Technology

15Wins Ventures Unveils Z-Habitat Hub

By Adedapo Adesanya

15Wins Ventures, a Dutch-based venture builder, has launched Z-Habitat Hub in Lagos, marking a new chapter in the company’s efforts to support innovation and entrepreneurship in Nigeria.

The launch, which happened on Thursday, October 24, 2024, was attended by key dignitaries, including The Netherlands Ambassador to Nigeria, Mr Bengt van Loosdrecht; The Netherlands Consul General in Lagos, Mr Michel Deelen; Mrs Sonia Onovughakpo Fajusigbe, Policy Advisor on Entrepreneurship, Youth Employment & Health Care, Consulate General of the Netherlands in Lagos; Mrs Valkamiya Ahmadu, Senior Policy Advisor on Economic & Political Affairs (Abuja); and Mr Adebola Adebowale, Chief Programme Analyst for Lagos State.

15Wins Ventures spans across Europe, the Middle East, and Africa, fostering innovation and growth through strategic partnerships in high-impact technology sectors.

Commenting on the significance of Z-Habitat in driving innovation and creating equitable opportunities for underserved communities, Mr Bengt van Loosdrecht said, “We see Z-Habitat Hub as a powerful connection point – a place where ideas can take root and thrive through collaboration. Many people in the West do not realize that Nigeria is a country on the brink of transformation.

“The domestic private sector, driven by young, well-educated individuals, is flourishing. This is a dynamic I have seen in other rapidly developing regions, and I believe Nigeria’s youth are on the cusp of an exciting future.’’

His remarks preceded the ribbon-cutting ceremony, which officially opened the hub’s doors to the Nigerian innovation ecosystem.

The launch of Z-Habitat underscores 15Wins Ventures’ commitment to fostering homegrown innovation and providing a structured, supportive environment for Nigerian entrepreneurs.

As the Lagos startup landscape continues to thrive, Z-Habitat is poised to play a critical role in helping entrepreneurs turn their ideas into impactful solutions that drive long-term growth.

The Z-Habitat Hub will host various programs, including workshops, mentorship sessions, and networking events, all aimed at empowering Lagos’s startup ecosystem. The hub’s mission aligns with 15 Wins Ventures’ goal to build a sustainable foundation for African tech development, bridging resources from its base in the Netherlands to local talent in West Africa.

Reflecting on the vision behind Z-Habitat, Mr Nelson T. Ajulo, Chief Executive Officer of 15Wins Ventures, highlighted the hub’s role as a transformative force within the Lagos startup ecosystem.

“Z-Habitat is a place where technology, creativity, and entrepreneurial spirit come together. Our mission is to provide local entrepreneurs and creatives with the resources, mentorship, and networks they need to turn their ideas into impactful solutions,” he said.

“Through Zarttalent, we have trained nearly 500 students and provided scholarships to underserved women. Now, with Z-Habitat, we are expanding our commitment to empowering Nigeria’s youth and the broader community.’’

Technology

Emergent Ventures, Others Invest $2.2m in Potpie

By Dipo Olowookere

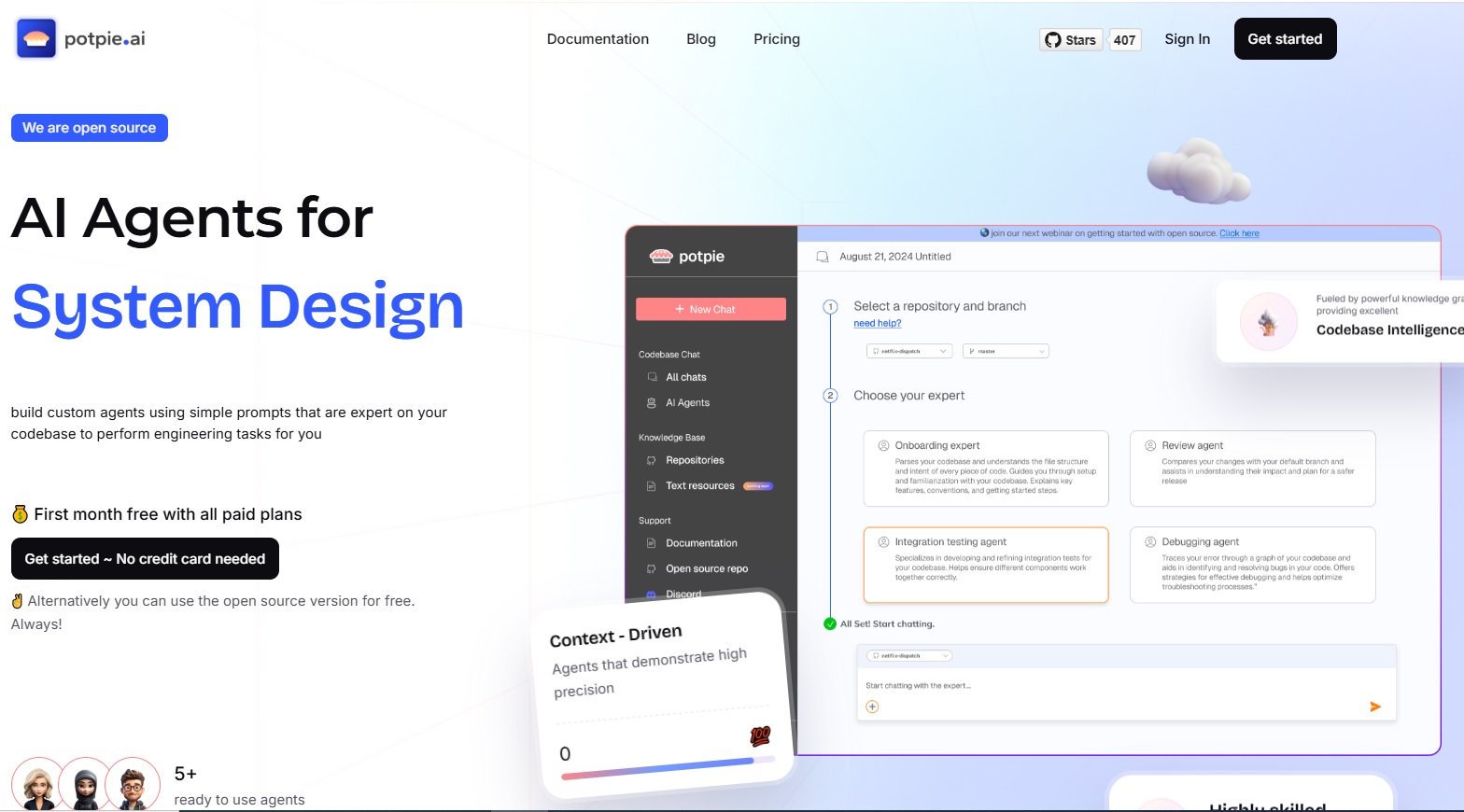

About $2.2 million pre-seed round to help engineering teams unify context across their entire stack and make AI agents genuinely useful in complex software environments has been announced by Potpie.

Potpie was established by Aditi Kothari and Dhiren Mathur, who were determined to unify context across the entire engineering stack and enabling spec driven development.

As generative AI adoption accelerates, most tools focus on surface-level code generation while ignoring the deeper problem of context.

Large language models are powerful, but without access to system-level understanding, tooling history, and architectural intent, they struggle in real production environments.

Traditional approaches rely on senior engineers to manually hold this context together, a model that breaks down at scale and fails when AI agents are introduced.

The platform enables teams to automate high-impact and non-trivial use cases across the software development lifecycle, like debugging cross-service failures, maintaining and writing end-to-end tests, blast radius detection and system design.

It is designed for enterprise companies with large and complex codebases, starting at around one million lines of code and scaling to hundreds of millions.

Rather than acting as another coding assistant, Potpie builds a graphical representation of software systems, infers behaviour and patterns across modules, and creates structured artefacts that allow agents to operate consistently and safely.

A statement made available to Business Post on Monday revealed that the funding support came from Emergent Ventures, All In Capital, DeVC and Point One Capital.

The capital will be used to support early enterprise deployments, expand the engineering team, and continue building Potpie’s core context and agent infrastructure, it was disclosed.

“As AI makes code generation easier, the real challenge shifts to reasoning across massive, interconnected systems. Potpie is our answer to that shift, an ontology-first layer that helps enterprises truly understand and manage their software,” Kothari was quoted as saying in the disclosure.

A Managing Partner at Emergent Ventures, Anupam Rastogi, said, “In large enterprises, the real challenge is not generating code, it is understanding the system deeply enough to change it safely.

“Potpie’s ontology-first architecture, combined with rigorous context curation and spec-driven development, creates a structured model of the entire engineering ecosystem. This allows AI agents to reason across services, dependencies, tickets, and production signals with the clarity of a senior engineer. That is what makes Potpie uniquely capable of solving complex RCA, impact analysis, and high-risk feature work even in codebases exceeding 50 million lines.”

Technology

Expert Reveals Top Cyber Threats Organisations Will Encounter in 2026

By Adedapo Adesanya

Organisations in 2026 face a cybersecurity landscape markedly different from previous years, driven by rapid artificial intelligence adoption, entrenched remote work models, and increasingly interconnected digital systems, with experts warning that these shifts have expanded attack surfaces faster than many security teams can effectively monitor.

According to the World Economic Forum’s Global Cybersecurity Outlook 2026, AI-related vulnerabilities now rank among the most urgent concerns, with 87 per cent of cybersecurity professionals worldwide highlighting them as a top risk.

In a note shared with Business Post, Mr Danny Mitchell, Cybersecurity Writer at Heimdal, said artificial intelligence presents a “category shift” in cyber risk.

“Attackers are manipulating the logic systems that increasingly run critical business processes,” he explained, noting that AI models controlling loan decisions or infrastructure have become high-value targets. Machine learning systems can be poisoned with corrupted training data or manipulated through adversarial inputs, often without immediate detection.

Mr Mitchell also warned that AI-powered phishing and fraud are growing more sophisticated. Deepfake technology and advanced language models now produce convincing emails, voice calls and videos that evade traditional detection.

“The sophistication of modern phishing means organisations can no longer rely solely on employee awareness training,” he said, urging multi-channel verification for sensitive transactions.

Supply chain vulnerabilities remain another major threat. Modern software ecosystems rely on numerous vendors and open-source components, each representing a potential entry point.

“Most organisations lack complete visibility into their software supply chain,” Mr Mitchell said, adding that attackers frequently exploit trusted vendors or update mechanisms to bypass perimeter defences.

Meanwhile, unpatched software vulnerabilities continue to expose organisations to risk, as attackers use automated tools to scan for weaknesses within hours of public disclosure. Legacy systems and critical infrastructure are especially difficult to secure.

Ransomware operations have also evolved, with criminals spending weeks inside networks before launching attacks.

“Modern ransomware operations function like businesses,” Mitchell observed, employing double extortion tactics to maximise pressure on victims.

Mr Mitchell concluded that the common thread across 2026 threats is complexity, noting that organisations need to abandon the idea that they can defend against everything equally, as this approach spreads resources too thin and leaves critical assets exposed.

“You cannot protect what you don’t know exists,” he said, urging organisations to prioritise visibility, map dependencies, and focus resources on the most critical assets.

Technology

NCC Begins Review of National Telecommunications Policy After 26 Years

By Adedapo Adesanya

In a consultation paper released to the public, the commission said it is seeking input from stakeholders, including telecom operators, tech companies, legal experts, and the general public, on proposed revisions designed to reposition Nigeria’s telecommunications framework to match current digital demands. Submissions are expected by March 20, 2026.

The NTP 2000 marked a turning point in Nigeria’s telecom landscape. It replaced the 1998 policy, introducing full liberalisation and a unified regulatory framework under the NCC, and paved the way for the licensing of GSM operators such as MTN, Econet (now Airtel), and Globacom in 2001 and 2002.

Prior to the NTP, the sector was dominated by Nigerian Telecommunications Limited (NITEL), a government-owned monopoly plagued by obsolete equipment, low teledensity, and poor service. At the time, Nigeria had fewer than 400,000 telephone lines for the entire country.

However, the NCC noted that just as the 1998 policy was overtaken by global developments, the 2000 framework has become structurally misaligned with today’s telecom reality, which encompasses broadband, 5G networks, satellite internet, artificial intelligence, and a thriving digital economy worth billions of dollars.

“The rapid pace of technological change and emerging digital services necessitate a comprehensive update to ensure the policy continues to support economic growth while protecting critical infrastructure,” the Commission stated.

The review will target multiple chapters of the policy. Key revisions include: Enhancements on online safety, content moderation, digital services regulation, and improved internet exchange protocols; a modern framework for satellite harmonisation, coexistence with terrestrial networks, and clearer spectrum allocation to boost service quality, and policies to address fiscal support, reduce multiple taxation, and lower operational costs for operators.

The NCC is also proposing entirely new sections to the policy to address emerging priorities. Among the key initiatives are clear broadband objectives aimed at achieving 70 per cent national broadband penetration, with a focus on extending connectivity beyond urban centres to reach rural communities.

The review also seeks to formally recognise telecom infrastructure, including fibre optic cables and network masts, as Critical National Infrastructure to prevent vandalism and enhance security.

In addition, the commission is targeting the harmonisation of Right-of-Way charges across federal, state, and local governments, alongside the introduction of a one-stop permitting process for telecom deployment, designed to reduce bureaucratic delays and lower operational costs for operators.

According to the NCC, the review aims to make fast and affordable internet widely accessible. “The old framework was largely voice-centric. Today, data is the currency of the digital economy,” the commission said, highlighting the need to close the urban-rural broadband divide.

The consultation process is intended to gather diverse perspectives to ensure the updated policy reflects current technological trends, market realities, and consumer needs. By doing so, the NCC hopes to maintain the telecommunications sector’s role as a key driver of economic growth and digital inclusion.

-

Feature/OPED6 years ago

Feature/OPED6 years agoDavos was Different this year

-

Travel/Tourism10 years ago

Lagos Seals Western Lodge Hotel In Ikorodu

-

Showbiz3 years ago

Showbiz3 years agoEstranged Lover Releases Videos of Empress Njamah Bathing

-

Banking8 years ago

Banking8 years agoSort Codes of GTBank Branches in Nigeria

-

Economy3 years ago

Economy3 years agoSubsidy Removal: CNG at N130 Per Litre Cheaper Than Petrol—IPMAN

-

Banking3 years ago

Banking3 years agoSort Codes of UBA Branches in Nigeria

-

Banking3 years ago

Banking3 years agoFirst Bank Announces Planned Downtime

-

Sports3 years ago

Sports3 years agoHighest Paid Nigerian Footballer – How Much Do Nigerian Footballers Earn

Pingback: 15Wins Ventures Unveils Z-Habitat Hub – Herald Today