute investment advice, a recommendation, or an offer to engage in any investment activity. It does not take into account your investment objectives, financial situation, or individual needs. Any action you take based on this content is at your sole discretion and risk. Octa and its affiliates accept no liability for any losses or consequences resulting from reliance on this material.

Trading involves risks and may not be suitable for all investors. Use your expertise wisely and evaluate all associated risks before making an investment decision. Past performance is not a reliable indicator of future results.

Availability of products and services may vary by jurisdiction. Please ensure compliance with your local laws before accessing them.

Hashtag: #Octa

The issuer is solely responsible for the content of this announcement.

Octa

![]() Octa is an international CFD broker that has been providing online trading services worldwide since 2011. It offers commission-free access to financial markets and various services used by clients from 180 countries who have opened more than 52 million trading accounts. To help its clients reach their investment goals, Octa offers free educational webinars, articles, and analytical tools.

Octa is an international CFD broker that has been providing online trading services worldwide since 2011. It offers commission-free access to financial markets and various services used by clients from 180 countries who have opened more than 52 million trading accounts. To help its clients reach their investment goals, Octa offers free educational webinars, articles, and analytical tools.

The company is involved in a comprehensive network of charitable and humanitarian initiatives, including the improvement of educational infrastructure and short-notice relief projects supporting local communities.

In Southeast Asia, Octa received the ‘Best Trading Platform Malaysia 2024’ and the ‘Most Reliable Broker Asia 2023’ awards from Brands and Business Magazine and International Global Forex Awards, respectively.

Media OutReach

Hong Kong Techathon+ 10th Anniversary Finale and Inaugural Global University Innovation Network (GUIN) Forum Successfully Held

Bringing together local and overseas innovation talents and leaders to deepen cross-border, cross-campus collaboration

HONG KONG SAR – Media OutReach Newswire – 27 January 2026 – Hong Kong Science and Technology Parks Corporation (HKSTP), together with 15 local tertiary institutions, marked a major milestone as Hong Kong Techathon+, the city’s largest international intercollegiate innovation and technology (I&T) annual event, celebrated its 10th anniversary. The Hong Kong Techathon+ Finale was successfully held recently (on 24 January) at Hong Kong Science Park. The team “Cresento” from The Hong Kong University of Science and Technology won the Gold Award in the category of Trusted AI and Data Science under the Local Track (Open Group) as well as the Best Presentation Award voted by the audience.

In parallel, the Global University Innovation Network (GUIN), jointly established by HKSTP and its 15 local tertiary institution partners, convened its inaugural forum on 23 January. The forum brought together GUIN member representatives and academic I&T leaders for in-depth exchanges on innovation and entrepreneurship ecosystem development, further strengthening Hong Kong’s position as an international I&T and talent hub.

Hong Kong Techathon+ is co-organised by HKSTP and 15 local tertiary institutions, including: City University of Hong Kong, Hong Kong Baptist University, Hong Kong Metropolitan University, Hong Kong Shue Yan University, Lingnan University, The Chinese University of Hong Kong, The Education University of Hong Kong, The Hang Seng University of Hong Kong, The Hong Kong Polytechnic University, The Hong Kong University of Science and Technology, The University of Hong Kong, Tung Wah College; and three institutions under the Vocational Training Council – The Technological and Higher Education Institute of Hong Kong, Hong Kong Institute of Vocational Education, and Hong Kong Institute of Information Technology.

Record-high International Participation Highlights Hong Kong’s Role as a Hub for Talent, Markets and Opportunity

This year’s Techathon+ attracted enthusiastic participation from both local and overseas universities, Approximately 1,900 participants formed over 470 teams. Notably, 215 overseas teams joined, underscoring the event’s growing international appeal.

Following rigorous selection, 172 teams advanced to the finale, including 122 local teams and 50 overseas teams from Australia, Brazil, Chinese Mainland, Japan, Kazakhstan, Malaysia, Portugal, Singapore, the Republic of Korea, Taiwan, the UK, and the US. Kazakhstan, Japan, Korea and the UK participated for the first time through their university representatives, further demonstrating Techathon+’s reach as an international platform for I&T exchange.

A Decade of Growth: From a Local Challenge to One of Asia’s Major Inter-University I&T Platforms

HKSTP Chief Executive Officer Mr Terry Wong said: “Since its launch in 2015, Hong Kong Techathon+ has grown from a local challenge to one of Asia’s largest intercollegiate I&T events — driving creativity and collaboration while creating international impact. Techathon+ brings together outstanding young talents across tertiary institutions, turning ideas into innovative solutions that respond to societal needs and carry strong potential for real-world application. The platform has expanded the global pipeline of innovators and entrepreneurs, reinforcing Hong Kong’s role as a hub connecting talents, markets, and opportunities, and writing the next chapter of Hong Kong’s I&T story.”

Beyond a Competition: A Comprehensive “Soft-landing” platform for Entrepreneurship

Hong Kong Techathon+ is more than a university innovation competition. Over the past decade, the platform has engaged over 9,000 participants, nurturing innovative talents and supporting the growth of startups.

Non-local teams also participated in a four-day immersive programme, featuring I&T ecosystem seminars, mentorship, investor matching, visits at Hong Kong Science Park, and tours to Chinese Mainland I&T bases, helping participants explore market expansion opportunities across the Greater Bay Area.

HKSTP also invites selected high-potential finalist teams and winners to join its Ideation Programme, offering up to HK$100,000 in seed funding (along with support aligned with participating universities’ startup programmes), free co-working spaces, access to advanced technology resources and professional mentorship. Through HKSTP’s incubation and industry networks, teams are supported from prototype development to sustainable startups operations – scaling progressively and building international impact.

Amazon Web Services (AWS) is the exclusive Technology Enabler for the 10th Edition of Hong Kong Techathon+, providing participating startups with access to leading cloud and artificial intelligence technologies and platforms. Through this collaboration, AWS offered competing teams technology resources in generative AI and machine learning, professional technical support, and workshop to accelerate innovation and drive Hong Kong’s development as an international I&T hub.

Inaugural GUIN Forum: Deepening Global University Innovation Collaboration

The first Global University Innovation Network (GUIN) Forum was successfully held on 23 January at Hong Kong Science Park, bringing together GUIN member institution representatives and I&T experts. The forum focused on three key areas:

- Exploring strategies for university-industry technology transfer collaboration to achieve win-win innovation outcomes

- Examining the Greater Bay Area as a hub for international innovation collaboration, including opportunities for research commercialisation and cross-border partnership, and

- Strengthening global collaboration networks through actionable pathways.

Speakers included Dr Tony Raven, former CEO of Cambridge Enterprise; Professor Poh Kam Wong, Emeritus Professor at National University of Singapore; and Dr Alwin Wong, Chair of the Association of Technology Transfer Professionals (ATTP), among others.

Co-founded last year by HKSTP and 15 local tertiary institution partners with support from multiple overseas institutions and partners, GUIN aims to bring together leading minds to advance international collaboration in innovation and entrepreneurship, reinforcing Hong Kong’s role as a global talent and innovation hub.

In his welcome address at the forum, Mr Terry Wong, Chief Executive Officer of HKSTP remarked: “We are building GUIN into a ‘global platform for innovation exchange and incubation’ — sharing knowledge, co-creating initiatives, and connecting startups with campus incubation resources and markets worldwide to turn concepts into tangible outcomes.”

Since last summer, HKSTP and university partners have launched the Theme-based Global Incubation Programmes under GUIN with three initiatives currently underway focusing on dentistry, visual technology, and the circular economy. The inaugural ” Global Hub for Future Dentistry” programme has attracted 40 top applicants worldwide. Additional thematic incubation programmes are in preparation, and GUIN members and partner organisations are welcomed to co-develop this expanding international collaboration.

The 10th Edition of Hong Kong Techathon+ Partial Awards List:

Local Track (Student Group)

| Technology Theme | Award | Winning Team | Project Brief |

| Trusted AI & Data Science | Gold | SpeakRight | An AI‑powered voice‑changing solution designed to demonstrate and enhance speech training applications. |

| Sustainability & ESG | Gold | Hydroforge Tech | Development of cost‑efficient AEM electrolysis systems using a binder‑free, self‑growing electrode technology to enable scalable green hydrogen production. |

| Life Science & Healthcare | Gold | Nanos | A tech‑driven Contract Development & Manufacturing Organisation (CDMO) platform that rescues undeliverable drug candidates through proprietary drug‑carrier optimisation, targeting breakthrough therapies including Alzheimer’s. |

| Digital Economy & Smart City | Gold | Smart Mall Wayfinding with AI Paedestrian Dead Reckoning Technology | An AI-powered Pedestrian Dead Reckoning (PDR) solution – an infrastructure‑light indoor navigation that delivers accurate mall wayfinding using AI‑powered pedestrian dead‑reckoning with minimal deployment cost. |

| Tech FYP Group | Gold | OmniWatch AI – A Scalable, Multi-Model AI Proctoring Engine and Invigilator Dashboard | A privacy‑preserving, multi‑modal AI platform for onsite digital exam proctoring that detects suspicious behaviours in real time and enables scalable, non‑intrusive invigilation. |

Local Track (Open Group)

| Technology Theme | Award | Winning Team | Project Brief |

| Trusted AI & Data Science | Gold | Cresento* | A Hong Kong–based sports technology startup developing AI‑powered smart shin guard solution, delivering actionable performance insights for safer, smarter football training. |

| Sustainability & ESG | Gold | Off-Grid AEM Hydrogen Production Driven by Fluctuating Renewable Energy | A modular off‑grid AEM electrolysis system designed for stable hydrogen production from fluctuating renewable energy sources. |

| Life Science & Healthcare | Gold | Illuminatio Medical Technology | A medical imaging startup developing non‑invasive diagnostics to improve the assessment of chronic liver disease (CLD). |

| Digital Economy & Smart City | Gold | MicroLink | A micro‑LED‑based optical interconnect technology enabling faster, more energy‑efficient data transfer for next‑generation AI data centres. |

Global Track

| Technology Theme | Award | Winning Team | Project Brief |

| Life Science & Healthcare | Gold | Cancer Immunotherapy | A next‑generation cancer immunotherapy programme developing novel PD‑1 combination treatments to improve outcomes for solid tumours. |

| Non-Life Science & Healthcare | Gold | ROTOBOOST | ROTOBOOST develops Thermo‑Catalytic Decomposition (TCD) technology to produce low‑cost, low‑carbon hydrogen from diverse hydrocarbon feedstocks, enabling efficient pre‑combustion carbon removal at industrial scale. |

*Winner of Best Presentation Award voted by the audience.

Hashtag: #HKSTP

The issuer is solely responsible for the content of this announcement.

Media OutReach

Asian Financial Forum in Hong Kong spotlights golden opportunities

The agreement was signed by the Secretary for Financial Services and the Treasury, Christopher Hui, and the Chairman of the Shanghai Gold Exchange, Yu Wenjian.

“The agreement just now signed is far more than a formal document,” said Mr Hui.

“It represents a resolute commitment to advancing the synergistic development of Hong Kong and Shanghai as premier international financial and gold markets. It reflects our joint determination to deepen the integration and complementary strengths of Hong Kong and Shanghai, so that together we can expand our share and influence in the global gold market, and better support Renminbi internationalisation.”

Mr Hui outlined the strategic significance of the agreement and the overall development blueprint for Hong Kong’s gold market.

“In recent years, amid heightened geopolitical uncertainty, inflationary pressures, and ongoing restructuring of the international monetary system, the strategic importance of gold has become even more pronounced,” Mr Hui said.

The agreement covers two major forward-looking areas of co-operation: establishing a high-level, collaborative governance structure for Hong Kong’s new gold central clearing system; and opening new avenues for physical infrastructure synergy and market interconnectivity.

“The signing of this agreement with the Shanghai Gold Exchange marks the dawn of a new chapter—one in which Hong Kong and Shanghai join forces to shape the future of global gold markets,” Mr Hui said.

A discussion session on gold trading themed “Global Spectrum – Gold Exchange” features expert panelists invited to examine recent market developments and share insights on Hong Kong’s role, potential and opportunity as a world-class gold trading centre. Speakers include overseas experts James Emmett, Chief Executive Officer, MKS PAMP SA and David Tait, Chief Executive Officer, World Gold Council.

Other highlights on day one of the AFF include a keynote luncheon speech by Dr José Manuel Barroso, former President of the European Commission, former Prime Minister of Portugal, and current Chairman of Goldman Sachs International Advisory Board, to share his insights on the current global landscape and macro‑level challenges.

Other notable speakers today include Zou Jiayi, President of Asian Infrastructure Investment Bank; Scott Morris, Vice-President (East and Southeast Asia, and the Pacific) of the Asian Development Bank; Mehmet Şimşek, Minister of Treasury and Finance of Türkiye; Klemen Boštjančič, Deputy Prime Minister and Minister of Finance of Slovenia; H.E. Waleed Saeed Abdul Salam Al Awadhi, Chief Executive Officer of Securities and Commodities Authority of United Arab Emirates; Burkhard Balz, Member of the Executive Board of the Deutsche Bundesbank; Rhee Chang-yong, Governor of the Bank of Korea; and Gokul Laroia, Chief Executive Officer Asia of Morgan Stanley.

The AFF serves as the opening event of the International Financial Week in Hong Kong, featuring over 10 partner activities covering a range of global financial and business topics, including ASEAN opportunities, asset and wealth management, and artificial intelligence.

Hashtag: #hongkong #brandhongkong #AFF #HKTDC #FSTB #finance

![]() https://www.brandhk.gov.hk/

https://www.brandhk.gov.hk/![]() https://www.linkedin.com/company/brand-hong-kong/

https://www.linkedin.com/company/brand-hong-kong/![]() https://x.com/Brand_HK/

https://x.com/Brand_HK/![]() https://www.facebook.com/brandhk.isd

https://www.facebook.com/brandhk.isd![]() https://www.instagram.com/brandhongkong

https://www.instagram.com/brandhongkong

The issuer is solely responsible for the content of this announcement.

Media OutReach

UABBHK 2025 Concludes with a Civic Performance in the Age of AI

UABBHK 2025 transformed traditional architectural exhibitions into a dynamic civic performance, positioning artificial intelligence (AI) not as a tool, but as a platform to co-create ethical, inclusive, and human-centred futures. Through immersive installations, public workshops, and experimental formats, UABBHK 2025 invited audiences to participate in the design of the city — in real time.

“The Biennale has not only showcased the possibilities of design in the AI era, but also activated a civic platform where architecture, technology and public imagination intersect,” said Ar. Allen Poon, Chairman of The Hong Kong Institute of Architects Biennale Foundation, during the ceremony. “Today’s conclusion marks both a milestone and a beginning — a new phase of creative exploration among Hong Kong, Shenzhen and the world.”

Exhibition Highlights: Tech Meets Imagination

UABBHK 2025 unfolded across two venues, Oil Street Art Space (Oi!) and the newly opened East Kowloon Cultural Centre (EKCC), showcasing 25 curated exhibits by architects, artists, researchers, and technologists from Hong Kong and beyond. Teams from 10+ regions, including Chinese Mainland, Hong Kong, Taiwan, as well as Australia, Austria, Italy, Japan, Singapore, the Netherlands, the UK, and the USA, explored how AI can be integrated into architectural thinking, spatial storytelling, and participatory design. Among the highlights were 4 video screening works that extended the exhibition’s themes through cinematic and documentary perspectives, addressing topics such as displacement and homecoming, the entanglement of code and culture, and speculative futures shaped by collective memory and student-led design fictions. Interactive installations like Prompt[Pond]ering, Sentient Mirror, and Collaborative Ephemeral Pavilion invited audiences to co-design spaces through AI-driven interactions. Works such as LANdLine Project and Flower Market Imaginaries grounded these future-facing visions in Hong Kong’s unique community and cultural context.

“In curating UABBHK 2025, we imagined AI not as a threat, but as a collaborator — a partner in rehearsing the future of our cities,” shared by Dr. Jimmy Ho and Ar. Aron Tsang, Lead Curators of UABBHK 2025. “We are proud to have created a platform that enables technology to be tangible, and civic imagination visible.”

Extending Impact: Public Programmes on Innovation & Collaboration

To extend the UABBHK 2025’s engagement beyond the galleries, two flagship public programmes were launched to bring AI and urban thinking into action: the ArchiTech Hackathon and the Hetao Vision: AI Video Competition.

ArchiTech Hackathon: Bridging Architecture and AI

Held earlier on the 24 January morning and co-hosted with Google Developer Group Hong Kong (GDGHK), the ArchiTech Hackathon was a first-of-its-kind 3-hour collaborative event that brought together 40 architects, developers and students — half from the HKIA Young Architects Group (YAG) and half from GDGHK — to explore how AI can support architectural workflows. The participants learned to use Google’s Gemini model and no-code platforms to build AI agents for architectural design code compliance.

Led by Mr. Frankie Wu from GDGHK, Ms. Adeline Chan and Ar. Owen Lam, Executive Curators of UABBHK 2025, the event embodied UABBHK’s vision by fostering cross-disciplinary collaboration between the tech and design communities, showcasing AI as a practical and imaginative tool for the built environment.

The winning team is Mr. Eric Chan and Ar. Toby Chiu. They successfully built the AI agent for the competition in an astonishing time of 3 minutes, 56.32 seconds within a 60-minute timeframe, and was able to answer 10 questions, as required by the competition, completing the complex professional architect exam questions with 90% accuracy under four minutes.

Hetao Vision: Innovative AI Video Competition

Also announced during the ceremony were the winners of the Hetao Vision AI Video Competition, which invited creators to imagine the future of the Hetao Shenzhen-Hong Kong Science and Technology Innovation Co-operation Zone (HSITP). All entries were required to be fully AI-generated — both visually and aurally — using tools such as Runway, Pika Labs, Suno, and Udio.

The competition explored how AI can democratise futurology, letting creators of all backgrounds envision interconnectivity, innovation, and inclusiveness across the “one river, two banks” vision of Hetao.

The winning video,titled 深港河脈:一河兩岸的科創樞紐宏圖(Shenzhen-Hong Kong River Network: A Grand Vision for a Science and Technology Innovation Hub Across Both Banks) by Mr. Zhang Xiaoshan, was praised for utilising AI to create a convincing narrative of a cross-border innovation hub, demonstrating a profound understanding of the development of the Hetao area. Two additional finalists were also recognised for their distinctive storytelling and technical creativity.

A public screening of the shortlisted videos will be held in the Hetao Science and Technology Innovation Centre, in February 2026, allowing the public to reflect on the role of AI in imagining future urban life.

What’s Next: Visit UABBSZ and Explore the Living Archive

UABBHK 2025 will continue its journey in the Shenzhen & Hong Kong Bi-City Biennale of UrbanismArchitecture (Shenzhen) (UABBSZ) from January to March 2026. Whether you participated in the Hong Kong Edition or missed it, we warmly welcome you to visit the parallel venue of UABBSZ, at the Shenzhen Hetao Science and Technology Innovation Centre. Come and view the selection of UABBHK 2025 exhibits, continuing the creative dialogue and collaboration between Hong Kong and Shenzhen.

In addition, UABBHK 2025’s ideas and output will remain accessible through a dedicated digital gallery website and a forthcoming archive booklet, both will preserve the curatorial vision, exhibited works, and public interactions from this edition. These resources will serve as an open, living archive — a springboard for future conversations across architecture, AI, and urban futures.

Hashtag: #UABBHK

The issuer is solely responsible for the content of this announcement.

About The Hong Kong Institute of Architects Biennale Foundation

The Hong Kong Institute of Architects Biennale Foundation is a non-profit making organisation established and incorporated in 2014 for charitable purposes. The objects for which the Biennale Foundation is established are:

- To promote creativity and advance the understanding, appreciation and interest of architectural and design excellence

- To encourage cross-border and cross-disciplinary dialogue and collaboration among creative professionals from Hong Kong, other parts of the Greater China region and overseas

- To support art, design, architectural and cultural education for students and youth, the community, and policy makers

- To create a favourable environment for study, research and experimentation of design, art and architectural works in an exhibition scale

- To energise and revitalise specific sites of interests by introduction of cultural and creative events

About the Cultural and Creative Industries Development Agency

The Cultural and Creative Industries Development Agency (CCIDA), formerly known as Create Hong Kong (CreateHK) since 2009, was established in June 2024. CCIDA is a dedicated office under the Culture, Sports and Tourism Bureau of the Government of the Hong Kong Special Administrative Region (HKSAR Government) to provide one-stop services and support to the cultural and creative sectors with a mission to foster a conducive environment in Hong Kong to facilitate development of the arts, culture and creative sectors as industries. CCIDA’s strategic foci are nurturing talent and facilitating start-ups, exploring markets, promoting cross-sectoral and multi-disciplinary collaboration, promoting industrialisation of the arts, culture and creative sectors under the industry-oriented principle, and fostering a creative atmosphere in the community, thereby reinforcing Hong Kong as Asia’s creative capital and our positioning as the East-meets-West centre for international cultural exchange.

-

Feature/OPED6 years ago

Feature/OPED6 years agoDavos was Different this year

-

Travel/Tourism9 years ago

Lagos Seals Western Lodge Hotel In Ikorodu

-

Showbiz3 years ago

Showbiz3 years agoEstranged Lover Releases Videos of Empress Njamah Bathing

-

Banking8 years ago

Banking8 years agoSort Codes of GTBank Branches in Nigeria

-

Economy3 years ago

Economy3 years agoSubsidy Removal: CNG at N130 Per Litre Cheaper Than Petrol—IPMAN

-

Banking3 years ago

Banking3 years agoSort Codes of UBA Branches in Nigeria

-

Banking3 years ago

Banking3 years agoFirst Bank Announces Planned Downtime

-

Sports3 years ago

Sports3 years agoHighest Paid Nigerian Footballer – How Much Do Nigerian Footballers Earn