Economy

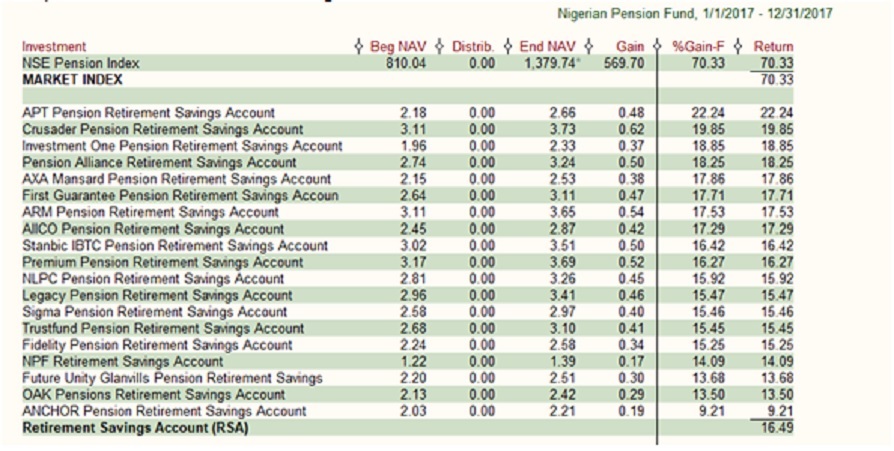

Nigerian Pension Funds Outperform Bench Mark Index

By Quantitative Financial Analytics

Nigerian pension funds once again recorded another year of brilliant performance in 2016 roundly beating the NSE Pension Index by wide margins.

The NSE Pension index ended the year 2016 at 810.04 points from its 2015 value of 815.16 points, thereby ending the year down by 5.13 points or -0.63%.

Savings Retirement Accounts (RSA):

Except for APT Pension Retirement Saving Account which ended the year with a negative performance of 22.96%, having lost N0.65 on the unit price of the RSA, every other RSA ended the year with positive performance of 8% or greater. The highest return of 12.67% came from AXA Mansard Pension Retirement Savings Account, followed by Future Unity Glanvills (FUG) RSA with 11.93%

Retiree Accounts:

The performance of the Retiree Accounts followed closely that of the RSA but unlike the RSAs, the Retiree Accounts did much better with no losses recorded by any one of them. Trust Pension Fund Retiree Account led the performance league with 14.68%. All the Retiree Accounts but one, recorded double digit positive return in 2016.

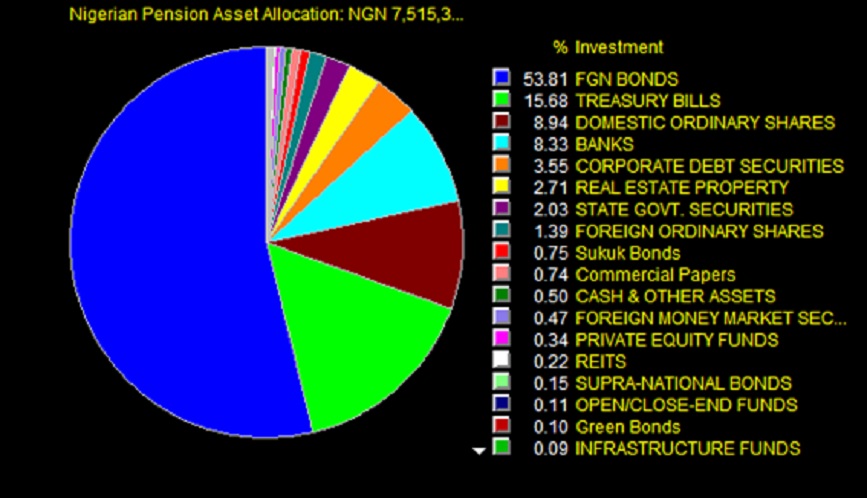

Asset Allocation is Everything

Asset allocation has been said to be responsible for most of the investment fortunes in history. That too can be rightly said about Nigerian pension funds. The implication of asset allocation is that it matters how a portfolio is divided between Bond, Equities, Cash, Money Market and other asset classes. Most Pension funds in Nigeria allocate at least 75% of their Asset Under Management (AUM) to fixed income securities (Government Bonds, Treasury Bills and corporate bonds). The interest rate on those assets has been on the increase over time and the CBN has signaled that it does not plan to reduce the rates any time soon. Though there is an inverse relationship between interest rate (yield) and bond prices, the increasing yield environment especially at the shorter end of the yield curve implies that matured bonds or treasury bills are being reinvested at higher yields and lower prices which benefits the pension funds. By having much of their AUM in fixed income securities, these PSAs tend to be insulated from the downside pressure of the stock market.

Asset Characteristics too

Another pointer to the performance of the Pension funds can be seen by looking at how they behave in relationship to the entire stock market. All the Pension funds have Betas of less than 1 indicating that they do not move in tandem with the stock market. This indication is also supported by the low R-Squared of the pension funds. All these relatively low statistics derive from the fact that majority of the pension fund assets are held in fixed income and money market instruments whose correlation with the market is relatively low.

A beta of 1 indicates that the security’s price moves in tandem with the market but a beta of less than 1 means that the security is imperially less volatile than the market while a beta of greater than 1 indicates that the security’s price is theoretically more volatile than the market. R-Squared on the other hand is a measure of the percentage of a portfolio’s or security’s performance that is attributable to the performance of its bench mark.

The implication of this is that for risk averse investors planning and saving for their retirement, it may be more prudent to overweight on pension fund assets by making additional voluntary contributions rather than investing same in the regular stock market.

Risk Adjusted Performance

Though the RSAs and other Retiree accounts are expectedly and comparatively less risky than similar products like Fixed Income Mutual Funds (as evidenced by their standard deviation of returns), their performance is not as mouthwatering as they seem when analyzed on a risk adjusted basis. Most of the pension funds have negative Alpha and negative Sharpe ratio, according to research by Quantitative Financial Analytics.

Alpha is a measure of the return on an investment compared to a suitable market index such that an alpha of 1% means the investment’s return over a period was 1% better than the market during that same period while an alpha of -1 means the investment underperformed the market. Sharpe ratio measures the risk adjusted performance of an asset or portfolio taking into consideration the prevailing risk-free rate.

The major reason for the negative alpha and Sharpe ratio is that the risk-free rate in Nigeria is quite high, (a risk-free rate of 15% was used for this analysis). Granting the low risk characteristics of the pension funds and the rising interest environment in Nigeria and compared to the performance of other asset classes, it will be appropriate to say Bravo to the pension fund managers for a job well done in 2016.

Contacts: info@mutualfundsnigeria.com

Economy

FAAC Disbursement for April 2025 Drops to N1.578trn

By Aduragbemi Omiyale

The amount shared by the federal government, the 36 state governments and the 774 local government areas of the federation from the Federation Account Allocation Committee (FAAC) in April 2025 from the revenue generated last month declined by N100 billion, Business Post reports.

This month, FAAC disbursed about N1.578 trillion to the three tiers of government, lower than the N1.678 billion distributed in March 2025.

In a communiqué by the Director of Press and Public Relations in the Office of the Accountant-General of the Federation (OAGF), Bawa Mokwa, it was stated that the N1.578 trillion comprised statutory revenue of N931.325 billion, Value Added Tax (VAT) revenue of N593.750 billion, Electronic Money Transfer Levy (EMTL) revenue of N24.971 billion, and an Exchange Difference revenue of N28.711 billion.

The money was shared after deducting N85.376 billion as cost of collection and N747.180 billion as total transfers, interventions and refunds from the total gross revenue of N2.411 trillion generated by the nation last month.

It was explained that gross statutory revenue of N1.718 trillion was received for March 2025 versus N1.653 trillion received in February 2025, and gross revenue of N637.618 billion was available from VAT compared with N654.456 billion a month earlier.

As for the distribution of the N1.578 trillion, FAAC said it gave the federal government N528.696 billion, the states N530.448 billion, the local councils N387.002 billion, and the benefiting states N132.611 billion as 13 per cent of mineral revenue.

It disclosed that on the N931.325 billion statutory revenue, the federal government received N422.485 billion, the state governments got N214.290 billion, the LGAs were given N165.209 billion, and the oil-producing states went away with N129.341 billion.

Further, from the N593.750 billion VAT revenue, the national government got N89.063 billion, the state governments received N296.875 billion, and the local councils got N207.813 billion.

In addition, from the N24.971 billion EMTL, the central government was given N3.746 billion, the state governments got N12.485 billion, and LGAs shared N8.740 billion.

Economy

Nigeria, South Africa Sign Agreement to Boost Mining

By Adedapo Adesanya

Nigeria and South Africa have signed a Memorandum of Understanding (MoU) to boost mining cooperation, focusing on investment, knowledge exchange, and technology transfer.

The agreement was signed in Abuja by the Solid Minerals Development Minister, Mr Dele Alake, and South Africa’s Mineral Resources, Mr Gwede Mantashe.

A statement on Wednesday said the MoU was part of efforts to strengthen ties under the Nigeria–South Africa Bi-National Commission framework.

It noted that the deal sets out specific areas of collaboration alongside defined implementation timelines for joint activities and engagements in the mining sector.

“Both ministers pledged ongoing engagement to advance intra-African trade and implement practical steps outlined in the agreement,” it said.

The ministers also expressed optimism that the renewed partnership would significantly strengthen the mining industries of both countries through shared expertise and innovation.

Key highlights include capacity building in geological methods using UAVs and applying spectral remote sensing technologies for mineral exploration and mapping.

Other areas cover geoscientific data sharing via the Nigeria Geological Survey Agency, training in mineral processing, and value-addition initiatives.

The MoU also supports capacity building in elemental fingerprinting with LA-ICP-MS and joint exploration of agro and energy minerals within Nigeria.

Mr Alake restated that bilateral cooperation holds promise for industrialisation, employment generation, and sustainable economic development across the African continent.

“The agreement on geology, mining, and mineral processing will foster knowledge exchange, promote investment, and encourage regional integration,” Mr Alake stated.

He reiterated Nigeria’s focus on developing its mining sector, noting mutual benefits through mineral wealth and South Africa’s technological expertise.

According to Mr Alake, this synergy will attract investments, build skills, and help diversify Nigeria’s economy for long-term growth and stability.

Mr Mantashe, on his part lauded the agreement, noting that it will be crucial to South Africa, as well as promote cooperation between the two African nations.

Economy

ARM-Harith Secures £10m to Unlock Nigerian Pension Funds

By Modupe Gbadeyanka

About £10 million has been injected into ARM-Harith’s Climate and Transition Infrastructure Fund (ACT Fund) to unlock local institutional capital for climate infrastructure.

The leading African private equity firm received the financial support from the United Kingdom-backed FSD Africa Investments (FSDAi) to unlock nigerian pension funds and catalyse local capital for infrastructure.

It was gathered that 75 per cent of the FSDAi facility would be provided in local currency, a first-of-its- kind approach specifically designed to mitigate the impact of foreign exchange (FX) volatility for pension funds.

This structure is expected to unlock an additional £31 million in pension fund contributions, nearly five times the participation achieved in ARM- Harith’s first fund.

The investment from ARM-Harith and FSDAi introduces an innovative solution to allow Nigerian pension funds to address a longstanding challenge in infrastructure equity finance: the ability to invest while receiving early liquidity.

By enabling predictable interim distributions during the early phases of investment, this innovative facility directly addresses a key barrier that has historically deterred domestic institutional capital from entering the asset class.

“For too long, domestic pension funds have remained on the sidelines of infrastructure equity due to liquidity constraints and heightened perception of risk.

“We are proud to have collaborated with FSDAi to design a pioneering solution that reduces risk for pension funds while delivering both early liquidity and long-term capital growth.

“This is a global first—a groundbreaking private sector-led solution that could fundamentally change how infrastructure equity is financed—not just in Nigeria, but across Africa,” the chief executive of ARM-Harith, Ms Rachel Moré-Oshodi, said.

Also, the Chief Investment Officer of FSDAi, Ms Anne-Marie Chidzero, said, “We are thrilled to collaborate with ARM-Harith to showcase how risk- bearing capital from a market-building investor like FSDAi can be strategically structured to unlock domestic institutional capital. This approach strengthens Africa’s financial markets and facilitates capital allocation towards sustainable, green economic growth across the continent.”

On his part, the British Deputy High Commissioner in Lagos, Mr Jonny Baxter, said, “The UK government, through its bilateral and investment vehicles is committed to continue to support the country’s financial sector — developing domestic capital markets as a means of financing priority sectors and driving economic development.

“Local currency capital helps mitigate the impact of foreign exchange volatility, narrows the financing gap, supports diversification into new asset classes and into climate- related projects and social sectors – while providing long-term funds to growing businesses.”

-

Feature/OPED5 years ago

Feature/OPED5 years agoDavos was Different this year

-

Travel/Tourism9 years ago

Lagos Seals Western Lodge Hotel In Ikorodu

-

Showbiz2 years ago

Showbiz2 years agoEstranged Lover Releases Videos of Empress Njamah Bathing

-

Banking7 years ago

Banking7 years agoSort Codes of GTBank Branches in Nigeria

-

Economy2 years ago

Economy2 years agoSubsidy Removal: CNG at N130 Per Litre Cheaper Than Petrol—IPMAN

-

Banking2 years ago

Banking2 years agoFirst Bank Announces Planned Downtime

-

Sports2 years ago

Sports2 years agoHighest Paid Nigerian Footballer – How Much Do Nigerian Footballers Earn

-

Technology4 years ago

Technology4 years agoHow To Link Your MTN, Airtel, Glo, 9mobile Lines to NIN