Technology

Why Developers Transfer from Other Blockchains to BSV

As blockchain-based applications and platforms continue to make waves as means to advance previously stagnant and problem-inundated systems and processes, there must be a clear understanding of the difference between popular digital currencies and blockchain technology.

Bitcoin, being the first functioning implementation of blockchain technology and the pioneer digital currency, has been a top choice for both digital currency trading and blockchain development. ETH, Hyperledger and EOS are also some of the more popular blockchains used by both individuals and enterprises.

While Bitcoin, ETH and EOS all have digital currencies traded in the market, Hyperledger does not have one and is focused mainly on providing blockchain-based solutions to developers. Digital currencies are built on blockchain technology, a decentralized distributed ledger that allows for data to be immutable, transparent and secure.

All digital currency transactions are recorded on that cryptocurrency’s blockchain, so there are currently many different blockchain providers all over the world. And while blockchain is essentially a decentralized database, not all blockchains have the same capabilities. And this is the main reason why developers transfer from one blockchain to another—because they are looking for certain efficiencies that their applications need.

The BSV Blockchain

BSV is an implementation of Bitcoin that has restored the original Bitcoin protocol, which creates a rock-solid foundation for developers to build on, and unlocked unbounded scaling. Unlike other popular yet unscalable implementations of Bitcoin, such as BTC and BCH, BSV is able to offer 2GB data blocks, extremely high throughput and the lowest possible fee per transaction.

And because BSV has the ability to scale limitlessly, these numbers are not fixed. For instance, the Teranode update scheduled to be released early next year will effectively increase throughput to 50,000 to 100,000 transactions per second (tps). Once released, data blocks will also become bigger at fees of very small fractions of a penny.

And as the network continues to scale, these numbers will continue to go up and fees will become lower until it reaches billions of tps at terabyte-sized blocks. These are the key capabilities of the BSV blockchain that make it ripe for blockchain development and also the reason why developers from other blockchains switch to BSV.

Other Blockchains vs. BSV

Many have tried building on other blockchains and have found them to be inadequate. One of the main reasons is that other blockchains have to rely on second-and third-tier solutions to make up for the flaw that the base layer, which is actually the blockchain, cannot scale.

If a blockchain is incapable of scaling, then there will always be a limit to what they can do. And when this limit is reached, either the system crashes or fees skyrocket. For instance, the ETH blockchain, which is endorsed and used by many celebrities, have been known to crash at crucial moments. This is because its blockchain cannot handle the surge of transactions.

The current average fee per transaction is at a whopping $37.45, even reaching over $60 last November, which is not practical at all. Coupled with network latency and crashes, many have transferred from ETH to BSV.

“If I am going to build something that I want to be durable and long-lasting, I don’t want the protocol to be changed all the time. The low transaction fees are also essential so we can do micropayments and that sort of thing,” independent app developer and investor Kevin Healy said when asked why he transferred from ETH to BSV.

The BSV blockchain is currently the largest public blockchain there is. A public blockchain means data is verifiable and available to anyone who is permitted to access the blockchain. This makes for utter transparency of data—something that many global systems lack.

“With a public chain you have to incentivize the public, otherwise it is not a public chain. If you don’t incentivize, no one is going to pay the electricity bill for free just to keep your chain happy. And so, if you want to be doing lots and lots of transactions, which ours should be able to do because it’s based on API calls, then you need that scalability. And I think that’s where the crucial aspect actually lies,” Peter Bainbridge-Clayton, founder and CTO of RegTech platform Kompany, explained as to why it is now working with BSV rather than Hyperledger alone.

And although Bitcoin has come under fire this year for its extremely high electricity consumption deemed by many as a waste of precious energy and detrimental to the environment, it has been proven that BSV is the most energy efficient Bitcoin implementation due to its ability to scale and utmost utility as energy efficiency of a blockchain can be measured through its throughput.

“I realized that proof-of-stake is inferior to proof-of-work, and it’s simply a marketplace to produce and consume negative space. And then I realized that we can have the whole vision of the Internet on BSV as it’s proven it can scale. I’m very passionate about building the whole Internet that is not advertising-based,” Rohan Sharan, product manager of cryptocurrency and exchange review platform BlockReview, revealed after trying out EOS and BCH and ultimately choosing BSV.

Because developers themselves know what capabilities are important in a blockchain, many have been transferring to BSV, which in itself is irrefutable proof that the BSV is the blockchain for enterprise adoption.

Technology

Capillary Technologies Acquires SessionM from Mastercard

By Modupe Gbadeyanka

A software product company established in 2012, Capillary Technologies India Limited, has acquired the customer engagement and loyalty company, SessionM, from Mastercard.

This followed a definitive agreement signed by the global leader in AI-powered customer loyalty and engagement solutions with the renowned digital payments firm.

The acquisition of SessionM is the latest in a series of strategic moves by Capillary, following its successful listing on the Indian Stock Exchange in November 2025.

With SessionM in its portfolio, Capillary reinforces its position as a global leader in enterprise loyalty, offering a leading platform to the world’s most sophisticated enterprise brands.

Mastercard has identified Capillary Technologies—consistently recognised as a Leader in The Forrester Wave as the ideal partner to lead SessionM into its next era of growth.

As part of the agreement, a specialised team within SessionM will transition to Capillary, ensuring that the platform’s deep technical expertise is preserved.

SessionM’s esteemed global customer base—which includes Fortune 500 retailers, airlines, and CPG brands—will continue to receive the same high-calibre support and service they experienced before the acquisition.

“M&A has been a key growth strategy for Capillary over the years, and as a public company, we are delivering on that promise to our shareholders and the market.

“By bringing SessionM into our portfolio, we are not just expanding our footprint across the globe; we are further strengthening our loyalty capabilities to deliver one of the industry’s most comprehensive offerings.

“Our mission remains to provide enterprises across industries with specialised, AI-native loyalty technology solutions,” the chief executive of Capillary Technologies, Aneesh Reddy, commented.

Technology

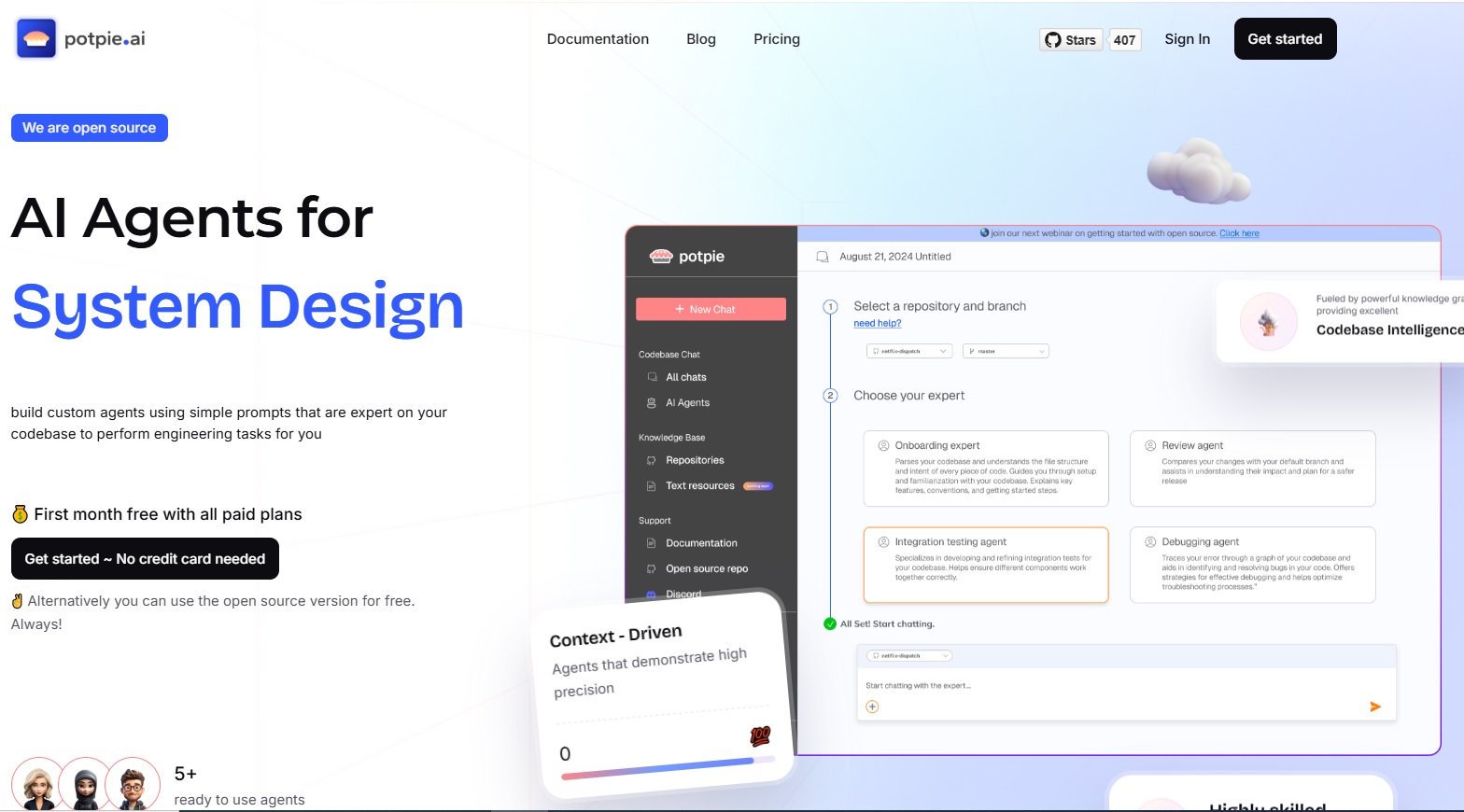

Emergent Ventures, Others Invest $2.2m in Potpie

By Dipo Olowookere

About $2.2 million pre-seed round to help engineering teams unify context across their entire stack and make AI agents genuinely useful in complex software environments has been announced by Potpie.

Potpie was established by Aditi Kothari and Dhiren Mathur, who were determined to unify context across the entire engineering stack and enabling spec driven development.

As generative AI adoption accelerates, most tools focus on surface-level code generation while ignoring the deeper problem of context.

Large language models are powerful, but without access to system-level understanding, tooling history, and architectural intent, they struggle in real production environments.

Traditional approaches rely on senior engineers to manually hold this context together, a model that breaks down at scale and fails when AI agents are introduced.

The platform enables teams to automate high-impact and non-trivial use cases across the software development lifecycle, like debugging cross-service failures, maintaining and writing end-to-end tests, blast radius detection and system design.

It is designed for enterprise companies with large and complex codebases, starting at around one million lines of code and scaling to hundreds of millions.

Rather than acting as another coding assistant, Potpie builds a graphical representation of software systems, infers behaviour and patterns across modules, and creates structured artefacts that allow agents to operate consistently and safely.

A statement made available to Business Post on Monday revealed that the funding support came from Emergent Ventures, All In Capital, DeVC and Point One Capital.

The capital will be used to support early enterprise deployments, expand the engineering team, and continue building Potpie’s core context and agent infrastructure, it was disclosed.

“As AI makes code generation easier, the real challenge shifts to reasoning across massive, interconnected systems. Potpie is our answer to that shift, an ontology-first layer that helps enterprises truly understand and manage their software,” Kothari was quoted as saying in the disclosure.

A Managing Partner at Emergent Ventures, Anupam Rastogi, said, “In large enterprises, the real challenge is not generating code, it is understanding the system deeply enough to change it safely.

“Potpie’s ontology-first architecture, combined with rigorous context curation and spec-driven development, creates a structured model of the entire engineering ecosystem. This allows AI agents to reason across services, dependencies, tickets, and production signals with the clarity of a senior engineer. That is what makes Potpie uniquely capable of solving complex RCA, impact analysis, and high-risk feature work even in codebases exceeding 50 million lines.”

Technology

Expert Reveals Top Cyber Threats Organisations Will Encounter in 2026

By Adedapo Adesanya

Organisations in 2026 face a cybersecurity landscape markedly different from previous years, driven by rapid artificial intelligence adoption, entrenched remote work models, and increasingly interconnected digital systems, with experts warning that these shifts have expanded attack surfaces faster than many security teams can effectively monitor.

According to the World Economic Forum’s Global Cybersecurity Outlook 2026, AI-related vulnerabilities now rank among the most urgent concerns, with 87 per cent of cybersecurity professionals worldwide highlighting them as a top risk.

In a note shared with Business Post, Mr Danny Mitchell, Cybersecurity Writer at Heimdal, said artificial intelligence presents a “category shift” in cyber risk.

“Attackers are manipulating the logic systems that increasingly run critical business processes,” he explained, noting that AI models controlling loan decisions or infrastructure have become high-value targets. Machine learning systems can be poisoned with corrupted training data or manipulated through adversarial inputs, often without immediate detection.

Mr Mitchell also warned that AI-powered phishing and fraud are growing more sophisticated. Deepfake technology and advanced language models now produce convincing emails, voice calls and videos that evade traditional detection.

“The sophistication of modern phishing means organisations can no longer rely solely on employee awareness training,” he said, urging multi-channel verification for sensitive transactions.

Supply chain vulnerabilities remain another major threat. Modern software ecosystems rely on numerous vendors and open-source components, each representing a potential entry point.

“Most organisations lack complete visibility into their software supply chain,” Mr Mitchell said, adding that attackers frequently exploit trusted vendors or update mechanisms to bypass perimeter defences.

Meanwhile, unpatched software vulnerabilities continue to expose organisations to risk, as attackers use automated tools to scan for weaknesses within hours of public disclosure. Legacy systems and critical infrastructure are especially difficult to secure.

Ransomware operations have also evolved, with criminals spending weeks inside networks before launching attacks.

“Modern ransomware operations function like businesses,” Mitchell observed, employing double extortion tactics to maximise pressure on victims.

Mr Mitchell concluded that the common thread across 2026 threats is complexity, noting that organisations need to abandon the idea that they can defend against everything equally, as this approach spreads resources too thin and leaves critical assets exposed.

“You cannot protect what you don’t know exists,” he said, urging organisations to prioritise visibility, map dependencies, and focus resources on the most critical assets.

-

Feature/OPED6 years ago

Feature/OPED6 years agoDavos was Different this year

-

Travel/Tourism10 years ago

Lagos Seals Western Lodge Hotel In Ikorodu

-

Showbiz3 years ago

Showbiz3 years agoEstranged Lover Releases Videos of Empress Njamah Bathing

-

Banking8 years ago

Banking8 years agoSort Codes of GTBank Branches in Nigeria

-

Economy3 years ago

Economy3 years agoSubsidy Removal: CNG at N130 Per Litre Cheaper Than Petrol—IPMAN

-

Banking3 years ago

Banking3 years agoSort Codes of UBA Branches in Nigeria

-

Banking3 years ago

Banking3 years agoFirst Bank Announces Planned Downtime

-

Sports3 years ago

Sports3 years agoHighest Paid Nigerian Footballer – How Much Do Nigerian Footballers Earn