Economy

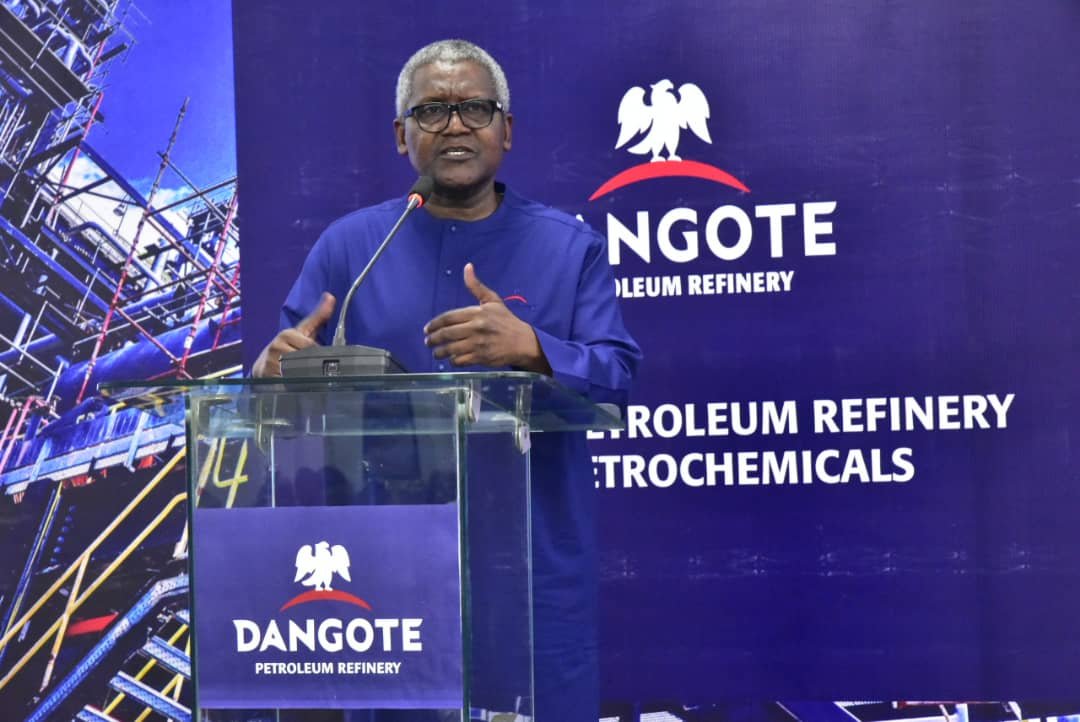

Dangote Refinery to be Ready Q1 2022, to Get Crude Oil in Naira

**Gets N100bn from CBN

By Adedapo Adesanya

The Central Bank of Nigeria (CBN) has supported projects undertaken by Nigerian and Africa’s richest person, Mr Alike Dangote, with N100 billion.

The Governor of the CBN, Mr Godwin Emefiele, disclosed this on Saturday when he inspected the sites of Dangote Refinery, Petrochemicals Complex Fertiliser Plant and Subsea Gas Pipeline at Ibeju Lekki, Lagos.

He explained that the intervention was to support Nigerian business. He further said that the first shipment of Urea from the Dangote Fertiliser Plant would begin in March to help boost agriculture in the country.

In addition, the nation’s chief bank disclosed that arrangements have been made to enable the Dangote Refinery to sell refined crude to Nigeria in Naira when it commences production.

The CBN Governor noted that the $15 billion projects being constructed by the Dangote Group would save Nigeria from expending about 41 per cent of its foreign exchange on the importation of petroleum products.

Mr Emefiele said, ”Based on agreement and discussions with the Nigerian National Petroleum Corporation (NNPC) and the oil companies, the Dangote Refinery can buy its crude in Naira, refine it, and produce it for Nigerians’ use in Naira.

“That is the element where foreign exchange is saved for the country becomes very clear.

“We are also very optimistic that by refining this product here in Nigeria, all those costs associated with either demurrage from import, costs associated with freight will be totally eliminated.

“This will make the price of our petroleum products cheaper in Naira.

“If we are lucky that what the refinery produces is more than we need locally you will see Nigerian businessmen buying small vessels to take them to our West African neighbours to sell to them in Naira.

“This will increase our volume in Naira and help to push it into the Economic Community of West African States as a currency,” Mr Emefiele added.

The head of the banking sector regulator expressed optimism that the refinery would be completed by the first quarter of 2022, adding that this would put an end to the issue of petrol subsidy in the country.

“I am saying that by this time next year, our cost of import of petroleum products for petrochemicals or fertiliser will be able to save that which will save Nigeria’s reserve.

“It will help us so that we can begin to focus on more important items that we cannot produce in Nigeria today,” Mr Emefiele noted.

On his part, Mr Dangote said that the fertiliser and petrochemicals plants were capable of generating $2.5 billion annually while the refinery would serve Nigeria and other countries across the world.

He said the projects would create jobs for Nigerians and build their capacity in critical areas of the oil and gas industry.

Mr Dangote thanked President Muhammadu Buhari and the CBN governor for their support toward the completion of the projects.

He said: “I will like to thank the president personally for helping us and assisting us in making sure that we are now back on track.

“Mr President personally wrote a letter to the president of China and asked them to bring the expatriates that we don’t have so that we can continue work.

“During the coronavirus, you will remember that we had one or two cases when it started and everybody ran away from the site but right now we are beginning to bring people back and we have about 30,000 people now.

“The good part of it is that we have learnt a lot also and there are a lot of Nigerians that just need small training and they are doing extremely well.

”So now we only need a small number of people coming from abroad just to give that training.”

He used the opportunity to call for the speedy passage of the Petroleum Industry Bill (PIB) currently before the National Assembly to maximise the opportunities in the Nigerian oil and gas sector.

Economy

Customs Street Chalks up 0.12% on Santa Claus Rally

By Dipo Olowookere

The Nigerian Exchange (NGX) Limited witnessed Santa Claus rally on Wednesday after it closed higher by 0.12 per cent.

Strong demand for Nigerian stocks lifted the All-Share Index (ASI) by 185.70 points during the pre-Christmas trading session to 153,539.83 points from 153,354.13 points.

In the same vein, the market capitalisation expanded at midweek by N118 billion to N97.890 trillion from the preceding day’s N97.772 trillion.

Investor sentiment on Customs Street remained bullish after closing with 36 appreciating equities and 22 depreciating equities, indicating a positive market breadth index.

Guinness Nigeria chalked up 9.98 per cent to trade at N318.60, Austin Laz improved by 9.97 per cent to N3.20, International Breweries expanded by 9.85 per cent to N14.50, Transcorp Hotels rose by 9.83 per cent to N170.90, and Aluminium Extrusion grew by 9.73 per cent to N16.35.

On the flip side, Legend Internet lost 9.26 per cent to close at N4.90, AXA Mansard shrank by 7.14 per cent to N13.00, Jaiz Bank declined by 5.45 per cent to N4.51, MTN Nigeria weakened by 5.21 per cent to N504.00, and NEM Insurance crashed by 4.74 per cent to N24.10.

Yesterday, a total of 1.8 billion shares valued at N30.1 billion exchanged hands in 19,372 deals versus the 677.4 billion shares worth N20.8 billion traded in 27,589 deals in the previous session, implying a slump in the number of deals by 29.78 per cent, and a surge in the trading volume and value by 165.72 per cent and 44.71 per cent apiece.

Abbey Mortgage Bank was the most active equity for the day after it sold 1.1 billion units worth N7.1 billion, Sterling Holdings traded 127.1 million units valued at N895.9 million, Custodian Investment exchanged 115.0 million units for N4.5 billion, First Holdco transacted 40.9 million units valued at N2.2 billion, and Access Holdings traded 38.2 million units worth N783.3 million.

Economy

Yuletide: Rite Foods Reiterates Commitment to Quality, Innovation

By Adedapo Adesanya

Nigerian food and beverage company, Rite Foods Limited, has extended warm Yuletide greetings to Nigerians as families and communities worldwide come together to celebrate the Christmas season and usher in a new year filled with hope and renewed possibilities.

In a statement, Rite Foods encouraged consumers to savour these special occasions with its wide range of quality brands, including the 13 variants of Bigi Carbonated Soft Drinks, premium Bigi Table Water, Sosa Fruit Drink in its refreshing flavours, the Fearless Energy Drink, and its tasty sausage rolls — all produced in a world-class facility with modern technology and global best practices.

Speaking on the season, the Managing Director of Rite Foods Limited, Mr Seleem Adegunwa, said the company remains deeply committed to enriching the lives of consumers beyond refreshment. According to him, the Yuletide period underscores the values of generosity, unity, and gratitude, which resonate strongly with the company’s philosophy.

“Christmas is a season that reminds us of the importance of giving, togetherness, and gratitude. At Rite Foods, we are thankful for the continued trust of Nigerians in our brands. This season strengthens our resolve to consistently deliver quality products that bring joy to everyday moments while contributing positively to society,” Mr Adegunwa stated.

He noted that the company’s steady progress in brand acceptance, operational excellence, and responsible business practices reflects a culture of continuous improvement, innovation, and responsiveness to consumer needs. These efforts, he said, have further strengthened Rite Foods’ position as a proudly Nigerian brand with growing relevance and impact across the country.

Mr Adegunwa reaffirmed that Rite Foods will continue to invest in research and development, efficient production processes, and initiatives that support communities, while maintaining quality standards across its product portfolio.

“As the year comes to a close, Rite Foods Limited wishes Nigerians a joyful Christmas celebration and a prosperous New Year filled with peace, progress, and shared success.”

Economy

Naira Appreciates to N1,443/$1 at Official FX Market

By Adedapo Adesanya

The Naira closed the pre-Christmas trading day positive after it gained N6.61 or 0.46 per cent against the US Dollar in the Nigerian Autonomous Foreign Exchange Market (NAFEM) on Wednesday, December 24, trading at N1,443.38/$1 compared with the previous day’s N1,449.99/$1.

Equally, the Naira appreciated against the Pound Sterling in the same market segment by N1.30 to close at N1,949.57/£1 versus Tuesday’s closing price of N1,956.03/£1 and gained N2.94 on the Euro to finish at N1,701.31/€1 compared with the preceding day’s N1,707.65/€1.

At the parallel market, the local currency maintained stability against the greenback yesterday at N1,485/$1 and also traded flat at the GTBank forex counter at N1,465/$1.

Further support came as the Central Bank of Nigeria (CBN) funded international payments with additional $150 million sales to banks and authorised dealers at the official window.

This helped eased pressure on the local currency, reflecting a steep increase in imports. Market participants saw a sequence of exchange rate swings amidst limited FX inflows.

Last week, the apex bank led the pack in terms of FX supply into the market as total inflows fell by about 50 per cent week on week from $1.46 billion in the previous week.

Foreign portfolio investors’ inflows ranked behind exporters and the CBN supply, but there was support from non-bank corporate Dollar volume.

As for the cryptocurrency market, it witnessed a slight recovery as tokens struggled to attract either risk-on enthusiasm or defensive flows.

The inertia follows a sharp reversal earlier in the quarter. A heavy selloff in October pulled Bitcoin and other coins down from record levels, leaving BTC roughly down by 30 per cent since that period and on track for its weakest quarterly performance since the second quarter of 2022. But on Wednesday, its value went up by 0.9 per cent to $87,727.35.

Further, Ripple (XRP) appreciated by 1.7 per cent to $1.87, Cardano (ADA) expanded by 1.2 per cent to $0.3602, Dogecoin (DOGE) grew by 1.1 per cent to $0.1282, Litecoin (LTC) also increased by 1.1 per cent to $76.57, Solana (SOL) soared by 1.0 per cent to $122.31, Binance Coin (BNB) rose by 0.6 per cent to $842.37, and Ethereum (ETH) added 0.3 per cent to finish at $2,938.83, while the US Dollar Tether (USDT) and the US Dollar Coin (USDC) remained unchanged at $1.00 each.

-

Feature/OPED6 years ago

Feature/OPED6 years agoDavos was Different this year

-

Travel/Tourism9 years ago

Lagos Seals Western Lodge Hotel In Ikorodu

-

Showbiz3 years ago

Showbiz3 years agoEstranged Lover Releases Videos of Empress Njamah Bathing

-

Banking8 years ago

Banking8 years agoSort Codes of GTBank Branches in Nigeria

-

Economy3 years ago

Economy3 years agoSubsidy Removal: CNG at N130 Per Litre Cheaper Than Petrol—IPMAN

-

Banking3 years ago

Banking3 years agoFirst Bank Announces Planned Downtime

-

Banking3 years ago

Banking3 years agoSort Codes of UBA Branches in Nigeria

-

Sports3 years ago

Sports3 years agoHighest Paid Nigerian Footballer – How Much Do Nigerian Footballers Earn