Media OutReach

Singapore Sports Hub renamed The Kallang, signals push to bring more diverse and accessible experiences across sport, entertainment, lifestyle and community

The Kallang is a vibrant precinct that encompasses all current infrastructure and assets that was previously known as the Singapore Sports Hub. It is not just a venue for events, but also a destination where memorable moments are made. The Kallang Group is the corporate entity that will continue to oversee the management, programming and delivery of world-class experiences at The Kallang, driving the next chapter of growth for the precinct.

Keith Magnus, Chairman, The Kallang Group, and Quek Swee Kuan, Chief Executive Officer, The Kallang Group, unveiled the new brand name at a launch event held at the Bank of Singapore (BOS) Lounge at the National Stadium. Joining them to celebrate the occasion were The Kallang Group staff and more than 300 stakeholders and partners representing The Kallang’s four pillars – sport, entertainment, lifestyle and community.

Growth since 2022 takeover

Since the 2022 government takeover, The Kallang has gone from strength to strength, delivering more sport, entertainment and lifestyle event days, and significantly increased event attendance. The energy continued into 2025, with The Kallang hosting world-class sporting events such as the World Aquatics Championships and the World Para Swimming Championships. Alongside performances by global icons like Lady Gaga, who chose Singapore as her only stop in Asia, this year’s robust event calendar has further solidified The Kallang’s position as the excitement epicentre of Singapore.

The Kallang has also hosted numerous community events such as the National School Games, Majulah Fiesta, GetActive!, and ONE Countdown, creating meaningful opportunities for people of all ages to come together and strengthen their connection with this iconic precinct.

Keith Magnus, Chairman, The Kallang Group, shared, “The launch of The Kallang marks an exciting new chapter for us. Over the past three years, this precinct has transformed into a dynamic hub for world-class sport, entertainment and community life, hosting over 4,000 event days and welcoming more than nine million visitors. The Kallang Group’s legacy of creating tangible impact extends beyond the numbers. What inspires us is the spirit this place now carries. Our ambition is for The Kallang to become the excitement epicentre of Singapore – a place where global acts, local heroes and everyday Singaporeans unite to share unforgettable experiences that strengthen our national fabric.

“The Kallang is not just a world-class venue. It is a feeling, a connection, a shared memory. This brand launch reflects our commitment to build a precinct that belongs to all Singaporeans – and to ensure The Kallang becomes one of the most exciting and loved destinations in the region for generations to come.”

Why “The Kallang”

In Singapore, “Kallang” represents more than a name or location. It is a powerful yet emotional symbol of national pride. Rooted in Singapore’s collective consciousness, “Kallang” has always represented a space where people unite through competitions, celebrations and shared experiences like the National Day Parade.

“Kallang” has been home to both the previous and current National Stadium, hosting countless memorable moments that united the nation. It is where the legendary “Kallang Roar” and “Kallang Wave” emerged as fans rallied behind Team Singapore, transforming individual voices into a powerful chorus of national pride.

This rich sporting legacy forms the foundation upon which The Kallang now builds. The transition from Singapore Sports Hub to The Kallang represents our evolution – where we broaden our identity while honouring our sporting heritage. It embraces our collective memories while strengthening our belief that sport, entertainment, lifestyle and community form the pillars of a dynamic ecosystem.

Commitment to delivering world-class experiences

The Kallang will continue to serve its purpose as a vibrant, multi-use destination that brings people together through world-class sport, entertainment, lifestyle and community experiences, contributing to the broader vision of bringing the wider Kallang Alive precinct to life.

The Kallang’s new tagline, “Feel Alive”, captures its inventive spirit of creating exciting experiences for all across sport, entertainment, lifestyle and community.

This tagline is anchored on the four brand values of:

- Connection: The Kallang will continue to build meaningful networks in the community, aided by how it designs space, creates events and fosters a sense of belonging between people and destination.

- Vibrancy: The Kallang is a place built for people, ideas and memories. The energy is woven into the fabric of the destination: where people train, play, perform and gather.

- Excellence: The Kallang plans every moment with care and operates with precision to ensure a stellar experience for all.

- Leadership: The Kallang continues to bring in firsts and build its momentum with world-class partners as the excitement epicentre of Singapore.

Yip Pin Xiu, Singapore’s most decorated Paralympian said “For Team Singapore athletes, The Kallang has always been a training ground and stage for world-class excellence. This refreshed identity will continue to inspire the nation and provide a home for iconic sporting moments like the World Aquatics Championships and World Para Swimming Championships.”

“The best venues don’t simply stage events — they create powerful connections between athletes and their fans,” said Charles Hsiung, President of APG and Women’s Tennis Association Tournament Board Representative for the APAC region. “The Kallang’s strength lies in its efficiency, multifunctional capability, and clear delivery of the organisation’s values and mission. It is a dynamic platform for Singapore to elevate the live event experience, inspire athletes to perform their best, deliver memorable moments that resonate deeply with fans across the world, and strengthen the region’s role in the global sport landscape.”

Ensuring diverse programmes for everyone and bringing spaces and experiences to life

The Kallang Group is committed to engaging different communities through our diverse programmes, and bringing spaces and experiences in the precinct to life.

Countdown 2026 at The Kallang, an annual signature countdown event and The Kallang Group’s first event under the new corporate name, brings communities together to usher in the new year as one. This year’s event will feature a thrilling programme, including the Countdown 2026 Concert headlined by K-pop group Super Junior and family-friendly community activities across The Kallang. The community can also look forward to the longest countdown fireworks in Singapore for this year – 35 minutes across four chapters – as the sky above the Kallang Basin lights up in vibrant colours.

To further curate a truly unique experience for our patrons, The Kallang Group announced the introduction of The Kallang Pass, which will grant one lucky winner a pair of tickets to attend a variety of events held at the National Stadium and Singapore Indoor Stadium in 2026. To stand a chance to win The Kallang Pass, patrons must attend Countdown 2026 at The Kallang on 31 December. All Singapore Residents aged 18 and above are eligible to participate. Register your interest here.

Infrastructure Enhancements

To shape a new era of vibrancy across sport, entertainment, lifestyle and community, The Kallang Group has lined up a series of infrastructure enhancements that will elevate the experiences of everyone who steps into The Kallang.

Visitors can look forward to new alfresco food and beverage concepts, a new sheltered padel ecosystem, refreshed family-friendly spaces and more.

An exciting tenant lineup will refresh the area into a community-centric and community-activated plaza that embodies the active spirit of The Kallang.

The action will add vibrancy to the waterfront, lined with new and experiential alfresco dining concepts. This inviting and dynamic esplanade will become the new go-to hangout along the Kallang Basin, serving up new gastronomical experiences from day to night.

The family-favourite Splash-N-Surf will evolve into an enhanced playscape for children of all ages, incorporating water play with active zones that engage the senses. The space will also introduce a sheltered padel ecosystem with competition-ready courts, combining competitive sports, active lifestyle and play all in one venue. The iconic Climb and Bouldering Walls in the mall will also be enhanced to bring new experiences to climbers of all levels.

The enhancement works will start in phases from Q2 2026, with the revitalised mall slated for completion in 2028. The mall will remain operational throughout the works.

Amplifying positive social impact on the community

The Kallang Group is committed to giving back and be a force for good in our community. We work closely with partners, schools and charity organisations to make sports, entertainment and recreational activities more accessible to underserved groups. We provide opportunities for youths, families, seniors and various community groups to participate in inclusive programmes, as well as support volunteerism in social causes and create shared experiences that strengthen our community. These efforts reflect our belief that The Kallang should serve as an inclusive space where Singaporeans from all walks of life can connect and thrive together.

Mr. Magnus added, “As we enter this next phase of growth, we are elevating both the curation and the hardware of the precinct with major upgrades, new national facilities and an even bolder calendar of marquee events. At the same time, we remain grounded in purpose. Since 2023, The Kallang Group has partnered more than 100 charities to create thousands of opportunities for their beneficiaries to enjoy world-class live experiences. We are now exploring a philanthropic fund to give donors and well-wishers a direct role in uplifting the communities we serve. Together, these efforts express who we are today and the kind of impact we aim to make for the future.”

Please find all media assets here.

Hashtag: #SingaporeSports #SportsHub #SportsCommunity #SingaporeLifestyle #SGEvents #LiveEvents

![]() https://www.thekallang.com.sg/

https://www.thekallang.com.sg/

The issuer is solely responsible for the content of this announcement.

The Kallang

The Kallang (formerly the Singapore Sports Hub) is Asia’s iconic destination for sporting, entertainment, lifestyle and community experiences. Managed by The Kallang Group (formerly Kallang Alive Sport Management), The Kallang is a vibrant ecosystem in the heart of Singapore that is building on its rich legacy as a national stage and cultural landmark by hosting and organising world-class sporting events, live entertainment and inclusive community activities for all. The Kallang stands as the excitement epicentre of Singapore for patrons from all corners of the world, and where they feel alive.

Home to unique, best-in-class sports and entertainment facilities within the city, The Kallang plays an integral role in accelerating the development of Singapore’s sports and tourism industry. The Kallang includes the following facilities:

- A 55,000-capacity National Stadium with a retractable roof and movable tiered seating

- A 12,000-capacity Singapore Indoor Stadium with pillarless interior

- A 6,000-capacity OCBC Aquatic Centre that meets World Aquatics standards

- A 3,000-capacity OCBC Arena which is scalable and flexible in layout

- Kallang Tennis Hub, Singapore’s first international tournament-ready indoor tennis facility

- Kallang Football Hub housing Singapore’s National Training Centre for football

- Water Sports Centre featuring kayaking and canoeing

- 41,000 sqm Kallang Wave Mall, including indoor climbing wall and Splash-N-Surf facility (Kids Waterpark, Stingray and Lazy River)

- Promenade that encircles the National Stadium

- Singapore Youth Olympic Museum & Singapore Sports Museum

- Shimano Cycling World

- Daily community facilities and activities, including beach volleyball, hard courts (futsal, basketball and netball), lawn bowls, giant chess, skate park and running & cycling paths.

For more information, please visit The Kallang’s website ![]() here.

here.

Media OutReach

Zoho Corporation Surpasses One Million Paying Organisations as Customers

On its 30th Anniversary, Zoho Corporation exceeds milestone of 150 million users

SINGAPORE – Media OutReach Newswire – 5 March 2026 – Zoho Corporation, a global technology company, today marked its 30th anniversary with the announcement of two major company milestones. Zoho Corporation, consisting of Zoho, ManageEngine, Qntrl, and TrainerCentral, is now a trusted technology provider to more than one million paying customers and more than 150 million users globally. Today’s announcement follows significant YoY customer (32%) and revenue (20%) growth in 2025.

Zoho Corporation would foremost like to thank every one of its customers, big and small, whose loyalty and support has had an outsized impact on the company’s foundation, growth, and future success. To honor that commitment, Zoho Corporation is shining a light on a few dedicated customers, whose success it is proud to have helped support.

“‘What made us stick with Zoho for so long is consistency and trust. Zoho continues to invest in its platform with a clear long-term vision, not short-term trends. The products are stable, well integrated, and designed to support real business needs, which allows us to confidently recommend Zoho to our clients year after year,” said Alexon Garcia, Technical Delivery Manager, Devtac, Philippines. “As Zoho turns 30, we would like to thank the people building the products. Your focus on privacy, value, and practical innovation truly sets Zoho apart in the market. It shows that the company is built for the long run and not driven by hype.”

“For almost a decade of using Zoho Desk and Zoho SalesIQ, we have seen a huge improvement in the way we handle tickets and access reports, enabling our team to make faster, data-driven decisions. Over time, Zoho has naturally become an integral part of our daily operations because it is easy to use, reasonably priced, and continues to evolve based on real feedback from its users. A big thank you to the Zoho team for building such a powerful SaaS platform—we look forward to continuing to grow together in the years to come,” said Wildan Zubaidi, VP of Customer Experience, PT Biznet Gio Nusantara, Indonesia.

“During periods of rapid business expansion and operational complexity, particularly when organizations needed to move from fragmented systems to integrated digital platforms, Zoho played a critical role. Solutions such as Zoho CRM, Creator, Analytics, and Finance applications enabled faster decision-making, improved visibility, and operational resilience, especially during times of disruption and digital transformation. These moments reinforced Zoho’s value not just as a software provider, but as a strategic enabler,” said Henry Soo, Founder, DataDevelop Consulting Ltd., Hong Kong.

Recent customers to Zoho Corporation include: In the United States, Rapid Response Monitoring and Synergy Home Care; In India, Mercedes-Benz India, Force Motors, Joyalukkas and Union Bank of India; in the UK/European Union, Flora Food Group, Handl Tyrol and Atout France; in Middle East-Africa, Al-Ahli Saudi FC and Al Qadsiah FC; in LATAM, Grupo Gonher; and in Brazil, Creditas and Editora Globo.

“Being bootstrapped, private, and built entirely in-house makes Zoho an outlier among competitors,” says Sridhar Vembu, Co-founder and Chief Scientist, Zoho Corporation. “But vendors don’t need our help, businesses do, which is why delivering customer value has, for 30 years, been Zoho Corporation’s North Star. Before any innovation, strategy, or guiding principle becomes a product, pivot, or policy, it must first affirm the question, ‘Will this help businesses?’ We are incredibly grateful that companies around the world have responded so positively to our customer-first approach over the past three decades, and will continue to meet the evolving needs of businesses with powerful, scalable, and affordable solutions.”

To learn more about the unique growth stories of Zoho Corporation’s customers over 30 years, visit here.

Hashtag: #ZohoCorporation

https://www.zoho.com![]() https://www.linkedin.com/company/zohoapac

https://www.linkedin.com/company/zohoapac

The issuer is solely responsible for the content of this announcement.

About Zoho Corporation

With 60+ apps in nearly every major business category, Zoho Corporation is one of the world’s most prolific technology companies. Zoho is privately held and profitable with more than 19,000 employees globally with headquarters in Austin, Texas and international headquarters in Chennai, India. Zoho APAC HQ is located in Singapore. For more information, please visit: www.zoho.com/

Zoho respects user privacy and does not have an ad-revenue model in any part of its business, including its free products. The company owns and operates its data centers, ensuring complete oversight of customer data, privacy, and security. More than 150 million users around the world, across hundreds of thousands of companies, rely on Zoho everyday to run their businesses, including Zoho itself. For more information, please visit: https://www.zoho.com/privacy-commitment.html

Media OutReach

Southco’s New Heavy-Duty Rotary Latch Simplifies Cab Access While Enhancing Operator Safety

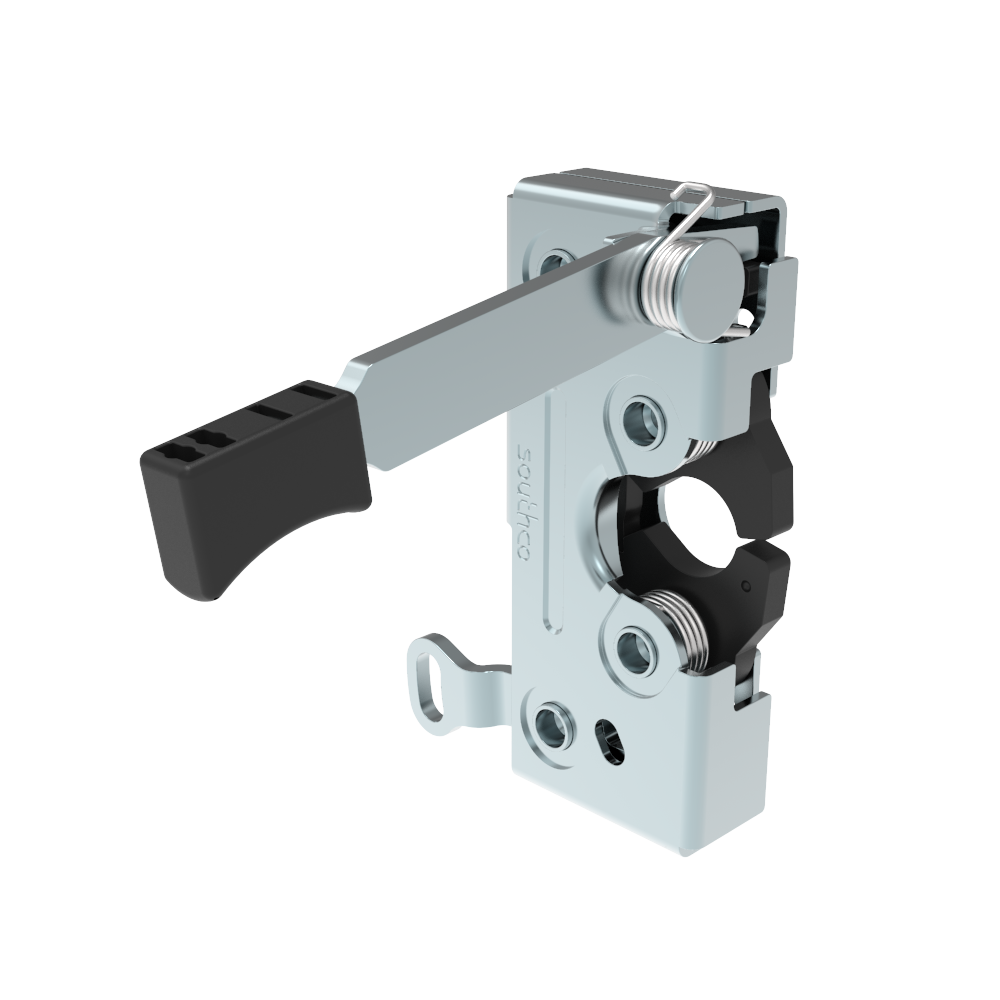

The new R4-50 Rotary Latch provides the heavy-duty performance that modern machinery demands, to tackles vibrations, safety-risking accidental releases, and complex access delays in rough environments.

Engineered for demanding conditions, the R4-50 delivers:

- Independent interior and exterior actuation – making it easier and safer to enter and exit equipment cabs.

- A pre-loaded interior hand lever – purpose-built for high-impact environments, reducing noise and vibration while ensuring smoother, more reliable operation.

- Accidental actuation prevention – minimizing unintended movement to keep operators secure and equipment protected.

- Flexible release options – including remote actuator connection via cable or rod, or direct push release, to meet different cab design needs.

Southco’s R4 Rotary Latch series is highly durable, and is available in a variety of configurations that meet customer needs with little to no modification, including compact mechanical and electromechanical designs made of durable materials suitable for any environment. R4-50 Rotary Latches with Dual Triggers are compliant with FMVSS 206 impact standards, IP65 dust and water intrusion standards, EN 45545-3 fire protection standards, as well as applicable vibration standards.

As a heavy-duty upgrade to Southco’s trusted R4 Rotary Latch line, the R4-50 with Dual Triggers combines operator safety, rugged durability, and simplified access in one cost-effective system. The latch is also compatible with Southco AC actuators, offering OEMs a low-investment, high-value option for enhancing their cab entry solutions.

Global Product Manager Cynthia Bart adds, “The new R4-50 Rotary Latch with Dual Triggers offers a complete, highly versatile cab door entry system for use in heavy-duty construction and agricultural vehicles. The latches are compatible with Southco AC Actuators, allowing designers to quickly and affordably upgrade their existing designs.”

For more information about the functionality of R4-50 Rotary Latches, please visit southco.com or email the 24/7 customer service department at in**@*****co.com

Hashtag: #Southco

The issuer is solely responsible for the content of this announcement.

About Southco

Southco, Inc. is the leading global designer and manufacturer of engineered access solutions. From quality and performance to aesthetics and ergonomics, we understand that first impressions are lasting impressions in product design. For over 75 years, Southco has helped the world’s most recognized brands create value for their customers with innovative access solutions designed to enhance the touch points of their products in transportation and industrial applications, medical equipment, data centers and more. With unrivalled engineering resources, innovative products and a dedicated global team, Southco delivers the broadest portfolio of premium access solutions available to equipment designers throughout the world.

Media OutReach

DBS Hong Kong collaborates with Know Your Customer Limited to further improve digital account opening for SMEs

Leveraging Know Your Customer’s cutting-edge digital compliance platform, DBS Hong Kong will gain real-time access to comprehensive business verification data — including instant retrieval of official company documents and automatic identification of complex ultimate beneficial ownership (UBO) networks across more than 140 jurisdictions.

This AI-powered automation addresses the traditionally manual and cumbersome SME onboarding processes by streamlining the end-to-end business KYC process, efficiently verifying corporate structures and ownership, reducing manual effort and accelerating onboarding timelines. The result is significantly enhanced operational efficiency and a faster, more seamless onboarding experience for DBS Hong Kong’s business customers.

[Lareina Wang, Head of SME Banking, DBS Bank Hong Kong] said,

” At DBS Hong Kong, we are dedicated to reimagining the customer onboarding experience through continuous digital innovation. By engaging Know Your Customer, we leverage advanced technology to streamline CDD workflows, delivering faster service to our customers. This collaboration also represents a major advancement in automating SME onboarding processes that have historically been complicated and manual, solidifying SME banking position of DBS in the market of Hong Kong. “

Claus Christensen, CEO and Co-Founder of Know Your Customer, added,

“Our service provided to DBS Hong Kong exemplifies how financial technology can simplify complex onboarding challenges. With our global data coverage and AI-powered automation, we empower DBS Hong Kong to accelerate KYC processes and provide business customers with an unrivalled onboarding journey. Together, we are shaping the future of digital banking.”

In recognition of its visionary digital strategy, DBS Hong Kong was named Asia’s Best Digital Bank in 2025 by Euromoney. The bank also continues to lead digital innovation, evidenced by over 70% of Hong Kong SMEs already integrating or exploring AI and digital technologies as part of their operations, according to its recent SME survey.

This transformative collaboration underscores DBS Hong Kong’s unwavering commitment to innovation and delivering safe and trusted digital onboarding solutions in Asia’s rapidly evolving financial landscape.

Hashtag: #KnowYourCustomer

The issuer is solely responsible for the content of this announcement.

About DBS Bank (Hong Kong) Limited

DBS is a leading financial services group in Asia with a presence in 19 markets. Headquartered and listed in Singapore, DBS is in the three key Asian axes of growth: Greater China, Southeast Asia and South Asia. The bank’s “AA-” and “Aa1” credit ratings are among the highest in the world.

Recognised for its global leadership, DBS has been named “![]() World’s Best Bank” by Global Finance, “

World’s Best Bank” by Global Finance, “![]() World’s Best Bank” by Euromoney and “

World’s Best Bank” by Euromoney and “![]() Global Bank of the Year” by The Banker. The bank is at the forefront of leveraging digital technology to shape the future of banking, having been named “

Global Bank of the Year” by The Banker. The bank is at the forefront of leveraging digital technology to shape the future of banking, having been named “![]() World’s Best Digital Bank” by Euromoney and the world’s “

World’s Best Digital Bank” by Euromoney and the world’s “![]() Most Innovative in Digital Banking” by The Banker. In addition, DBS has been accorded the “

Most Innovative in Digital Banking” by The Banker. In addition, DBS has been accorded the “![]() Safest Bank in Asia” award by Global Finance for 17 consecutive years from 2009 to 2025. In 2026, DBS won the “Triple A award – Best Digital Customer Onboarding Experience – Hong Kong”

Safest Bank in Asia” award by Global Finance for 17 consecutive years from 2009 to 2025. In 2026, DBS won the “Triple A award – Best Digital Customer Onboarding Experience – Hong Kong”

DBS provides a full range of services in consumer, SME and corporate banking. As a bank born and bred in Asia, DBS understands the intricacies of doing business in the region’s most dynamic markets.

DBS is committed to building lasting relationships with customers, as it banks the Asian way. Through the DBS Foundation, the bank creates impact beyond banking by uplifting lives and livelihoods of those in need. It provides essential needs to the underprivileged, and fosters inclusion by equipping the underserved with financial and digital literacy skills. It also nurtures innovative social enterprises that create positive impact.

With its extensive network of operations in Asia and emphasis on engaging and empowering its staff, DBS presents exciting career opportunities. For more information, please visit ![]() www.dbs.com.

www.dbs.com.

About Know Your Customer Limited

Know Your Customer Limited is an award-winning RegTech company specialised in next-generation business verification solutions for financial institutions and regulated organisations worldwide. For teams struggling with inefficient client due diligence and onboarding processes, Know Your Customer offers an intuitive digital compliance workspace that combines unmatched real-time registry data, covering over 140 countries, seamless integrations, and AI-powered smart automation. This streamlined approach transforms the compliance function at its core, allowing customers to customise their solutions by selecting only the functionalities they need, all accessible via a robust REST API.

Founded in Hong Kong in 2015, with a local presence in Singapore, Dublin, London, and Shanghai, Know Your Customer has built a global customer base across 11 verticals and 18 jurisdictions. The company also maintains a wide network of technology and data partners, ensuring high-quality entity data and enhanced compliance processes for its customers.

For more information visit ![]() https://knowyourcustomer.comor follow Know Your Customer Limited on

https://knowyourcustomer.comor follow Know Your Customer Limited on ![]() LinkedIn or

LinkedIn or ![]() X.

X.

-

Feature/OPED6 years ago

Feature/OPED6 years agoDavos was Different this year

-

Travel/Tourism10 years ago

Lagos Seals Western Lodge Hotel In Ikorodu

-

Showbiz3 years ago

Showbiz3 years agoEstranged Lover Releases Videos of Empress Njamah Bathing

-

Banking8 years ago

Banking8 years agoSort Codes of GTBank Branches in Nigeria

-

Economy3 years ago

Economy3 years agoSubsidy Removal: CNG at N130 Per Litre Cheaper Than Petrol—IPMAN

-

Banking3 years ago

Banking3 years agoSort Codes of UBA Branches in Nigeria

-

Banking3 years ago

Banking3 years agoFirst Bank Announces Planned Downtime

-

Sports3 years ago

Sports3 years agoHighest Paid Nigerian Footballer – How Much Do Nigerian Footballers Earn