Economy

Naira Closes at N363.32/$ as President Denies Ban on Food Imports

By Adedapo Adesanya

On Monday, August 19, 2019, the Investors and Exporters (I&E) segment of the foreign exchange market closed with the Naira appreciating 0.03 percent or 30 kobo against the US Dollar. The local currency was quoted at N363.32 to one Dollar at the market window in contrast to N363.62 it was exchanged at the last trading session.

At the market segment yesterday, the daily turnover was recorded at $253.70 million. This was as President Muhammadu Buhari cleared the air that there was no ban on forex for food imports.

At the Central Bank’s interbank market, the Naira saw changes as it depreciated by 5 kobo, equivalent to 0.02 percent to trade at N306.95 per Dollar against N306.90 it traded throughout last week.

For the local currency’s performance at the parallel market segment of the foreign exchange market, there were appreciations against both the British Pound Sterling and the Euro on Monday.

The Naira gained N3 against the British currency to trade at N445/£1 from N448/£1 last Friday, while the Nigerian currency gained N2 to trade at N396/€1 on Monday after it closed at N398/€1 on Friday.

However, for the first trading day of the week, the Naira/USD continued to see no changes against the American Dollar at the black market as the local currency remained flat at N360/$1.

Economy

Oil Prices up as US Inflation Data Outweighs OPEC Supply Concerns

By Adedapo Adesanya

Oil prices were marginally higher on Friday after data showed an overall slowdown in US inflation, helping offset supply concerns as the Organisation of the Petroleum Exporting Countries and allies (OPEC+) is leaning towards a resumption in production increases.

Brent crude futures grew by 23 cents or 0.3 per cent to $67.75 a barrel, while the US West Texas Intermediate (WTI) crude futures expanded by 5 cents or 0.08 per cent to $62.89 per barrel.

US consumer prices increased less than expected in January amid cheaper gasoline prices and a moderation in rental inflation.

The Consumer Price Index rose 0.2 per cent last month after an unrevised 0.3 per cent gain in December, the Labor Department’s Bureau of Labor Statistics said.

The report followed news this week of an acceleration in job growth in January and a drop in the unemployment rate to 4.3 per cent from 4.4 per cent in December.

Market analysts noted that since inflation is stabilising, it may lead to interest rates probably continuing to move a little bit lower.

OPEC is leaning towards a resumption in oil output increases from April, ahead of the upcoming peak summer fuel demand, and amid firmer crude prices owing to tensions over US-Iran relations.

There are indications that this will happen when eight OPEC+ producers – Saudi Arabia, Russia, the United Arab Emirates, Kazakhstan, Kuwait, Iraq, Algeria and Oman – meet on March 1.

The eight members raised production quotas by about 2.9 million barrels per day from April to the end of December 2025, equating to about 3 per cent of global demand, and froze further planned increases for January through March 2026 because of seasonally weaker consumption.

OPEC’s latest oil market forecasts show demand for OPEC+ crude in the second quarter falling by 400,000 barrels per day from the first three months of the year, but demand for the whole year is projected to be 600,000 barrels per day higher than in 2025.

Oil prices had strengthened earlier in the week on concerns that the US could attack Middle Eastern oil producer Iran over its nuclear programme. The US is sending an aircraft carrier from the Caribbean to the Middle East on Friday, a move that would put two carriers in the region as tensions soar between the two countries.

The US also eased sanctions on Venezuela’s energy sector on Friday, issuing two general licenses that allow global energy companies to operate oil and gas projects in the OPEC member and for other companies to negotiate contracts to bring in fresh investments.

On the US supply side, Baker Hughes said oil rigs fell by three to 409 this week.

Economy

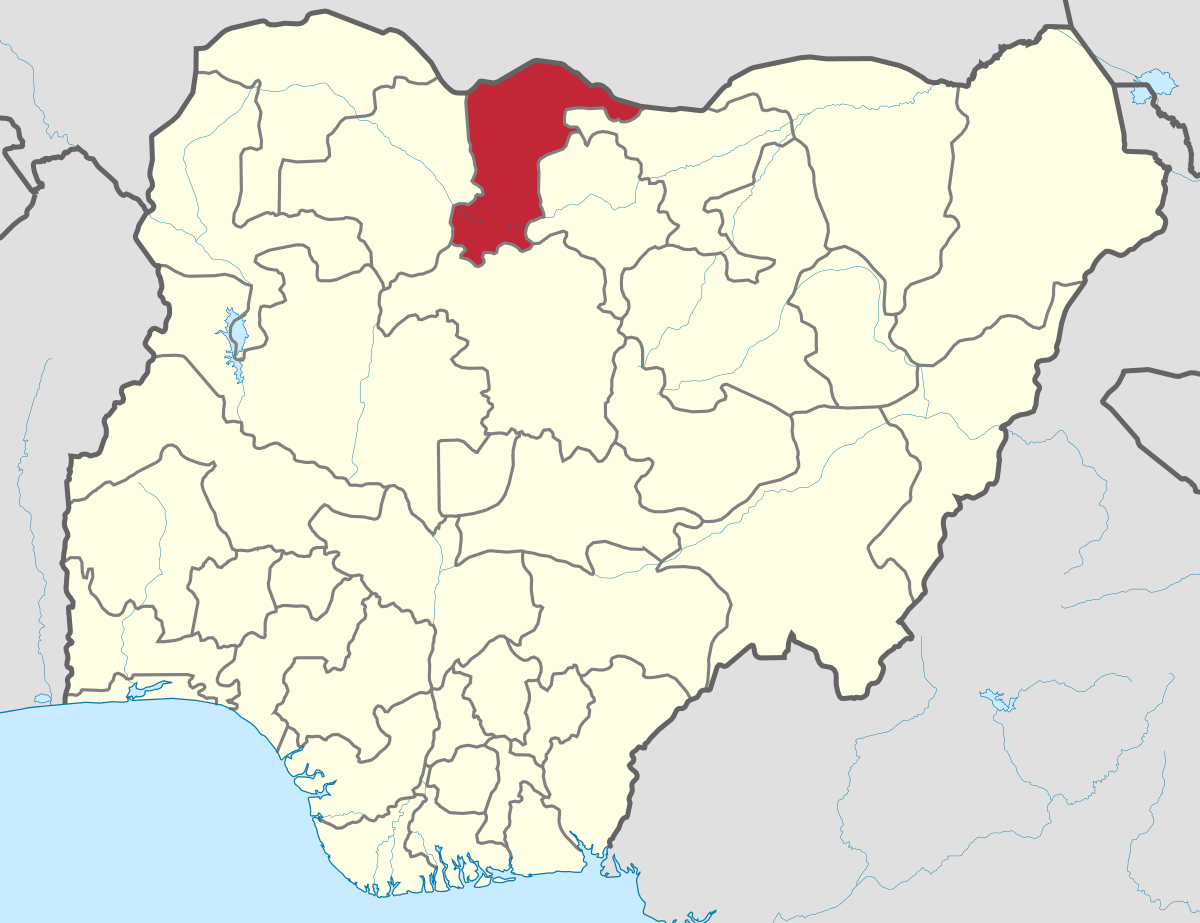

Katsina Provides Additional N500m for Women-owned Businesses

By Modupe Gbadeyanka

The Katsina State government has offered additional N500 million to support women-owned businesses in the state as part of efforts to boost economic activities.

Governor Dikko Umaru Radda announced this at the Women of Influence and Investment Summit hosted by the Katsina Inner Wheel Development Initiative (KIWDI), in partnership with Access Bank Plc.

The event brought together women entrepreneurs, investors, policymakers, and development partners to advance women’s economic empowerment in the state.

The summit, themed Where Influence Meets Investment, focused on positioning women as key drivers of enterprise, leadership, and inclusive growth. It also highlighted the growing collaboration between Access Bank and the Katsina State Government on financial inclusion and SME development.

Mr Radda noted that investing in women was critical to building a productive and sustainable economy.

In her welcome address, the founder of KIWDI, Ms Amina Zayyana, said the summit was designed to connect women to opportunities, training, finance, and markets, stressing that when women-led businesses grow, families and communities benefit.

On her part, the Group Head of Women Banking at Access Bank, Mrs Nene Kunle-Ogunlusi, said the lender was proud to partner with Katsina State and KIWDI in advancing women’s economic participation.

“At Access Bank, we are committed to moving women from potential to prosperity. Through our Women Banking proposition and the ‘W’ Initiative, we provide access to finance, capacity building, and market linkages that help women start, stabilise, and scale their businesses,” she said.

She noted that the W Initiative, launched in 2014, is Access Bank’s flagship women- focused platform, designed to meet the real needs of women entrepreneurs and professionals across Nigeria and Africa.

“Our partnership with Katsina State goes beyond banking. It is about supporting economic empowerment, SME growth, and financial inclusion, especially for women,” she added.

Mrs Kunle-Ogunlusi noted that Access Bank was proud to participate not just as a financial institution, but as a long-term partner in women’s economic advancement across Nigeria and Africa.

“At Access Bank, we made a deliberate decision to change that, not with charity, but with strategy. Not with sympathy, but with solutions. The W Initiative, which was launched in 2014, is Access Bank’s flagship women-focused proposition, created to respond to the real needs of women,” she said.

The banker disclosed that through the W Initiative, the bank has disbursed over N314 billion in loans to women, supporting over 3.6 million female loan beneficiaries, and helping women-owned businesses start, stabilise, and scale up.

Economy

2026 Budget: Reps Threaten Zero Allocation for SON, NAICOM, CAC, Others

By Adedapo Adesanya

The House of Representatives Public Accounts Committee (PAC) has recommended zero allocation for the Standards Organisation of Nigeria (SON), the National Insurance Commission (NAICOM), and the Corporate Affairs Commission (CAC), among others, in the 2026 budget for allegedly failing to account for public funds appropriated to them.

The committee, at an investigative hearing, accused the affected ministries, departments and agencies (MDAs) of shunning invitations to respond to audit queries contained in the Auditor-General for the Federation’s annual reports for 2020, 2021 and 2022.

The affected MDAs include the Federal Housing Authority (FHA), the Federal Ministry of Housing and Urban Development, the Federal Ministry of Women Affairs and Social Development, the National Business and Technical Examinations Board (NABTEB), and the Nigerian Meteorological Agency (NiMet).

Others are Federal University of Gashua; Federal Polytechnic, Ede; Federal Polytechnic, Offa; Federal Medical Centre, Owerri; Federal Medical Centre, Makurdi; Federal Medical Centre, Bida; Federal Medical Centre, Birnin Kebbi; Federal Medical Centre, Katsina; Federal Government College, Kwali; Federal Government Boys’ College, Garki, Abuja; Federal Government College, Rubochi; Federal College of Land Resources Technology, Owerri; Council for the Regulation of Freight Forwarding in Nigeria; and the FCT Secondary Education Board.

The PAC chairman, Mr Bamidele Salam, while speaking on the decision of the committee to recommend a zero budget for the defaulting MDAs, stated that the National Assembly should not continue to appropriate public funds to institutions that disregard accountability mechanisms.

“Public funds are held in trust for the Nigerian people. Any agency that fails to account for previous allocations, refuses to submit audited accounts, or ignores legislative summons cannot, in good conscience, expect fresh budgetary provisions. Accountability is not optional; it is a constitutional obligation,” he said.

The panel maintained that its recommendation for a zero budget for the affected MDAs is aimed at restoring fiscal discipline and strengthening transparency across federal institutions and conforms with extant financial regulations and the oversight powers of the parliament.

-

Feature/OPED6 years ago

Feature/OPED6 years agoDavos was Different this year

-

Travel/Tourism10 years ago

Lagos Seals Western Lodge Hotel In Ikorodu

-

Showbiz3 years ago

Showbiz3 years agoEstranged Lover Releases Videos of Empress Njamah Bathing

-

Banking8 years ago

Banking8 years agoSort Codes of GTBank Branches in Nigeria

-

Economy3 years ago

Economy3 years agoSubsidy Removal: CNG at N130 Per Litre Cheaper Than Petrol—IPMAN

-

Banking3 years ago

Banking3 years agoSort Codes of UBA Branches in Nigeria

-

Banking3 years ago

Banking3 years agoFirst Bank Announces Planned Downtime

-

Sports3 years ago

Sports3 years agoHighest Paid Nigerian Footballer – How Much Do Nigerian Footballers Earn