Technology

Aella, Amazon Target Unbanked Nigerians for Credit Services

By Adedapo Adesanya

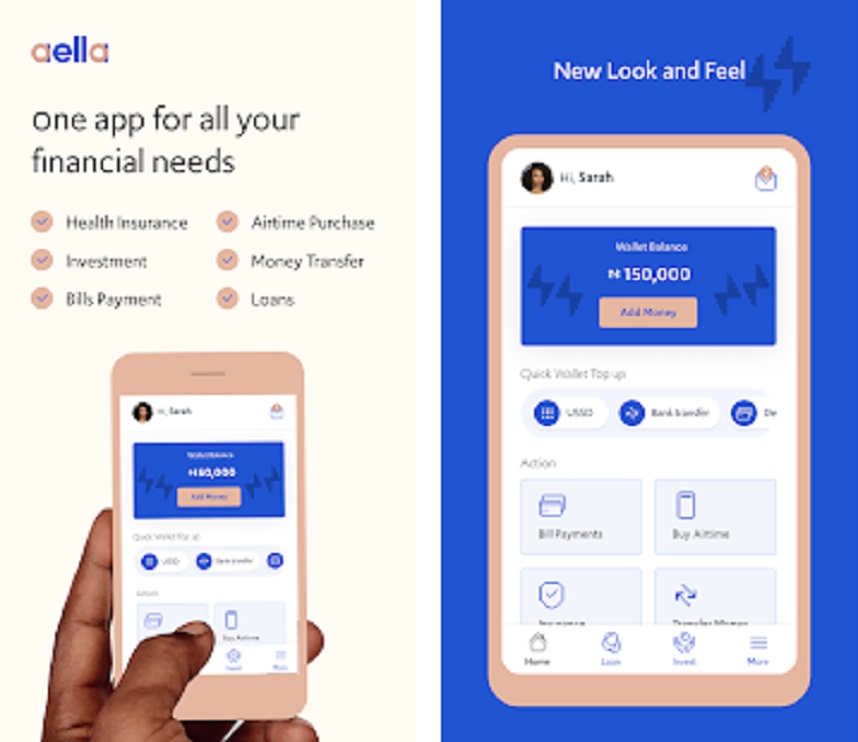

Aella App, Nigeria’s leading single-point financial service and payment solution provider, is working with Amazon Web Services (AWS) to provide quick access to credit and other financial services to underbanked individuals using Amazon Rekognition for identity verification.

Amazon Rekognition is a fully managed computer vision service that enables developers to analyse images and videos for a variety of uses, including face identification and verification, media intelligence, custom industrial automation, and workplace safety.

With the lack of application programming interface (API) infrastructure that allows the real-time verification of government identifications in Nigeria, Aella App is changing the fintech ecosystem by taking advantage of cutting-edge AI technologies and using biometric identity verification on its mobile application, improving the accuracy of facial verification by over 40 per cent.

In a statement, Aella said that this will help to reduce verification errors, increases credit approval speed, provides scalability, and drives financial inclusivity for everyone.

On the collaboration, Aella App’s CEO, Mr Akin Jones said: “With only 38 per cent of Nigerians who have no form of identification, we realised that a vast majority of the population were being left out of financial services, taking away their financial independence and leaving them on the fringe of building bankable credit ratings.

“Our job as a fintech organisation is to come up with more creative ways to bring more people into the ecosystem, reinforcing our commitment to provide products that democratise financial services, ultimately alleviating poverty and driving economic growth in the region.”

On the part of Amazon Web Services, Ms Michelle Lee, the Vice President, Amazon Machine Learning Solutions Lab reaffirmed AWS’s commitment to developing technology that could help tackle some of the world’s hardest problems.

She said, “We are impressed by Aella’s dedication to driving financial independence for the under-banked.

“With the fintech ecosystem in Nigeria accounting for 1.25 per cent of retail banking revenues, it is clear that there is an opportunity to continue democratising financial service access for all.

“We are proud to work with Aella as they strive to ensure everyone from individuals to small business owners are not left without financial support.”

Technology

The Rise of Web3 Developers: Why This Career Path is the Future of Tech

As technology advances, the internet is undergoing a revolutionary shift toward decentralization. Known as Web3, this next phase of the internet is redefining how we interact with digital systems by emphasizing transparency, user ownership, and autonomy.

At the heart of this evolution are Web3 developers—professionals whose expertise in blockchain and decentralized systems is driving innovation and creating exciting new opportunities. Pursuing a Web3 career is not just about adapting to industry trends; it’s about shaping the future of technology. In this article, we’ll explore why Web3 developers are in high demand and how you can step into this promising field.

What is Web3?

Web3 represents the decentralized evolution of the internet. Unlike its predecessor, Web2, where centralized platforms dominate, Web3 leverages blockchain technology to create an ecosystem that is transparent, secure, and community-driven.

Some of the defining features of Web3 include:

- Decentralization: Control is distributed among users rather than being concentrated in a single organization.

- Transparency: Blockchain technology ensures that all transactions and operations are open and verifiable.

- Automation: Smart contracts allow for self-executing agreements, reducing the need for intermediaries.

This paradigm shift has unlocked immense opportunities, particularly for developers who can create, manage, and enhance Web3 applications.

Why a Web3 Career is the Future

- Rapid Growth in Blockchain Technology

Blockchain is no longer just about digital currencies; its applications have expanded to include finance, healthcare, logistics, and gaming, among others.

This rapid adoption is driving an unprecedented demand for Web3 developers to build decentralized applications (dApps) and integrate blockchain solutions across various sectors.

- High Demand and Competitive Compensation

The demand for Web3 talent has outpaced supply, making it one of the most lucrative fields in tech. Web3 developers often earn significantly more than traditional developers due to their specialized skills.

Many roles offer remote and flexible working arrangements, enabling global opportunities.

- Opportunities for Innovation

Web3 is still in its infancy, making it a playground for innovators. From creating decentralized finance systems to building virtual economies in the metaverse, developers have the chance to work on groundbreaking projects that redefine industries.

Key Skills for a Successful Web3 Career

To excel as a Web3 developer, mastering certain skills is essential:

- Programming Knowledge: Proficiency in languages like Solidity, Rust, or Go, commonly used in smart contract and blockchain development.

- Blockchain Fundamentals: A deep understanding of how decentralized networks function and their architecture.

- Smart Contracts: The ability to design and implement self-executing contracts.

- Cryptography: Knowledge of encryption techniques to ensure security in applications.

Soft skills such as adaptability and problem-solving are equally important, given the fast-paced nature of the industry.

Benefits of Pursuing a Web3 Career

A career in Web3 comes with a range of unique advantages:

- Global Reach: The decentralized nature of Web3 opens doors to international opportunities without geographical limitations.

- Future-Ready Skills: Web3 expertise is increasingly sought after, offering a secure and sustainable career path.

- Collaborative Ecosystem: Unlike traditional tech environments, Web3 thrives on open collaboration and community-driven development.

- Freedom to Innovate: Developers have the flexibility to experiment and contribute to transformative projects.

Steps to Start Your Web3 Journey

Breaking into a Web3 career may seem challenging, but with a focused approach, it’s entirely achievable. Here’s how to get started:

Understand the Basics

- Learn the core concepts of blockchain technology, decentralized systems, and smart contracts.

- Explore educational resources, tutorials, and online communities for foundational knowledge.

Develop Technical Skills

- Master programming languages and frameworks commonly used in blockchain development.

- Familiarize yourself with Web3-specific tools and libraries to streamline your workflow.

Build Projects

- Start small by creating basic decentralized applications or experimenting with smart contracts.

- Showcase your work in a portfolio to demonstrate your capabilities for a potential employer.

Engage with the Community

- Join forums, developer meetups, and hackathons to network with others in the field.

- Stay updated on industry trends by following Web3-focused discussions and publications.

Continue Learning

- The Web3 space is constantly evolving, so staying up-to-date with advancements is crucial.

- Seek out certifications or courses to deepen your expertise and credibility.

Challenges and Future Outlook

While the opportunities in Web3 are immense, they come with challenges. The fast-evolving technology requires developers to continually upskill. Additionally, the regulatory landscape for blockchain and decentralized systems is still developing, which may introduce uncertainties. A Web3 career offers more than just a job—it provides a chance to shape the next wave of technological innovation. As industries embrace decentralization, the demand for Web3 developers will only grow. Whether you’re a seasoned tech professional or someone looking to enter the field, now is the perfect time to explore this exciting career path. By stepping into the world of Web3, you’re not just advancing your skills—you’re becoming part of a movement that’s redefining how we connect, transact, and collaborate online. The future of technology is here, and it’s decentralized. Will you be part of it?

Technology

HubPharm Wins FCMB HERccelerate Women in Tech Programme

By Adedapo Adesanya

HubPharm has emerged as the winner of First City Monument Bank (FCMB)’s HERccelerate Showcase Day held recently at Hub One, FCMB’s Innovation Hub in Yaba, Lagos.

The tech accelerator, powered by FCMB’s SheVentures and Hub One and delivered by 8thGear Hub & Venture Studios, was designed to empower women-led startups in Nigeria with the skills and resources needed to secure funding and scale.

HubPharm was the best out of 10 finalists with Midddleman, a platform simplifying payments for African e-commerce businesses sourcing from China coming second, while Onit, a productivity tool designed for African SMEs, secured third place.

The Showcase Day brought together the finalists selected from over 1,000 applications who pitched their innovative solutions to a panel of judges.

Ms Tope Kareem, the co-founder of the startup explained that HubPharm is a digital platform with a retail pharmacy chain which has delivered over 100,000 medications across 15 cities, ensuring 98 per cent on-time delivery with AI-driven logistics.

We plan to explore more options and ensure Nigerians, both at home and abroad, know the importance of prioritizing their health. This funding will enable us to keep growing and making an impact,” she noted.

Speaking on the HERccelerate initiative, Mrs Nnenna Jacob-Ogogo, Group Head of SheVentures, described it as “a testament to what we can achieve when we invest in women. While this is the first pilot of its kind, it is clear that women in tech have the talent, resilience, and vision to drive innovation.”

She also highlighted SheVentures’ broader impact, noting that over the past five years, they have “scaled businesses through four key pillars: access to finance, knowledge, markets, and networks. Our Zero Interest Loan program has provided over N800 million in funding to women entrepreneurs so far, an unprecedented achievement in the industry.”

The top 10 finalists will get free access to Hub One’s coworking space for a year, valued at over N5 million and will also be supported to scale their businesses.

FCMB’s HERccelerate programme is setting a new standard for supporting women in tech, with plans to accelerate over 200 startups in the next five years. By fostering innovation and inclusion, FCMB is shaping a brighter future for women entrepreneurs in Nigeria.

Technology

AI and Web Development: The Unexpected Partnership That’s Changing Everything

By eTraverse

That’s Changing Everything

Imagine a web development company that employs Artificial Intelligence (AI) to produce a completely personalized website in a matter of minutes rather than months. That is the real power of AI for web development.

Artificial intelligence technologies have allowed companies like Wix to generate websites 50% faster, and website developers are now able to reduce coding time by up to 40% with the use of AI tools. In addition to increasing user engagement, these developments in website design and development are also establishing new benchmarks for effectiveness and security.

In this blog, we dive into how AI is transforming web development, offering real-world examples, and compelling metrics.

The Evolution of Web Development

Over time, web development has undergone significant change. Static HTML pages were used in the early development of websites, providing little to no interactivity. With the advent of dynamic web apps, websites could become more interactive and visually appealing thanks to JavaScript, CSS, and HTML5.

Rich, dynamic user experiences replaced static material as of this change. To ensure that websites function flawlessly across all devices and screen sizes, responsive design and sophisticated structures are now the main focuses of current web development.

Web interactions are now more seamless and intuitive than ever thanks to these developments, which have raised the bar for website design and development.

The Emergence and Growth of AI

From a theoretical concept, AI has developed into a potent instrument that is revolutionizing the industry. AI first concentrated on developing computers with intelligence like that of humans.

Important turning points include deep learning, that utilizes neural networks to analyse complex data, and machine learning, where algorithms learn from data. Automated language comprehension is made possible by Natural Language Processing (NLP).

Sectors such as healthcare (AI-driven tools have improved diagnostic accuracy by 20%) and finance (AI forecasts market movements with 90% accuracy) have been transformed by these breakthroughs. AI is currently improving website design and development and changing web development.

AI technologies, for instance, can increase user engagement by 35% and speed up coding by 50%. AI has a significant impact on web development and is establishing new benchmarks for productivity and creativity.

AI’s Impact on Web Development

Enhanced User Experience (UX)

User experience (UX) has been completely transformed by AI thanks to its highly tailored and natural interactions. With AI algorithms analyzing user data to provide recommendations and information that is specifically catered to, personalization is at the forefront.

For instance, AI is used by e-commerce giants like Amazon and Netflix to recommend movies and goods to consumers based on their past interactions, making the user experience more relevant and engaging. Because material is tailored to each user’s tastes, this personalized approach can boost user happiness and retention.

Virtual assistants and chatbots are further important applications of AI in UX. These AI-powered solutions effectively respond to consumer questions and support requests while offering immediate help. For example, Sephora’s chatbot improves the overall shopping experience by assisting customers with product discovery and appointment scheduling.

Virtual assistants, such as those powered by AI like Google Assistant and Siri, offer hands-free interaction and seamless integration into daily activities, improving user convenience and engagement.

Automated Coding and Development Tools

Artificial Intelligence (AI) has brought strong tools to the field of automated coding and development that simplify the coding process. Code generation and code management are being revolutionized by AI-powered solutions like GitHub Copilot and code generators.

For instance, GitHub Copilot uses AI to automate repetitive operations and provide code snippets, freeing up developers to work on more intricate project components. This results in more effective and dependable development by cutting down on coding time by up to 40% and lowering the possibility of errors.

Because these technologies provide standard coding methods and minimize the need for intensive manual testing, they help improve developer collaboration. AI incorporation into development workflows increases code quality and speeds up project completion.

SEO and Content Optimization

Significant advancements in SEO and content optimization have also been made by AI. Large volumes of data are analyzed by AI-driven SEO technologies to improve website visibility and ranking by optimizing content for search engines.

AI is used by programs like Clearscope and MarketMuse to assess the relevance of material and offer recommendations that can be implemented. By using a data-driven strategy, material may be made to comply with SEO guidelines and increase organic traffic.

Predictive analytics is also essential for performance monitoring and content production.

Businesses can create content strategies that are in line with future demands thanks to AI algorithms that predict trends and consumer preferences. This proactive strategy aids in sustaining high levels of engagement and adjusting to shifting market dynamics.

Web Security

AI has a significant impact on web security since it provides cutting-edge methods for detecting and reducing security risks. Real-time pattern analysis and anomaly detection capabilities of AI systems enable them to provide early alerts of possible security breaches. To improve overall security, for example, systems such as Darktrace employ AI to monitor network traffic and spot anomalous activity.

Artificial intelligence (AI) further improves automated security testing and vulnerability assessments, enabling ongoing system and web application evaluation. This keeps sensitive data protected and the internet ecosystem secure by guaranteeing that any vulnerabilities are fixed quickly.

Case Studies and Real-World Examples

Websites and apps with artificial intelligence (AI) enhancements are demonstrating the revolutionary potential of AI in web development. Wix’s Artificial Design Intelligence (ADI) is one notable example. Wix ADI employs artificial intelligence (AI) to generate personalized websites by assessing user preferences and content requirements. With this technology, the process of creating a website has been greatly expedited. Development time has been reduced by 50%, enabling enterprises to launch a polished website more rapidly.

Adobe Sensei, an AI and machine learning platform incorporated within Adobe’s toolkit, is another well-known example. Adobe Sensei improves the creation of websites by offering predictive content, automated tagging, and sophisticated image recognition.

For example, Adobe Sensei’s AI-driven solutions can assess user behavior patterns and streamline content distribution, leading to a 30% rise in user engagement and happiness on platforms that make use of these capabilities.

Success examples demonstrate how AI in web development has real benefits. eBay has introduced AI-powered visual search features that let consumers look for products by utilizing photos rather than text. Conversion rates have grown by 20% and user engagement has improved because of this functionality. Shopify’s use of AI to provide tailored product recommendations has increased sales for its merchants by 35%.

These illustrations show how businesses are using AI to improve user experiences, expedite the development process, and produce quantifiable commercial results. The application of AI in web development is becoming more and more important as it makes digital experiences more effective, customized, and interesting.

Challenges and Considerations

AI ethical considerations include biases in AI and data privacy. Keeping people’s trust requires protecting user data while avoiding biased results. AI dependence raises questions regarding dependence, as it may result in job displacement and less supervision from humans.

Technical challenges also include the potentially difficult and resource-intensive integration of AI with current web frameworks and technologies.

Ethical and efficient web development requires striking a balance between these factors and the advantages of artificial intelligence. By addressing these issues, we can minimize any potential negative effects and ensure that AI breakthroughs have a good impact.

AI and Web Development’s Future

Forecasts and patterns indicate that artificial intelligence (AI) will have a greater impact on web development in the future, propelling advancements in automation and user experience.

Website user and device interactions will change because of emerging technologies like AI in AR/VR and IoT, which will provide more connected and immersive experiences. To remain competitive, web developers of the future will need to combine their traditional talents with AI knowledge. It will be essential to master both traditional web development methods and AI technologies in order to create cutting-edge, intelligent web solutions and adjust to changing industry demands.

eTraverse’s Competency in Using AI for Web Development

eTraverse excels in harnessing AI to elevate web development. Leveraging AI, eTraverse enhances website design and development through advanced tools like AI-driven personalization and automated coding solutions.

Our use of machine learning and predictive analytics optimizes user experiences, delivering tailored content and recommendations. With a focus on integrating AI with existing web frameworks, eTraverse ensures seamless, cutting-edge solutions.

Our expertise extends to AI-enhanced SEO and web security, providing comprehensive, data-driven strategies that drive business growth and efficiency. eTraverse’s innovative approach positions them as a leader in AI-powered web development.

Conclusion

With automation, security, and user experience previously unheard of, the industry is being revolutionized by the incorporation of Artificial Intelligence (AI) into web development. Artificial intelligence (AI) technologies, such as deep learning, machine learning, and Natural Language Processing (NLP), are changing the way websites are created, built, and optimized.

Leading companies, such as eTraverse, are utilizing artificial intelligence (AI) to provide creative solutions that improve website performance and user engagement. Accepting AI simplifies development procedures and creates new opportunities for intelligent, safe, and adaptable web experiences. The revolutionary potential of AI promises a bright future for web development.

-

Feature/OPED5 years ago

Feature/OPED5 years agoDavos was Different this year

-

Travel/Tourism8 years ago

Lagos Seals Western Lodge Hotel In Ikorodu

-

Showbiz2 years ago

Showbiz2 years agoEstranged Lover Releases Videos of Empress Njamah Bathing

-

Banking6 years ago

Banking6 years agoSort Codes of GTBank Branches in Nigeria

-

Economy2 years ago

Economy2 years agoSubsidy Removal: CNG at N130 Per Litre Cheaper Than Petrol—IPMAN

-

Banking2 years ago

Banking2 years agoFirst Bank Announces Planned Downtime

-

Sports2 years ago

Sports2 years agoHighest Paid Nigerian Footballer – How Much Do Nigerian Footballers Earn

-

Technology4 years ago

Technology4 years agoHow To Link Your MTN, Airtel, Glo, 9mobile Lines to NIN