Economy

Nigeria: Moody’s Predicts 2.5% GDP Growth in 2017, 4% in 2018

**Affirms Country’s B1 Rating With Stable Outlook

By Modupe Gbadeyanka

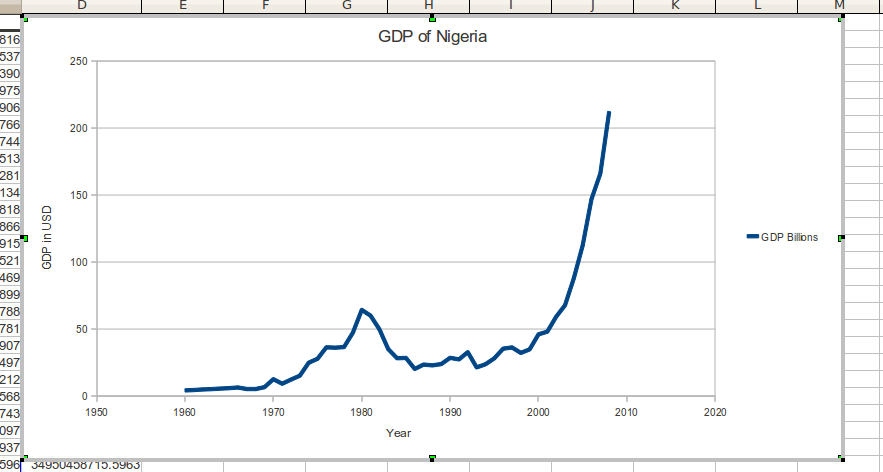

Moody’s Investors Service on Friday affirmed the B1 long-term issuer rating of the government of Nigeria with a stable outlook just as it forecasts that real GDP growth will rise to 2.5 percent in 2017 and accelerate further in 2018 to 4 percent.

The global rating firm disclosed that the key drivers for these were the medium term growth prospects remain robust despite the current challenging environment, with the rebound in oil production helping to rebalance the economy over the next two years; and the government’s balance sheet, which it said remains strong relative to its peers, resilient to the contractionary environment and temporarily elevated interest payments while the authorities pursue their efforts to grow non-oil taxes.

The long-term local-currency bond and deposit ceilings remain unchanged at Ba1. The long-term foreign-currency bond and deposit ceilings remain unchanged at Ba3 and B2, respectively.

Moody’s said it expects Nigeria’s medium term growth to remain robust, driven by the recovery in oil output and also over the near term, it expects Nigeria’s economic growth and US dollar earnings to improve in 2017, supported by a recovery in oil production.

According to Moody’s, after an estimated -1.5 percent real GDP growth in 2016, it forecasts real GDP growth to rise to 2.5% in 2017 and accelerate further in 2018 to 4%. A rebound in oil production to two million barrels per day (mbpd) will, if sustained, enhance economic growth and support the US dollar supply in the economy.

It noted that Nigeria has made significant gains in terms of governance and transparency in the oil sector. Improved availability of data, progress in restructuring the Nigerian National Petroleum Company (NNPC), rising effectiveness of operations at the refineries and a readiness to tackle difficult issues with partners (such as funding issues at the Joint Ventures) speak to a material improvement in the operating environment. The Petroleum Investment Bill (PIB bill), which had been blocked for 8 years in parliament, has been reactivated with a portion of the law drafted and passed by the Senate. Moreover, militant activity in the Niger Delta is set to wane following the resumption of payments from the government, though it will remain a threat to the recovery of the economy.

Moody’s further said the economy is also likely to benefit from the more timely implementation of the 2017 budget than its predecessor and in particular from the increase in capital spending on infrastructure which that will allow.

It also said the scarcity of Dollars, worsened by the soft capital controls imposed by the Central Bank of Nigeria (CBN), is likely to continue to negatively affect important sectors of the economy especially in services and manufacturing sectors.

“We do not expect the current policy mix to significantly change over the short term but a gradual easing of restrictions is possible as foreign currency receipts improve with rising oil production,” the firm said on Friday in a statement obtained by Business Post.

In 2017 and 2018, we expect Nigeria’s balance of payments to move back into surplus, supported by government external borrowings and a falling current account deficit. The latter is quickly reducing, supported by falling imports and increased oil production.

Depreciation of the naira, soft capital controls and current dollar scarcity have been relatively effective at constraining imports. We expect foreign exchange reserves to grow modestly in 2017. While improved foreign investor sentiment should support the rebalancing of the economy over the medium term, with the return of portfolio investors improving dollar liquidity in the country, the continued existence of a parallel, unofficial foreign exchange market is likely to act as a strong deterrent over the near term.

RESILIENT GOVERNMENT BALANCE SHEET STRONGER THAN PEERS’ DESPITE TURBULENCE

Moody’s says it expects the medium-term impact of the oil price shock on Nigeria’s government balance sheet to be contained, and recent erosion of debt affordability to be reversed.

The effect of the recent downturn on the government’s budget sheet has been contained as the authorities have been able to offset the shortfall in revenue with large cuts in capital expenditure. As a result, Moody’s forecasts a budget deficit of 3 percent of GDP in 2016, comprised of a 2 percent of GDP federal government budget deficit and around 1% of arrears split between federal, state and municipality levels of government, it explained.

Moody’s forecasts the federal government deficit to remain around 2% of GDP in 2017 and 2018, with large capital expenditure outlays resuming as the government’s cash flow situation improves. Based on these underlying projections, Nigeria’s balance sheet will continue to compare favourably with peers’, with government debt remaining well below 20% of GDP over the coming years against 55% median for B1-rated peers.

By end-2016, Moody’s estimates the government debt stock will be comprised of 85% domestic borrowing and 15% external debt, resulting in a manageable external debt profile. Government external debt amounts to just 2.9% of GDP, with interest payments set to remain low, at around $330 million dollars per annum. Domestic debt has increased significantly in recent years, reaching its current level of NGN10 trillion. Around 30% of this debt is comprised of costly T-bills, which have increased refinancing risk and interest rate exposure. However, Moody’s expects the ratio of interest payments to government revenues to peak at 20% for general government, and close to 40% of revenues for federal government in 2017.

Although debt service costs are high, Nigeria’s domestic capital market is sufficiently developed to accommodate the yearly public sector borrowing requirements of around NGN5.5 trillion. This is another positive credit feature that distinguishes Nigeria from many similarly rated peers. The country’s banking sector is well-capitalised and liquid and the national pension fund still has additional capacity. Should banking sector liquidity decline, the Central Bank of Nigeria has tools at its disposal to support appetite for government securities, including lowering the cash reserve requirement ratio from its presently high level of 22.5%. However, appetite for government securities remains strong, with all instruments remain oversubscribed.

Moody’s expects the recent increase in debt service costs to prove temporary, as a result of i) the government’ initiatives to expand the non-oil revenue base, and ii) efforts to improve the structure of government debt.

Measures by the Federal Revenue Inland Service are expected to increase non-oil revenue to around NGN4 trillion in 2016 from NGN2.5 trillion in 2015. These include a tax amnesty on penalties and interest on tax liabilities due in 2013, 2014 and 2015. However, not all the initiatives have proven successful: the independent re-appropriation of revenues from the ministries departments and agencies (MDAs) has yielded disappointing results so far. Such outcomes highlight the considerable execution risks inherent in the transition to a less oil-dependent federal budget, and the implications for the government balance sheet should it not meet its objectives.

The government’s medium-term debt strategy should also help to lower the interest burden. The debt strategy is geared towards exchanging costly short-term debt with long-term concessional borrowing. Although a portion of future external borrowings are expected to be raised through the Eurobond markets, this is likely to be complemented with ongoing support from other multilateral institutions including the African Development Bank and the World Bank. The combined effect of these measures should help to bring interest payments/general government revenues down to 16.8% by 2018, from an estimated 19.8% in 2016.

RATIONALE FOR THE OUTLOOK AT STABLE

The stable outlook is driven by Moody’s view that the downside risks posed by the weakening of the country’s fiscal strength, and the external and economic pressures anticipated this year and next, are balanced by Nigeria’s strengths, which exceed those of sovereigns rated below B1. In 2016, Nigeria’s external vulnerability indicator of 31% will remain far below the expected B1 median of 51%, while its debt-to-GDP of 16.6% will remain far below the expected B1 median of 55%. Set against that, its expected debt servicing burden in terms of interest payments to revenue of 19% is more than double the B1 median of 9%. To a large extent, Moody’s believes that this reflects Nigeria’s underdeveloped public sector revenue base, a credit weakness that the administration is attempting to address.

WHAT COULD CHANGE THE RATING UP

Positive pressure on Nigeria’s issuer rating will be exerted upon: 1) successful implementation of structural reforms by the Buhari administration, in particular with respect to public resource management and the broadening of the revenue base; 2) strong improvement in institutional strength with respect to corruption, government effectiveness, and the rule of law; 3) the rebuilding of large financial buffers sufficient to shelter the economy against a prolonged period of oil price and production volatility.

WHAT COULD CHANGE THE RATING DOWN

Nigeria’s B1 issuer rating could be downgraded in the event of 1) a greater-than-anticipated deterioration in the government’s balance sheet or continued erosion of debt affordability, for example resulting from the failure to implement revenue reform; and 2) lower than expected medium term growth, for example as a result of delays in implementing key structural reforms, especially in the oil sector, or continued militancy in the Niger Delta, which undermine the level of oil production over the medium-term.

GDP per capita (PPP basis, US$): 6,184 (2015 Actual) (also known as Per Capita Income)

Real GDP growth (% change): -1.5% (2016 Estimate) (also known as GDP Growth)

Inflation Rate (CPI, % change Dec/Dec): 19% (2016 Estimate)

Gen. Gov. Financial Balance/GDP: -2.9% (2016 Estimate) (also known as Fiscal Balance)

Current Account Balance/GDP: -0.6% (2016 Estimate) (also known as External Balance)

External debt/GDP: 4.2% (2016 Estimate)

Level of economic development: Low level of economic resilience

Default history: No default events (on bonds or loans) have been recorded since 1983.

On 7 December 2016, a rating committee was called to discuss the ratings of the Government of Nigeria. The main points raised during the discussion were: The issuer’s economic fundamentals, including its economic strength, have not materially changed. The issuer’s fiscal or financial strength, including its debt profile, has not materially changed. The issuer’s susceptibility to event risks has not materially changed. Other views raised included: the issuer’s institutional strength/framework, have not materially changed. The issuer’s governance and/or management, have not materially changed.

The principal methodology used in these ratings was Sovereign Bond Ratings published in December 2015. Please see the Rating Methodologies page on www.moodys.com for a copy of this methodology.

The weighting of all rating factors is described in the methodology used in this credit rating action, if applicable.

Economy

Customs Oil and Gas Free Trade Zone in Rivers Collects N53.98bn Revenue

By Adedapo Adesanya

The Nigeria Customs Service (NCS) Oil and Gas Free Trade Zone Command in Rivers State says it has achieved a record-breaking revenue collection of N53.98 billion between January and November 2024, exceeding its annual target by 2.3 per cent and nearly doubling the N26.80 billion generated in 2023.

This was disclosed by the Customs Area Controller, Oil and Gas Free Trade Zone, Onne, Comptroller Seriki Usman, during a press briefing at the command’s headquarters, where he attributed the success to strategic collaboration with stakeholders, operational efficiency, and a focus on regulatory compliance.

He said, “A notable achievement of the command was its record-breaking revenue collection of N53.98 billion. This figure represents a 2.3 per cent increase over our annual target for 2024 and a remarkable 98.6% rise compared to the N26.80 billion collected in 2023.

“Our record-breaking revenue underscores the importance of effective trade facilitation and regulatory compliance. This achievement reflects the commitment of our officers, the collaboration with stakeholders, and the critical role of the Oil and Gas Free Trade Zone in driving Nigeria’s economic growth,” he said.

He explained that the Command successfully facilitated the export of key products such as refined sugar, fertiliser, liquefied natural gas, LNG, and crude oil from major facilities, including Bundu Sugar Refinery, Notore Chemical PLC, and Bonny Island.

“The seamless management of imports and exports within the free trade zone has enhanced operations for licensed enterprises,” he noted.

Speaking on the significance of these achievements, Comptroller Usman emphasized the need to maintain the momentum.

“This accomplishment is not just about numbers but about fostering trade growth, innovation, and creating a conducive environment for businesses to thrive within the free trade zone.”

On regulatory compliance, Comptroller Usman reassured Nigerians of the Command’s commitment to ensuring adherence to international trade regulations while fostering economic progress.

“Our focus remains on enhancing service delivery, promoting ease of doing business, and driving revenue generation that supports the nation’s development goals,” he said.

The command emphasized that collaboration with stakeholders, particularly the Oil and Gas Free Trade Zone Authority, has been pivotal in achieving these milestones, and called for continued partnership to sustain trade growth and improve service delivery.

As the year comes to a close, the command has reiterated its resolve to solidify its role as a critical revenue driver and trade facilitator in Nigeria’s oil and gas sector.

Mr Usman said the performance reflects the command’s vital role in strengthening Nigeria’s non-oil revenue base and its determination to remain a key player in the country’s economic transformation efforts.

“We remain committed to sustaining our achievements, fostering trust among stakeholders, and contributing significantly to the nation’s economic growth,” Comptroller Usman concluded.

Economy

FAAC Disburses 1.727trn to FG, States Local Councils in December 2024

By Modupe Gbadeyanka

The federal government, the 36 states of the federation and the 774 local government areas have received N1.727 trillion from the Federal Accounts Allocation Committee (FAAC) for December 2024.

The funds were disbursed to the three tiers of government from the revenue generated by the nation in November 2024.

At the December meeting of FAAC held in Abuja, it was stated that the amount distributed comprised distributable statutory revenue of N455.354 billion, distributable Value Added Tax (VAT) revenue of N585.700 billion, Electronic Money Transfer Levy (EMTL) revenue of N15.046 billion and Exchange Difference revenue of N671.392 billion.

According to a statement signed on Friday by the Director of Press and Public Relations for FAAC, Mr Bawa Mokwa, the money generated last month was about N3.143 trillion, with N103.307 billion used for cost of collection and N1.312 trillion for transfers, interventions and refunds.

It was disclosed that gross statutory revenue of N1.827 trillion was received compared with the N1.336 trillion recorded a month earlier.

The statement said gross revenue of N628.972 billion was available from VAT versus N668.291 billion in the preceding month.

The organisation stated that last month, oil and gas royalty and CET levies recorded significant increases, while excise duty, VAT, import duty, Petroleum Profit Tax (PPT), Companies Income Tax (CIT) and EMTL decreased considerably.

As for the sharing, FAAC disclosed that from the N1.727 trillion, the central government got N581.856 billion, the states received N549.792 billion, the councils took N402.553 billion, while the benefiting states got N193.291 billion as 13 per cent derivation revenue.

From the N585.700 billion VAT earnings, the national government got N87.855 billion, the states received N292.850 billion and the local councils were given N204.995 billion.

Also, from the N455.354 billion distributable statutory revenue, the federal government was given N175.690 billion, the states got N89.113 billion, the local governments had N68.702 billion, and the benefiting states received N121.849 billion as 13 per cent derivation revenue.

In addition, from the N15.046 billion EMTL revenue, FAAC shared N2.257 billion to the federal government, disbursed N7.523 billion to the states and transferred N5.266 billion to the local councils.

Further, from the N671.392 billion Exchange Difference earnings, it gave central government N316.054 billion, the states N160.306 billion, the local government areas N123.590 billion, and the oil-producing states N71.442 billion as 13 per cent derivation revenue.

Economy

Okitipupa Plc, Two Others Lift Unlisted Securities Market by 0.65%

By Adedapo Adesanya

The NASD Over-the-Counter (OTC) Securities Exchange recorded a 0.65 per cent gain on Friday, December 13, boosted by three equities admitted on the trading platform.

On the last trading session of the week, Okitipupa Plc appreciated by N2.70 to settle at N29.74 per share versus Thursday’s closing price of N27.04 per share, FrieslandCampina Wamco Nigeria Plc added N2.49 to end the session at N42.85 per unit compared with the previous day’s N40.36 per unit, and Afriland Properties Plc gained 50 Kobo to close at N16.30 per share, in contrast to the preceding session’s N15.80 per share.

Consequently, the market capitalisation added N6.89 billion to settle at N1.062 trillion compared with the preceding day’s N1.055 trillion and the NASD Unlisted Security Index (NSI) gained 19.66 points to wrap the session at 3,032.16 points compared with 3,012.50 points recorded in the previous session.

Yesterday, the volume of securities traded by investors increased by 171.6 per cent to 1.2 million units from the 447,905 units recorded a day earlier, but the value of shares traded by the market participants declined by 19.3 per cent to N2.4 million from the N3.02 million achieved a day earlier, and the number of deals went down by 14.3 per cent to 18 deals from 21 deals.

At the close of business, Geo-Fluids Plc was the most active stock by volume on a year-to-date basis with a turnover of 1.7 billion units worth N3.9 billion, followed by Okitipupa Plc with the sale of 752.2 million units valued at N7.8 billion, and Afriland Properties Plc with 297.3 million units sold for N5.3 million.

In the same vein, Aradel Holdings Plc remained the most active stock by value on a year-to-date basis with the sale of 108.7 million units for N89.2 billion, trailed by Okitipupa Plc with 752.2 million units valued at N7.8 billion, and Afriland Properties Plc with a turnover of 297.3 million units worth N5.3 billion.

-

Feature/OPED5 years ago

Feature/OPED5 years agoDavos was Different this year

-

Travel/Tourism8 years ago

Lagos Seals Western Lodge Hotel In Ikorodu

-

Showbiz2 years ago

Showbiz2 years agoEstranged Lover Releases Videos of Empress Njamah Bathing

-

Banking6 years ago

Banking6 years agoSort Codes of GTBank Branches in Nigeria

-

Economy2 years ago

Economy2 years agoSubsidy Removal: CNG at N130 Per Litre Cheaper Than Petrol—IPMAN

-

Banking2 years ago

Banking2 years agoFirst Bank Announces Planned Downtime

-

Sports2 years ago

Sports2 years agoHighest Paid Nigerian Footballer – How Much Do Nigerian Footballers Earn

-

Technology4 years ago

Technology4 years agoHow To Link Your MTN, Airtel, Glo, 9mobile Lines to NIN