Economy

Dangote Cement Exports 14 Clinker Shipments to Ghana, Cameroon

By Dipo Olowookere

A total of 14 shipments of clinker have been exported from Nigeria to Ghana and Cameroon by Dangote Cement Plc as part of its efforts to boost foreign exchange (FX) inflows for the country, the chief executive of the company, Mr Arvind Pathak, has confirmed.

“By leveraging our robust export-to-import strategy, Dangote Cement completed 14 shipments of clinker from Nigeria to Ghana and Cameroon. This effort resulted in a 55.2 per cent surge in our Nigerian exports, underscoring our commitment to fostering African self-sufficiency,” Mr Pathak said in a statement made available to Business Post.

The cement maker said the demand for its products because of their high quality has resulted in a significant increase in its pan-African operations.

This was reflected in the financial performance of the organisation in the first half of 2024, as its operations outside its home market, Nigeria, went up by 139.9 per cent to N807.1 billion from the N336.4 billion recorded in the corresponding period of 2023.

The Nigerian operations also witnessed an improvement in the period under consideration despite the macroeconomic headwinds, with the firm demonstrating strong resilience due to the strategies implemented by the management.

It was observed that revenue and EBITDA jumped by 85.1 per cent and 50.3 per cent to N1.760 trillion and N666.2 billion, respectively.

In addition, the post-tax profit grew by 6.3 per cent to N189.9 billion amid the promotion of a cleaner environment, with the commissioning of 11 of the 17 Alternative Fuel Projects across the organisation and the delivery of 300 full CNG trucks for its Nigerian business.

“We effectively navigated macroeconomic headwinds to deliver positive results in the first half of the year. Group volumes were up 3.8 per cent, with our Nigeria operations achieving double-digit volume growth of 10.9 per cent.

“This growth was driven by improved efficiency across our operations and supported by increased market activity levels compared to the election year and cash crunch in 2023.

Despite the challenges of elevated inflation, high borrowing costs, and a further weakening of the currency in the first six months of the year, our business demonstrated strong resilience. This was due to our rigorous focus on cost minimisation and our diversified business model,” Mr Pathak stated.

He assured that, “Looking ahead, we remain bullish about the growth prospect of the African region, evident in our increased capital investments.

“We continue to prioritise innovation, cleaner energy transition, and cost leadership towards achieving our vision of transforming Africa and building a sustainable future.”

Economy

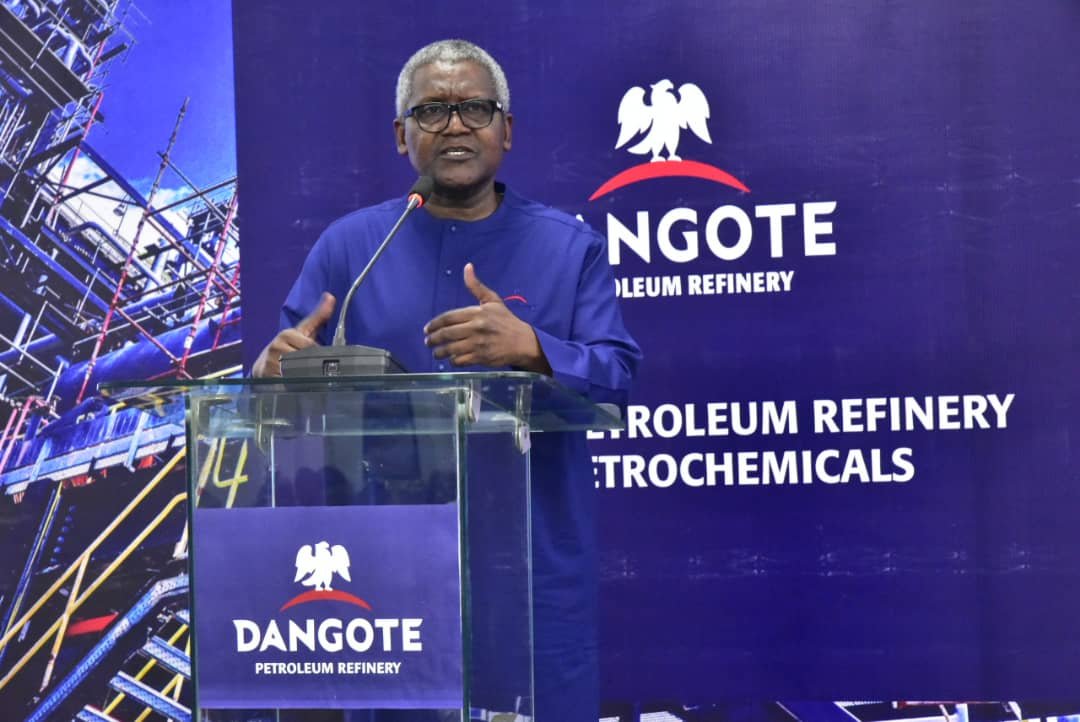

Dangote Refinery Finally Hits Full 650,000-Barrel Per Day Capacity

By Adedapo Adesanya

Dangote Refinery has reached its full capacity of 650,000 barrels per day following the successful optimisation of critical processing units, marking a turning point for Africa’s largest refinery, located in Lagos.

The $20 billion facility is now operating at full capacity, a world-record milestone for a single-train refinery.

This achievement comes after the completion of an intensive performance testing on the refinery’s Crude Distillation Unit and Motor Spirit production block.

According to the chief executive of Dangote Refinery, Mr David Bird, the refinery is now positioned to supply up to 75 million litres of petrol daily to the domestic market, a dramatic increase from the 45 million – 50 million litres delivered during the recent festive period.

The development can reshape Nigeria’s energy landscape and reduce the country’s longstanding dependence on imported refined products.

“Our teams have demonstrated exceptional precision and expertise in stabilising both the CDU and MS Block,” Mr Bird said. “This milestone underscores the strength, reliability, and engineering quality that define our operations.”

The refinery has completed a 72-hour series of performance test runs in collaboration with technology licensor UOP, a Honeywell company, to validate operational efficiency and confirm that all critical parameters meet international standards.

The tests covered the naphtha hydrotreater, isomerisation unit, and reformer unit, which together form the backbone of the facility’s gasoline production capability.

The milestone marks another achievement for the businessman and majority stake owner at the facility in his ambition to transform Nigeria from Africa’s largest crude oil producer into a refining powerhouse.

Since the commencement of the facility in 2016, it has faced numerous setbacks, including pandemic-related delays, foreign exchange challenges, and technical complications.

It was finally commissioned in May 2023 to help wean Nigeria off imported petroleum products, due to the chronic underperformance of its state-owned refineries.

Despite being Africa’s largest crude producer, the country has not been able to self-produce, even with four state-owned refineries with a combined capacity of 445,000 barrels per day. This has led to decades of high dependency on importation.

The Dangote refinery’s emergence at full capacity has the potential to eliminate this import dependence while positioning Nigeria as a net exporter to West African markets.

Yet, the refinery faces difficulty securing adequate crude oil supplies from Nigerian producers, forcing it to import feedstock from the US, Brazil, Angola, and other countries.

Mr Bird also confirmed that Phase 2 performance test runs for the remaining processing units are scheduled to commence next week, suggesting further capacity optimisation ahead.

The official emphasised the refinery’s commitment to “enhancing Nigeria’s energy security while supporting industrial development, job creation, and economic diversification.”

Economy

NASD OTC Exchange Rallies 0.74%

By Adedapo Adesanya

For the third consecutive session, the NASD Over-the-Counter (OTC) Securities Exchange closed in positive territory after it gained 0.74 per cent on Wednesday, February 11, amid a flat market breadth index.

The bourse recorded five appreciating securities as well as five depreciating securities during the midweek session.

On the gainers’ side of the market was Central Securities Clearing System (CSCS), which added N5.80 to sell at N70.53 per share versus Tuesday’s closing price of N64.73 per share.

Further, Air Liquide Plc appreciated by N2.02 to N22.34 per unit from N20.32 per unit, Afriland Properties Plc improved by 25 Kobo to N16.20 per share from N15.95 per share, First Trust Mortgage Bank Plc expanded by 6 Kobo to 75 Kobo per unit from 69 Kobo per unit, and Food Concepts Plc grew by 2 Kobo to N2.91 per share from N2.89 per share.

On the flip side, Okitipupa Plc lost N17.00 to sell at N220.00 per unit compared with the previous day’s N237.00 per unit, NASD Plc dropped N5.14 to trade at N46.26 per share versus N51.40 per share, Geo-Fluids Plc depreciated by 39 Kobo to close at N4.02 per unit versus N4.41 per unit, Acorn Petroleum Plc went down by 6 Kobo to N1.31 per share from N1.37 per share, and Industrial and General Insurance (IGI) Plc slipped by 5 Kobo to 54 Kobo per unit from 59 Kobo per unit.

At the close of trading activities, the market capitalisation increased by N17.05 billion to N2.308 trillion from N2.291 trillion, while the NASD Unlisted Security Index (NSI) advanced by 29.50 points to 3,858.81 points from 3,830.31 points.

Yesterday, the volume of securities jumped 15,181.4 per cent to 1.06 billion units from 6.9 million units, the value of securities surged 10.4 per cent to N465.7 million from N89.1 million, and the number of deals rose by 21.8 per cent to 56 deals from 46 deals.

The most active stock by value on a year-to-date basis was CSCS Plc with 18.2 million units worth N790.9 million, trailed by Resourcery Plc with 1.04 billion units valued at N408.6 million, and Geo-Fluids Plc with 29.2 million units sold for N150.8 million.

As for the most active stock by volume on a year-to-date basis, the position was taken over by Resourcery Plc with a turnover of 1.04 billion units valued at N408.6 million, while Geo-Fluids Plc moved to second place with 29.2 million units exchanged for N150.8 million, and the third place was occupied by Mass Telecom Innovation Plc with 20.1 million units worth N8.1 million.

Economy

Naira Trades N1,348/$1 as CBN Opens Official Market to BDC Operators

By Adedapo Adesanya

The Naira appreciated against the US Dollar in the Nigerian Autonomous Foreign Exchange Market (NAFEX) on Wednesday, February 11, by N2.07 or 0.15 per cent to N1,348.95/$1 from N1,351.02/$1 as the Central Bank of Nigeria (CBN) moved to further ease shortages and narrow the gap between the official and street rates.

The CBN approved the participation of licensed Bureaux De Change (BDC) operators in the Nigerian Foreign Exchange Market (NFEM) as part of efforts to improve forex liquidity in the retail segment of the market and meet the legitimate needs of end users.

The apex bank capped the weekly FX purchases at $150,000, adding that utilisation complies with existing BDC operational guidelines.

In the same official market, the Nigerian currency gained N6.46 against the Pound Sterling to quote at N1,840.11/£1 versus N1,846.57/£1, and added N6.36 on the Euro to close at N1,600.13/€1, in contrast to the preceding session’s N1,606.49/€1.

At the GTBank FX counter, the Nigerian Naira gained N5 on the greenback to settle at N1,358/$1 versus the previous day’s N1,363/$1, but remained unchanged at N1,430/$1 in the black market.

Meanwhile, the digital currency market was bearish yesterday as traders sold their positions after digesting a more hawkish macro outlook.

Analysts mainly attributed the latest crypto selloff to shifting expectations around US macro policy, following a “hawkish shift” in Federal Reserve expectations after Kevin Warsh’s nomination as chairman of the US central bank, which signals tighter liquidity and fewer rate cuts ahead.

Traders will be watching key US labour market data for signs on the future path of interest rates and broader risk appetite.

Solana (SOL) shed 3.2 per cent to sell at $79.86, Ethereum (ETH) depreciated by 2.7 per cent to $1,958.44, Bitcoin (BTC) dropped 1.5 per cent to $67,540.62, Cardano (ADA) slid 1.5 per cent to $0.2579, Ripple (XRP) dipped 1.4 per cent to $1.37, Binance Coin (BNB) slumped 1.2 per cent to $609.73, Litecoin (LTC) went down by 1.2 per cent to $52.58, and Dogecoin (DOGE) crashed by 1.1 per cent to $0.0917, while the US Dollar Tether (USDT) and the US Dollar Coin (USDC) closed flat at $1.00 each.

-

Feature/OPED6 years ago

Feature/OPED6 years agoDavos was Different this year

-

Travel/Tourism10 years ago

Lagos Seals Western Lodge Hotel In Ikorodu

-

Showbiz3 years ago

Showbiz3 years agoEstranged Lover Releases Videos of Empress Njamah Bathing

-

Banking8 years ago

Banking8 years agoSort Codes of GTBank Branches in Nigeria

-

Economy3 years ago

Economy3 years agoSubsidy Removal: CNG at N130 Per Litre Cheaper Than Petrol—IPMAN

-

Banking3 years ago

Banking3 years agoSort Codes of UBA Branches in Nigeria

-

Banking3 years ago

Banking3 years agoFirst Bank Announces Planned Downtime

-

Sports3 years ago

Sports3 years agoHighest Paid Nigerian Footballer – How Much Do Nigerian Footballers Earn