Economy

One-Year Treasury Bills Yield Drop to 15.21%

By Dipo Olowookere

Yields of treasury bills at the secondary market in Nigeria moved in different directions for most of the maturities monitored during Friday’s trading session.

Business Post reports traders yesterday were cautious at the market as they chew outcome of the previous day’s OMO sale by the Central Bank of Nigeria (CBN), while they kept an eye on the Monetary Policy Committee (MPC) meeting of the apex bank, where the benchmark interest rate was kept unchanged at 13.5 percent despite the inflation rate easing to 11.02 percent in August 2019, according to data released by the National Bureau of Statistics (NBS) on Tuesday.

At the close of business on Friday, the average yields of treasury bills at the secondary market settled at 13.26 percent after appreciating by 0.02 percent.

Of the four tenors tracked yesterday, yields of two of the maturities closed positive, while the two others ended negative.

Yield on the one-month instrument appreciated by 0.22 percent to close at 12.50 percent against 12.28 percent it finished in the previous trading day.

In the same vein, yield on the six-month debt instrument went up by 0.17 percent to settle at 13.29 percent in contrast to 13.12 percent it closed on Thursday.

However, yield on the three-month tenor fell on Friday by 0.21 percent to close at 12.03 percent compared with 12.24 percent it previously ended, while yield on the 12-month maturity declined by 0.10 percent to finish at 15.21 percent versus 15.30 percent it settled in the previous session.

Economy

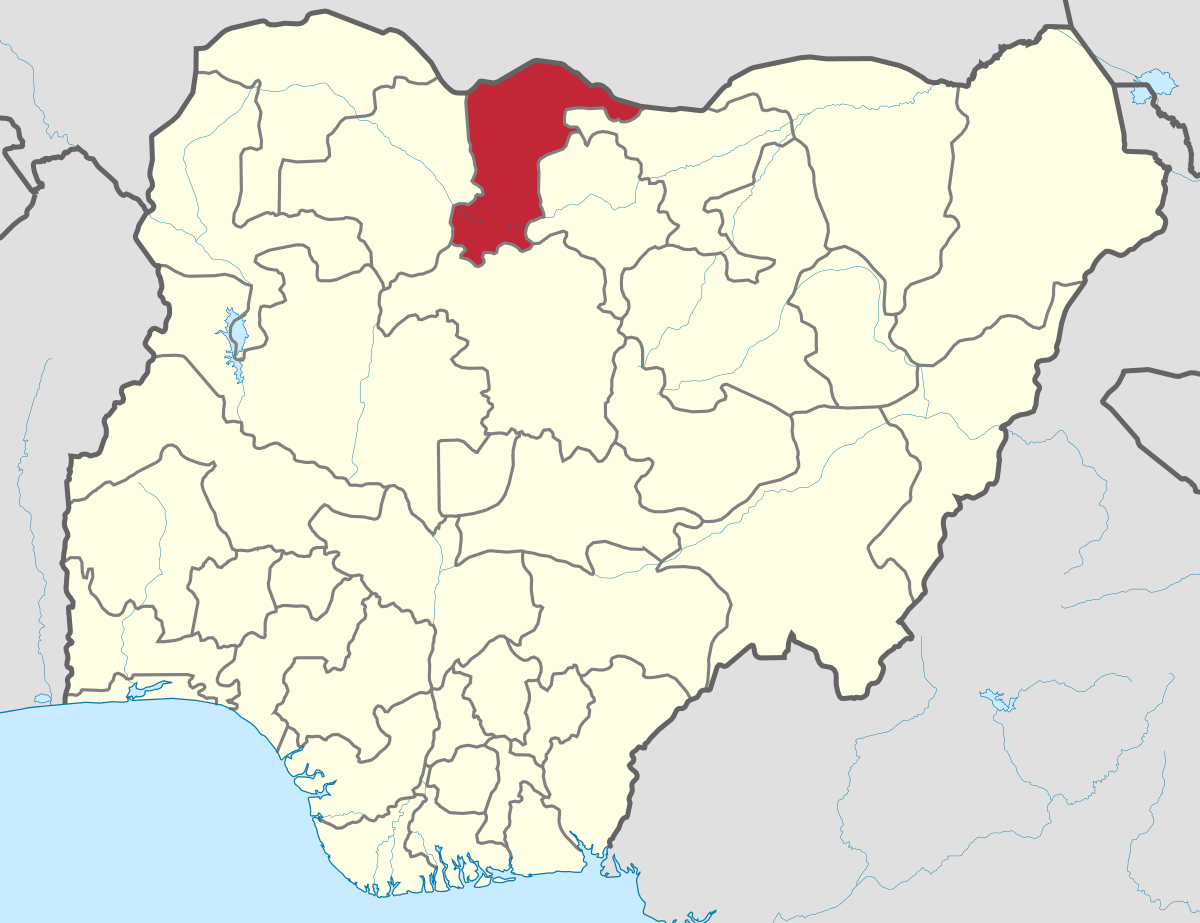

Katsina Provides Additional N500m for Women-owned Businesses

By Modupe Gbadeyanka

The Katsina State government has offered additional N500 million to support women-owned businesses in the state as part of efforts to boost economic activities.

Governor Dikko Umaru Radda announced this at the Women of Influence and Investment Summit hosted by the Katsina Inner Wheel Development Initiative (KIWDI), in partnership with Access Bank Plc.

The event brought together women entrepreneurs, investors, policymakers, and development partners to advance women’s economic empowerment in the state.

The summit, themed Where Influence Meets Investment, focused on positioning women as key drivers of enterprise, leadership, and inclusive growth. It also highlighted the growing collaboration between Access Bank and the Katsina State Government on financial inclusion and SME development.

Mr Radda noted that investing in women was critical to building a productive and sustainable economy.

In her welcome address, the founder of KIWDI, Ms Amina Zayyana, said the summit was designed to connect women to opportunities, training, finance, and markets, stressing that when women-led businesses grow, families and communities benefit.

On her part, the Group Head of Women Banking at Access Bank, Mrs Nene Kunle-Ogunlusi, said the lender was proud to partner with Katsina State and KIWDI in advancing women’s economic participation.

“At Access Bank, we are committed to moving women from potential to prosperity. Through our Women Banking proposition and the ‘W’ Initiative, we provide access to finance, capacity building, and market linkages that help women start, stabilise, and scale their businesses,” she said.

She noted that the W Initiative, launched in 2014, is Access Bank’s flagship women- focused platform, designed to meet the real needs of women entrepreneurs and professionals across Nigeria and Africa.

“Our partnership with Katsina State goes beyond banking. It is about supporting economic empowerment, SME growth, and financial inclusion, especially for women,” she added.

Mrs Kunle-Ogunlusi noted that Access Bank was proud to participate not just as a financial institution, but as a long-term partner in women’s economic advancement across Nigeria and Africa.

“At Access Bank, we made a deliberate decision to change that, not with charity, but with strategy. Not with sympathy, but with solutions. The W Initiative, which was launched in 2014, is Access Bank’s flagship women-focused proposition, created to respond to the real needs of women,” she said.

The banker disclosed that through the W Initiative, the bank has disbursed over N314 billion in loans to women, supporting over 3.6 million female loan beneficiaries, and helping women-owned businesses start, stabilise, and scale up.

Economy

2026 Budget: Reps Threaten Zero Allocation for SON, NAICOM, CAC, Others

By Adedapo Adesanya

The House of Representatives Public Accounts Committee (PAC) has recommended zero allocation for the Standards Organisation of Nigeria (SON), the National Insurance Commission (NAICOM), and the Corporate Affairs Commission (CAC), among others, in the 2026 budget for allegedly failing to account for public funds appropriated to them.

The committee, at an investigative hearing, accused the affected ministries, departments and agencies (MDAs) of shunning invitations to respond to audit queries contained in the Auditor-General for the Federation’s annual reports for 2020, 2021 and 2022.

The affected MDAs include the Federal Housing Authority (FHA), the Federal Ministry of Housing and Urban Development, the Federal Ministry of Women Affairs and Social Development, the National Business and Technical Examinations Board (NABTEB), and the Nigerian Meteorological Agency (NiMet).

Others are Federal University of Gashua; Federal Polytechnic, Ede; Federal Polytechnic, Offa; Federal Medical Centre, Owerri; Federal Medical Centre, Makurdi; Federal Medical Centre, Bida; Federal Medical Centre, Birnin Kebbi; Federal Medical Centre, Katsina; Federal Government College, Kwali; Federal Government Boys’ College, Garki, Abuja; Federal Government College, Rubochi; Federal College of Land Resources Technology, Owerri; Council for the Regulation of Freight Forwarding in Nigeria; and the FCT Secondary Education Board.

The PAC chairman, Mr Bamidele Salam, while speaking on the decision of the committee to recommend a zero budget for the defaulting MDAs, stated that the National Assembly should not continue to appropriate public funds to institutions that disregard accountability mechanisms.

“Public funds are held in trust for the Nigerian people. Any agency that fails to account for previous allocations, refuses to submit audited accounts, or ignores legislative summons cannot, in good conscience, expect fresh budgetary provisions. Accountability is not optional; it is a constitutional obligation,” he said.

The panel maintained that its recommendation for a zero budget for the affected MDAs is aimed at restoring fiscal discipline and strengthening transparency across federal institutions and conforms with extant financial regulations and the oversight powers of the parliament.

Economy

SEC, NOA to Sensitize Nigerians to Illegal Investment Schemes

By Adedapo Adesanya

The Securities and Exchange Commission (SEC) and the National Orientation Agency (NOA) have partnered to enlighten Nigerians on illegal investment schemes in Nigeria.

The director-general of SEC, Mr Emomotimi Agama, stated this during a meeting with his NOA counterpart, Mr Lanre Issa-Onilu, in Abuja on Thursday, according to a statement from SEC.

Mr Agama said the capital market is an available tool for national development, but beyond all that, there is a tendency for people to do the wrong things that will lead to the impoverishment of Nigerians.

According to him, these are not supposed to be, but many people fall victim due to a lack of knowledge. He stated that these schemes are springing up daily, and those involved are defrauding Nigerians, as people are always gullible because of the need to survive.

“As a management, we decided to move out to enlighten people; we cannot assume that people know, we need to go out for mass communication, hence this collaboration. It is only by co-operation that we can achieve the purpose of our existence,” he stated.

The SEC DG solicited the co-operation of the NOA to reach Nigerians because of its capacity and vast network of mass media, in a bid to ensure that the message reaches every nook and cranny of the country.

“This collaboration is important because it will go a long way in ensuring that Nigerians are no longer victims of these fraudulent schemes. We appreciate that you value this country, and we value the work that you do,” he added.

On his part, Mr Issa-Onilu commended the SEC for the capital market’s achievements in recent times, adding that the commission has not been celebrated enough.

“We commend you and thank you on behalf of the country, but most Nigerians are not aware of the opportunities in the capital market. An ignorant society will fall victim to many things that are avoidable. It is our responsibility to enlighten people to make the right decisions.

“We request that you provide information on what you do to enable us to propagate them. Our primary assignment is to serve all government institutions as the communications arm. We do a lot of enlightenment in places like the religious houses, motor parks, town halls, among others.”

Mr Issa-Onilu said the NOA engages in civic education to create the right values that will help most Nigerians be better citizens, saying that “many Nigerians are deficient in good behaviour. Both the Ponzi scheme promoters and those who patronise them are suffering from the wrong attitude and values.

“We have to encourage people to have the right attitude so they do not fall victim to Ponzi schemes. We have created a lot of platforms to interact with Nigerians.”

-

Feature/OPED6 years ago

Feature/OPED6 years agoDavos was Different this year

-

Travel/Tourism10 years ago

Lagos Seals Western Lodge Hotel In Ikorodu

-

Showbiz3 years ago

Showbiz3 years agoEstranged Lover Releases Videos of Empress Njamah Bathing

-

Banking8 years ago

Banking8 years agoSort Codes of GTBank Branches in Nigeria

-

Economy3 years ago

Economy3 years agoSubsidy Removal: CNG at N130 Per Litre Cheaper Than Petrol—IPMAN

-

Banking3 years ago

Banking3 years agoSort Codes of UBA Branches in Nigeria

-

Banking3 years ago

Banking3 years agoFirst Bank Announces Planned Downtime

-

Sports3 years ago

Sports3 years agoHighest Paid Nigerian Footballer – How Much Do Nigerian Footballers Earn