Economy

Understanding Stock Market Volatility: How to Manage Risk

Introduction to Stock Market Volatility

No one does stock investing without understanding what volatility means. Stock Market volatility shows just how unpredictable the stock market really is. The higher and more frequently the stock prices move, the more volatile it becomes. Investors must take their time to properly watch these movements to mitigate risks and make informed and wise investment decisions.

Let’s look into what stock market volatility really means, its causes,types and how to understand it and reduce investment risks

Definition of stock market volatility

Stock market volatility refers to the frequent and irregular movement of prices in a stock or market index over a period of time. It is often measured by the standard deviation of returns. In other words, it shows how far prices move away from their average over time.

In 2023 and 2024, we have seen periods where markets swung wildly due to economic surprises and global events, making volatility an important topic for every investor to know about. Examples are Netflix, Amazon, Tesla amongst others. In 2025, the S&P 500 index had a 10% fluctuation showing just how uncertain the market can be while helping investors make the best decisions.

Importance of understanding volatility for investors

As an investor, you need to understand everything that involves the stock market, including its movements. Why should investors care about volatility?

First, volatility helps to understand investment risks. A stock’s movement can either offer high returns and lower risks or low return and even lower risks. An investor that has a higher risk tolerance can decide to go for the one with higher returns.

Next, volatility helps to make wise investment decisions on which investment plan fits into your goals and investment portfolio. For example, a mix of both high and low volatility stocks would create a balance on the investment portfolio.

Finally, volatility affects market and investment sentiments. When uncertainty rises, investors often react emotionally, causing sharp swings. Understanding this helps investors avoid common mistakes like panic selling or chasing quick gains during turbulent times.

Common Misconceptions About Market Fluctuations

There are several myths and misconceptions when it comes to market fluctuations.

One common misconception is that the market should be stable, and ups and downs are always signs of failure. In reality, fluctuations are normal and necessary for markets to function. In fact, times of high volatility can present buying opportunities when prices drop.

Another myth is that it is always best to hold on to stocks no matter what. However, the truth is that while long-term investment has a lot of advantages, it is essential to watch out for high volatility and risks to avoid big losses.

Also, some think low volatility means no risk, but even stable stocks can lose value due to sudden movements. Conversely, increased volatility does not imply that a stock is unfavorable. It may simply require a stronger stomach to withstand short-term swings.

Investors who understand these facts are better equipped to navigate markets that are more unpredictable due to global economic changes and geopolitical events.

Causes of Stock Market Volatility

Economic indicators and data releases

Economic reports like inflation rates, economic growth, employability rate, amongst others can affect investor decisions.

Imagine if the inflation rate of a country moves at the speed of light! This could lead to investors losing their trust in the economy, leading to rapid shares sales, then to prices going down. On another hand, positive economic news, like an increase in companies’ growth or employment rate, builds investor confidence and causes an increase in buying stock prices, making prices go higher.

These reports act like signals that guide investor decisions and can trigger big market swings.

Political Events and Policy Changes

Majorly, politics can affect how the market moves. New government policies, election results or political instability can create uncertainty for businesses and investors.

For example, new tax laws or trade rules can affect the profits and growth of companies. This can make investors nervous and lead to them rushing to sell stocks. Other issues like war, unrest and political tensions can affect prices. An instance is the Arab Spring uprisings in Egypt in 2011, there was a sharp decline in stock prices on the Egyptian Exchange like the EGX 30.

Politics often play a big role in market movements. Changes in government policy, election results, or sudden political tensions can pull down prices quickly.

Corporate earnings reports

Businesses release earnings reports that show their profits and losses every three months. When a well-known company (maybe a blue-chip stock, eg: Apple and Microsoft) releases a report that shows more loss than profit over and over, they begin to lose stock prices. This could also affect other corporations in that sector.

But, when a company earns more than expected, it can improve investor trust and even boost the entire industry. However, if many companies miss earnings targets around the same time, it can trigger a broader market selloff.

Global Market Influences and Crises

Today, markets are interconnected, so a problem in one country or more could lead to a worldwide market instability. Using COVID-19 as an example, the pandemic led to huge price swings all over the world as a result of restricted movements.

Similarly, changes in oil prices or financial troubles in major economies like the United States or China can cut across markets everywhere. Investors often react fast to these global events, which increases volatility.

Market Sentiment and Investor Behavior

Finally, it is important to note that investors are human and will sometimes make decisions based on how they feel. When investors feel good, they are more likely to buy more stocks, leading to an increase in prices. But, if investors face something that makes them nervous, they try to sell quickly leading to prices falling.

There’s also the herd mentality. When people follow the crowd, prices will swing farther than the true worth of the company.

Measuring Stock Market Volatility

Volatility Index (VIX)

The Volatility Index, also referred to as the VIX, is a measure of expected future volatility of the S&P 500 Index (SPX) – the core index for U.S. equities. It shows how much the stock market is expected to move in the near future, especially over the next 30 days. A high VIX value means that big price swings are expected. On the other hand, a low VIX could mean a stable market with reduced price changes. Today, investors use the VIX to get an understanding of market risk as well as investor sentiment.

Standard Deviation and Variance

Standard deviation and variance are statistical tools that are used to measure how much stock prices move around their average price.

Standard deviation tells us how widely distributed prices are from the average prices. A higher value means higher prices and volatility.

Variance is simply the square of standard deviation and is less commonly used directly but important in calculations. For example, if a stock has a standard deviation of 5%, it means its price typically moves 5% above or below the average price. These numbers help investors understand how risky a stock is compared to others.

Historical volatility vs. Implied Volatility

Historical volatility looks at the story that a stock or index has told over time. It examines how a stock price has changed over a particular span of time, like the past 30 or 90 days. This helps to notice patterns and to understand previous dangers.

On the other hand, implied volatility has more to do with predictions. It forecasts how much price movement the market is expecting.

Both metrics are helpful in managing the difficulties that volatility presents and comprehending how it affects investments.

Types of Market Volatility

Short-term Volatility

Short-term volatility is the quick and sudden change in prices over a few days or weeks. These changes can be affected by news, company reports, political changes, etc. Long-term investors would typically ignore these short fluctuations.

Long-term Volatility

As opposed to short-term volatility, long-term volatility happens over months or even years. They are usually a result of big market changes due to economic cycles, trends, or global events. Let’s look at the FTSE 100, for instance. Its decline started with the financial crisis of 2008, but after going through a period of recovery, economic instability affected it too. Then came the COVID-19 in 2020, leading to big market drops and a slower recovery.

Systematic vs. Unsystematic Volatility

There are two categories of volatility:

Systematic Volatility: This affects the entire market or many stocks at once. Its causes include interest rate changes, inflation, or political instability. It’s like a strong wind that shakes everything in the market.

Unsystematic Volatility: This only affects a specific company or industry. For example, a tech company’s stock may become volatile if it releases a new product or faces a lawsuit. This type can be reduced or avoided by diversifying your investments across different sectors.

Both types show the risk in the stock market, but understanding the difference helps investors manage risk better by spreading their money wisely.

Risks Associated with High Volatility

Loss of Investment Value

One of the biggest risks with high volatility is loss of money. Stock prices can drastically drop, leading to a decreased value in your investments. An example is the significant and sudden fall of Jumia in 2019. This drop was caused by issues with its governance, finance and sustainability. This kind of sudden loss can be scary, especially if you need to sell shares when prices are low.

Increased Trading Costs

Volatility can cause markets to rise, leading to investors buying and selling stocks more frequently. The higher the trading and transaction, the greater the fees, charges and taxes. If an investor trades a lot to capitalize on market movements, these charges can eat into profit. Volatile markets can lead to increased trading expenses more than calmer times.

Emotional Decision-Making

Investors frequently experience anxiety or overconfidence when prices fluctuate wildly. This could lead to emotional decisions like panic selling or impulsive purchases. Long-term success is typically harmed by this behavior. Many investors tend to lose out on profits by selling low and buying high when they respond to market fluctuations too soon.

Impact on Long-Term Portfolio Performance

Though volatility can seem risky, it doesn’t always harm long-term investing. However, if you panic or trade too often during volatile periods, your portfolio returns may suffer. Staying disciplined, diversifying investments, and focusing on long-term goals help reduce volatility’s negative effects. For instance, data shows that patient investors who held stocks through the 2008 financial crisis saw strong rebounds within five years.

Strategies to Manage Risk During Market Volatility

Diversification Across Sectors and Assets

Diversification has always been one of the best risk mitigation strategies. You can do this by spreading your investments across different sectors and/or various asset types. This way, if one sector falls, others might do well, balancing your overall portfolio. For example, during the 2020 COVID crash, some sectors like tech actually grew while others dropped sharply.

Dollar-Cost Averaging

Dollar-cost averaging means choosing to invest a fixed amount regularly, irrespective of what the market is saying. This evens out your expenses over time by enabling you to purchase more shares at low prices and fewer at high ones.It’s an excellent method to relieve the stress of attempting to time the market precisely.

Hedging with Derivatives

Hedging means protecting your investment against losses by using financial tools like options or futures. Although more advanced, these tools can reduce risks, especially for large investors. There have when inflation caused market swings, hedging helped some investors limit their losses.

Maintaining a Cash Reserve

Holding cash during volatile times is a smart idea because you have cash at hand to cover your expenses when market prices drop. Having a cash reserve means you don’t have to sell assets at a loss.

Setting Stop-Loss Orders

A stop-loss order is an instruction to sell a stock automatically if its price falls to a certain level. This prevents bigger losses by exiting a position before the price drops further. For instance, if you buy a stock at 100 naira, setting a stop-loss at 90 naira helps limit your loss to 10%.

Long-Term Investing and Volatility

Staying Focused on Investment Goals

Stock market volatility means prices can move up and down quickly. However, as a long-term investor, you need to put all sentiments aside and focus on your goals. There is a long line of history concerning the movement of stock market. So, keep your eyes on your plans and don’t follow the market noise.

Avoiding Panic Selling

When investors lead with emotions, they can end up panic selling when the market falls. This is usually a bad idea as it could lead to losses. It is, therefore, important to remain calm and avoid emotional or hasty decisions. By resisting the urge to sell when things look bad, you give your investment the best chance to grow.

Taking Advantage of Buying Opportunities

Volatility can actually create chances to buy good shares at lower prices. When other investors panic and sell, prices drop. If you have a long-term mindset, you can use these moments to buy quality stocks cheaply. This helps you build wealth over time as the market recovers and grows. So, rather than fearing volatility, see it as an opportunity to invest more wisely.

Frequently Asked Questions(FAQS)

- What is stock market volatility? Stock market volatility means how much and how quickly stock prices go up or down over a certain time.

- Why do stock markets become volatile?

Volatility can be caused by many things like political changes, company news, economic reports, global events, or even natural disasters. - Is high volatility good or bad for investors?

High volatility means more risk because prices can drop suddenly. But it also creates chances to buy stocks cheap or sell at a profit. It depends on your strategy and risk tolerance. - How can I measure volatility?

Volatility is often measured using standard deviation or indexes like the VIX. These tools show how much stock prices vary from their average. - Does market volatility affect all stocks the same way?

No, some stocks are more volatile than others. Smaller companies or those in unstable industries tend to have more price swings compared to large, stable companies.

Conclusion

Stock market volatility is a natural part of investing, showing how much and how fast prices move over time. Understanding stock market volatility helps you manage risks better and make smarter investment decisions. Remember, while volatility can be scary, it also offers opportunities if you stay patient and focused on your long-term goals. By learning how to handle volatility, you strengthen your path to financial success and build confidence in the stock market.

Economy

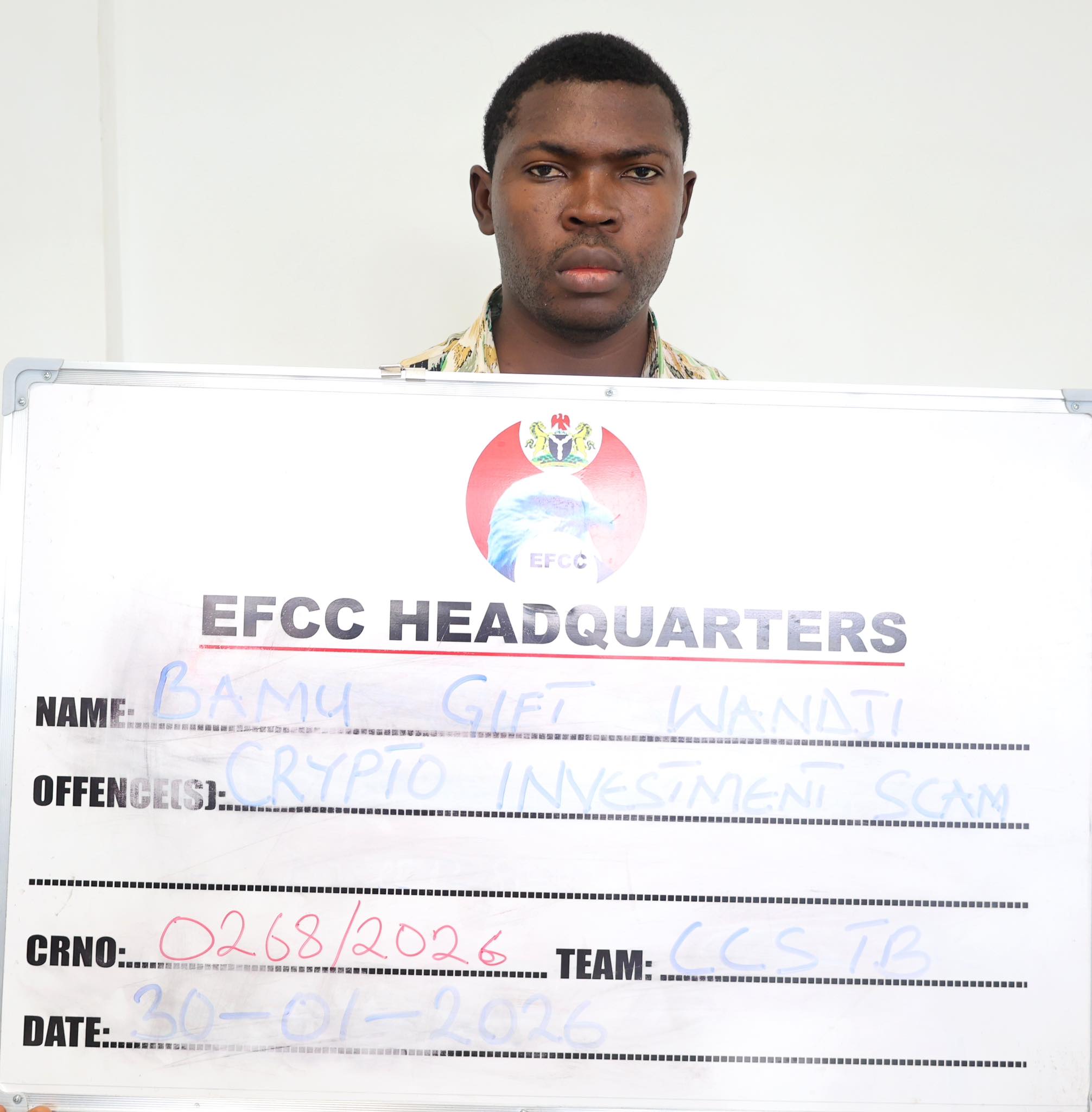

Crypto Investor Bamu Gift Wandji of Polyfarm in EFCC Custody

By Dipo Olowookere

A cryptocurrency investor and owner of Polyfarm, Mr Bamu Gift Wandji, is currently cooling off in the custody of the Economic and Financial Crimes Commission (EFCC).

He was handed over to the anti-money laundering agency by the Nigerian Security and Civil Defence Corps (NSCDC) on Friday, January 30, 2026, after his arrest on Monday, January 12, 2026.

A statement from the EFCC yesterday disclosed that the suspect was apprehended by the NSCDC in Gwagwalada, Abuja for running an investment scheme without the authorisation of the Securities and Exchange Commission (SEC), which is the apex capital market regulator in Nigeria.

It was claimed that Mr Wandji created a fraudulent crypto investment platform called Polyfarm, where he allegedly lured innocent Nigerians to invest in Polygon, a crypto token that attracts high returns.

Investigation further revealed that he also deceived the public that his project, Polyfarm, has its native token called “polyfarm coin” which he sold to the public.

In his bid to promote the scheme, the suspect posted about this on social media platforms, including WhatsApp, X (formally Twitter) and Telegram. He also conducted seminars in some major cities in Nigeria including Kaduna, Lagos, Port Harcourt and Abuja where he described the scheme as a life-changing programme.

Further investigation revealed that in October, 2025, subscribers who could not access their funds were informed by the suspect that the site was attacked by Lazarus group, a cyber attacking group linked to North Korea.

Further investigations showed that Polyfarm is not registered and not licensed with SEC to carry out crypto transactions in Nigeria. Also, no investment happened with subscribers’ funds and that the suspect used funds paid by subscribers to pay others in the name of profit.

Investigation also revealed that native coin, polyfarm coin was never listed on coin market cap and that the suspect sold worthless coins to the general public.

Contrary to the claim of the suspect that his platform was attacked, EFCC’s investigations revealed that the platform was never attacked or hacked by anyone and that the suspect withdrew investors’ funds and utilized the same for his personal gains.

The EFCC, in the statement, disclosed that Mr Wandji would be charged to court upon conclusion of investigations.

Economy

Nigerian Stocks Shed 0.09% on Mild Profit-Taking

By Dipo Olowookere

Profit-takers pounced on the Nigerian Exchange (NGX) Limited on Friday, weakening it by 0.09 per cent at the close of transactions.

Investors toned down on their hunger for Nigerian stocks during the last trading session of the week, with selling pressure mainly on the banking space, which shed 0.78 per cent.

The bourse crumbled despite the other sectors closing green, with the consumer goods up by 0.10 per cent, and the energy index up by 0.02 per cent, while the industrial index closed flat.

Livestock Feeds depreciated by 10.00 per cent to sell for N6.30, Learn Africa declined by 10.00 per cent to N8.10, Living Trust Mortgage Bank also slipped by 10.00 per cent to N4.05, Deap Capital gave up 9.97 per cent to trade at N9.39, and Industrial and Medical Gases lost 9.61 per cent to finish at N31.50.

On the flip side, Zichis appreciated by 9.97 per cent to N4.19, Abbey Mortgage Bank gained 9.94 per cent to quote at N9.40, RT Briscoe jumped by 9.93 per cent to N7.86, Haldane McCall grew by 9.90 per cent to N4.33, and Omatek increased by 9.87 per cent to N3.00.

Business Post reports that the market breadth index was positive despite the poor outcome, recording 33 price gainers and 31 price losers, representing strong investor sentiment.

The All-Share Index was down by 156.91 points during the session to 165,370.40 points from the 165,527.31 points achieved a day earlier, and the market capitalisation depleted by N184 billion to N106.153 trillion from N105.969 trillion.

Trading data showed that 687.4 million equities valued at N15.0 billion exchanged hands in 41,553 deals yesterday compared with the 691.4 million equities worth N15.4 billion traded in 38,665 deals on Thursday, implying a jump in the number of deals by 7.47 per cent, and a slip in the trading volume and value by 2.60 per cent, respectively.

The busiest stock on Friday was Veritas Kapital with 80.5 million units worth N197.0 million, Secure Electronic Technology transacted 79.3 million units valued at N87.5 million, Deap capital transacted 33.3 million units for N340.5 million, Access Holdings sold 31.0 million units valued at N703.0 million, and Zenith Bank exchanged 30.6 million units worth N2.2 billion.

Economy

NASD Exchange Rises 0.20%

By Adedapo Adesanya

The NASD Over-the-Counter (OTC) Securities Exchange appreciated by 0.20 per cent on Friday, January 30, supported by the gains achieved by two securities on the platform.

During the session, Okitipupa Plc went up by N15.70 to finish at N234.60 per share versus the previous day’s N218.90 per share and Paintcomm Investment Plc expanded by 5 Kobo to close at N11.05 per unit compared with the previous day’s N11.00 per unit.

It was observed that yesterday, there were three price losers led by Geo-Fluids Plc, which dropped 60 Kobo to sell at N5.75 per share versus N6.35 per share, Afriland Properties Plc declined by 35 Kobo to close at N13.65 per unit compared with Thursday’s closing price of N14.00 per unit, and Industrial and General Insurance (IGI) Plc depreciated by 3 Kobo to 66 Kobo per share from 69 Kobo per share.

At the close of business, the NASD Unlisted Security Index (NSI) rose by 7.34 points to 3,630.11 points from 3,622.77 points and the market capitalisation grew by N4.39 billion to N2.171 trillion from N2.167 trillion.

A total of 287,618 units of securities exchanged hands on Friday compared with the previous day’s 1.9 million units of securities, indicating a decline in the volume of trades by 85.6 per cent.

The value of transactions, according to data, was down by 77.2 per cent to N3.1 million from N13.4 million, but the number of deals increased by 31.3 per cent to 21 deals from 16 deals.

Central Securities Clearing System (CSCS) Plc remained the most traded stock by value (year-to-date) with 15.4 million units exchanged for N623.0 million, followed by FrieslandCampina Wamco Nigeria Plc with 1.6 million units traded for N108.5 million, and Geo-Fluids Plc with 9.1 million units valued at N61.1 million.

CSCS Plc also ended the session as the most active stock by volume (year-to-date) with 15.4 million units sold for N623.0 million, followed by Mass Telecom Innovation Plc with 10.1 million units worth N4.1 million, and Geo-Fluids Plc with 9.1 million units valued at N61.1 million.

-

Feature/OPED6 years ago

Feature/OPED6 years agoDavos was Different this year

-

Travel/Tourism9 years ago

Lagos Seals Western Lodge Hotel In Ikorodu

-

Showbiz3 years ago

Showbiz3 years agoEstranged Lover Releases Videos of Empress Njamah Bathing

-

Banking8 years ago

Banking8 years agoSort Codes of GTBank Branches in Nigeria

-

Economy3 years ago

Economy3 years agoSubsidy Removal: CNG at N130 Per Litre Cheaper Than Petrol—IPMAN

-

Banking3 years ago

Banking3 years agoSort Codes of UBA Branches in Nigeria

-

Banking3 years ago

Banking3 years agoFirst Bank Announces Planned Downtime

-

Sports3 years ago

Sports3 years agoHighest Paid Nigerian Footballer – How Much Do Nigerian Footballers Earn