Economy

How to Invest in Stocks in Nigeria: Guide for Beginners

One of the most efficient and successful ways of building wealth over a long period of time is through investing in stocks.

All the most successful people have dedicated themselves to investing. One of the prime examples of stock investors is Warren Buffet.

Investing in stock allows you to invest your money in a company and reap the benefits of the company’s growth through the years.

The biggest misconception that exists or existed is that there’s a barrier to entry due to large funds being involved in the stock market. But it’s not at all true. With the technology and facilities that exist today, you can invest as little as N500 to start.

As an investor who is looking to invest in stocks, you need to start by depositing money into an online investment account. From there onwards, you can find yourself a suitable investment broker and start investing in stocks.

How do you invest in stocks?

You always hear some of your friends say that they have started investing in stocks, but you are unaware of how to do it? Or what is it all about?

In this guide, we will help you clearly understand all the steps and procedures needed to start investing in stocks or trading them.

- Choose how you want to invest

There are so many different ways to start investing in stocks, but the first and foremost question you need to answer is that whether you need help with your investments or whether you are aware of what you are doing and you know which stocks to buy.

If you are someone who knows what stocks they want to buy, then it is best that you start off by opening an individual account with a stockbroker and start investing in stocks as per your investment strategy.

If you are someone who needs help with your investments, then it’s ideal to invest in mutual funds or ETFs. Mutual funds are managed by qualified professionals and there are many funds with different investment strategies. Some invest in gold, some in equities etc. and you can choose one based on which markets you want to invest in. Mutual funds are usually safe since they are regulated and managed by professionals.

With a mutual fund, you don’t need to do any research on your own. There is someone who is willing to do all the work for you for a small fee. Everything is taken care of and you needn’t do much apart from providing funds for investments.

- Create your investment plan

Before you begin investing in stocks, the question you will need to ask yourself is why are you interested to invest? Is it because you want to make quick money? Or you want to have a secure source of income for the long term?

As an investor, you need to decide whether you are looking at short term or long-term gains. There’s no doubt that you can make money with short term as well as long-term investing but long-term investing mitigates risks like short-term market volatility and gives you a more secure investment.

Let me explain short-term and long-term through an example. Due to COVID-19, the markets fell by as high as 40 per cent, but within a few months, the market recovered and has since then recovered all the losses.

So, if you were a short-term investor buying a stock, you would likely have lost a lot of money due to market crash had you not held on until the market regained. But if you were a long-term investor, these market conditions wouldn’t have affected your investments a lot.

Long term investors generally focus on value investing and select companies they want to invest in for many years. While short-term investors focus on trading and making money from market movements.

So, set your goals accordingly, don’t expect your money to double over a day or a week, the prices of stocks gradually increase and your wealth gets accumulated over years. This is why you need to be patient and allow market forces to react and drive your prices up. If you have chosen a good company to invest in, then you can be certain that the prices will go up in a few years.

Use a savings and investment compound calculator tool to manage your goals, plan your investments and decide how much you want to save or gain in 10 years.

If you made a small investment as little as 38,12,500 Naira in S&P 500 Index 30-40 years ago, then would have been a millionaire today. This is what the stock market can do for you.

Here’s an example for you that gives you a rough idea about how much you can earn with a small investment over a long period of time:

If you start with N38,050.00 in a savings account earning a 7 per cent interest rate, compounded monthly, and make N3,805.00 deposits on a monthly basis.

After 10 years, your savings account will have grown to N738,897.07 of which N494,650.00 is the total of your beginning balance plus deposits, and N244,247.07 is the total interest earnings.

- Open a trading account

If you are looking to invest in local companies, you can check the Nigerian Exchange (NGX) Limited and choose a stockbroker that will allow you to invest in NGX.

But if you want to invest in international companies that are not listed on the NGX but listed somewhere like New York Stock Exchange (NYSE), then you can choose an online trading platform such as Bamboo, Chaka, Weath.ng etc.

If you are only looking to trade securities i.e., buy or short sell them for the short term, then you can also trade stock CFDs via a Tier-1 licensed forex broker or you can trade stock options via an international broker that accepts Nigerian clients.

As per research by Forex Brokers SA, there are no locally regulated CFD brokers in Nigeria but there are 40+ FSCA regulated South African derivative brokers that accept traders from Nigeria. These brokers offer NASDAQ, American and European stock CFDs.

There are several online platforms in Nigeria that allow you to invest in stocks all around the world, so choose a platform that allows you to invest in a wide variety of stocks and other commodities.

For new investors who are not aware of how the market functions or you are not familiar with the investment process, its highly advisable that you open your account through a Mutual Fund advisor so they can assist you with the entire process and you also will be able to learn and adapt quickly.

Every online platform or stockbroker requires you to complete KYC before you start trading as it’s mandatory. You would normally be asked for your BVN number, ID proof and address proof.

Make sure you provide the correct details and original documents for verification. If there is an error in KYC documents, then there are high chances that you will not be allowed to open your account or likely face issues during withdrawals.

- Decide which stocks do you want to buy

Once you have opened your trading account; you can view all the stocks available on the platform or what the stockbroker offers.

Experienced investors diversify their investments into different stocks and other asset classes like metals, commodities since it is more secure and helps you build a diverse portfolio.

So, avoid investing in just one company, look around the platform and view what other options you might have.

A word of advice to new investors is that don’t invest in every stock you see; you need to understand what the company does and what their business is. After you understand everything about a company and how it is doing, you can further decide to invest in it.

If you are considering investing in a particular company, then you might want to calculate their intrinsic value, which would include analysing the margin of safety, EPS, book value, cash flow and earnings before interest, taxes, depreciation, and amortization (EBITDA).

Once you are aware of all these things, then it will help you make an informed decision.

- Make a budget

The budget is entirely dependent on your lifestyle.

First list all your expenses and take away money for your rent, utilities and groceries and keep it away. The next is to list all your debts and liabilities such as loan repayment, EMI etc.

Once you know what you need for your necessities and liabilities, you will know how much you can spare every month. After this, it will be easy for you to see how much you can invest every month.

One of the biggest mistakes that new investors make is that they will not be able to invest regularly due to other commitments.

So, if you are planning to start investing then make sure that you are regular with your investments. If you make a plan that you will invest N50,000 (approx. $100) every month, no matter what then make sure you do it.

If you feel that there may be an emergency, then save a small amount of money from your income every month so that you can use that fund for emergencies. This way, you needn’t take money from your investments.

If you ensure that a minimum of 40 per cent of your income goes into investments then in 10 years’ time you will definitely start reaping the rewards for years of investment. So, make sure you can invest as much as you can after covering your expenses and liabilities.

There’s a famous saying that if you can’t buy something twice then you can’t afford it. Try cutting down all your expensive wants so you can invest and grow your investments.

A good place for investors with low funds is Exchange Traded Funds (ETF) since the minimum investment requirements are very low.

Warren Buffett once said in his investor letter “The goal of the non-professional should not be to pick winners — neither he nor his “helpers” can do that — but should rather be to own a cross-section of businesses that in the aggregate are bound to do well. A low-cost S&P 500 index fund will achieve this goal.”

- Diversify and manage your portfolio

You can only fully gain from stock market investments over a period of time. Building a diverse portfolio enables you to park your money into more than a single asset class. This is not only safer but it’s less risky than investing all your money into one stock.

If in case the stock that you are invested in crashes, then you lose your entire investment. So, it’s always better to invest in more than one stock. Non-professionals should invest in blue-chip stocks only, or the index fund.

If you are finding it hard to diversify your investments, then invest in a Mutual Fund. Even if you are investing in a mutual fund, then you also need to be absolutely sure about all the costs, fees, expected returns and risks involved with that too.

Another big advantage of building a diverse portfolio is that it will help you fight market volatility without suffering major losses. Since your investments are tied into different stocks, assets, it will lower the risks that come with markets.

You should look at stock market investing as a long-term process rather than checking daily returns and let your investments handle themselves. You should just wait for your investments to mature.

Conclusion

Investing in stocks is a good way to building long term wealth but it requires you to be patient and regular with your investments. If you are looking for short term gains then stock market investments aren’t the best option for you.

If you are regular with your investments, it can almost be assured that a good portfolio might even allow you to retire early.

Also, be fully aware of the risks, and don’t invest money that you cannot afford to lose. Do your full research & invest wisely.

Economy

LIRS Shifts Deadline for Annual Returns Filing to February 7

By Aduragbemi Omiyale

The deadline for filing of employers’ annual tax returns in Lagos State has been extended by one week from February 1 to 7, 2026.

This information was revealed in a statement signed by the Head of Corporate Communications of the Lagos State Internal Revenue Service (LIRS), Mrs Monsurat Amasa-Oyelude.

In the statement issued over the weekend, the chairman of the tax collecting organisation, Mr Ayodele Subair, explained that the statutory deadline for filing of employers’ annual tax returns is January 31, every year, noting that the extension is intended to provide employers with additional time to complete and submit accurate tax returns.

According to him, employers must give priority to the timely filing of their annual returns, noting that compliance should be embedded as a routine business practice.

He also reiterated that electronic filing through the LIRS eTax platform remains the only approved method for submitting annual returns, as manual filings have been completely phased out. Employers are therefore required to file their returns exclusively through the LIRS eTax portal: https://etax.lirs.net.

Describing the platform as secure, user-friendly, and accessible 24/7, Mr Subair advised employers to ensure that the Tax ID (Tax Identification Number) of all employees is correctly captured in their submissions.

Economy

Airtel on Track to List Mobile Money Unit in First Half of 2026—Taldar

By Adedapo Adesanya

The chief executive of Airtel Africa Plc, Mr Sunil Kumar Taldar, has disclosed that the company is still on track to list its mobile money business, Airtel Money, before the end of June 2026.

Recall that Business Post reported in March 2024 that the mobile network operator was considering selling the shares of Airtel Money to the public through the IPO vehicle in a transaction expected to raise about $4 billion.

The firm had been in talks with possible advisors for a planned listing of the shares from the initial public offer on a stock exchange with some options including London, the United Arab Emirates (UAE), or Europe.

However, so far no final decisions have been made regarding the timing, location, or scale of the IPO.

In September 2025, the telco reportedly picked Citigroup Incorporated as advisors for the planned IPO which will see Airtel Money become a standalone entity before it can attain the prestige of trading on a stock exchange.

Mr Taldar, noted that metrics continued to show improvements ahead of the listing with its customer base hitting 52 million, compared to around 44.6 million users it had as of June 2025.

He added that the subsidiary processed over $210 billion in a year, according to the company’s nine-month financial results released on Friday.

“Our push to enhance financial inclusion across the continent continues to gain momentum with our Mobile Money customer base expanding to 52 million, surpassing the 50 million milestone. Annualised total processed value of over $210 billion in Q3’26 underscores the depth of our merchants, agents, and partner ecosystem and remains a key player in driving improved access to financial services across Africa.

“We remain on track for the listing of Airtel Money in the first half of 2026,” Mr Taldar said.

Estimating Airtel Money at $4 billion is higher than its valuation of $2.65 billion in 2021. In 2021, Airtel Money received significant investments, including $200 million from TPG Incorporated at a valuation of $2.65 billion and $100 million from Mastercard. Later that same year, an affiliate of Qatar’s sovereign wealth fund also acquired an undisclosed stake in the unit.

The mobile money sector in Africa is expanding rapidly, driven by a young population increasingly adopting technology for financial services, making the continent a key market for fintech companies.

Economy

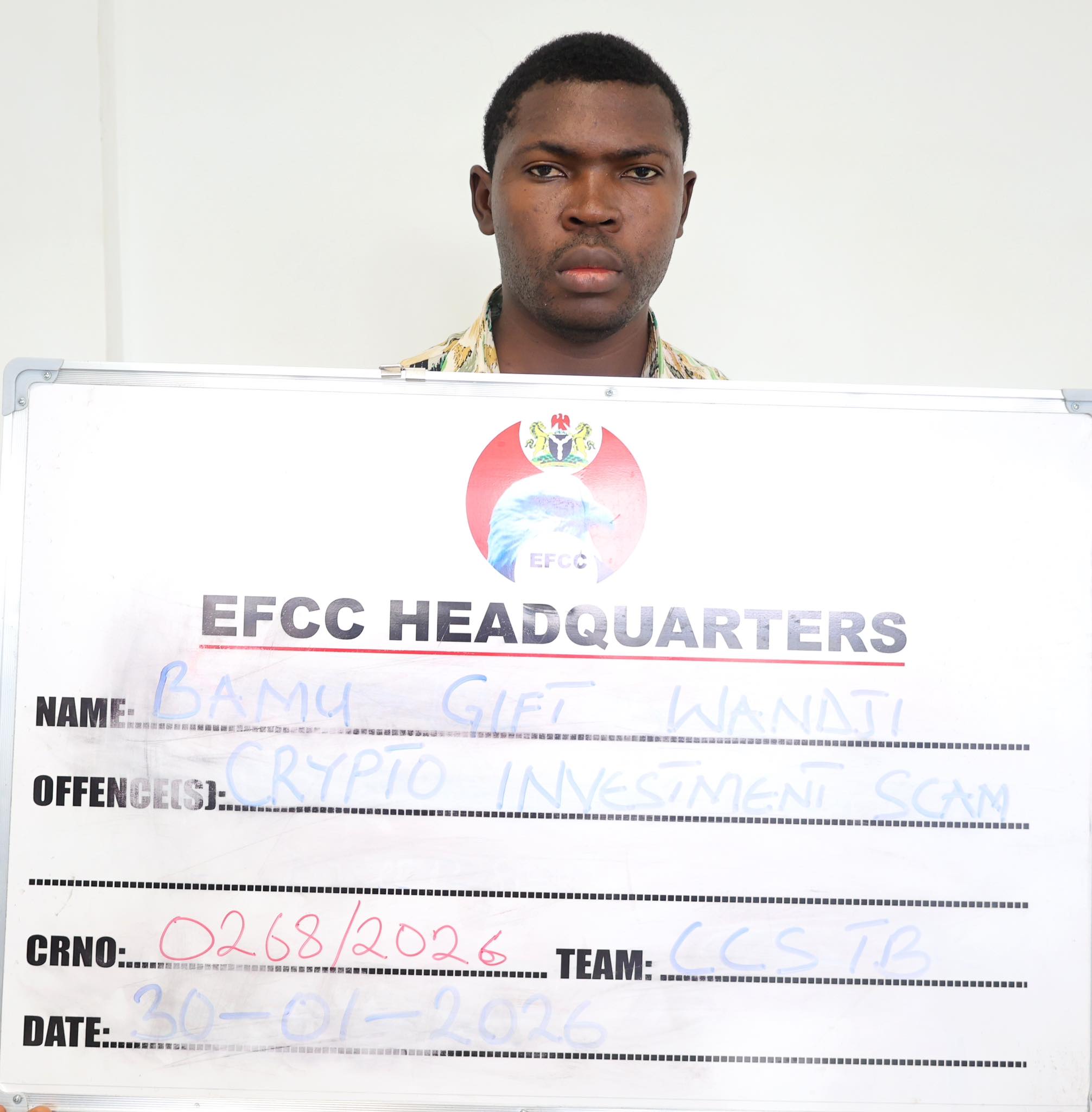

Crypto Investor Bamu Gift Wandji of Polyfarm in EFCC Custody

By Dipo Olowookere

A cryptocurrency investor and owner of Polyfarm, Mr Bamu Gift Wandji, is currently cooling off in the custody of the Economic and Financial Crimes Commission (EFCC).

He was handed over to the anti-money laundering agency by the Nigerian Security and Civil Defence Corps (NSCDC) on Friday, January 30, 2026, after his arrest on Monday, January 12, 2026.

A statement from the EFCC yesterday disclosed that the suspect was apprehended by the NSCDC in Gwagwalada, Abuja for running an investment scheme without the authorisation of the Securities and Exchange Commission (SEC), which is the apex capital market regulator in Nigeria.

It was claimed that Mr Wandji created a fraudulent crypto investment platform called Polyfarm, where he allegedly lured innocent Nigerians to invest in Polygon, a crypto token that attracts high returns.

Investigation further revealed that he also deceived the public that his project, Polyfarm, has its native token called “polyfarm coin” which he sold to the public.

In his bid to promote the scheme, the suspect posted about this on social media platforms, including WhatsApp, X (formally Twitter) and Telegram. He also conducted seminars in some major cities in Nigeria including Kaduna, Lagos, Port Harcourt and Abuja where he described the scheme as a life-changing programme.

Further investigation revealed that in October, 2025, subscribers who could not access their funds were informed by the suspect that the site was attacked by Lazarus group, a cyber attacking group linked to North Korea.

Further investigations showed that Polyfarm is not registered and not licensed with SEC to carry out crypto transactions in Nigeria. Also, no investment happened with subscribers’ funds and that the suspect used funds paid by subscribers to pay others in the name of profit.

Investigation also revealed that native coin, polyfarm coin was never listed on coin market cap and that the suspect sold worthless coins to the general public.

Contrary to the claim of the suspect that his platform was attacked, EFCC’s investigations revealed that the platform was never attacked or hacked by anyone and that the suspect withdrew investors’ funds and utilized the same for his personal gains.

The EFCC, in the statement, disclosed that Mr Wandji would be charged to court upon conclusion of investigations.

-

Feature/OPED6 years ago

Feature/OPED6 years agoDavos was Different this year

-

Travel/Tourism9 years ago

Lagos Seals Western Lodge Hotel In Ikorodu

-

Showbiz3 years ago

Showbiz3 years agoEstranged Lover Releases Videos of Empress Njamah Bathing

-

Banking8 years ago

Banking8 years agoSort Codes of GTBank Branches in Nigeria

-

Economy3 years ago

Economy3 years agoSubsidy Removal: CNG at N130 Per Litre Cheaper Than Petrol—IPMAN

-

Banking3 years ago

Banking3 years agoSort Codes of UBA Branches in Nigeria

-

Banking3 years ago

Banking3 years agoFirst Bank Announces Planned Downtime

-

Sports3 years ago

Sports3 years agoHighest Paid Nigerian Footballer – How Much Do Nigerian Footballers Earn