Showbiz

Nigeria Will Add $2.8b, Kenya $3.2b, SA $13.4b to E&M Sector by 2021—Report

By Dipo Olowookere

A report by PwC titled ‘Entertainment and Media Outlook: 2017 – 2021: An African Perspective’ has revealed that during the period under review, Nigeria will contribute about $2.8 billion to the Entertainment and Media industry.

According to the report, “In terms of total E&M revenue, Nigeria is one of the fastest-growing countries in our Outlook, but this figure must be treated with caution, as a huge proportion of that growth comes from Internet access revenue alone–specifically mobile Internet access revenue.

“Of the $2.8 billion that the Nigerian market will add between 2016 and 2021, all but $452 million will come from Internet access revenue. The combined elements of TV and video will add nearly $200 million in revenue growth to 2021.”

PwC, in the report, explained that the Outlook was a comprehensive source of analyses and five-year forecasts of consumer and advertising spending across five countries (South Africa, Nigeria, Kenya, Ghana and Tanzania) and 14 segments: Internet, data consumption, television, cinema, video games, e-sports, virtual reality, newspaper publishing, magazine publishing, book publishing, business-to-business publishing, music, out-of-home, and radio.

The report further pointed out that it observed significant shifts are underway in how Africa’s E&M companies compete and generate value, as the quality of the experience they deliver to consumers becomes their primary basis for strategic differentiation and revenue growth.

To thrive in a marketplace that is increasingly competitive and crowded, companies are focusing on implementing strategies and building capabilities to engage with consumers.

It said for Kenya, “The E&M industry was worth $2.1 billion in 2016, up 13.6 percent on 2015. Revenue is forecast to grow at an 8.5 percent CAGR over the next five years, hitting the $3 billion mark in 2020, and totalling $3.2 billion in 2021.

“Internet access is the most established industry within the Kenyan market, boasting the largest revenues and one of the highest growth rates to 2021.”

However for Ghana, its E&M industry is beginning to gear up.

“In 2012, total revenue was just at $214 million, but four consecutive years of year-on-year growth above 25 percent have led it to revenues of $685 million in 2016. This is forecast to more than double over the next five years, with revenues of $1 billion being surpassed in 2019 and a total of $1.5 billion forecast for 2021, thanks to a 16.5 percent CAGR,” the report stated.

According to PwC, “Tanzania’s total E&M revenue stood at $504 million in 2016, but is set to more than double to $1.1 billion in 2021, a 17.2 percent CAGR over the coming five years.

“The symbolic crossing of the $1 billion mark is set to occur in 2021. This is significant growth from 2012 where the industry stood at just $175 million.”

The report, in its analysis of the South African market, said by 2021, total E&M revenue in the country is expected to reach R177.9 billion (about $13.4 billion), up from R132.7 billion in 2016.

It noted that internet access remains the key growth driver and will account for R27 billion of this increase.

The fastest growing sectors will be virtual reality (VR) and e-sports compounded annually at 72.6% and 39.6%, although these segments are still new revenue lines and remain the smallest in terms of absolute revenue numbers. Although overall growth in revenue will hold up, it is expected to slow down by the end of 2021.

“Companies that wish to capture value amid shifting consumer preferences and business model disruptions must focus on an increasingly prominent source of competitive advantage: the user experience. They must harness technology and data to attract, retain and engage users–and convert them into devoted fans,” says Vicki Myburgh, Entertainment and Media Industry Leader for PwC Southern Africa. These imperatives assume a larger importance because, as we document in the Outlook, the entertainment and media industry is confronting several challenges to continued top-line growth.

Digital spend will continue to drive the overall growth. Nearly 40% of total spend will be derived from Internet access in revenue. South Africa’s mobile Internet penetration is forecast to rise to 77.8% by the end of 2021 from 52.3% in 2016. This increased Internet penetration will drive mobile Internet access revenues, which are projected to grow by a CAGR of 10.7% to nearly R62 billion.

South Africa can expect a CAGR of 7.2% for consumer revenue over the forecast period, rising from R87.4 billion in 2016 to R123.7 billion in 2021. The largest contributor will be Internet access, with a 48% share in 2016 rising to 56% in 2021.

South Africa continues to remain the largest TV market on the African continent, with total revenues of R40.9 billion in 2016. The total TV market is estimated to be worth R51.2 billion by 2021. At this time, end-user spending (Pay-TV subscriptions, physical and Internet home video and license fees) will account for 56.7% of the total TV market.

The video game market is also performing well and revenue is forecast to grow at a CAGR of 15.4% to reach R5.4 billion in 2021, up from R2.6 billion in 2016. The primary growth driver in the video games market is social/casual gaming revenue, which will be worth R3.7 billion by 2021. Furthermore, the console and PC markets are experiencing a significant shift towards digital and online/micro transaction revenue, which will exceed physical sales for the first time in 2020.

The growing interest in gaming is helping to fuel the rapid growth in the related segment of VR and e-sports. As a segment that only reached consumers in 2016, almost the entire VR market is new. According to the Outlook, the consumer VR content market will be worth R455 million by 2021. Of this, R282 million will be spending on VR video.

Alongside video, the B2B market is showing continued growth. In 2016 revenues grew by 3.8% to R9.7 billion and by 2021 this is forecast to rise to R11 billion, a CAGR of 2.6%. The slowdown in growth is largely attributable to ongoing macroeconomic challenges which are likely to weigh on B2B revenues.

The South African cinema sector currently presents a mixed picture. Overall revenue, including box office and cinema advertising, is expected to reach R2.2 billion in 2021, up from R1.9 billion in 2016. South Africa continues to be an attractive destination for international filmmakers. Although some short-term economic and political issues are impacting the film sector, it is expected in the long term to continue to expand.

South Africa’s music industry is on a growth curve with live music being a key driver. Live music revenue is expected to rise from R1.2 billion in 2016 to R1.7 billion in 2021, a CAGR of 7.4% over the forecast period.

It is notable that only one digital subcomponent is seeing a significant decline in the entire Outlook – digital music downloading revenue, which is forecast to see a -15.7% CAGR, as consumers shift from ownership to access. Digital music streaming revenue is forecast to rise at a CACR of 34.5% to 2021, reaching R518 million in that year. This growth rate is only beaten by new revenue lines from VR and e-sports.

Among the largely non-digital segments, magazines and newspaper revenue are set to continue their decline. Total newspaper revenue in the South African newspaper market has been unpredictable. The market showed growth in 2013, declined in 2014 and bounced back marginally in 2015, contracting at a slower rate. In 2016, total newspaper revenue was worth R8.9 billion, but this figure is forecast to drop to R7.4 billion in 2021. Marginal growth is expected for the book publishing industry over the next five years. The educational book market will contract by a -0.1% CAGR. On the contrary, professional titles and consumer books will exhibit some growth as e-book revenues continue to grow.

The report shows that South Africa’s total entertainment and media advertising revenue is expected to rise to R54.2 billion by 2021 from R45.3 billion in 2016, representing a 3.7% CAGR. TV advertising remains dominant, but in terms of absolute growth it is Internet advertising that is almost an equal contributor, helped by a sizeable 12.9% CAGR.

Myburgh says: “It is clear that something fundamental has changed in the entertainment and media industry. E&M companies that have become accustomed to competing and creating differentiation, based primarily on content and distribution, need to focus more intensely on the user experience. The marketplace has increasingly become more competitive, slower-growing and dependent on personal recommendations.

“Thriving in this new world of intense competition and continual disruption will be challenging. The opportunities are, however, immense. Across the industry, the resulting quest to create the most compelling, engaging and intuitive user experiences is now the primary objective for growth and investment strategies, with technology and data at the centre.

“Accordingly, companies will need to develop strategies to engage, grow and monetise their most valuable customers: their fans.”

Showbiz

New Drama Alert: Africa Magic’s Latest Shows to Watch on GOtv

Just when you thought GOtv was done bringing top-tier entertainment, it’s back with more! If you’ve been sleeping on Our Husband and The Yard, now is the time to catch up. Plus, a brand-new drama, Wings, is here to take you on a thrilling ride.

Wings – Love, Power, and Dangerous Secrets

Investigative journalist Deino Akume never backs down from a story. When she crosses paths with Yani Goma, the powerful COO of Sun’Su Airlines, she is drawn to him. But beneath the airline’s glamorous image lies a dark underworld of smuggling and corruption,

As Deino digs deeper, she realizes Yani may be part of the very crimes she’s trying to expose. Now, she faces an impossible choice– pursue the truth and risk everything, or protect the man she’s falling for.

With tension, betrayal, and shocking twists. Wings will keep you on the edge of your seat! Don’t miss the premiere of Wings on Africa Magic Showcase, GOtv Channel 8.

Other new Africa Magic shows you do not want to miss are Our Husband and The Yard.

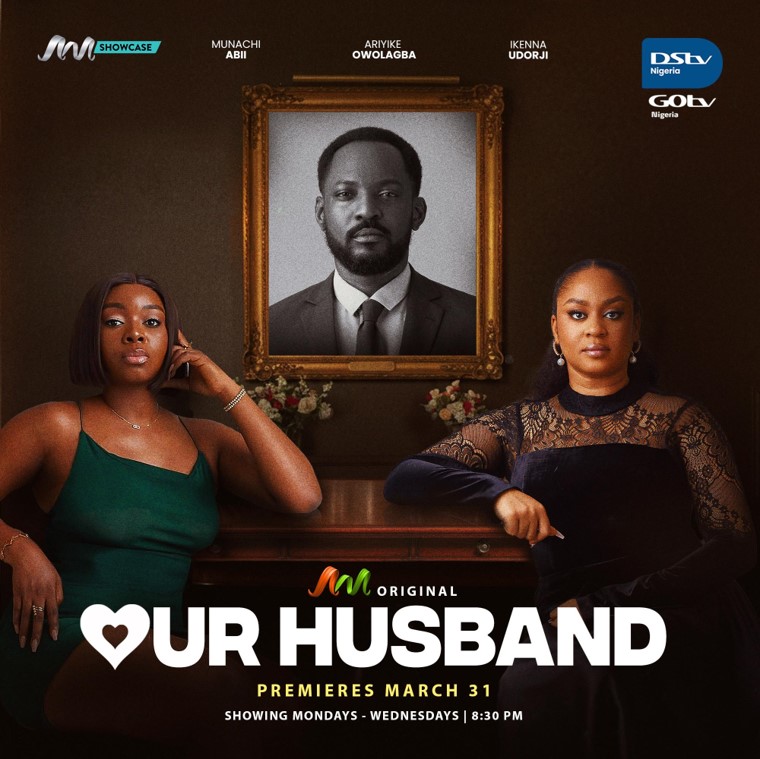

Our Husband, a marriage built on lies.

Zara Nnamani thought she had the perfect marriage until her husband suddenly drops dead, exposing a shocking truth. His side chick, Tiny, enters the picture, and instead of mourning, Zara is forced into an uneasy alliance with Tiny. With secrets, betrayal, and a mysterious death hanging over them, can these two women survive each other? Find out on Africa Magic Showcase, GOtv Channel every Monday to Wednesday at 8:30 PM.

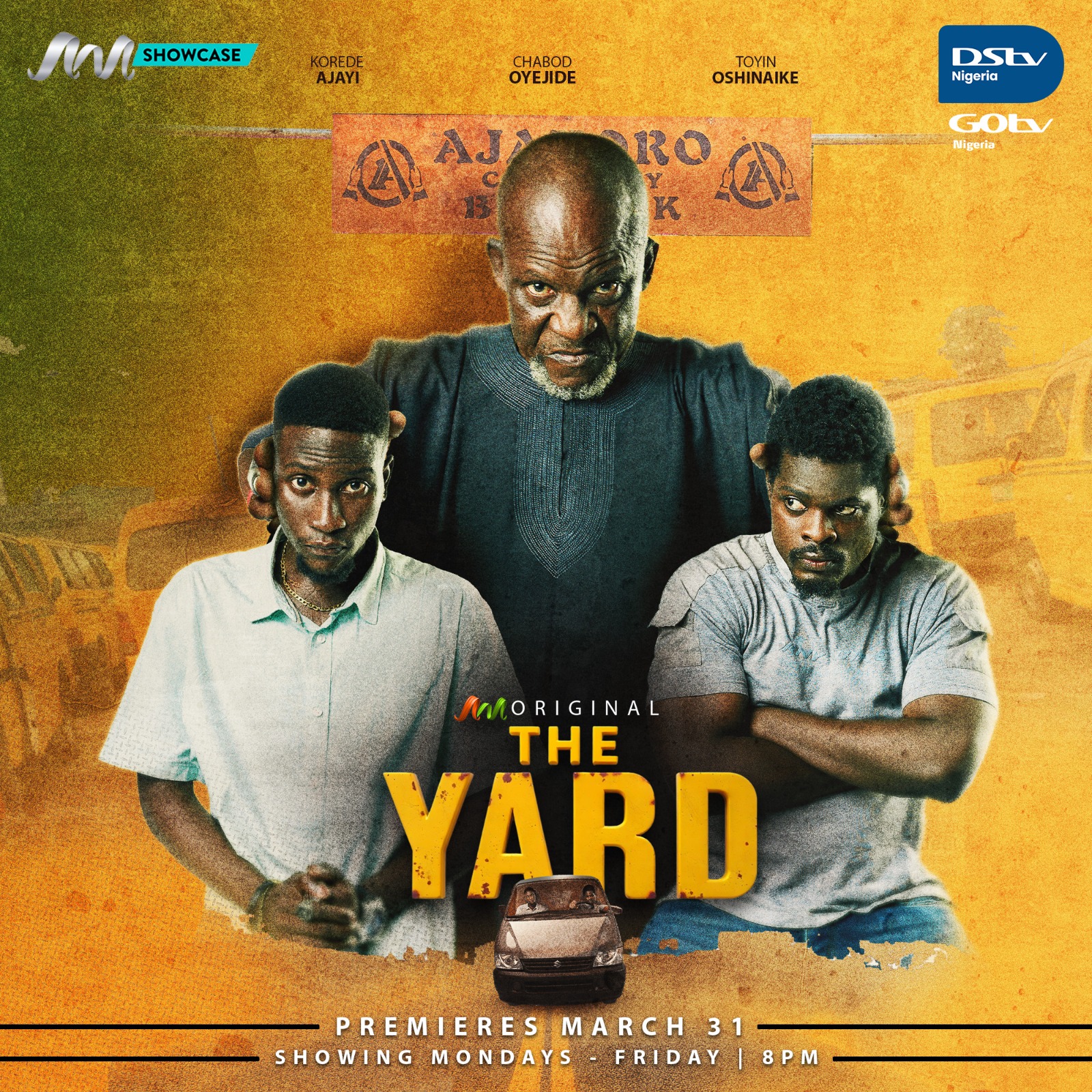

Then there’s The Yard –Power, Survival & Revenge

In the gritty streets of Ajagoro, power is everything. Tega, a hustling bus driver, just wants to survive as he’s left with overwhelming debts incurred from the sudden death of his father. On the other hand, Odafe Junior, the son of a powerful bus park boss, refuses to follow in his father’s footsteps. But when fate pulls both boys together, they have one goal– bring down Chief Odafe. However, power has a way of changing people. Will Tega become the very thing he despised? The Yard is a gripping tale of ambition and power, airing every Monday to Wednesday at 8:00 PM on Africa Magic Showcase.

Do not just hear about it, experience it. Step up now to unlock a world of exciting and entertaining programs. To upgrade, subscribe, or reconnect, simply download the MyGOtv app or dial *288# and download the GOtv Stream App to enjoy your favourite shows anytime, anywhere.

Showbiz

Voices of the Future: How MultiChoice Talent Factory Filmmakers are Redefining African Storytelling

Africa’s creative landscape is transforming, driven by the dynamic voices of Generation Z. This tech-savvy, socially conscious, and unapologetically authentic generation are not just consuming content; they are shaping it. Through film, television, and digital media, they are challenging norms, driving culture, and defining the future of African entertainment.

With one of the youngest populations in the world, Gen Z’s influence on Africa’s cultural landscape is undeniable. From activism movements like #EndSARS in Nigeria to the Finance Bill protests in Kenya, young Africans are making their voices heard across various sectors, including entertainment. Their stories are not only relevant; they are becoming the cornerstone of the modern African narrative.

Gen Z’s evolving media consumption habits reflect their desire for authenticity and representation. According to the PwC Africa Entertainment and Media Outlook 2024–2028, Nigeria’s over-the-top (OTT) streaming is set to grow at a 10.5% compound annual growth rate, while linear TV is expected to increase by 8.1%. Similarly, in Kenya, OTT streaming is projected to grow by 10.9%, with linear TV seeing a smaller 3.2% rise. These statistics highlight the shift towards digital platforms, where Gen Z seeks content that aligns with their realities.

An Ernst & Young (EY) survey reinforces this trend, revealing that authenticity is the most valued trait in content among Gen Z. They crave stories that mirror their experiences, struggles, and aspirations, unfiltered and true to life. This is where young African filmmakers are stepping in, bringing fresh perspectives and narratives that resonate deeply with their audience.

Recognising the importance of nurturing this new wave of filmmakers, MultiChoice Africa’s leading entertainment powerhouse has invested in the MultiChoice Talent Factory (MTF) academies in Lagos, Lusaka, and Nairobi. These academies equip aspiring creatives with the skills to excel in storytelling, production, and cinematography. Each year, 60 filmmakers graduate from the MTF programme, stepping into the industry with innovative ideas and techniques. Many of these filmmakers go on to produce critically acclaimed films that captivate audiences across the continent.

The significance of the MTF initiative is reflected in the continued success of its alumni. Films such as Gone (West Africa), Everything Light Touches (West Africa), The Immersive Alarm (East Africa), Deadbeat (East Africa), Mwananga (Southern Africa), and Rivals in Time (Southern Africa) were nominated for the AMVCAs, showcasing the impact of MTF-trained filmmakers. Past standout productions like Irora Iya, Obi Di Omimi, and Inu Jin have also earned critical acclaim, further cementing the diversity and depth of storytelling coming from MTF alumni.

These achievements highlight a fundamental shift in the media landscape: Viewers are now creators. By empowering young filmmakers to tell their stories, MultiChoice has played a pivotal role in this transformation. The work of MTF alumni proves that authentic African stories, told by Africans, have the power to lead the way in global entertainment.

Showbiz

Watch, Laugh, Bond: The Best Shows for Every Occasion

TV isn’t just about what you watch, it’s about who you watch it with. We can’t deny that there is something special about watching TV with people you care about. The random side comments, someone laughing before the funny part even lands, or that one person who starts asking questions in the middle of the show.

It is the little things that make watch parties fun and GOtv makes it even easier to enjoy these moments. Whether you’re cuddled up with your partner, hanging with your siblings, or catching up on drama with your long-distance best-friend, here is how to make every viewing moment feel perfect.

A Night in with your partner

You and your partner might have had a long day and you both want something chill. Well, that is the perfect time to grab a blanket, order your favourite food or warm something quick, and press play on ‘Forgiveness’ on Africa Magic Showcase (Ch. 8). It’s one of those emotional stories that spark real conversations like the kind where someone suddenly asks, “Would you still love me if I did that?” You’ll laugh, get a little teary, and pause at least once to argue about who was wrong. It’s not just a movie night, but also a perfect time to bond with your partner.

Family Movie Night

There is nothing more wholesome than having the whole family gather in front of the screen. A perfect choice for family movie night is Anna Ferrah’s Story on Saturday at 8:00 PM on Africa Magic Family (Ch. 7). It’s packed with emotions and lessons thateveryone in the family can learn from. It is also the kind of entertainment that will make everyone more intentional about the bond in the family, including your dad who swears he doesn’t like TV.

Movie Night With The Crew

Friends are over, the snacks are ready, and all that’s missing is the perfect show to bring all the vibes. My Flatmates on Africa Magic Family (Ch. 7) is exactly what you need– pure comedy, full of drama in the best way. It would almost feel like you’re watching your own friend group on screen and this is a great way to unwind with your crew and initiate the playful banter.

Virtual watch party for long distance best friends

You and your best friend might be living in different cities, but that doesn’t mean you can’t still binge-watch something together. Plan a virtual watch party and both tune into The Reunion of the Real Housewives of Lagos on Africa Magic Showcase (Ch. 8) on April 13. You already know how it goes, one of you will text first saying “Omg, did you see that part?”. The best part about watching something as juicy as a reunion for RHOL is that you’re not just watching, but you and your best friend would probably have a topic to talk about throughout the week and might even turn the virtual watch party to a tradition for reality shows.

Solo Movie Night

Sometimes, the best nights are the ones you spend alone, just you, your favorite snack, and a good movie. If you are feeling like kicking back and letting the world pause for a bit, it’s the perfect time to watch Ill Fated on Africa Magic Showcase (Ch.8). Elfreda, a freshman at the University of Lagos, befriends her troubled neighbour Femi, unaware he’s a victim of illegal research. Their relationship grows, despite danger. It is packed with intrigue and thrill. The unfolding story will keep you glued to the screen, with no need to talk to anyone. It is just you, yourself, and a deeply emotive story with no interruptions.

So, no matter the occasion, GOtv has the perfect shows to keep you entertained. In order not to miss out, quickly renew your subscription or upgrade your package today via the MyGOtv app or dial *288#. And if you are out and about, you can still catch your favoriteshows anytime, anywhere with the GOtv Stream App

-

Feature/OPED5 years ago

Feature/OPED5 years agoDavos was Different this year

-

Travel/Tourism9 years ago

Lagos Seals Western Lodge Hotel In Ikorodu

-

Showbiz2 years ago

Showbiz2 years agoEstranged Lover Releases Videos of Empress Njamah Bathing

-

Banking7 years ago

Banking7 years agoSort Codes of GTBank Branches in Nigeria

-

Economy2 years ago

Economy2 years agoSubsidy Removal: CNG at N130 Per Litre Cheaper Than Petrol—IPMAN

-

Banking2 years ago

Banking2 years agoFirst Bank Announces Planned Downtime

-

Sports2 years ago

Sports2 years agoHighest Paid Nigerian Footballer – How Much Do Nigerian Footballers Earn

-

Technology4 years ago

Technology4 years agoHow To Link Your MTN, Airtel, Glo, 9mobile Lines to NIN