Economy

Nigeria Needs Full Tax Reform—IMF

By Dipo Olowookere

The International Monetary Fund (IMF) has advised Nigeria to embark on a full Value Added Tax (VAT) reform.

With this in place, according to the global lending firm, the country’s economy would be on the way to full recovery.

The lender’s Mission Chief for Nigeria, African Department, Mr Amine Mati, who was a guest at the 2017 Chartered Institute of Bankers of Nigeria (CIBN) Investiture in Lagos last weekend, said government must raise taxes where necessary, especially on luxury items.

According to Mr Mati, the Federal Government must broaden its VAT system by revisiting exemptions.

At the event themed ‘Coherent set of Policies for Greater Exchange Rate Flexibility, the IMF chief in Nigeria said government should consider cancelling tax holidays and exemptions that erode the Company Income Tax (CIT) base.

In addition, government should also increase taxes on alcohol and tobacco and broaden VAT by revisiting exemptions, he said.

Mr Mati noted that if the Federal Government can work reform its tax system, the economy would be jumpstarted.

Lately, Nigeria has looked toward tax to generate more revenue due to its fall into recession last year.

Minister of Finance, Mrs Kemi Adeosun, has consistently said the government intends to increase its revenue by increasing its tax base.

According to Federal Inland Revenue Service (FIRS), the total number of tax payers in Nigeria is just 12,649,654 [as at April 2017]. Of these, 96 percent have their taxes deducted at source under PAYE and just 4 percent comply with Direct Assessment.

In June 2017, the Federal Government launched the Voluntary Asset and Income Declaration Scheme (VAIDS).

The platform was put in place for defaulting Nigerian taxpayers to work out a flexible way to pay their outstanding tax liabilities due from them relating to the last six relevant tax years, regularize their tax transactions and obtain genuine tax clearance certificates for all the relevant years without fear of criminal prosecution for tax offences and with the benefit of forgiveness of interest and penalties.

Mrs Adeosun had stated at the launch of the initiative that the policy embraces all federal and state taxes such as Companies Income Tax, Personal Income Tax, Petroleum Profits Tax, Capital Gains Tax, Stamp Duties, Tertiary Education Tax, Technology Tax, Tenement Rates, Property Taxes.

Earlier this month, the Finance Minister said Nigeria will reduce the rate at which it borrows money for developmental projects only if the tax to gross domestic product (GDP) hits 10 percent.

At the moment, the country’s tax to GDP ratio is at 6 percent.

“We must pay taxes properly in Nigeria, if we do this, we do not need to borrow.

“Of course I am not suggesting that there isn’t responsibility on the part of government; we have to be more responsible, to be more efficient (when people citizens pay their taxes).

“We are really focusing on this, we are finding ways to cut cost, but fundamentally, we must invest but we don’t have the power we need, the roads, we are working in progress.

“A lot of money is needed to reposition this economy and we need to generate more through tax.

“We just need to move our tax to GDP from 6 percent from where it is now to 10 percent; it will significantly reduce the amount of money we need to borrow and that will have a wider effect on the economy.

“One, it would reduce the demand for short-term borrowing and help bring down interest rate.

“Two, it would create headroom for the private sector to borrow; that is the strategy,” Mrs Adeosun had said.

At the 3rd International Conference on Tax in Africa (ICTA) held in Abuja from September 25 to 29, 2017, stakeholders highlighted the need for African countries to build stronger domestic tax regimes by strengthening VAT, PIT and CIT.

At the Pan-African Conference on Illicit Financial Flows (IFFs) from Africa organised by Tax Justice Network Africa (TJNA) in Nairobi, Kenya, it was said that Africa has lost over $50 billion to multinationals who take advantage of weak tax laws and unfair trade treaties on the continent.

Economy

Trump’s Tariff: Alake Woos Investors to Nigeria’s Solid Minerals Sector

By Adedapo Adesanya

The Minister of Solid Minerals Development, Mr Dele Alake, has called on foreign investors to consider Nigeria amid prevailing barrage of tariffs imposed by the United States, which he says may be a blessing in disguise for African countries.

Speaking during the Fireside Chat session on Foreign Direct Investment in Abu Dhabi, United Arab Emirates, the Minister called on African countries to adopt an introspective approach by looking inward and adjusting their domestic policies to focus more on intra-African trade, with less dependence on external forces.

In a statement by his Special Assistant on Media, Mr Segun Tomori, on Sunday in Abuja, it was stated that the Minister’s remarks were part of his contribution to the discourse on the impact of the tariffs on Africa’s economic climate.

“The barrage of tariffs imposed carries wide-ranging implications for the global economy, U.S. trade relationships, and developing nations, including those in Africa,” he said.

He stressed the need need for African countries to organise economic imperatives to ensure a balance of trade and strengthen intra African trade among countries.

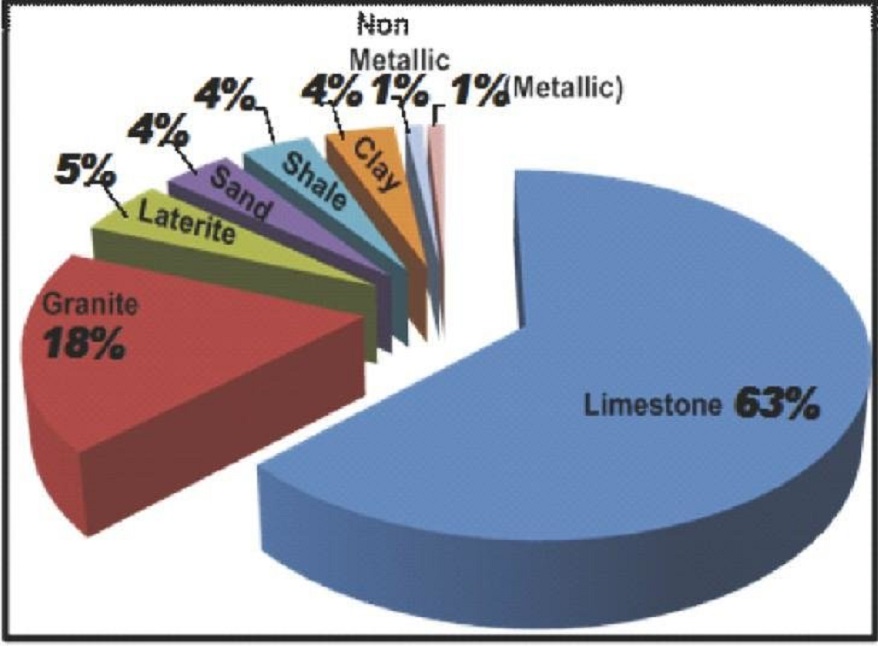

Mr Alake highlighted the persistent challenge faced by African countries, where rare mineral resources were exported without any value addition, noting that the old ‘pit-to-port’ model, where resources are extracted and sent out of the continent can no longer be allowed to continue.

“Interested investors, who wish to come into Africa are welcome to set up their factories in the continent, add value to our mineral resources and create jobs here, rather than just shipping our wealth out of our shores”, he stated.

The minister said that his stance on protecting Africa’s mineral wealth has been adopted by many African countries, particularly mineral-producing nations, where he served as the pioneering chairman of the African Minerals Strategic Group (AMSG).

He reaffirmed that Nigeria’s policy on mineral sector development remained strictly focused on value addition and boosting the local economy through job creation.

Economy

Arnergy Raises $18m to Boost Solar Energy Access in Nigeria

By Adedapo Adesanya

Arnergy, a cleantech startup, has raised a $15 million Series B extension, on top of a $3 million B1 round last year, bringing its total for the round to $18 million to boost solar energy access in Nigeria.

According to TechCrunch, the new funding round was led by Nigerian private equity firm CardinalStone Capital Advisers (CCA) and saw participation from Breakthrough Energy Ventures as well as British International Investment, Norfund, EDFI MC, and All On.

Launched in 2013, Arnergy was established to provide solar systems to homes and businesses across sectors like hospitality, education, finance, agriculture, and healthcare.

The firm raised a $9 million Series A in 2019 backed by Bill Gates’s Breakthrough Energy Ventures.

The Lagos-based cleantech is in talks to raise additional local debt from banks and development financial institutions (DFIs) to support some of its projects including energy-as-a-service (EaaS) solutions for multinationals.

The cleantech is planning to install more than 12,000 systems by 2029 to help boost access to solar energy, which Nigerians have began to adopt increasingly following policy shifts, particularly the removal of fuel subsidies, that led to rise in energy costs.

Arnergy has so far deployed over 1,800 systems across 35 Nigerian states, totaling 9MWp of solar and 23MWh of battery storage.

Over the next four years, it will be targeting a 567 per cent increase to the set 12,000 systems goal.

According to the founder, Mr Femi Adeyemo, there has been increased adaptation of solar energy and this presents the perfect opportunity.

Its lease-to-own product, Z Lite, has gained more traction as customers pay fixed monthly fees over 5 to 10 years before owning the system while outright purchases comprised 60 per cent to 70 per cent of revenue in 2023, accounting for just 25 per cent of sales last year, as per TechCrunch.

“Imagine paying N200,000 (~$125) every month for power. With our product, that drops to N96,000 (~$60). Over five years, it’s a no-brainer what you’ll save,” Mr Adeyemo told the tech publication.

Recall that the federal government has also announced plans to ban importation of solar panels as part of efforts to boost local capacity. This has been projected to see a substantial increase in prices.

Speaking on this, Mr Adeyemo said, “We’re advocates for local manufacturing. But let’s build capacity before shutting the door on imports. Otherwise, we risk doing more harm than good, both to the industry and to the millions of Nigerians who now rely on solar as their primary energy source.”

Economy

Value of NASD OTC Exchange Rises 0.40% to N1.919trn in Week 15 of 2025

By Adedapo Adesanya

The total value of stocks at the NASD Over-the-Counter (OTC) Securities Exchange increased by 0.40 per cent or N9.21 billion to N1.919 trillion in the 15th trading week of 2025 from the N1.911 trillion it ended in Week 14.

The growth was mainly influenced by the inclusion of new shares of Infrastructure Credit Guarantee Company Plc (InfraCredit) to the trading platform in the week.

InfraCredit joined the alternative stock market on March 6 and last week, it brought addition 11.166 million equities, which increased its total securities at the NASD OTC exchange to 26.421 million units.

However, the NASD Unlisted Securities Index (NSI) went down by 0.20 per cent or 31.89 points to 3,277.57 points from the 3,309.46 points it ended a week earlier.

In the week, the total value of trades ballooned by 29,234.5 per cent to N4.79 billion from the N16.3 million recorded in the previous week, and the total volume of transactions increased by 1,485.1 per cent to 171.4 million units from 10.8 million units.

The bourse recorded seven price losers led by Nipco Plc, which depreciated by 20.2 per cent to close at N199.00 per share versus N220.00 per share, Central Securities Clearing System (CSCS) Plc lost 2.5 per cent to finish at N22.70 per unit versus N25.21 per unit, FrieslandCampina Wamco Nigeria Plc shed 1.3 per cent to sell for N35.55 per share against the former value of N36.80 per share, and Afriland Properties Plc went down by 0.6 per cent to N17.80 per unit from N18.42 per unit.

Further, Geo-Fluids Plc slipped by 0.5 per cent to N2.00 per share from N2.48 per share, Acorn Petroleum Plc slid by 0.2 per cent to N1.17 per unit from N1.30 per unit, and InfraCredit Plc declined by 0.09 per cent to N2.34 per share from N2.43 per share.

On the flip side, Mixta Real Estate Plc improved by 0.4 per cent to N4.55 per unit from N4.14 per unit, Lagos Building Investment Company (LBIC) Plc expanded by 0.2 per cent to N2.63 per share from N2.80 per share, First Trust Microfinance Bank Plc appreciated by 0.04 to 62 Kobo per unit from 58 Kobo per unit, and Paintcom Investment Plc gained 0.02 per cent to end at N10.74 per share compared with the preceding week’s N10.72 per share.

The most active stock in the week by value was Okitipupa Plc with N4.6 billion, Paintcom Investment Plc recorded N190.9 million, FrieslandCampina Wamco Nigeria Plc traded N28.0 million, Nipco Plc transacted N3.5 million, and 11 Plc recorded N1.7 million.

Okitipupa Plc was also the most traded stock by volume with 152.1 million units, Paintcom Investment Plc transacted 17.8 million units, FrieslandCampina Wamco Nigeria Plc recorded 0.751 million, Geo-Fluids Plc traded 0.356 million units, and Food Concepts Plc exchanged 0.180 million units.

-

Feature/OPED5 years ago

Feature/OPED5 years agoDavos was Different this year

-

Travel/Tourism9 years ago

Lagos Seals Western Lodge Hotel In Ikorodu

-

Showbiz2 years ago

Showbiz2 years agoEstranged Lover Releases Videos of Empress Njamah Bathing

-

Banking7 years ago

Banking7 years agoSort Codes of GTBank Branches in Nigeria

-

Economy2 years ago

Economy2 years agoSubsidy Removal: CNG at N130 Per Litre Cheaper Than Petrol—IPMAN

-

Banking2 years ago

Banking2 years agoFirst Bank Announces Planned Downtime

-

Sports2 years ago

Sports2 years agoHighest Paid Nigerian Footballer – How Much Do Nigerian Footballers Earn

-

Technology4 years ago

Technology4 years agoHow To Link Your MTN, Airtel, Glo, 9mobile Lines to NIN