Economy

BTC Price In USD | Investing In Bitcoin Discussed By Traders Union

In the ever-evolving sphere of cryptocurrencies, Bitcoin (BTC) has consistently held its position as a key player. The volatile nature of BTC prices in USD makes it a hot topic of discussion among investors, analysts, and financial enthusiasts alike.

Traders Union revealed the BTC price in USD. TU experts recently divulged their perspective on the BTC price USD, providing much-needed insight.

Is Bitcoin a good investment today?

According to TU experts, Bitcoin presents a promising investment opportunity today. Despite its notorious volatility, the cryptocurrency market has witnessed exponential growth since Bitcoin’s inception in 2009. With the increasing demand for blockchain technologies, Bitcoin has proven to be one of the best-performing assets on the market, immune to traditional economic forces such as inflation or central bank manipulation. Even in its current correction phase after peaking above $60,000, Bitcoin’s historical growth rates suggest it could still offer significant long-term investment rewards.

Investment outcomes: Bitcoin 1 month/1 year ago

Drawing from their expertise, TU professionals note that ups and downs have marked the past year’s Bitcoin performance. The one-year return on Bitcoin stands at -35.47%, indicating a bearish period for the cryptocurrency. However, the one-month return paints a different picture, showing an impressive recovery rate of 26.29%. This stark contrast elucidates the volatile and unpredictable nature of Bitcoin investments.

Why investing in Bitcoin is a good idea

TU experts list several reasons why investing in Bitcoin could be beneficial:

- Price Correction: Bitcoin is currently trading at a significant discount from its all-time high, opening up potential buying opportunities.

- Institutional Adoption: Bitcoin’s acceptance by investment firms and funds lends it credibility and attracts retail investors.

- Lightning Network Success: Bitcoin’s network, though slower than some competitors like Visa, offers significantly lower transaction costs.

- Store of Value: With a maximum supply of 21 million coins, Bitcoin is a digital store of value akin to gold.

- Halving Cycle: Bitcoin’s halving cycle leads to a decreased supply of coins, which could increase the price.

- Bull Cycle Theory: The recurrent cycles of bull runs and subsequent corrections imply that another bull run could be imminent.

- Benchmark Status: Bitcoin is the benchmark for other cryptocurrencies, adding trust and recognition to its name.

Why investing in Bitcoin might be a problem

However, Bitcoin investments aren’t without risks. TU experts highlight some potential concerns:

- Regulatory Concerns: Regulatory actions worldwide pose a significant risk to Bitcoin. Some governments have imposed stringent restrictions or outright bans on the use and trade of cryptocurrencies, creating a highly uncertain future for Bitcoin. With such regulatory uncertainty, potential investors may navigate a precarious and unpredictable landscape.

- Fear of Recession: Bitcoin is still a relatively new asset despite its digital gold status. In times of economic instability or recession, newer assets are often the first to take a hit. The inherent volatility of Bitcoin, coupled with global economic uncertainties, can make Bitcoin a high-risk investment, particularly for short-term investors.

- Divided Forecasts: Sharply divided forecasts mark the world of Bitcoin. While some analysts believe we have seen the worst and expect a rebound, others anticipate further drops in Bitcoin’s price. This prediction divergence adds another layer of complexity to investment decisions.

Is investing $100 or $1000 in Bitcoin enough?

According to TU experts, how much one should invest in Bitcoin depends on individual circumstances and risk tolerance. It is crucial not to invest more than one can afford to lose. With Bitcoin’s swift growth, investing $20, $100, or $1000 per month could yield returns, but due to its volatile nature and limited liquidity, small investments might not provide sufficient diversification. Therefore, potential investors should be cautious and informed about the potential risks.

Additionally, Traders Union has also revealed the XAUUSD prediction today. To know further, visit the official website of the Traders Union

Conclusion

As we venture further into the digital age, Bitcoin is making waves in the financial world. While it presents promising opportunities for investors, it comes with unique challenges and risks. Understanding these dynamics is critical to making informed investment decisions. To delve deeper into the world of Bitcoin, visit the official Traders Union website.

Economy

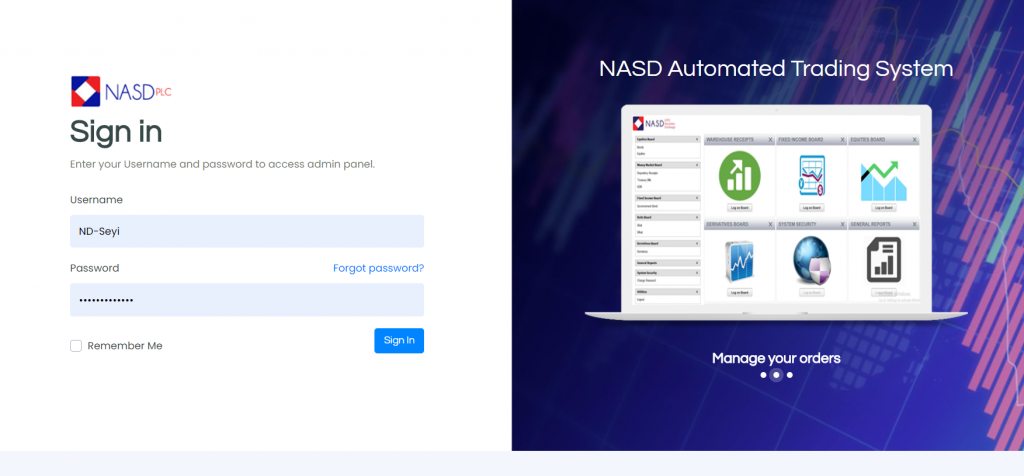

NASD Exchange in Red for Third Straight Session After 0.15% Fall

By Adedapo Adesanya

For the third straight session, the NASD Over-the-Counter (OTC) Securities Exchange closed bearish, further losing 0.15 per cent on Thursday amid weak demand for unlisted stocks.

During the session, the NASD Unlisted Security Index (NSI) declined by 5.70 points to 3,908.67 points from 3,914.37 points, and the market capitalisation lost N3.41 billion to end N2.338 trillion compared with the N2.342 trillion it ended on Wednesday.

The alternative stock exchange suffered a loss despite having more price gainers than price losers, with five for the former and four for the latter.

Okitipupa Plc lost N10.00 to close at N250.00 per unit versus midweek’s N260.00 per unit, Central Securities Clearing System (CSCS) Plc depreciated by N4.98 to N64.92 per share from N69.90 per share, Industrial and General Insurance (IGI) Plc dropped 4 Kobo to sell at 50 Kobo per unit compared with the previous day’s 54 Kobo per unit, and Acorn Petroleum Plc moderated by 1 Kobo to N1.32 per share from N1.33 per share.

Conversely, 11 Plc gained N13.65 to quote at N276.55 per unit versus the preceding session’s N263.00 per unit, FrieslandCampina Wamco Nigeria Plc appreciated by N6.10 to N84.15 per share from N78.05 per share, Food Concepts Plc expanded by 32 Kobo to N3.60 per unit from N3.28 per unit, Geo-Fluids Plc improved by 30 Kobo to N3.60 per share from N3.30 per share, and First Trust Mortgage Bank Plc increased by 10 Kobo to N1.09 per unit from 99 Kobo per unit.

Yesterday, the volume of transactions surged 2,797.1 per cent to 45.8 million units from 1.6 million units, the value of transactions jumped 315.2 per cent to N208.2 million from N50.1 million, and the number of deals soared 18.2 per cent to 39 deals from 33 deals.

At the close of business, CSCS Plc remained the most active stock by value (year-to-date) with 32.6 million units worth N1.9 billion, followed by Geo-Fluids Plc with 117.4 million units valued at N463.1 million, and Resourcery Plc with 1.05 billion units exchanged for N408.6 million.

Resourcery Plc ended the session as the most traded stock by volume (year-to-date) with 1.05 billion units sold for N408.6 million, trailed by Geo-Fluids Plc with 117.4 million exchanged for N463.1 million, and CSCS Plc with 32.6 million units traded for N1.9 billion.

Economy

Bulls Reaffirm Control of Nigeria’s Stock Exchange With 1.39% Surge

By Dipo Olowookere

Sell-offs in energy stocks could not bring down Nigeria’s stock exchange on Thursday, as the gains recorded by the others sustained the upward momentum.

Yesterday, the Nigerian Exchange (NGX) Limited further appreciated by 1.39 per cent on the back of a strong appetite for domestic equities, which are gaining traction among investors.

The banking index grew by 2.63 per cent, the consumer goods sector appreciated by 054 per cent, the insurance counter improved by 0.50 per cent, and the industrial goods space rose by 0.29 per cent, while the energy industry fell by 0.11 per cent.

When the bourse closed for the day, the All-Share Index (ASI) pointed northwards by 2,645.61 points to settle at 193,073.57 points compared with the previous day’s 190,427.96 points, and the market capitalisation soared by N1.698 trillion to N123.934 trillion from N122.236 trillion.

The trio of Deap Capital, Okomu Oil, and Fortis Global Insurance appreciated by 10.00 per cent each to N6.93, N1,459.70, and 55 Kobo apiece, while the duo of Infinity Trust Insurance and Zichis gained 9.96 per cent each to settle at N14.35, and N15.79, respectively.

On the flip side, the quartet of Tripple G, Multiverse, Secure Electronic Technology, and McNichols lost 10.00 per cent each to quote at N5.40, N25.20, N1.80, and N8.28, respectively, while Meyer declined by 9.80 per cent to N20.70.

Business Post reports that there were 52 appreciating equities and 26 depreciating equities on Thursday, showing a positive market breadth index and strong investor sentiment.

The busiest stock yesterday was Japaul with 80.1 million units valued at N293.3 million, Secure Electronic Technology sold 71.8 million units worth N136.5 million, Mutual Benefits transacted 58.7 million units for N277.6 million, Zenith Bank exchanged 53.2 million units valued at N4.5 billion, and GTCO traded 52.6 million units worth N6.2 billion.

Unlike the preceding session, the activity chart was in red after market participants transacted 898.5 million shares for N38.5 billion in 61,953 deals compared with the 3.7 billion shares worth N61.9 billion traded in 68,693 deals at midweek, implying a decline in the trading volume, value, and number of deals by 75.72 per cent, 37.80 per cent, and 9.81 per cent apiece.

Economy

Naira Fall 0.24% to N1,341/$1 at Official FX Window

By Adedapo Adesanya

The Naira depreciated further against the Dollar in the Nigerian Autonomous Foreign Exchange Market (NAFEX) on Thursday, February 19, by N3.24 or 0.24 per cent to N1,341.35/$1 from the N1,338.11/$1 it was traded a day earlier.

However, it improved its value against the Pound Sterling in the official market during the session by N11.16 to sell for N1,805.86/£1 compared with the previous day’s N1,817.02/£1, and gained N7.83 against the Euro to close at N1,577.29/€1 versus Wednesday’s closing price of N1,585.12/€1.

At the GTBank forex counter, the Naira lost N2 against the greenback to settle at N1,349/$1 compared with the N1,347/$1 it was exchanged at midweek, and at the black market, the exchange rate remained unchanged at N1,370/$1.

The performance of the domestic currency in the spot market was weak yesterday amid prevailing dynamics of supply and demand, as the Central Bank of Nigeria (CBN) maintains its efforts to stabilise the foreign exchange market. The exchange rate remained within the expected range, lifted by strong forex inflows and central bank dollar sales to Bureaux de Change (BDC) operators.

Meanwhile, the cryptocurrency market remained bearish, as there was continued caution in coins amid shaky interest in the digital assets.

On the policy front, there were tentative signs of progress on the digital asset market structure bill. The White House hosted talks between crypto industry representatives and bankers, which yielded incremental movement, though no compromise has yet emerged.

Ripple (XRP) declined by 1.7 per cent to $1.39, Litecoin (LTC) went down by 1.3 per cent to $52.46, Cardano (ADA) dropped 0.8 per cent to trade at $0.2715, Dogecoin (DOGE) retreated by 0.7 per cent to $0.0978, and Ethereum (ETH) contracted by 0.2 per cent to $1,943.30.

On the flip side, Solana (SOL) appreciated by 0.8 per cent to $82.12, Bitcoin improved its value by 0.7 per cent to $66,854.86, and Binance Coin (BNB) chalked up 0.1 per cent to sell for $605.58, while the US Dollar Tether (USDT) and the US Dollar Coin (USDC) closed flat at $1.00 each.

-

Feature/OPED6 years ago

Feature/OPED6 years agoDavos was Different this year

-

Travel/Tourism10 years ago

Lagos Seals Western Lodge Hotel In Ikorodu

-

Showbiz3 years ago

Showbiz3 years agoEstranged Lover Releases Videos of Empress Njamah Bathing

-

Banking8 years ago

Banking8 years agoSort Codes of GTBank Branches in Nigeria

-

Economy3 years ago

Economy3 years agoSubsidy Removal: CNG at N130 Per Litre Cheaper Than Petrol—IPMAN

-

Banking3 years ago

Banking3 years agoSort Codes of UBA Branches in Nigeria

-

Banking3 years ago

Banking3 years agoFirst Bank Announces Planned Downtime

-

Sports3 years ago

Sports3 years agoHighest Paid Nigerian Footballer – How Much Do Nigerian Footballers Earn