Banking

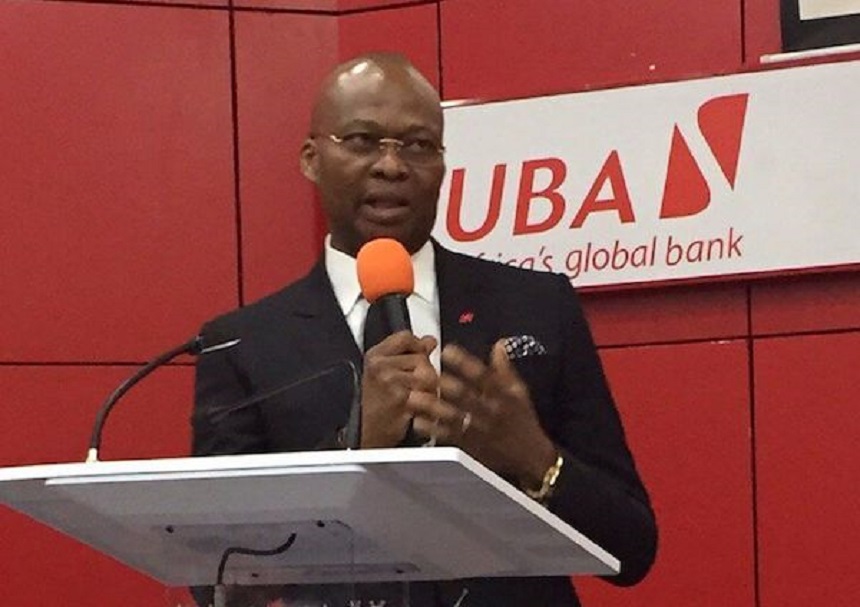

Fitch Upgrades UBA to ‘B+’ with Stable Outlook

By Dipo Olowookere

Fitch Ratings has upgraded United Bank for Africa Plc’s (UBA) Long-Term Issuer Default Rating (IDR) to ‘B+’ from ‘B’ with a stable outlook, a statement from the firm has said.

It was stated that UBA’s Viability Rating (VR) has also been upgraded to ‘b+’ from ‘b’, reflecting an improvement in the bank’s performance metrics and funding and liquidity profile, which the rating agency considers to be sustainable.

According to the statement, UBA’s strong capital ratios, increasingly diversified funding base and well managed liquidity mean that its risk profile is now more closely aligned with those of Zenith Bank and Guaranty Trust Bank (GTBank), both rated ‘B+’.

Fitch said UBA’s IDRs are driven by its intrinsic creditworthiness, as defined by its VR and like all Nigerian banks, UBA’s VR is constrained by the operating environment in Nigeria (B+/Stable) where the fragile economic recovery restrains banks’ growth prospects and asset quality.

The VR reflects UBA’s position as one of Nigeria’s largest banks, as well as its sound financial metrics and reasonable capital buffers. It controls an overall market share in Nigeria of approximately 10% and its well-established franchise is a rating strength, it said.

Fitch noted that operating conditions are still difficult for banks and despite stronger oil prices in 2H18 supporting economic growth, credit demand is weak and banks face pressure on margins and capital.

UBA is also Nigeria’s most international bank, operating in 20 other sub-Saharan African countries. Its objective is to operate as a pan-African commercial bank.

“Our assessment is that geographic diversification is credit positive because it provides growth opportunities and can reduce exposure to Nigeria’s cyclical economic growth trends but it also adds complexity, especially considering the high risk environment associated with many sub-Saharan African countries. This also constrains the VR.

“International subsidiaries contributed 40% of group earnings in 1H18, but Nigerian assets dominate the group, representing around 70% of consolidated assets,” Fitch said.

Corporate lending dominates the loan book and large borrower concentrations are high, as is common in Nigeria. This exposes the group to potentially high losses in the event of default. The top 20 loans represented approximately 42% of total end-1H18 loans. Positively, exposure to the oil sector represented 20% of total loans, below the 30% sector average. Retail lending, representing 7% of total loans at end-1H18, is developing steadily. Impaired loans represented 7.2% of gross loans at end-1H18, slightly higher than the 5% average for its closest peers. Loan loss cover at approximately 95% is reasonable, but not outstanding, the statement said.

Fitch said UBA’s local currency funding profile is a rating strength. Its loans/deposits ratio (57% at end-1H18) is low compared with peers (69%). The deposit base is well diversified by single customer and retail deposits represent approximately one-third of customer deposits, which is higher than the average for rated peers.

UBA’s digital offerings continue to attract deposit inflows. Local currency liquidity ratios are comfortable and the issue of a $500 million senior medium-term bond on the international capital markets in June 2017 eased pressure on the group’s overall foreign currency liquidity position.

“UBA’s Fitch Core Capital/weighted risks ratio (24.9% at end-1H18) is among the highest in the sector. However, capital and leverage are not considered to be outstanding compared with Guaranty Trust Bank and Zenith Bank because UBA’s risk-weight density is lower and concentrations at UBA can be high, especially at the subsidiaries. This could lead to potential unexpected losses.

“UBA’s earnings and profitability trends show signs of improvement and have been stable for many years, which we view positively. Our expectation is that performance trends will continue to strengthen, based on growing contributions from international subsidiaries and increased stability in Nigeria.

“UBA’s National Ratings reflect its creditworthiness relative to Nigeria’s best credit and relative to peers operating in Nigeria,” the statement said.

Banking

Moniepoint Processes N412trn Transactions, Disburses N1trn Loans in 2025

By Adedapo Adesanya

Nigerian financial services firm, Moniepoint Incorporated, processed N412 trillion in transaction value and disbursed more than N1 trillion in loans to small businesses in 2025, as the company continues to grow Nigeria’s expanding retail payments and credit structure.

The company said it handled more than 14 billion transactions during the year and now powers about 80 per cent of in-person payments nationwide, underscoring the increasing concentration of payment flows through a small number of fintech platforms.

Moniepoint also averaged 1.67 billion monthly transactions in 2025 and grew its card user base by 200 per cent, with its cards being used 1.7 million times daily.

The organisation also processed over 500,000 data renewals daily, while customers spent N90 million ($64,264) daily at gyms.

Moniepoint’s scale reflects a broader shift in Nigeria’s payments landscape, where point-of-sale terminals and digital transfers have become central to everyday commerce, from neighbourhood shops to open-air markets.

Founded in 2015, Moniepoint has evolved from a backend technology provider into Nigeria’s largest merchant acquirer, offering payments, banking, credit, foreign exchange and business management tools to more than 6 million active businesses.

The company said it expanded lending to small businesses that are often excluded from bank credit, disbursing more than N1 trillion in loans through its microfinance banking unit in the year under review.

“Our focus has been on building infrastructure that works for how businesses actually operate,” said Mr Tosin Eniolorunda, Moniepoint’s founder and chief executive, pointing to the prevalence of informal trade in Africa’s largest economy.

In 2025, Moniepoint became a unicorn after it raised more than $200 million in a Series C funding round backed by investors including Development Partners International, Google’s Africa Investment Fund, Visa, the International Finance Corporation and Verod Capital, providing capital to scale its payments and financial services operations.

Beyond acquiring, the company said its switching and processing subsidiary, TeamApt Ltd, secured licences from Mastercard and Visa to operate as a processor and acquirer, enabling it to handle international card payments and provide switching services to other businesses across Africa. Its web payments gateway, Monnify, processed N25 trillion in transactions during the year.

Recently, the Central Bank of Nigeria (CBN) upgraded Moniepoint’s microfinance bank to a national microfinance bank licence, allowing it to expand its footprint across the country and broaden the range of products that it can offer.

Banking

Standard Bank Helps Aradel Energy With $250m Financing Facility

By Aduragbemi Omiyale

A $250 million financing facility to support the acquisition of about 40 per cent equity in ND Western Limited from Petrolin Trading Limited has been secured by Aradel Energy Limited, a wholly owned subsidiary of Aradel Holdings Plc.

The funding package was facility for the energy firm by Standard Bank, which comprises Stanbic IBTC Capital Limited, Stanbic IBTC Bank Limited, and the Standard Bank of South Africa Limited.

The facility, Business Post gathered, was structured to support Aradel Energy’s strategic growth agenda, the refinancing of existing loan facilities, and the funding of increased production from the company’s existing asset base.

Aradel Energy is the operator of the Ogbele and Omerelu onshore marginal fields, as well as OPL 227 in shallow water terrain.

Prior to the transaction, Aradel Energy held a 41.67 per cent equity interest in ND Western, and following the completion of the acquisition, its shareholding in ND Western has increased to 81.67 per cent.

ND Western holds a 45 per cent participating interest in OML 34 and a 50 per cent equity interest in Renaissance Africa Energy Company Limited, the operator of the Renaissance Joint Venture and a 30 per cent owner of one of Nigeria’s largest and most strategic energy portfolios.

As a result of the transaction, Aradel Energy’s indirect equity interest in Renaissance has increased to 53.3 per cent, significantly strengthening the company’s upstream position and long-term value creation potential.

Standard Bank acted as Global Coordinator and Bookrunner, leading the structuring, execution, and funding of the facility, affirming its deep sectoral expertise and reinforces its position as a leading financier in Africa’s energy industry.

This transaction reinforces Standard Bank Group’s commitment to providing strategic capital to clients as they execute on their transformative growth objectives.

By delivering tailored financing solutions that enable sustainable value creation, the Bank remains a trusted partner to leading corporations across Africa’s evolving energy landscape.

“As Aradel Energy consolidates its position as one of Nigeria’s leading oil and gas companies, Stanbic IBTC Bank is proud to serve as a trusted long-term partner supporting the company’s growth ambitions,” the Executive Director for Corporate and Transaction Banking at Stanbic IBTC Bank, Mr Eric Fajemisin, stated.

Also commenting, the Regional Head of Energy and Infrastructure Finance for West Africa at Standard Bank, Mr Cody Aduloju, said, “The transaction illustrates Standard Bank’s ability to deliver large-scale, tailored funding solutions and further demonstrates our support to the fast-growing indigenous companies of Nigeria’s oil and gas sector.”

The chief executive of Aradel Holdings, Mr Adegbite Falade, said, “The acquisition bolsters Aradel Energy’s competitive positioning across Nigeria’s oil and gas value chain and supports our commitment to strategic growth, asset optimisation, and enduring value creation. We are pleased to have partnered with Standard Bank, who supported us and delivered a fully funded solution under very tight timelines.”

Banking

CBN Upgrades Operating Licences of OPay, Moniepoint, Others to National

By Modupe Gbadeyanka

The operating licences of major financial technology (fintech) platforms like OPay and Moniepoint, have been upgraded to national by the Central Bank of Nigeria (CBN).

Also upgraded by the banking sector regulator were PalmPay, Kuda Bank, and Paga after compliance with some regulatory requirements, allowing them to operate across Nigeria.

Speaking at annual conference of the Committee of Heads of Banks’ Operations in Lagos recently, the Director of the Other Financial Institutions Supervision Department of the CBN, Mr Yemi Solaja, said the licences were upwardly reviewed after the financial institutions met some requirements, including the Know-Your-Customer (KYC) policy.

“Institutions like Moniepoint MFB, Opay, Kuda Bank, and others have now been upgraded. In practice, their operations are already nationwide,” he said at the event.

The upgrade also reinforces financial inclusion, as fintechs and agent networks continue to play a pivotal role in providing access to banking and payments services, especially in rural and underserved areas.

The central bank executive stressed the importance of physical presence for customer support.

According to him, “Most of their customers operate in the informal sector. They need a clear point of contact if any issues arise,” to strengthen internal controls, and enhance customer service, particularly around KYC and anti-money laundering (AML) processes.

-

Feature/OPED6 years ago

Feature/OPED6 years agoDavos was Different this year

-

Travel/Tourism9 years ago

Lagos Seals Western Lodge Hotel In Ikorodu

-

Showbiz3 years ago

Showbiz3 years agoEstranged Lover Releases Videos of Empress Njamah Bathing

-

Banking8 years ago

Banking8 years agoSort Codes of GTBank Branches in Nigeria

-

Economy3 years ago

Economy3 years agoSubsidy Removal: CNG at N130 Per Litre Cheaper Than Petrol—IPMAN

-

Banking3 years ago

Banking3 years agoSort Codes of UBA Branches in Nigeria

-

Banking3 years ago

Banking3 years agoFirst Bank Announces Planned Downtime

-

Sports3 years ago

Sports3 years agoHighest Paid Nigerian Footballer – How Much Do Nigerian Footballers Earn