Feature/OPED

Dangote, the Congo Plant and the Imperative of African Industrialization

By Ehiedu Iweriebor

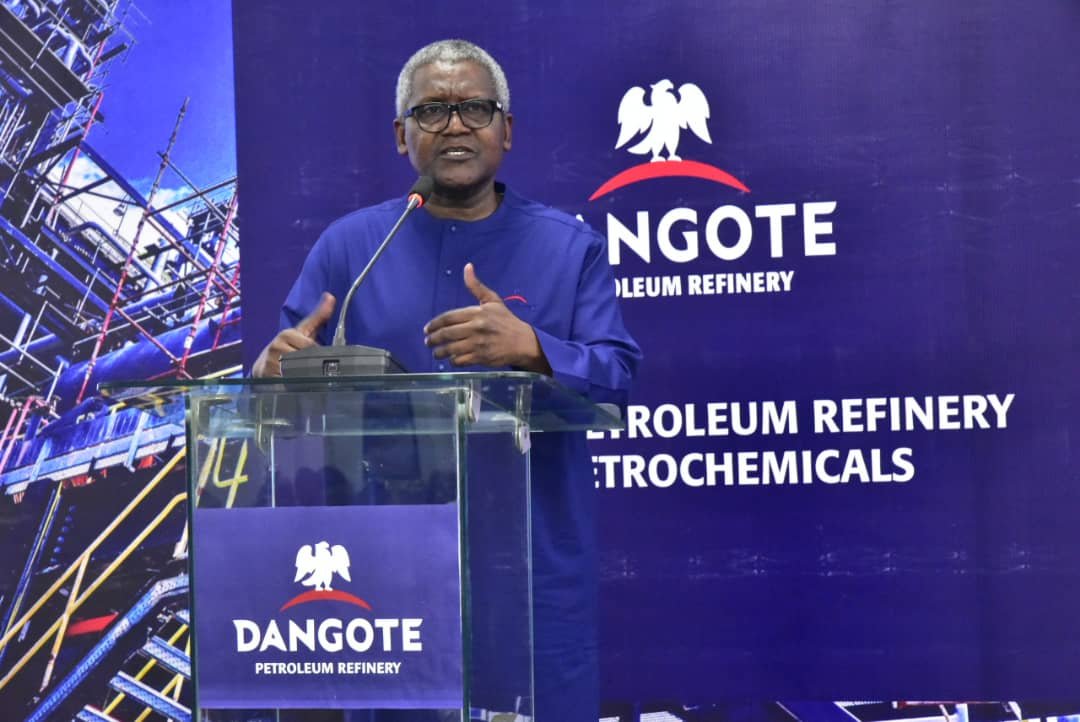

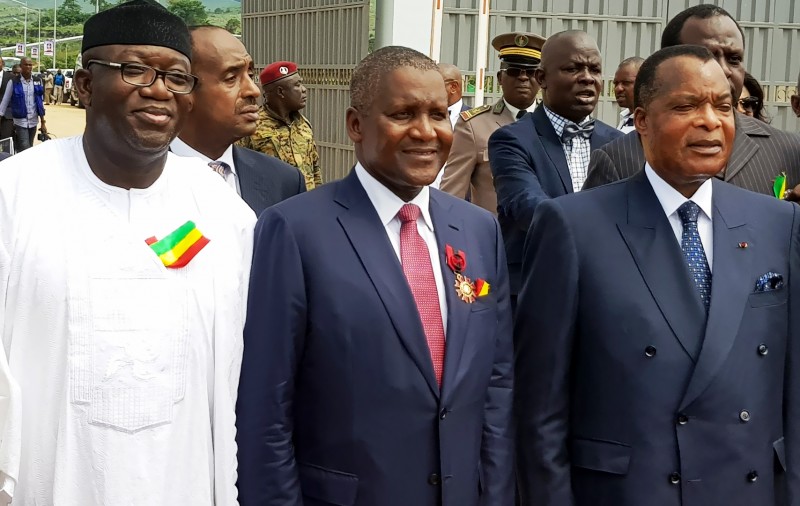

The Dangote Group of Nigeria, one of the pre-eminent industrial conglomerates in Africa, in pursuit of its pan-African development and emancipation strategy, on November 23, 2017 formally launched its newest economic development industrial project, the Dangote Cement plant in Mfila, in Congo-Brazzaville.

With this $300 million, 1.5 million metric tonne per annum plant, the Group now has a presence in ten of the 17 countries in which it plans to construct and expand cement plans.

While it had to re-calibrate the pace and timing of its earlier ambitious plans to complete its various planned plants at an earlier date, because of the economic down turn in Nigeria from 2014, the completion of the Congo plant indicates that the Group’s Pan-African cement plant’s expansion and new plants’ construction programme is still very much on course even though the pace of completion is now staggered over a longer time frame.

This new plant, as an industrial project will have direct and indirect benefits in Congo-Brazzaville that domestic resource-based industrial projects plants usually generate. It is expected to provide at least 1,000 direct jobs and numerous other employment opportunities that will be stimulated by its presence.

For example, other sectors that will be stimulated include the following: expansion of local civil and housing construction projects by state and private builders; expansion of cement block makers; the establishment of a transportation fleet for the distribution of the cement and the employment of drivers, conductors and mechanics for the trucks; the expanded use of fuel; the emergence of small and medium scale cement distributors and even big distribution companies and workers and new sale stores; banks, food suppliers and sellers of small dry goods and items.

In short, the impact of this plant will be the progressive creation of new economic activities and employment opportunities. From these new economic activities the Congolese state, the local government and community authorities will derive Internally Generated Revenues (IGR) that did not previously exist.

The various speeches at the launching of the Congo-Brazzaville plant highlighted the economic development significance and prospective impact of this this massive industrial project. President Denis Sassou Nguesso of Congo-Brazzaville, noted that the plant was the biggest industrial plant in the country and the investment represented an industrial revolution within the regional group – Economic Community of Central African States.

He noted that from their assessment of the impact of Dangote cement plants in other countries, they had always stimulated multiplier effects through the promotion of complementary and cognate industries and hoped that similar multiple direct and indirect effects will happen in the country.

He also noted the timeliness of the take-off of the plant as a contributor to state revenues at a time when his government’s revenues had precipitously declined by 31.3 percent and oil sector revenues had also declined by 65.1 due to the fall in oil prices.

Clearly, the Congo-Brazzaville government appreciates the investment, presence and impact of the Dangote cement plant.

In his own address, the Nigerian President, Muhammadu Buhari, affirmed that Aliko Dangote and the Dangote Group by their pan-African investments had emerged as “worthy Ambassadors” of the country.

He highlighted the various areas in which the Dangote Group had through its massive investments in the cement sector changed the course of Nigeria’s economic history. These include the provision of a key material for infrastructure development, the introduction of road construction with cement, the pursuit of expansion through backward integration and import substitution and the achievement of national self-sufficiency in cement availability and the contributions to savings of over $2 billion annually from the termination of dependency through importation.

Aliko Dangote, President of the Dangote Group, in his address, articulated the significance of the plant in terms of timely completion, its contribution of widespread availability of affordable cement, the plant’s contribution to the country’s expanded cement production capacity in excess of current demand and the consequence of reducing dependency on cement importation. He also noted that the plant will contribute to the country’s economic renaissance through foreign exchange conservation, employment generation, infrastructure expansion and multiple economic activities.

Dangote graciously and gratefully highlighted the strong and dedicated support provided by the government and people of Congo-Brazzaville from project’s conception to completion. Partly in pursuit of the Group’s philosophy and strategy of Corporate Social Responsibility, the Group was implementing several social projects including school construction, provision of scholarships, renovation of a hospital, road construction and bridge renovation. It also affirmed its company’s policy and commitment to give priority in employment to indigenes of the area of the plant’s location.

The various addresses highlighted the great economic impact of the Dangote’s chosen investments in cement production. But they did not often directly and fully underscore the actual primary sources of its revolutionary impact as a specific type of non-dependent industrial project with its inherent catalytic consequences. That is that they are resource-based industrial plants whose productions are based on the exploitation and processing of a local resource.

In short, the reasons for the great impact of these projects is that unlike the more common, attractive and lucrative arenas of foreign direct investment (FDI) such as extractive, wasting and non-development sectors like mineral and mining sectors and enclave assembly plant industries that are unconnected to the local economic environment, Dangote chose a different trajectory.

The Dangote Group’s choice of resource-based industrialization based on a comprehensive backward integration strategy as the primary pathway and its contribution to African self-actuated and self-directed economic development, prosperity generation, transformation and emancipation is developmentally apt, strategic and fecund.

This can best be understood within the perspective of Africa’s greatest failure in the post-independence era: economic development. This has been due to the failure to create and apply an autonomous economic philosophy and strategy of self-actuated development based on the well-established principles of endogenous technology capacitation and industrialization.

On the contrary, African states and leaders at independence chose the maintenance of the inherited colonial economy, and in the neo-colonial framework of the times, the focus became the expansion of the production and export of raw materials: agricultural and mineral; the mass importation of consumer goods, intermediate goods and capital goods. This entailed the corresponding non-domestication of the historically established levers of development levers: the productive forces – technology and industrialization and equally importantly the ideological premise of development: the psychologically disposition, political will and activated self-agency for self-actuated and self-reliant development that is imperative to any successful development.

The result of this failure of the inherited and non-development neo-colonial economic system and strategy has been the condition of growth without development characterized by the persistence of underdevelopment, expanded dependency and poverty generation. The fact is that no African state since independence from the 1950s has been able to establish and sustain a philosophy, policy and strategy of self-actuated development and secure domestic prosperity generation.

This economic development failure was aggravated by the largely successful recolonization of African economic development objectives, policies, strategies and programmes in the 1980s through the acceptance, imposition and implementation of the Multilateral imperialist agencies – World Bank and International Monetary Fund(IMF) – non-development dogmas embodied in their Structural Adjustment Programmes (SAP) by the African leadership and states. Based on the unproven and unvarying dogmas called conditionalities: currency devaluation, trade liberalization, removal of subsidies, deregulation and privatization, they were not intended in any way to address the core causes of the balance of payments crisis of African economies of the late 1970s and early 1980s, that is African countries development incapacitation, raw material exports, dependency, mass importation, non-industrialization, under-production and poverty generation.

It was the African leaders’ inability or unwillingness to identify and address these fundamental issues and their preference for pre-packaged supposedly neutral external “expert technical” solutions that led them as supplicants to these neo-imperialist agencies.

The substantive objective of these imperialist agencies was to forcefully return the incrementally economically self-directed African states back into the conditions economic colonialism with its exclusive focus on primary commodities (raw materials) production and export and dependency on importation of all manufactured goods.

Furthermore, the World Bank and IMF also wanted to effect the removal of African states’ as promoters and activators of economic and social development especially freedom conferring industrialization through the cession of development responsibility by privatization to the undeveloped and dependent local capitalist groups; but more consequentially to foreigners through the fetish of foreign Direct Investments (FDI) as the new promoters of African “economic development.”

But the FDI fetish is a dangerously misleading dogma of non-development: it misdirects, misrepresents and disarms societies and leaderships from ownership and responsibility for the philosophy, objectives and strategies for their own societies’ development.

The ability of external forces to inflict these damaging, disruptive and painful consequences of neo-colonial economic failure and their expression in persistent underdevelopment, dependency, underproduction, poverty, beggarliness, humiliation and indignity on Africans, has been possible due to active and direct complicity of much of African leaderships’ and elite who were successfully programmed to marginalize African agency and responsibility for its own development. These African elite enthroned and accepted foreign diktat, policies and programmes as inescapable for African development.

Yet, this situation of the subservience and servility of the psychologically programmed African leadership, elite, intelligentsia has not been uniformly one-dimensional.

Not all African leaderships, elite, intelligentsia, business people, bureaucrats and technocrats have supinely conceded to Africa’s surrender, submission and acquiescence to conditions permanent underdevelopment and cession of self-responsibility for development to others.

Some among these were patriotic elite and leaderships who came to the ineluctable and correct conclusion that Africa can only enter into the state of freedom, dignified existence and a prosperous world by the pro-active choice and creation of its own philosophy and strategy of self-actuated development.

This new development strategy will comprise the assumption of responsibility; the centrality of African agency; technological capacitation; modernization of all productive forces including agriculture and mineral production but above all the relentless pursuit of mass industrialization and mass production as the indisputable pathway and proven expressions of societal self-modernization in the contemporary world.

In the African business world today, it can be said without equivocation that Dangote and the Dangote Group has been and is in the vanguard of the promotion African self-development through resource based development capacitation; backward integration and genuine import substitution; radical reduction of import dependency for consumer goods and industrial inputs; mass industrialization, mass production and in-country and incontinent prosperity generation.

The expansive range of the industrial products of the Dangote Group beyond cement; and including food and agro industry: sugar, salt, tomato, rice, pasta, milk, flour; poly products and heavy industry like motor vehicles, coal mining and processing, refined petroleum, fertilizer and petrochemicals all attest to the promoter and Group’s understanding of the centrality of industrialization to genuine economic diversification and successful societal development and advancement.

The opening of the Congo cement plant within the Dangote Group’s pan-African industrial development strategy and its multiplier effects, creation of diverse employment opportunities and in-country prosperity generation, all attests to the Group’s contribution economic development and empowerment, and re-dignifying of Africans through the single-minded commitment to economic advancement through industrialization.

What is now required of African states, leaderships, technocratic and bureaucratic elite and business leaders and intelligentsia is following Dangote’s example, to prioritize technological capacitation and industrialization as the indisputable foundations and pathways for the project of Africa’s self-conceived, self-directed, self-funded and self-actuated and non-dependent programme of radical economic transformation and renaissance in the modern era. Only liberated African peoples, states and leaders can create this made in Africa – Africa by Africans for Africans and the world.

Ehiedu Iweriebor is a Professor, Department of Africana and Puerto Rican/Latino Studies, Hunter College, City University of New York, USA.

Feature/OPED

Daniel Koussou Highlights Self-Awareness as Key to Business Success

By Adedapo Adesanya

At a time when young entrepreneurs are reshaping global industries—including the traditionally capital-intensive oil and gas sector—Ambassador Daniel Koussou has emerged as a compelling example of how resilience, strategic foresight, and disciplined execution can transform modest beginnings into a thriving business conglomerate.

Koussou, who is the chairman of the Nigeria Chapter of the International Human Rights Observatory-Africa (IHRO-Africa), currently heads the Committee on Economic Diplomacy, Trade and Investment for the forum’s Nigeria chapter. He is one of the young entrepreneurs instilling a culture of nation-building and leadership dynamics that are key to the nation’s transformation in the new millennium.

The entrepreneurial landscape in Nigeria is rapidly evolving, with leaders like Koussou paving the way for innovation and growth, and changing the face of the global business climate. Being enthusiastic about entrepreneurship, Koussou notes that “the best thing that can happen to any entrepreneur is to start chasing their dreams as early as possible. One of the first things I realised in life is self-awareness. If you want to connect the dots, you must start early and know your purpose.”

Successful business people are passionate about their business and stubbornly driven to succeed. Koussou stresses the importance of persistence and resilience. He says he realised early that he had a ‘calling’ and pursued it with all his strength, “working long weekends and into the night, giving up all but necessary expenditures, and pressing on through severe setbacks.”

However, he clarifies that what accounted for an early success is not just tenacity but also the ability to adapt, to recognise and respond to rapidly changing markets and unexpected events.

Ambassador Koussou is the CEO of Dau-O GIK Oil and Gas Limited, an indigenous oil and natural gas company with a global outlook, delivering solutions that power industries, strengthen communities, and fuel progress. The firm’s operations span exploration, production, refining, and distribution.

Recognising the value of strategic alliances, Koussou partners with business like-minds, a move that significantly bolsters Dau-O GIK’s credibility and capacity in the oil industry. This partnership exemplifies the importance of building strong networks and collaborations.

The astute businessman, who was recently nominated by the African Union’s Agenda 2063 as AU Special Envoy on Oil and Gas (Continental), admonishes young entrepreneurs to be disciplined and firm in their decision-making, a quality he attributed to his success as a player in the oil and gas sector. By embracing opportunities, building strong partnerships, and maintaining a commitment to excellence, Koussou has not only achieved personal success but has also set a benchmark for future generations of African entrepreneurs.

His journey serves as a powerful reminder that with determination and vision, success is within reach.

Feature/OPED

Pension for Informal Workers Nigeria: Bridging the Pension Gap

***The Case for Informal Sector Pensions in Nigeria

***A Crucial National Conversation

By Timi Olubiyi, PhD

In Nigeria today, the phrase “pension” evokes many different mixed reactions. For many civil servants and people in the corporate world, it conjures a bit of hope, but for the majority in the informal sector, who are in the majority in Nigeria, it is bleak. Millions of Nigerians are facing old age without any financial security due to a lack of retirement plans and a stable pension plan. Particularly, the millions who operate in markets, corner shops, transportation, agriculture, and loads of the nano and micro scale enterprises operators are without pension plans or retirement hope.

From the observation of the author and available records, staggering around 90 per cent of Nigeria’s workforce operates in the informal economy. Yet current pension coverage for this group is virtually non-existent. As observed, the absence of meaningful pension participation by this class of worker reinforces the vulnerability, intensifies poverty among older people, and puts pressure on families who are ill-equipped to shoulder the burden.

The significance of having a pension plan for informal workers in Nigeria, given the large number of people in that sector and the high level of unemployment and underemployment, cannot be overstated. As it is deeply connected to sustenance and the level of poverty in the country. Pension for informal workers in Nigeria is not just a technical policy matter; it is a story about dignity, security, and whether a lifetime of hard work ends in rest or in desperation.

Nigeria’s pension system, primarily structured around the Contributory Pension Scheme (CPS) managed by the National Pension Commission (PenCom), has made significant progress for formal sector employees, yet the large portion of the informal workforce which are traders, artisans, okada riders, small-scale farmers, domestic workers, and gig economy participants who drive the real engine of the economy.

Though the Micro Pension Plan (MPP) was launched in 2019, which is intended to provide a voluntary contributory framework for informal workers, its uptake has been underwhelming; after several years, only a fraction of the millions targeted have enrolled, and far fewer contribute actively. One big reason for this is that, unlike formal workers who receive regular salaries and have employers who deduct and remit pension contributions, informal workers face irregular incomes, a lack of documentation, limited financial literacy, and deep mistrust of government institutions, making traditional pension models ill-suited for their realities.

Moreso the informal worker most times live on day-to-day income. For instance, a motorcycle rider in Lagos who earns ₦14,000 on a good day but must pay for fuel, bike maintenance, police “settlements,” and family expenses, how can he realistically commit to a monthly pension contribution when his income fluctuates wildly? So, the Micro Pension Plan for the informal sector participation will remain low due to poor awareness, complex processes, lack of tailored contribution flexibility, and limited trust.

To truly make pensions work for informal workers, Nigeria must rethink the system from the ground up, designing it around the lived realities of its people rather than forcing them into rigid formal-sector structures. First, the government should introduce a co-contributory model where the state matches a percentage of informal workers’ savings, similar to what is practised in some European countries, turning pension contributions into a powerful incentive rather than a burdensome obligation.

Second, digital technology must be leveraged aggressively—mobile-based pension platforms linked to BVN or NIN could allow daily, weekly, or micro-contributions as small as ₦100, integrating seamlessly with fintech apps like OPay, Paga, or bank USSD services so that saving becomes as easy as buying airtime.

Third, automatic enrollment through cooperatives, trade unions, market associations, and transport unions could significantly expand coverage, with opt-out rather than opt-in mechanisms to counter human inertia.

Fourth, financial literacy campaigns in local languages via radio, community leaders, and religious institutions are essential to rebuild trust and demonstrate that pensions are not a “government scam” but a personal safety net.

Fifth, Nigeria should consider a universal social pension for elderly citizens who never participated in formal or informal schemes, modelled after systems in countries like Denmark and the Netherlands, ensuring that no Nigerian dies in poverty simply because they worked outside formal structures.

Sixth, investment strategies for pension funds must prioritise both security and development—allocating a portion to infrastructure projects that create jobs, improve power supply, and stimulate economic growth while maintaining prudent risk management.

Seventh, inflation protection should be built into pension payouts so that retirees’ purchasing power is not eroded by Nigeria’s volatile economy.

Eighth, the system must be inclusive of women, who dominate the informal sector yet often lack property rights or formal identification, by simplifying documentation requirements and providing gender-sensitive outreach.

Ninth, limited emergency withdrawal options could be introduced—strictly regulated—to help contributors handle crises without abandoning the system entirely.

Finally, transparency and accountability are non-negotiable; regular public reporting, independent audits, and user-friendly dashboards would strengthen confidence that contributions are safe and growing. If Nigeria can blend its innovative spirit with lessons from global best practices—combining Denmark’s social security ethos, Singapore’s savings discipline, and Canada’s inclusivity—it could transform the lives of millions of informal workers who currently face retirement with fear rather than hope.

Imagine Aisha, years from now, closing her market stall not in exhaustion and anxiety but in calm assurance that her pension will cover her basic needs; imagine Tunde hanging up his helmet knowing he can afford healthcare and shelter; imagine Ngozi harvesting not just crops but the fruits of a lifetime of secure savings. The suspense that hangs over the future of Nigeria’s informal workers can be resolved, but only if policymakers act boldly, creatively, and compassionately—because a nation that allows its hardest workers to age in poverty is a nation that undermines its own prosperity, while a nation that secures their retirement builds not just pensions, but peace.

Hope comes from innovation. Fintech-powered pension models that allow small, frequent contributions similar to informal savings associations like esusu offer ways to integrate pensions into existing savings cultures. Making pension contributions compatible with mobile money and agent networks could drastically reduce barriers to entry. Hope comes from public education. Building financial literacy campaigns, partnering with community leaders, marketplaces, trade associations, and digital platforms can help shift perceptions. A pension should be understood not as a distant bureaucratic programme, but as future self-insurance and dignity

The significance of having a pension plan for informal workers in Nigeria, given its large informal sector and high level of unemployment and underemployment, cannot be overstated, as it is deeply connected to social stability, economic sustainability, poverty reduction, and national development.

First, from a social protection and human dignity perspective, a pension plan for informal workers is critical because it provides a safety net for old age. Nigeria’s informal sector includes traders, artisans, mechanics, tailors, hairdressers, okada riders, gig workers, domestic workers, small-scale farmers, and street vendors, many of whom work hard throughout their lives but have no formal retirement benefits. Without a pension, these individuals often become completely dependent on their children, relatives, or charity in old age, which can strain families and increase intergenerational poverty. A well-structured pension system ensures that ageing informal workers can maintain a basic standard of living, access healthcare, and avoid extreme deprivation, thereby preserving their dignity and reducing elderly vulnerability.

Second, from an economic stability and poverty reduction standpoint, pensions play a crucial role in reducing old-age poverty. Nigeria already struggles with high poverty levels, and a large proportion of elderly citizens without income support exacerbates this problem. When informal workers lack pension savings, they continue working well into old age, often in physically demanding jobs, which reduces productivity and increases health risks. A pension system allows for smoother retirement transitions, reduces reliance on welfare, and ensures that older citizens remain consumers rather than economic burdens, thereby sustaining economic activity.

Third, pensions for informal workers are significant for financial inclusion and savings culture. Many Nigerians in the informal sector operate primarily in cash and have limited engagement with formal financial institutions. A pension plan tailored to informal workers, especially one integrated with mobile money and digital platforms, can encourage regular saving, improve financial literacy, and bring millions of people into the formal financial system. This, in turn, strengthens Nigeria’s overall financial sector and increases the pool of domestic savings available for investment in infrastructure, businesses, and development projects.

Fourth, the significance is evident in reducing dependence on government emergency support. Currently, the Nigerian government often has to intervene with ad-hoc social assistance programs, especially during crises such as the COVID-19 pandemic, inflation shocks, or economic downturns. If informal workers had functional pension savings, they would be better able to absorb economic shocks in retirement without relying heavily on government aid, reducing fiscal pressure on the state.

Fifth, pensions for informal workers contribute to intergenerational equity and family stability. In Nigeria, many elderly parents depend on their working children for survival, which places financial strain on younger generations who may already be struggling with unemployment, housing costs, and education expenses. A pension system reduces this burden, allowing younger Nigerians to invest in their own futures rather than being trapped in a cycle of supporting ageing relatives without external assistance.

Sixth, from a national development perspective, including informal workers in the pension system strengthens Nigeria’s long-term economic planning. Pension funds represent large pools of capital that can be invested in critical sectors such as housing, energy, transportation, and manufacturing. If millions of informal workers contribute even in small amounts, this could significantly expand Nigeria’s pension fund assets, providing stable, long-term financing for development projects that create jobs and stimulate growth.

Seventh, pensions for informal workers are important for gender equity, because women dominate many informal occupations in Nigeria, such as petty trading, market vending, tailoring, and caregiving roles. These women often have lower lifetime earnings, limited access to formal employment, and fewer assets. A targeted informal sector pension scheme can protect elderly women from destitution and reduce gender-based economic inequality in old age.

Eighth, the significance is also linked to public trust and governance. A transparent, accessible, and reliable pension system for informal workers can strengthen citizens’ trust in government institutions. Many informal workers currently distrust government programs due to past corruption, failed schemes, or poor implementation. A well-functioning pension plan that delivers real benefits would demonstrate that the state values all citizens, not just formal sector employees.

Lastly, given Nigeria’s demographic reality of a large and growing population, failing to integrate informal workers into a pension framework poses serious long-term risks. As life expectancy increases, the number of elderly Nigerians will rise significantly in the coming decades. Without a structured pension system for informal workers, Nigeria could face a severe old-age crisis characterised by mass poverty, social unrest, and increased pressure on healthcare and social services.

In summary, having a pension plan for informal workers in Nigeria is significant because it promotes social security, reduces poverty, enhances financial inclusion, supports economic stability, eases intergenerational burdens, strengthens national development, promotes gender equity, builds public trust, and prepares the country for its ageing population. For a nation where the majority of workers are informal, excluding them from pension coverage is not just an oversight; it is a major structural weakness that must be urgently addressed for Nigeria’s long-term prosperity and social cohesion.

Feature/OPED

Revived Argungu International Fishing Festival Shines as Access Bank Backs Culture, Tourism Growth

The successful hosting of the 2026 Argungu International Fishing Festival has spotlighted the growing impact of strategic public-private partnerships, with Access Bank and Kebbi State jointly reinforcing efforts to promote cultural heritage, tourism development, and local economic growth following the globally attended celebration in Argungu.

At the grand finale, Special Guest of Honour, Mr Bola Tinubu, praised the festival’s enduring national significance, describing it as a powerful expression of unity, resilience, and peaceful coexistence.

“This festival represents a remarkable history and remains a powerful symbol of unity, resilience, and peaceful coexistence among Nigerians. It reflects the richness of our culture, the strength of our traditions, and the opportunities that lie in harnessing our natural resources for national development. The organisation, security arrangements, and outlook demonstrate what is possible when leadership is purposeful and inclusive.”

State authorities noted that renewed institutional backing has strengthened the festival’s global appeal and positioned it once again as a major tourism and cultural platform capable of attracting international visitors and investors.

“Argungu has always been an iconic international event that drew visitors from across the world. With renewed partnerships and stronger institutional support, we are confident it will return to that global stage and expand opportunities for our people through tourism, culture, and enterprise.”

Speaking on behalf of Access Bank, Executive Director, Commercial Banking Division, Hadiza Ambursa, emphasised the institution’s long-standing commitment to supporting initiatives that preserve heritage and create economic opportunities.

“We actively support cultural development through initiatives like this festival and collaborations such as our partnership with the National Theatre to promote Nigerian arts and heritage. Across states, especially within the public sector space where we do quite a lot, we work with governments on priorities that matter to them. Tourism holds enormous potential, and while we have supported several hotels with expansion financing, we remain open to working with partners interested in developing the sector further.”

Reports from the News Agency of Nigeria indicated that more than 50,000 fishermen entered the historic Matan Fada River during the competition. The overall winner, Abubakar Usman from Maiyama Local Government Area, secured victory with a 59-kilogram catch, earning vehicles donated by Sokoto State and a cash prize. Other top contestants from Argungu and Jega also received vehicles, motorcycles and monetary rewards, including sponsorship support from WACOT Rice Limited.

Recognised by UNESCO as an Intangible Cultural Heritage of Humanity, the festival blends traditional fishing contests with boat regattas, durbar processions, performances, and international competitions, drawing visitors from across Nigeria and beyond.

With the 2026 edition concluded successfully, stakeholders say the strengthened collaboration between government and private-sector partners signals a renewed era for Argungu as a flagship cultural tourism destination capable of driving inclusive growth, preserving tradition, and projecting Nigeria’s heritage on the world stage.

-

Feature/OPED6 years ago

Feature/OPED6 years agoDavos was Different this year

-

Travel/Tourism10 years ago

Lagos Seals Western Lodge Hotel In Ikorodu

-

Showbiz3 years ago

Showbiz3 years agoEstranged Lover Releases Videos of Empress Njamah Bathing

-

Banking8 years ago

Banking8 years agoSort Codes of GTBank Branches in Nigeria

-

Economy3 years ago

Economy3 years agoSubsidy Removal: CNG at N130 Per Litre Cheaper Than Petrol—IPMAN

-

Banking3 years ago

Banking3 years agoSort Codes of UBA Branches in Nigeria

-

Banking3 years ago

Banking3 years agoFirst Bank Announces Planned Downtime

-

Sports3 years ago

Sports3 years agoHighest Paid Nigerian Footballer – How Much Do Nigerian Footballers Earn