Technology

Sophos Acquires Braintrace to Provide Next Generation Cybersecurity

By Adedapo Adesanya

Sophos, a global leader in next-generation cybersecurity, has announced the acquisition of Braintrace to manage cyber threats and provide responses to its customers.

This further enhances Sophos’ Adaptive Cybersecurity Ecosystem with Braintrace’s proprietary Network Detection and Response (NDR) technology.

Braintrace’s NDR provides deep visibility into network traffic patterns, including encrypted traffic, without the need for Man-in-the-Middle (MitM) decryption. Located in Salt Lake City, Utah, Braintrace launched in 2016 and is privately held.

As part of the acquisition, Braintrace’s developers, data scientists and security analysts have joined Sophos’ global Managed Threat Response (MTR) and Rapid Response teams.

Sophos’ MTR and Rapid Response services business has expanded rapidly, establishing Sophos as one of the largest and fastest-growing MDR providers in the world, with more than 5,000 active customers.

Braintrace’s NDR technology will support Sophos’ MTR and Rapid Response analysts and Extended Detection and Response (XDR) customers through integration into the Adaptive Cybersecurity Ecosystem, which underpins all Sophos products and services.

The Braintrace technology will also serve as the launchpad to collect and forward third-party event data from firewalls, proxies, virtual private networks (VPNs), and other sources.

These additional layers of visibility and event ingestion will significantly improve threat detection, threat hunting and response to suspicious activity.

Speaking on the acquisition, Mrs Joe Levy, chief technology officer, Sophos said, “You can’t protect what you don’t know is there, and businesses of all sizes often miscalculate their assets and attack surfaces, both on-premises and in the cloud. Attackers take advantage of this, often going after weakly protected assets as a means of initial access.

“Defenders benefit from an ‘air traffic control system’ that sees all network activity, reveals unknown and unprotected assets, and exposes evasive malware more reliably than Intrusion Protection Systems (IPS).”

“We’re particularly excited that Braintrace built this technology specifically to provide better security outcomes to their Managed Detection and Response (MDR) customers.

“It’s hard to beat the effectiveness of solutions built by teams of skilled practitioners and developers to solve real-world cybersecurity problems,” he added.

Sophos will deploy Braintrace’s NDR technology as a virtual machine, fed from traditional observability points such as a Switched Port Analyzer (SPAN) port or a network Test Access Point (TAP) to inspect both north-south traffic at boundaries or east-west traffic within networks.

These deployments help discover threats inside any type of network, including those that remain encrypted, serving as a complement to the decryption capabilities of Sophos Firewall.

The technology’s packet and flow engine feed a variety of machine learning models trained to detect suspicious or malicious network patterns, such as connections to Command and Control (C2) servers, lateral movement and communications with suspicious domains.

Since Braintrace built its NDR technology specifically for predictive, passive monitoring, its engine also provides intelligent network packet capture that IT security administrators and threat hunters can use as supporting evidence during investigations. The novel NDR analysis and prediction technique is patent pending.

On his part, Mr Bret Laughlin, CEO and co-founder of Braintrace said, “NDR is critical to successful threat hunting. Braintrace’s competitive differentiation is its unique NDR technology that our MDR analysts leveraged for finding, interrupting and remediating cyberattacks.

“With our own NDR technology, the team responds faster and more accurately because of the real-time, automated visibility and threat verification they have into encrypted traffic.

“We built Braintrace’s NDR technology from the ground up for detection and now, with Sophos, it will fit into a complete system to provide cross-product detection and response across a multi-vendor ecosystem.”

Braintrace’s NDR technology is a key component for defending against cyberattacks today and in the future.

Sophos research demonstrates how adversaries aggressively and constantly change tactics to evade detection and execute their attacks.

Braintrace’s technology helps uncover malicious C2 traffic from malware, such as ColbaltStrike, BazaLoader and TrickBot, as well as zero-days, that could lead to ransomware and other attacks. This visibility allows threat hunters and analysts to pre-empt any potential ransomware attack, including recent strikes by REvil and DarkSide.

Sophos plans to introduce Braintrace’s NDR technology for MTR and XDR in the first half of 2022.

Technology

AI Legal Tech Firm Ivo Gets $55m for Contract Intelligence

By Dipo Olowookere

The sum of $55 million has been injected into an Artificial Intelligence (AI)-powered contract intelligence platform, Ivo, to support product development and scaling as the company deepens its reach across the hundreds of organizations that already rely on its product, including Uber, Shopify, Atlassian, Reddit, and Canva.

The Series B funding round comes after a year of substantial growth in product performance, customer adoption, and market traction to accelerate its mission of making contract intelligence available to every business.

Since its last funding round, Ivo has grown annual recurring revenue by 500 per cent, increased total customers by 134 per cent, and expanded adoption within the Fortune 500 by 250 per cent.

Business Post gathered that the latest funding support came from Blackbird, Costanoa Ventures, Uncork Capital, Fika Ventures, GD1 and Icehouse Ventures.

Ivo is purpose-built for in-house teams that need both reviews with surgical accuracy as well as visibility into their complete contract library.

The company’s AI-powered contract review solution, Ivo Review, allows users to complete reviews in a fraction of the time; customers report saving up to 75 per cent of the time that manual review would demand.

The product standardizes a company’s positions and precedents using playbooks built and implemented by lawyers. This means that every contract is reviewed accurately, consistently, and efficiently, critical for large and globally distributed teams.

“Our goal has always been to make interacting with contracts fast, accurate, and enjoyable. Every key relationship in a business is defined by an agreement, yet most organizations struggle to extract the insights inside them.

“Our focus is to give in-house teams a trustworthy solution that helps them work faster and gives them visibility into their contracts that was previously impossible,” the chief executive and co-founder of Ivo, Min-Kyu Jung, stated.

Also commenting, a Principal at Blackbird, Mr James Palmer, said, “In-house legal teams demand products that are deeply accurate and aligned to how they work. The most sophisticated teams are incredibly selective about the tools they trust.

“Ivo’s traction with some of the world’s best companies shows it consistently exceeds that bar. With exceptional product execution and an uncompromising quality bar, we believe Ivo is defining and leading the category.”

The Senior Manager for Contract Operations at Uber, Ms Kate Gardner, said, “Uber selected Ivo because it was intuitive to use, demonstrated a high level of accuracy, could work in multiple languages, and met its confidentiality requirements. Furthermore, the Ivo team was highly responsive to Uber’s needs.”

Technology

Nigeria Leads in AI for Learning, Entrepreneurship—Google

By Modupe Gbadeyanka

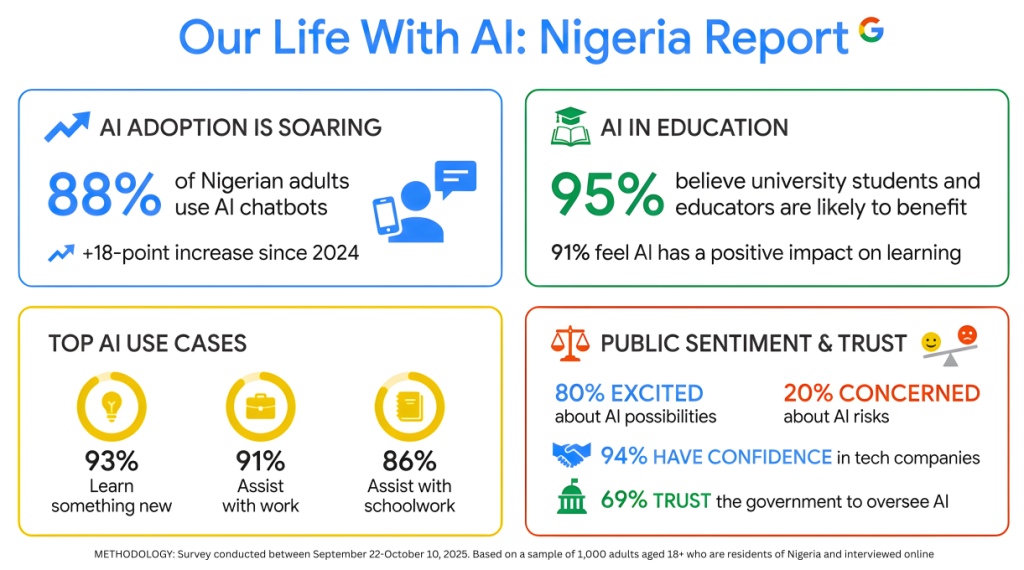

A new report released by global tech giant, Google, in collaboration with Ipsos, has revealed that Nigeria is writing the playbook on Artificial Intelligence (AI) as it leads in AI for learning and entrepreneurship.

In the study titled Our Life with AI: Helpfulness in the hands of more people, it was shown that Nigerians are using AI tools for everything from education to entrepreneurship at a remarkable rate, showing immense optimism for the technology’s future.

It was disclosed that about 88 per cent of Nigerian adults have used an AI chatbot, a huge 18-point jump from 2024, placing the West African country well ahead of the global average of 62 per cent.

It was also found out that while the top use for AI globally has shifted to learning, Nigerians are taking it a step further, using AI as a powerful tool for personal and professional development.

A staggering 93 per cent of Nigerians use AI to learn or understand complex topics, compared to 74 per cent globally, with 91 per cent using the tool to assist them with their work.

In addition, the research observed that 80 per cent of Nigerians are using AI to explore a new business or career change—nearly double the global average of 42 per cent.

Nigerians have overwhelmingly positive feelings about AI’s role in the classroom and beyond, seeing it as a game-changer for education, with 91 per cent feeling AI is having a positive impact on how we learn and access information versus 65 per cent globally.

The report showed that 95 per cent believe university students and educators are likely to benefit from AI, as 80 per cent of Nigerians are more excited about the possibilities of AI, versus just 20 per cent who are more concerned. Globally, the split is much closer at 53 per cent excited and 46 per cent concerned).

Commenting on the findings, the Communications and Public Affairs Manager for Google in West Africa, Taiwo Kola-Ogunlade, said, “It’s inspiring to see how Nigerians are creatively and purposefully using AI to unlock new opportunities for learning, growth, and economic empowerment.

“This report doesn’t just show high adoption rates; it tells the story of a nation that is actively shaping its future with technology, using AI as a tool to accelerate progress and achieve its ambitions. We’re committed to ensuring that AI remains a helpful and accessible tool for everyone.”

Business Post gathered that the research was conducted by Ipsos between September 22 and October 10, 2025, on behalf of Google.

For this survey, a sample of roughly 1,000 adults aged 18+ who are residents of Nigeria and were interviewed online, representing the country’s online population.

Technology

NCC Grants Three Satellite Licences to Boost Broadband Services

By Adedapo Adesanya

The Nigerian Communications Commission (NCC) has licensed three additional global internet service providers, Amazon’s Project Kuiper, BeetleSat-1, and and Germany-based Satelio IoT Services, as part of efforts to strengthen internet connectivity via satellite and to boost competition among existing internet service providers in the country.

Amazon Leo, formerly Project Kuiper, is Amazon’s Low Earth Orbit (LEO) satellite network, designed to provide fast, reliable internet to customers and communities beyond the reach of existing networks, while BeetleSat (formerly NSLComm) is an international company with strong ties to both Israel and Spain, and its corporate structure involves multiple countries, building a Low Earth Orbit (LEO) constellation of 250 satellites to provide high-throughput, low-latency, satellite internet, cellular backhaul, and mobility services globally, and Satelio IoT was approved for its planned 491-satellite IoT system, though only one satellite is currently in orbit.

NCC granted the global internet operators seven-year licences to each to operate in Nigeria from February 28, 2026, to February 28, 2033.

These operators were granted Ka-Band for their frequency band operations, and the licence is renewable after the seven years expiration, according to the regulator.

The NCC’s landing permit authorises Project Kuiper to operate its space segment in Nigeria as part of a global constellation of up to 3,236 satellites.

According to the NCC, the approval aligns with global best practices and reflects Nigeria’s willingness to open its satellite communications market to next-generation broadband providers.

The permit positions Project Kuiper to provide satellite internet services over Nigerian territory and sets the stage for intensified competition with Starlink, currently the most visible Low-Earth Orbit (LEO) satellite internet provider in the country.

The permit also gives Amazon LEO and BeetleSat-1, the legal certainty to invest in ground infrastructure, local partnerships, and enterprise contracts, while giving Nigeria a wider market opportunity to play in space internet service delivery, where Starlink currently operates.

Amazon’s Kuiper will offer three categories of satellite services in Nigeria: Fixed Satellite Service (FSS), Mobile Satellite Service (MSS), and Earth Stations at Sea (ESAS).

FSS enables broadband connectivity between satellites and fixed ground stations, such as homes, enterprises, telecom base stations, and government facilities. This is the core service behind satellite home internet and enterprise backhaul; MSS, by contrast, is designed for mobility and resilience; and ESIM extends high-speed satellite broadband to moving platforms, including aircraft, ships, trains, and vehicles.

These systems rely on sophisticated antennas that can track satellites in real time while in motion, making them critical for aviation and maritime connectivity as well as logistics and transport sectors.

BeetleSat was founded in Israel, where its groundbreaking antenna technology was developed and supported by the Israel Space Agency.

In 2021, it formed a strategic alliance with the Spanish technology group Arquimea, which is now BeetleSat’s largest shareholder and main industrial partner.

-

Feature/OPED6 years ago

Feature/OPED6 years agoDavos was Different this year

-

Travel/Tourism9 years ago

Lagos Seals Western Lodge Hotel In Ikorodu

-

Showbiz3 years ago

Showbiz3 years agoEstranged Lover Releases Videos of Empress Njamah Bathing

-

Banking8 years ago

Banking8 years agoSort Codes of GTBank Branches in Nigeria

-

Economy3 years ago

Economy3 years agoSubsidy Removal: CNG at N130 Per Litre Cheaper Than Petrol—IPMAN

-

Banking3 years ago

Banking3 years agoSort Codes of UBA Branches in Nigeria

-

Banking3 years ago

Banking3 years agoFirst Bank Announces Planned Downtime

-

Sports3 years ago

Sports3 years agoHighest Paid Nigerian Footballer – How Much Do Nigerian Footballers Earn