Economy

FG Gazettes New Tax Reform Laws

By Adedapo Adesanya

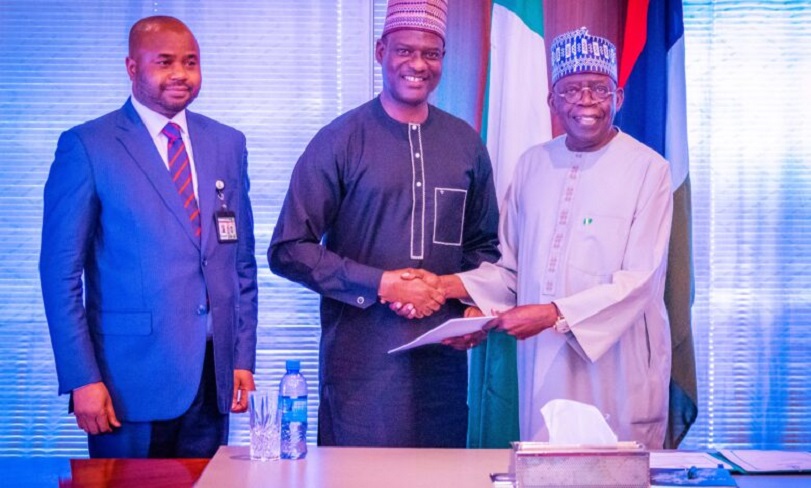

The federal government has officially published Nigeria’s new tax reform laws in the government gazette, marking a historic overhaul of the country’s fiscal framework.

This was revealed in a statement signed by the Personal Assistant to the President on Special Duties, Mr Kamorudeen Yusuf, on Wednesday.

Signed into law by President Bola Tinubu on June 26, 2025, the reforms establish a new foundation for taxation, administration, and revenue collection based on four keenly contested bills.

The four legislations are: Nigeria Tax Act (NTA), 2025, Nigeria Tax Administration Act (NTAA), 2025, Nigeria Revenue Service (Establishment) Act (NRSEA), 2025, and the Joint Revenue Board (Establishment) Act (JRBEA), 2025.

By officially publishing these laws, Nigeria has confirmed the legitimacy of these legislations, notifying citizens, institutions, and businesses of these laws, and therefore, they have come into effect.

He noted that key features includes small businesses with turnover under N100 million and assets below N250 million are exempted from corporate tax while corporate tax rate for large firms may be cut from 30 per cent to 25 per cent at the President’s discretion.

“Top-up tax thresholds: N50 billion (local firms) and €750 million (multinationals).

“5 per cent annual tax credit introduced for eligible priority-sector projects.

“Companies transacting in foreign currency may now pay taxes in Naira at official exchange rates,” Mr Yusuf stated.

The statement noted that while the implementation timeline for the Nigeria Tax Act and Nigeria Tax Administration Act takes effect on January 1, 2026, the Nigeria Revenue Service (Establishment) Act and Joint Revenue Board (Establishment) Act have become effective since June 26, 2025.

“These reforms aim to simplify Nigeria’s tax system, support small businesses, attract investment, and strengthen fiscal stability, aligning with President Tinubu’s Renewed Hope Agenda to diversify revenue away from oil,” the statement added.

Economy

Sachet Alcohol Ban: NECA Demands Respect for Due Process

By Adedapo Adesanya

The Nigeria Employers’ Consultative Association (NECA) has expressed concern over the renewed enforcement of a ban on the production and sale of alcoholic beverages in sachets and small PET bottles by the National Agency for Food and Drug Administration and Control (NAFDAC).

The group’s director general, Mr Wale-Smatt Oyerinde, warned that the action of the agency could have adverse economic and governance consequences.

NECA is the organisation expressing worry of this issue after the Manufacturers Association of Nigeria (MAN) raised concerns about it earlier this week.

Mr Oyerinde said the enforcement contradicts a directive from the Office of the Secretary to the Government of the Federation dated December 15, 2025, which suspended the ban, as well as a March 14, 2024 resolution of the House of Representatives calling for restraint and broader stakeholder engagement.

The NECA chief said the continued enforcement is already disrupting legitimate businesses, unsettling ongoing investments, and putting thousands of jobs at risk, while weakening confidence in Nigeria’s regulatory environment.

According to Mr Oyerinde, regulation should be based on evidence, proportionality and the rule of law. He noted that the affected products were tested, registered and periodically revalidated under NAFDAC’s regulatory procedures, with alcohol content clearly labelled in line with internationally recognised Alcohol by Volume standards.

He added that underage drinking is primarily an enforcement issue at the retail level rather than a packaging issue, and called for stricter licensing, monitoring, and sanctions for erring retailers rather than a blanket ban on certain product formats.

NECA boss also warned that sachet and small-pack formats reflect affordability realities for many adult consumers, and that eliminating them could push demand into informal, unregulated markets, increasing public health risks and shrinking the formal economy.

He further expressed concern that enforcement efforts are focused on a regulated segment of the beverage industry while more dangerous illicit narcotics and abused pharmaceuticals continue to circulate widely among young people.

On the economic impact, NECA said the wines and spirits value chain supports significant direct and indirect employment across manufacturing, packaging, distribution, transportation, retail and agriculture.

It cautioned that sudden regulatory actions could threaten livelihoods, reduce government revenue and undermine investor confidence.

Addressing environmental concerns, NECA said plastic waste issues should be tackled through improved waste management, recycling systems and extended producer responsibility frameworks, rather than selective product bans.

Economy

NASD OTC Index Drops 0.27% as Market Cap Slides to N2.167trn

By Adedapo Adesanya

The NASD Over-the-Counter (OTC) Securities Exchange lost 0.27 per cent on Thursday, January 29, weakening the Unlisted Security Index (NSI) by 9.79 points to 3,622.77 points from the previous session’s 3,632.56 points, as the market capitalisation recorded a N5.85 billion loss to end at N2.167 trillion compared with Wednesday’s closing value of N2.173 trillion.

Three securities were responsible for the downfall of the alternative stock market, with leaders being Okitipupa Plc, which shrank by N15.70 to end at N218.90 per unit versus the previous day’s N234.60 per unit. Afriland Properties Plc declined by 50 Kobo to close at N14.00 per share compared with the N14.50 per share it finished at midweek, and Food Concepts Plc dropped 9 Kobo to sell at N2.63 per unit versus N2.72 per unit.

Business Post reports that there were two price gainers yesterday led by Nipco Plc, which added N17.48 to its value to settle at N259.48 per share versus N242.00 per share, and Central Securities Clearing System (CSCS) Plc appreciated by 35 Kobo to N40.50 per unit from N40.15 per unit.

During the trading session, the volume of securities went down by 57.3 per cent to 1.9 million units from 4.7 million units, the value of securities decreased by 74.4 per cent to N13.4 million from N52.4 million, and the number of deals slipped by 50 per cent to 16 deals from 32 deals.

When the market closed for the day, CSCS Plc was still the most active stock by value on a year-to-date basis with 15.3 million units traded for N622.9 million, trailed by FrieslandCampina Wamco Nigeria Plc with 1.6 million units exchanged for N108.4 million, and Geo-Fluids Plc with 8.9 million units worth N60.4 million.

CSCS Plc was also the most active stock by volume on a year-to-date basis with 15.3 million units valued at N622.9 million, followed by Mass Telecom Innovation Plc with 10.1 million units sold for N4.1 million, and Geo-Fluids Plc with 8.9 million units transacted for N60.4 million.

Economy

RT Briscoe, Others Lift Stock Exchange by 0.22%

By Dipo Olowookere

The gains recorded by RT Briscoe and 40 other equities lifted the Nigerian Exchange (NGX) Limited by 0.22 per cent on Thursday after a day with the bears.

Rebound of the stock exchange was triggered by renewed bargain-hunting activities by the market participants, with RT Briscoe gaining 10.00 per cent to sell for N7.15.

SCOA Nigeria appreciated by 9.91 per cent to N31.60, Deap Capital also jumped by 9.91 per cent to N10.43, Veritas Kapital appreciated by 9.85 per cent to N2.23, and Zichis chalked up 9.80 per cent to trade at N3.81.

Conversely, Haldane McCall depreciated by 9.84 per cent to finish at N3.94, Union Dicon shed 9.79 per cent to close at N8.75, University Press shrank by 8.00 per cent to N5.75, Legend Internet crashed by 7.56 per cent to N5.50, and Austin Laz lost 7.50 per cent to quote at N3.70.

Data indicated that the bourse ended the session with 41 price gainers and 27 price losers, implying a positive market breadth index and strong investor sentiment.

Business Post reports that the industrial goods index was flat yesterday, but this was offset by the others, with the banking space up by 0.68 per cent, the insurance segment rose by 0.64 per cent, the consumer goods counter expanded by 0.46 per cent, and the energy sector grew by 0.10 per cent.

Consequently, the All-Share Index (ASI) went up by 362.93 points to 165,527.31 points from 165,164.38 points and the market capitalisation gained N232 billion to finish at N105.969 trillion versus the previous day’s N105.737 trillion.

The most traded stock for the day was Cutix with 144.6 million units worth N464.9 million, Veritas Kapital traded 56.6 million units for N124.3 million, GTCO sold 26.0 million units valued at N2.6 billion, Tantalizers exchanged 26.0 million units worth N110.0 million, and Japaul transacted 25.9 million units valued at N67.2 million.

When Customs Street closed for business, the activity chart showed the trading was up by 10.94 per cent to 691.4 million shares from 623.2 million shares, the trading value was down by 6.67 per cent to N15.4 billion from N16.5 billion and the number of deals shrank by 8.32 per cent to 38,665 deals from 42,172 deals.

-

Feature/OPED6 years ago

Feature/OPED6 years agoDavos was Different this year

-

Travel/Tourism9 years ago

Lagos Seals Western Lodge Hotel In Ikorodu

-

Showbiz3 years ago

Showbiz3 years agoEstranged Lover Releases Videos of Empress Njamah Bathing

-

Banking8 years ago

Banking8 years agoSort Codes of GTBank Branches in Nigeria

-

Economy3 years ago

Economy3 years agoSubsidy Removal: CNG at N130 Per Litre Cheaper Than Petrol—IPMAN

-

Banking3 years ago

Banking3 years agoSort Codes of UBA Branches in Nigeria

-

Banking3 years ago

Banking3 years agoFirst Bank Announces Planned Downtime

-

Sports3 years ago

Sports3 years agoHighest Paid Nigerian Footballer – How Much Do Nigerian Footballers Earn