Economy

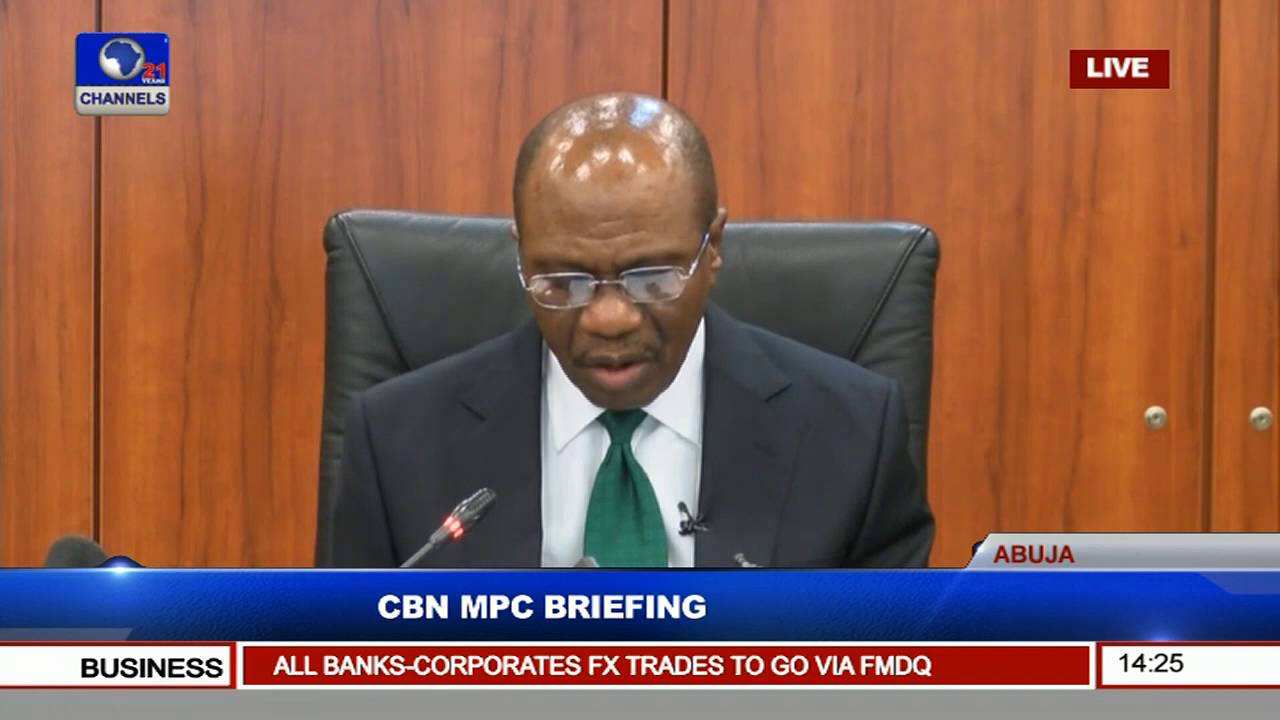

MPC to Maintain Status Quo on Policy Variables Despite Falling Market Rates

By Afrinvestor Research

Since we released our Pre-MPC Note last week, two major developments have surfaced in the global and domestic scene with potential impacts on domestic market condition and near term outlook for monetary policy.

Whilst we consider these events important talking points as the Monetary Policy Committee (MPC) convenes next week (tomorrow) to deliberate, our expectation of the outcome of the meeting remains unchanged as we anticipate committee members to overwhelmingly vote to retain policy rates at current levels.

The first major development is the outcome of the US Fed policy meeting which held midweek. Dismissing the deceleration in US inflation rate below the 2.0% target since the start of the year as a “mystery”, the US Fed Chairman, Janet Yellen, guided on one additional rate hike in 2017 and three more in 2018 in addition to measures to begin slowly reducing the Fed’s US$4.5tn balance sheet.

Although the slightly hawkish statement of the US Fed caught many by surprise, markets’ reaction has so far been calm against the backdrop of the strong and synchronized global growth expansion as well as effective use of forward guidance communication by the Fed to guide on a policy path.

Thus, US equity markets, which have been on a tear this year, traded flattish on Wednesday and Thursday, although yields have risen on US bonds and Emerging Market sovereign and corporate Eurobonds. Nonetheless, we do not expect the MPC to respond as the likelihood of a large-scale capital flow reversal from emerging markets remains low as long as the US Fed sticks to its guided gradual tightening path whilst other major central banks’ policy outlook remains broadly accommodative.

Contrarily, we consider the recent developments in the domestic scene more significant to the MPC’s discourse next week. Over the last three weeks, rates have been dropping sharply in the Treasury Bills market in response to possible near term easing of monetary policy as well as reduction in supply of longer dated bills since CBN stopped offering 364-day bills at its OMO auctions.

Consequently, we have observed a bull flattening pattern (i.e. longer term rates falling faster than shorter ones) at primary and secondary market for Treasury Bills as investors aggressively position in longer-dated bills.

At the PMA held mid-week, the 364-day stop rate fell to 17.0%, 152bps lower than the August 30th Auction stop rate, compared to a 15bps and 56bps drop in 91-day and 182-day papers respectively.

As demand increases relative to supply, secondary market rates on T-bills have also declined across tenors, down 134bps M-o-M as of market close today. The bullish sentiment in the fixed income market is also noticeable in the bond market where yields have dropped 74bps on average M-o-M across benchmark bonds to 16.2%. Given market sentiments are often leading indicators of policy rate changes, we expect the MPC to take notice of recent movements in the yield curve.

However, as we noted in our Pre-MPC note last week, we believe MPC would maintain status quo on all rates next week given the need to consolidate gains on stabilizing FX and inflation rates. Our expectations are based on the following considerations:

Price level remains sticky as high base effect thins out: the National Bureau of Statistics (NBS) Inflation report for August released today indicated Headline inflation marginally decelerated 3bps to 16.01% Y-o-Y from 16.04% in July. M-o-M CPI growth have remained elevated since the start of the year against the backdrop of a food price pressure which took Food Inflation to an all-time high of 20.3% in July 2017. With the economy now running out of high base effect driven moderation in headline inflation, our model projects inflation rate will rise for the first time since the start of the year in September. Given supposed price-anchored monetary policy regime, the MPC is not likely to cut benchmark rate in a period of rising inflation expectation.

MPR has become a less effective Monetary Policy Tool: the case for easing via benchmark rate reduction becomes weaker if the current disparity between the benchmark rate and short-term fixed income yields is taken into consideration. Although the recent bullish streak in the fixed income market has narrowed this spread, it is not enough to justify a cut in interest.

While our medium term outlook favours a gradual monetary easing, we believe the stabilization of the FX market is paramount to achieving monetary policy objectives. The FX market, despite improvements recorded so far in the year, is still in a fragile state as the CBN is yet to harmonize all rates at the official market. As such, in the event that a unified rate is not achieved, monetary easing poses a threat for FX stability. Furthermore, the current realities of Nigeria’s budget deficit, suggests the need for the fiscal authorities to continuously fund this disparity which current tightening stance enhances; though at a higher cost to government.

In light of the above, the more rational decision we foresee the MPC making is to maintain status quo and continue to consolidate on gains in the FX market. Hence, we believe the outcome of the 5th MPC meeting would be to; retain the MPR at 14.0%; retain the CRR at 22.5%; retain the Liquidity Ratio at 30.0%; and retain the Asymmetric corridor at +200 and -500 basis points around the MPR.

Economy

Stock Market Gains N2.367trn as All-Share Index Rises 2.06%

By Dipo Olowookere

The Nigerian Exchange (NGX) Limited appreciated by 2.06 per cent on Friday, amid a rush for local equities due to encouraging earnings of companies for 2025.

Business Post reports that the buying pressure was across the key sectors of Customs Street yesterday, with the banking index growing by 2.49 per cent. The energy industry appreciated by 2.05 per cent, the consumer goods counter grew by 0.78 per cent, the insurance space improved by 0.64 per cent, and the industrial goods sector expanded by 0.44 per cent.

At the close of trades, the market capitalisation went up by N2.367 trillion to N117.027 trillion from N114.660 trillion, and the All-Share Index (ASI) gained 3,687.45 points to close at 182,313.08 points compared with the previous day’s 178,625.63 points.

Cornerstone Insurance, Infinity Trust, and Nestle Nigeria appreciated by 10.00 per cent each to sell at N6.38, N9.90 and N2,662.00, respectively, while Okomu Oil rose by 9.99 per cent to N1,327.00, with RT Briscoe up by 9.97 per cent to N17.42.

Conversely, SAHCO depleted by 10.00 per cent to M135.00, Guinness Nigeria lost 9.97 per cent to trade at N103.00, Omatek shrank by 9.39 per cent to N2.99, NPF Microfinance Bank decreased by 6.51 per cent to N5.60, and eTranzact slipped by 6.33 per cent to N10.80.

A total of 53 stocks ended in the green side and 33 stocks finished in the red side, representing a positive market breadth index and strong investor sentiment.

Data showed that 936.4 million shares valued at N52.7 billion were transacted in 50,068 deals on Friday versus the 698.3 million shares worth N28.438 billion traded in 50,886 deals on Thursday, indicating a rise in the trading volume and value by 34.10 per cent, and 85.56 per cent apiece, and a slip in the number of deals by 1.61 per cent.

First Holdco closed the session as the most active equity with 106.3 million units worth N5.1 billion, Zenith Bank transacted 72.6 million units valued at N5.7 billion, United Capital traded 45.4 million units for N963.2 million, GTCO sold 45.0 million units worth N4.9 billion, and Fidelity Bank exchanged 31.4 million units valued at N639.0 million.

Economy

OTC Securities Exchange Extends Positive Run by 0.86%

By Adedapo Adesanya

The NASD Over-the-Counter (OTC) Securities Exchange rose further by 0.86 per cent on Friday, February 13, with the market capitalisation growing by N20.27 billion to N2.378 trillion from the previous session’s N2.357 trillion, and the NASD Unlisted Security Index (NSI) rising by 33.87 points to 3,974.77 points from the 3,940.90 points it ended a day earlier.

The improvement recorded by the bourse yesterday was influenced by six price gainers led by Okitipupa Plc, which went up by N18.00 to sell at N260.00 per share compared with the previous day’s N242.00 per share.

Further, Central Securities Clearing System (CSCS) Plc added N3.39 to quote at N80.47 per unit versus N77.08 per unit, IPWA Plc chalked by 31 Kobo to finish at N3.44 per share versus N3.13 per share, Lagos Building Investment Company (LBIC) Plc gained 31 Kobo to settle at N3.41 per unit versus N3.10 per unit, Afriland Properties Plc appreciated by 31 Kobo to N16.51 per share from N16.20 per share, and Food Concepts Plc increased by 8 Kobo to N3.28 per unit from N3.20 per unit.

There were three price losers, led by MRS Oil Plc, which weakened by N10.00 to close at N170.00 per share compared with Thursday’s price of N200.00 per share, FrieslandCampina Wamco Nigeria Plc lost N2.59 to sell for N65.52 per unit compared with the preceding session’s N68.10 per unit, and Geo-Fluids Plc depreciated by 33 Kobo to N3.30 per share from N3.63 per share.

During the session, the volume of securities transacted by the market participants went up by 9.5 per cent to 9.4 million units from 8.6 million units, the value increased by 1,206.5 per cent to N703.6 million from N53.9 million, and the number of deals grew by 7.1 per cent to 45 deals from 42 deals.

CSCS Plc remained the most traded stock by value (year-to-date) with 27.1 million units exchanged for N1.5 billion, followed by Resourcery Plc with 1.05 billion units traded at N408.6 million, and Geo-Fluids Plc with 29.9 million units valued at N152.6 million.

Resourcery Plc ended the day as the most traded stock by volume (year-to-date) with 1.05 billion units sold for N408.6 million, followed by Geo-Fluids Plc with 29.9 million worth N152.6 million, and CSCS Plc with 27.1 million units sold for N1.5 billion.

Economy

Naira Value Further Dips 0.13% to N1,355/$1

By Adedapo Adesanya

The Naira depreciated further against the United States Dollar by N1.76 or 0.13 per cent on Friday in the Nigerian Autonomous Foreign Exchange Market (NAFEX) to close at N1,33.42/$1, in contrast to the N1,353.66/$1 it was exchanged a day earlier.

However, the Naira appreciated against the Pound Sterling in the same market window yesterday by N5.05 to trade at N1,844.59 versus Thursday’s closing price of N1,849.64/£1, and against the Euro, it improved by 75 Kobo to quote at N1,60/€1 versus the previous day’s N1,608.68/€1.

At the GTBank FX desk, the domestic currency lost N6 on the US Dollar on Friday to settle at N1,365/$1 versus the preceding session’s N1,359/$1, and at the parallel market, it chalked up N10 to trade at N1,430/$1 versus the previous day’s N1,430/$1.

The weakening of the Nigerian currency in the official market happened as the Central Bank of Nigeria (CBN) refrained from intervening in the official window.

The FX supply side was eclipsed by growing demand for foreign payments. Exporters’ inflows, non-bank corporate supply, and other market participants’ contributions had enhanced the FX liquidity level.

Pressure came with the entry of all duly licensed Bureau De Change (BDCs) into the official foreign exchange, although there are indications that the move will help the Naira-US Dollar exchange value, as BDC operators have started approaching their banks to understand the operational modalities and framework for accessing Dollars.

As for the cryptocurrency market, benchmarked tokens improved as US interest rate futures on Friday raised odds of rate cuts by the Federal Reserve after a report that showed inflation rose less than expected in January.

Data showed the Consumer Price Index (CPI) rose 0.2 per cent last month after an unrevised 0.3 per cent gain in December, with Solana (SOL) up by 7.9 per cent to $85.17, and Ethereum (ETH) up by 6.5 per cent to trade at $2,059.78.

Further, Cardano (ADA) added 5.3 per cent to close at $0.2758, Ripple (XRP) jumped 5.1 per cent to $1.42, Bitcoin expanded by 4.8 per cent to $69,357.35, Litecoin (LTC) grew by 4.7 per cent to $55.27, Binance Coin (BNB) jumped 4.0 per cent to $621.88, and Dogecoin (DOGE) increased by 3.8 per cent to $0.0965, while the US Dollar Tether (USDT) and the US Dollar Coin (USDC) remained unchanged at $1.00 each.

-

Feature/OPED6 years ago

Feature/OPED6 years agoDavos was Different this year

-

Travel/Tourism10 years ago

Lagos Seals Western Lodge Hotel In Ikorodu

-

Showbiz3 years ago

Showbiz3 years agoEstranged Lover Releases Videos of Empress Njamah Bathing

-

Banking8 years ago

Banking8 years agoSort Codes of GTBank Branches in Nigeria

-

Economy3 years ago

Economy3 years agoSubsidy Removal: CNG at N130 Per Litre Cheaper Than Petrol—IPMAN

-

Banking3 years ago

Banking3 years agoSort Codes of UBA Branches in Nigeria

-

Banking3 years ago

Banking3 years agoFirst Bank Announces Planned Downtime

-

Sports3 years ago

Sports3 years agoHighest Paid Nigerian Footballer – How Much Do Nigerian Footballers Earn