**As APT RSA Pension Fund Leads Peers Again

By Dipo Olowookere/Quantitative Financial Analytics

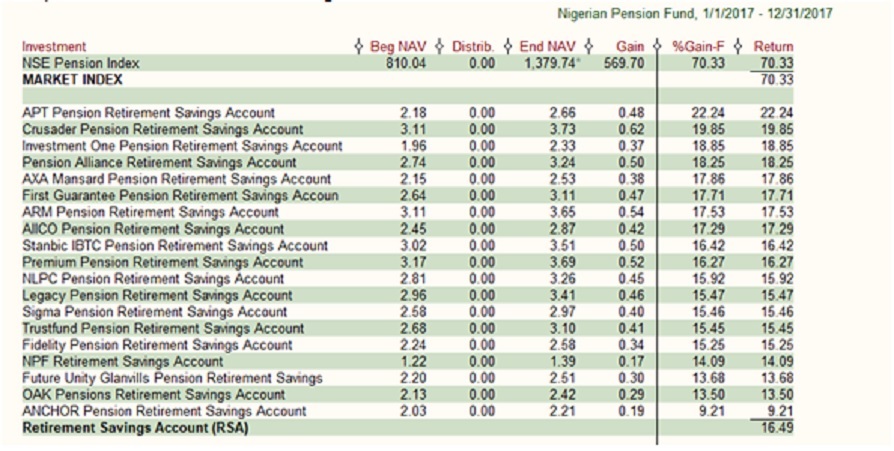

A new data analysis from Quantitative Financial Analytics has shown that the Nigerian pension funds earned an annualized 16.37 percent average return for the period ended December 31, 2017.

This is against the 11.56 percent average yields the fund made in the previous year.

Also during the period, the APT RSA Pension fund was the best-performing among the RSA category of funds, raking 22.24 percent return.

It was followed by the 19.85 percent return produced by the Crusader RSA Pension fund.

According to the report, eight of the 19 RSA funds being tracked by Quantitative Financial Analytics produced returns that beat the industry average of 16.37 percent while the rest produced returns below the industry average. All but one RSA fund produced returns in the double digit.

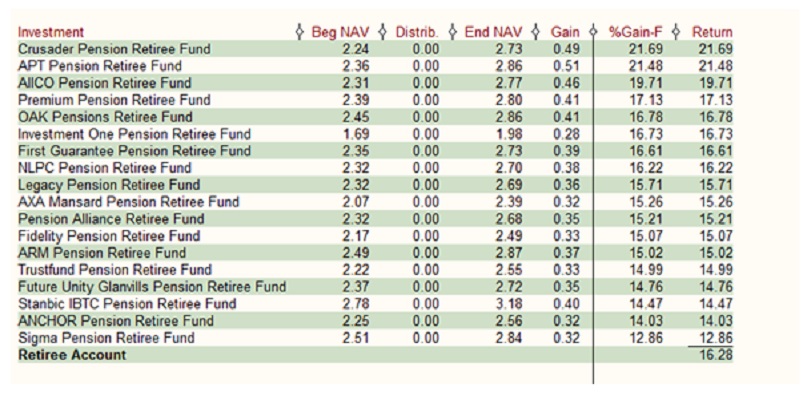

Quantitative Financial Analytics said in the report that the Retiree fund category followed closely the trend and pattern of the RSA funds recording an average return of 16.28 percent compared to last year’s average of 12.42 percent.

Crusader Pension Retiree Fund took the lead by producing 21.69 percent return while APT Pension Retiree Fund came second with 21.48 percent return.

Seven of the 18 Retiree funds recorded better returns than the industry average and all the Retiree funds closed the year with double digit returns.

The gratuity fund category, occupied by funds managed by Pension Alliance (PAL), recorded an improved performance in 2017 as the Pal Emenite and Pal Guinness funds produced 16.5 percent and 15.1 percent return respectively compared to their 15.04 percent and 13.74 percent returns in 2016.

Though the pension funds did well in 2017, they were walloped by the NSE Pension index which produced a whopping 70.3 percent return. Whether the index is a good bench mark for pension funds is still subject to debate.

While most pension funds are predominantly invested in fixed income funds, the NSE pension Index fund is an equity-based index.

Comparing an equity-based index with a fixed income-based portfolio looks like comparing apples and oranges.

According to analysis by Quantitative Financial Analytics, Nigerian pension funds have about 74 percent of their assets allocated to Government Bonds and treasury bills with only 10 percent invested in domestic and foreign equity securities.

APT Stands out

APT Pension fund has really stood out over the past few years as the top performer taking either the first or second positions in the performance table year after year.

In 2015, it took the second position in the RSA fund performance chart with 31.86 percent. In 2016, it came second again with 12.58 percent topping the Retiree fund category with 14.99 percent performance.

While it is not very apparent why APT does so well, it looks like it has to do with their asset allocation strategy.

APT seems to be the only pension fund that has a double-digit allocation to the stock market with about 13.75 percent of its RSA assets allocated to equities while 12.81 percent of Retiree fund asset is also allocated to equities.

The industry average allocation to equities in 2017 was 10.33 percent.

According to available information on their website, APT pension managers oversee the pension accounts of about 120k registered RSA members.