Brands/Products

Digital Consumers are Driving New Era of Online Shopping, Transforming How Nigerian Youth Buy

The digital revolution is hitting Nigeria’s retail scene fast, and it’s being powered by the country’s youth. Armed with smartphones and a demand for affordability, they’re shaping the e-commerce industry where convenience reigns supreme.

Nigeria’s internet users, reaching more than half its population, creates a strong foundation for e-commerce growth. This growth is significantly fueled by the nation’s youth, a substantial 160 million (70% of the population), whose tech-forward nature drives the popularity of platforms like Temu, satisfying their demand for accessible and budget-friendly online retail.

This generation has flipped the retail script. Value is their compass, price comparisons their weapon, social media their guide, and convenience their non-negotiable. This isn’t just shopping; it’s a calculated pursuit of savvy options, the widest selection, and the best value-for-money deals.

The power of finding a good deal is undeniable, especially for these shoppers watching their wallets. Social media is a testament to this, filled with posts celebrating the newfound ability to purchase items once considered luxuries.

Take Anwulika Udanoh (@Anwulika Udanoh on Facebook), for example. Her recent post, detailing her shopping experience on Temu, is a perfect snapshot of this online shopping revolution. She stumbled upon affordable jewelry on the platform, swayed by glowing reviews, and took a chance. What followed was a delightful surprise: customised earrings bearing her name, a feat once thought impossible.

Even her son’s friend jumped on the personalisation trend with custom pendants. ‘Their prices will shock you,’ she wrote, with genuine excitement. And despite any concerns about longevity, the sheer joy of affordable, personalised style at good quality won her over. That’s the power of this shift.

This goes beyond mere bargain hunting; it’s about empowerment. It’s about unlocking the ability to express your unique style without sacrificing your financial stability. It’s about finding those small sparks of joy, like personalised jewelry that feels uniquely yours. For many, these platforms are a portal to a more colourful and individually tailored life.

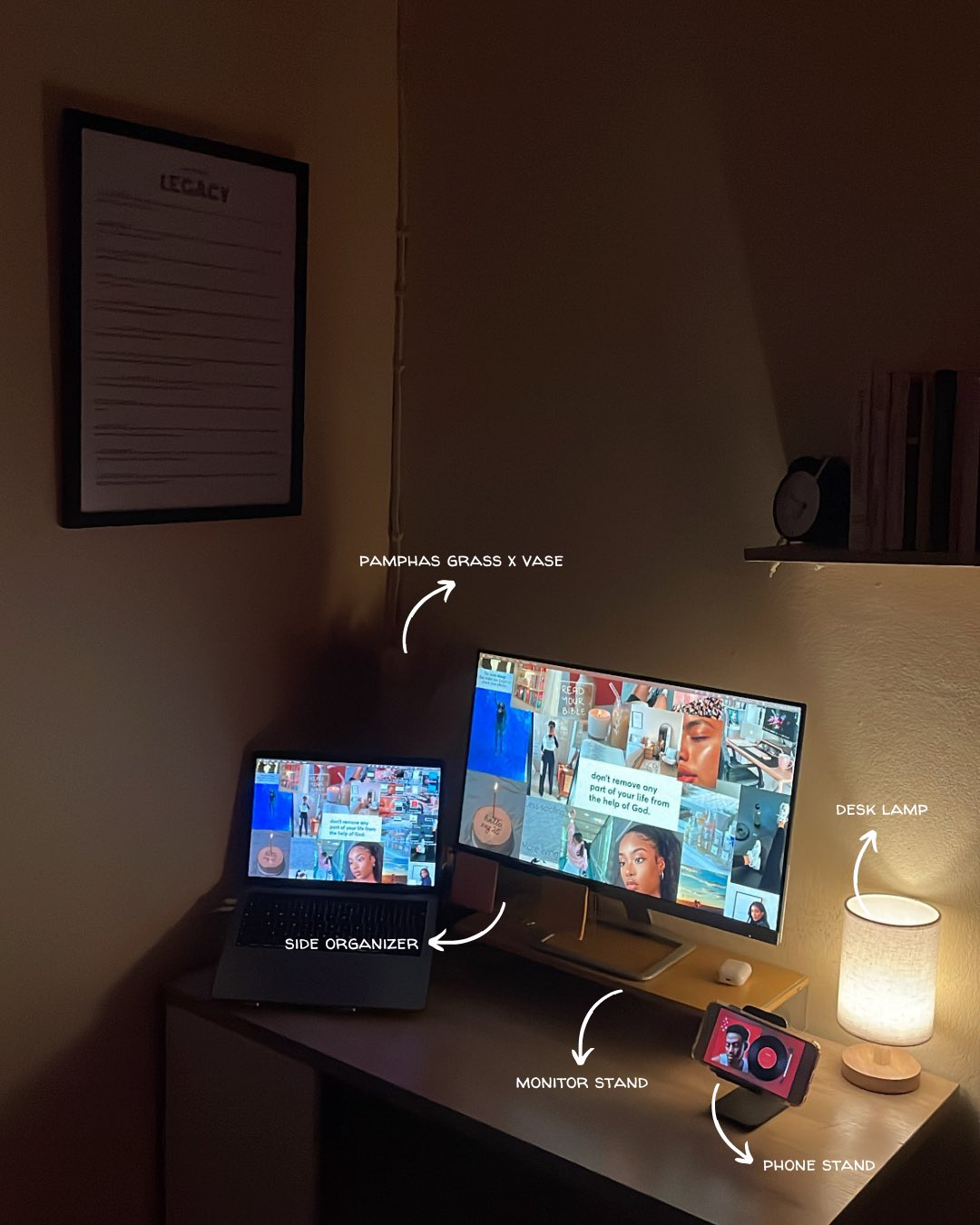

Then there’s the spirit of adventure, captured in a simple tweet by Steph (@steph on X): ‘ordered a couple of desk items, wish me luck.’ It’s the essence of a generation eager to discover new ways to elevate their everyday life.

Launched in the country in November 2024, Temu offers a diverse selection that aligns with the dynamic needs of young Nigerians. The direct-from-factory online marketplace is known for cutting out layers of middlemen and their associated markups and costs, passing on savings to consumers. Serving more than 90 markets globally, Temu has become one of the most visited e-commerce sites worldwide and a top Apple-recommended app of 2024.

Let’s be real: budgets matter. In a country where every naira is carefully considered, competitive pricing and accessible payment methods, aided by partnerships like Temu and Verve, empower Nigerian shoppers with greater choice and freedom to embrace trends while making the budget go beyond. It’s like opening up a world of possibilities.

Adding to the appeal is a user experience designed for the mobile age. With 193.9 million cellular connections, smartphones are the gateway to this digital world, and intuitive platforms allow for seamless browsing and purchasing on the go, perfectly aligning with the dynamic rhythms of young Nigerian life.

This mobile-first approach is further amplified by the power of social proof. In a nation of 31.60 million social media users, reviews and recommendations carry significant weight, transforming satisfied shoppers into passionate brand advocates.

A growing digital environment, particularly in urban areas, presents a rich opportunity for platforms that resonate with the aspirations of young people. They seek more than just products; they want to build online communities, create digital identities, and shape their lifestyles.

Real stories like those of Anwulika and Steph show that Temu isn’t just a place to shop, but a platform that’s unlocking joy, creativity, and financial freedom for Nigeria’s youth. Whether it’s personalised jewellery, playful desk accessories or everyday essentials, Temu is turning everyday purchases into moments of empowerment — proving that with the right platform, anything is possible.

Brands/Products

Investors Inject $9.2m into AI Dating App Ditto for Yacht Blind Dates

By Dipo Olowookere

About 9.2 million funding round has been secured by an AI-dating app, Ditto, for the expansion of its iMessage-based matchmaker, with the participation of Peak XV Partners, Gradient, Scribble Ventures, Alumni Ventures, and Llama Venture.

The iMessage-based matchmaker plans real dates for users, handling everything from the match to logistics, so students can focus on showing up and connecting in real-life. Users grow tired of endless swiping and stalled conversations.

College students swipe endlessly, juggle multiple chats, and still struggle to turn matches into actual dates. Ditto was created to remove that friction entirely.

The business was established by two Berkeley undergraduates, Mr Allen Wang and Mr Eric Liu, who saw friends spend hours on dating apps without forming meaningful connections.

The platform initially launched at UC San Diego and went viral across sorority group chats before quickly expanding to UC Berkeley, USC, UCLA, and UC Davis.

It operates entirely over iMessage, where users already communicate daily. Users tell Ditto their preference for a date, such as ‘a 6 ‘2 hot nerd that brings me flowers’ or ‘an ABG who mastered leetcode’. After sharing their preferences and availability, users receive a text with a complete date plan, including the time, place, and details of their match, all centred around the campus they are near.

After each date, Ditto collects feedback and incorporates these feedbacks into the user’s profile to improve future matches. The result is a system that feels personal, efficient, and low-pressure, while removing much of the anxiety and inefficiency associated with modern dating apps.

“Our goal was to build something that actually helps people go on dates, not stay stuck in an app. When you remove swiping and chatting, you remove a lot of the toxicity and anxiety that people associate with online dating.

“We plan the date, people show up, and real connections have a chance to form. About 20 per cent of our matches turned into actual dates,” Mr Wang stated.

With this funding, Ditto is kicking off 2026 by hosting 10 yacht parties across the US, starting in Los Angeles on Valentine’s Day.

Each yacht will host 100 college singles, matched into 50 couples. This will be the biggest yacht party in college history. Ditto is co-hosting these parties with the hottest school clubs and Greek life organisations in Los Angeles, New York, Boston, and more.

A Partner at Gradient, Vig Sachidananda, while commenting on the new funding package, said, “Ditto is leveraging AI in a creative way to build a novel online dating experience — one which resembles a true matchmaking service.

“We’ve seen a great early response from users to this approach, and we’re excited to continue to work with Ditto as they expand to college campuses across the US.”

Since launching, Ditto has grown to more than 42,000 users across four college campuses, with over 25 per cent of users coming through referrals.

Looking ahead, Ditto plans to expand beyond college campuses and eventually support other forms of connection, including professional networking and group social experiences. The long-term vision is to become a matchmaker for modern life, helping people turn intent into meaningful, real-world interactions, one plan at a time.

Brands/Products

Odekina Leaves UBA for AEDC to Head Corporate Communications Department

By Aduragbemi Omiyale

One of the foremost Public Relations practitioners in Nigeria, Mr Omede Odekina, has joined the Abuja Electric Distribution Company (AEDC).

He is now on the payroll of the energy firm as the Head of Brand Marketing and Corporate Communications Department after leaving the United Bank for Africa (UBA) Plc.

The Kogi State University graduate will use his experience as a media relations expert to sell the image of the electricity organization.

In an announcement via his LinkedIn page, Mr Odekina described his movement from the banking space to the energy industry as the “beginning of an exciting new chapter and a unique opportunity to help shape how one of Nigeria’s most critical service organisations engages with its customers and communities.”

He thanked UBA for providing him with the platform to grow his career, describing the lender as “truly one of the best places to work.”

According to him, “UBA was more than a workplace; it was a family. The culture, leadership, and people created an environment of excellence, trust, and continuous growth. I leave deeply appreciative of the journey, the friendships, and the values that will remain with me always.”

The Associate of the Nigerian Institute of Public Relations (NIPR) disclosed that in his new role, “my focus is firmly on positioning Abuja Electricity Distribution Plc as Nigeria’s number one electricity distribution company, one that delivers reliable service with professionalism, respect, transparency, and a strong sense of community partnership.”

“It is a responsibility I embrace with enthusiasm, purpose, and optimism for what lies ahead,” he said further.

Brands/Products

Reputation Economy: How Nigerian Brands Won and Lost Public Trust in 2025

Nigeria’s leading independent media intelligence consultancy, P+ Measurement Services, has released its 2025 Industry Media Reputation Report, revealing that corporate reputation has emerged as one of the most decisive assets for Nigerian companies, rivaling financial performance and market share in shaping public trust.

The report analysed and audited thousands of print and online news reports published in 2025 across the banking, insurance, telecommunications, and e-hailing sectors. In total, coverage of 29 commercial banks, 13 insurance companies, five e-hailing platforms, and four telecommunications operators was examined to determine how corporate actions translated into public perception.

According to the findings, rising operational costs, currency pressures, regulatory scrutiny, labour relations, and service reliability now directly influence how brands are judged in the media and by stakeholders.

“Reputation is no longer a soft outcome of publicity. It is a measurable business asset shaped by corporate behaviour, governance quality, customer experience, and crisis response,” said a Senior Analyst at P+ Measurement Services, Ms Tumininu Balogun.

She added, “For more than a decade, we have been at the forefront of media intelligence in Nigeria. Our commitment to the PR and communications industry is to ensure that reliable media data and actionable insight are always available, so professionals can move beyond intuition and make truly data-driven decisions.”

E-Hailing Industry: Driver Relations Reshaped Corporate Reputation

The e-hailing sector recorded one of the clearest shifts in reputation dynamics in 2025, driven largely by labour policies and platform economics.

inDrive Nigeria led the sector with 39% of positive reputation share, following extensive media coverage of its decision to reduce driver commission to 0.1% during peak hours in Abuja. Bolt Nigeria followed with 32%, supported by reports on its electric tricycle deployment in Lagos. LagRide recorded 17%, driven by coverage of its electric vehicle infrastructure partnership, while Uber Nigeria accounted for 11% and Rida 1%.

On the negative reputation scale, Bolt recorded the highest share at 40%, linked to driver protests following fare reduction policies. Uber accounted for 29%, inDrive 20%, LagRide 8%, and Rida 3%, largely associated with reports on strike threats, platform reliability concerns, and driver earnings disputes.

The report notes that how platforms treat drivers has become as influential to reputation as rider experience.

Banking Industry: Profitability Confronted by Governance Risk

Among commercial banks, Stanbic IBTC recorded the strongest positive reputation position at 26%, driven by recognition as KPMG’s top retail bank. Zenith Bank followed with 22%, supported by dividend payout coverage. Fidelity Bank (19%), UBA (17%), and FirstBank (16%) gained positive reputation visibility through education initiatives, digital service upgrades, and branch automation projects.

However, reputational exposure remained significant. GTCO recorded the highest negative reputation share at 28%, followed by FirstBank at 26%, FCMB at 18%, and both UBA and Ecobank at 14%, mainly due to media reports concerning legal disputes, fraud investigations, and customer-related controversies.

The report highlights that in the banking sector, strong earnings and digital innovation strengthen reputation, but governance failures can rapidly undermine it.

Insurance Industry: Financial Stability and Data Protection Define Trust

In the insurance sector, AXA Mansard led positive reputation share with 36%, followed by Leadway Assurance (29%), AIICO (16%), NEM Insurance (11%), and SanlamAllianz (8%).

AXA Mansard also accounted for the highest negative reputation exposure at 68%, driven by reports of a significant decline in pre-tax profit. AIICO recorded 18%, Leadway 12%, and NEM 2%, largely connected to regulatory matters and data protection concerns, including coverage of customer data breaches.

The findings indicate that insurers are now judged as much by financial resilience and cybersecurity posture as by product offerings.

Telecommunications Industry: Infrastructure Investment Meets Rising Public Expectations

MTN Nigeria led positive reputation share with 47%, driven by infrastructure expansion narratives and innovation campaigns. Glo followed with 28%, Airtel Nigeria with 16%, and T2 (formerly 9mobile) with 9%, largely supported by its rebranding coverage.

On the negative reputation side, MTN recorded 44%, T2 31%, Glo 13%, and Airtel 12%, influenced by reports on service quality challenges and the Nigeria Labour Congress boycott directive targeting telecommunications operators.

The sector’s results suggest that while capital investment enhances visibility, network reliability and customer experience increasingly determine long-term reputation.

Reputation Has Become a Strategic Business Asset

Across all four industries, the report finds a consistent pattern: reputation in 2025 closely followed corporate behaviour.

Brands that demonstrated transparency, operational fairness, financial discipline, digital reliability, and customer focus were more likely to build positive public trust. Companies facing labour unrest, legal disputes, regulatory sanctions, data breaches, or service disruptions saw these issues rapidly reflected in their reputation profile.

For brand owners, investors, regulators, and communication professionals, the implication is clear: reputation is no longer managed only through messaging, but through measurable actions that are permanently recorded in the media ecosystem and searchable online.

-

Feature/OPED6 years ago

Feature/OPED6 years agoDavos was Different this year

-

Travel/Tourism9 years ago

Lagos Seals Western Lodge Hotel In Ikorodu

-

Showbiz3 years ago

Showbiz3 years agoEstranged Lover Releases Videos of Empress Njamah Bathing

-

Banking8 years ago

Banking8 years agoSort Codes of GTBank Branches in Nigeria

-

Economy3 years ago

Economy3 years agoSubsidy Removal: CNG at N130 Per Litre Cheaper Than Petrol—IPMAN

-

Banking3 years ago

Banking3 years agoSort Codes of UBA Branches in Nigeria

-

Banking3 years ago

Banking3 years agoFirst Bank Announces Planned Downtime

-

Sports3 years ago

Sports3 years agoHighest Paid Nigerian Footballer – How Much Do Nigerian Footballers Earn