Auto

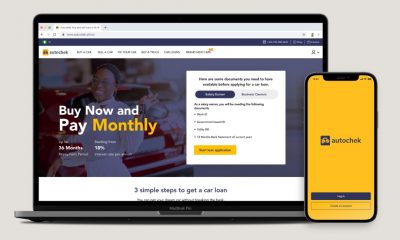

Autochek Secures $13.1m Seed Fund to Facilitate Auto Financing

By Adedapo Adesanya

Autochek, the automotive technology company facilitating auto financing across Africa, has secured $13.1 million in seed funding.

Co-led by follow-on investors, TLcom Capital and 4DX Ventures, the round also included participation from existing investors, Golden Palm Investments, Enza Capital, Lateral Capital as well as new participants, ASK Capital and Mobility 54 Investment SAS (the venture capital arm of Toyota Tsusho Corporation/CFAO Group).

With the new funding secured just under a year after Autochek’s $3.4mn pre-seed raise, the round was led by Autochek’s lead investors – TLcom Capital and 4DX Ventures.

As part of Autochek’s growth strategy, the capital will be deployed to bolster its core auto loan processing platform and deepen its footprint in West Africa, starting with its recent entry into Cote d’Ivoire.

Additionally, the company is rapidly expanding its footprint across East Africa, following its recent acquisition of Cheki Kenya and Cheki Uganda. As part of the investment by Mobility54, Autochek will be leveraging Toyota Tsusho’s vast retail network across 54 African countries to further deepen its expansion.

Launched in October 2020 and operational across East and West Africa in 5 countries – Nigeria, Kenya, Ghana, Uganda and Cote d’Ivoire; Autochek combines technology, underpinned by data analytics to deepen auto finance penetration across the continent.

Powered by its residual value algorithm, Autochek has built in-house digital solutions such as Collateral Management, Dealer Management Systems and a proprietary CRM system for managing stakeholder operations within the ecosystem such as vehicle financing, inspection, valuation, and inventory management.

Since its pre-seed raise in November 2020, the platform has achieved rapid traction across its business, most notably in the area of auto-financing, where the number of processed loan applications rose from just 10 in November to over 46,000 to date.

Autochek has partnered with 70 banks across the continent, including leading regional players such as Access Bank, Ecobank, UBA, Bank of Africa and NCBA Bank.

Since the start of the year, the startup has also achieved several key milestones, including over 1000 dealers on the Autochek network actively using the loan processing solution and over 15,000 certified and financeable vehicles on the Autochek marketplace across its markets. Over the course of the year, Autochek also launched its truck financing platform and, more recently, financing of brand new vehicles.

Speaking on the next phase of Autochek’s rapid growth following its fundraise, Mr Etop Ikpe, Founder and CEO of Autochek, said, “At Autochek, our driving force is to increase financing penetration on the continent; we have been amazed by the market adoption rate and the support from our banking partners in the countries we operate in.

“We stepped into this space knowing we were tackling one of the most significant challenges for Africa’s automotive sector – the lack of a simplified, digital-first financing process. By combining our expertise and networks, we have been able to impact the automotive sector.

“We are extremely delighted with the progress we’ve made in a short amount of time. With this funding and the support of our strategic investors, the entire team at Autochek are dedicated to delivering exceptional service for customers and partners, as well as deploying our technology across Africa.”

On his part, Mr Andreata Muforo, Partner at TLcom, says “Autochek has achieved significant traction in one of Africa’s key verticals and is making impressive progress in bringing transparency and efficiency in this complex and fragmented industry. The foundation of its growth has been the strong leadership of its CEO, Etop Ikpe, a repeat founder in the automotive market whose world-class experience gave us the confidence to initially invest in Autochek in 2020.

“We look forward to the next chapter of Autochek’s growth as it continues to unlock the major upside which has remained dormant in Africa’s automotive sector for decades.”

Auto

LAMATA to Boost Red Line Rail Capacity With 24 New Coaches

By Adedapo Adesanya

The Lagos Metropolitan Area Transport Authority (LAMATA) has announced plans to deploy 24 new coaches to boost the capacity of the Red Line rail by the third quarter of 2026.

In a Wednesday statement signed by its Head of Corporate Communications, LAMATA said it acknowledged recent reports and social media footage highlighting passenger discomfort on the Oyingbo-Agbado train service due to technical issues affecting the air conditioning system.

It noted that the plan to provide the 24 new coaches forms part of its long-term strategy to enhance capacity, comfort and service reliability.

“We sincerely apologise to our valued commuters for the heat and inconvenience experienced during their journey.

“As part of our long-term strategy to enhance capacity, comfort, and service reliability, LAMATA is pleased to announce the expected delivery and operationalisation of additional rolling stock by the third quarter of 2026.

“The new acquisition will comprise three train sets, each with eight coaches, bringing a total of 24 additional coaches to strengthen the existing fleet and improve passenger experience across the Red Line corridor,” the organisation stated.

The statement further revealed that the agency has deployed a technical team to diagnose and resolve the cooling system’s failure to return affected coaches to optimal operating conditions.

“In the immediate term, our technical and engineering teams have been deployed to diagnose and resolve the root cause of the cooling system failure. Restoration works are ongoing, and efforts are being intensified to return the affected coaches to optimal operating condition as swiftly as possible.

“LAMATA remains firmly committed to delivering safe, efficient, and world-class rail services. We continue to take proactive measures to minimise technical disruptions and improve overall service quality.

“We appreciate the patience, understanding, and continued support of the public as we complete these essential repairs. The comfort, safety, and well-being of all passengers remain central to our operations,” the statement concluded.

Auto

inDrive Ranks Second in Ride-Hailing App Downloads Globally

By Modupe Gbadeyanka

A global mobility and urban services platform, inDrive, for the fourth consecutive year, has emerged as second in ride-hailing app downloads in the world.

In its latest report, a leading market intelligence firm, Sensor Tower, also disclosed that the company ranked fourth globally in the travel category for downloads, up from fifth place in 2024, reflecting growing engagement as it continues its transition into a super app.

It was also revealed that inDrive was ranked number one in the travel category by downloads in nine countries, with newcomers to the list including Peru and Pakistan, and placed among the top three most downloaded travel apps in 22 countries.

The chief executive of inDrive, Mr Arsen Tomsky, while commenting on these feats and others, said the continued rise underscores a broader shift toward multi-service platforms that deliver everyday value while remaining closely aligned with local market needs and user expectations.

“Maintaining our position as the world’s second most downloaded ride-hailing app for a fourth consecutive year is a powerful validation of the value inDrive delivers to its users every day.

“This recognition reflects the trust people place in our platform and the continued dedication of our global team.

“As inDrive evolves into a super app, we remain focused on our core principles of fairness, transparency, and user choice, while expanding access to services that make a meaningful difference in people’s daily lives,” Mr Tomsky said.

The latest report highlights that super app ecosystems are becoming a key growth driver for the ride-hailing industry, particularly in emerging markets where users are engaging more frequently and across a broader range of use cases.

The inDrive app – defined by its peer-to-peer pricing model that allows drivers and riders to agree on a fair price mutually – has now been downloaded over 400 million times since its launch. Available in 1,065 cities worldwide, it has facilitated more than 8 billion transactions.

The platform operates across 48 countries, driven by strong global adoption, including growing momentum across Africa and continued growth in Nigeria.

In 2025, inDrive accelerated its transition into a super app, expanding beyond its core ride-hailing offering to offer additional services, including intercity transportation, courier, grocery delivery, and financial services.

By expanding its offering and meeting more of its users’ daily needs, inDrive is driving deeper and more frequent user engagement – an approach that underpins its continued global momentum.

Technology under the hood, including AI and advanced analytics, plays a significant role in supporting this evolution by enabling greater personalization and more seamless user experiences.

From using machine learning to fix mapping gaps and deliver more accurate ETAs, to predictive analytics that anticipate user needs and personalize service offerings, these capabilities drive innovation. In contrast, ensuring users retain complete control over pricing decisions is consistent with inDrive’s commitment to fairness through choice.

Auto

GoCab Receive $45m to Scale Ethical Mobility Financing Platform

By Dipo Olowookere

A funding package of up to $45 million has been secured by a mobility fintech firm, GoCab, to scale its ethical mobility financing platform across emerging markets.

A statement made available to Business Post disclosed that the funds comprise $15 million equity and $30 million debt, with the equity round co-led by E3 Capital and Janngo Capital. Others involved in the transactions were KawiSafi Ventures and Cur8 Capital.

GoCab operates a drive-to-own mobility fintech model that provides credit to gig-economy workers to buy their own car, bike and others in emerging markets.

It offers vehicles in drive-to-own programmes, mobile phone BNPL, motorbike financing for delivery couriers, and other value-added services through a single digital platform powered by proprietary technology.

With this financing support, GoCab plans to expand its operations and fleet, aiming for 10,000 active vehicles and $100 million in annual recurring revenue within the next 24 months.

Across five markets, GoCab now generates over $17 million in Annual Recurring Revenue (ARR) after just 18 months of operations and is on target to reach $50 million by end of 2026 and $100 million in 2027.

The company was established in 2024 by Mr Azamat Sultan and Mr Hendrick Ketchemen to address the limited access to ethical financing and vehicle ownership for gig-economy workers in Africa.

By combining mobility, technology, and inclusive finance, the organization enables drivers and delivery couriers to generate stable income while progressively gaining ownership of their vehicles.

By 2025, GoCab had taken a leading position in several African markets, supporting thousands of drivers and contributing to cleaner, more sustainable urban mobility systems.

“Transforming lives and improving the daily reality of thousands of families is the mission we have set for ourselves. We believe that capital can and must become a powerful force for transformation across Africa and emerging markets,” Mr Ketchemen said.

His counterpart, Mr Sultan, disclosed that, “For us, GoCab is about restoring dignity and opportunity through ownership.

“Across Africa, millions of people are locked out of both mobility and finance. We saw how capital was flowing everywhere except to the people who actually needed it to work.

“This round allows us to scale responsibly expanding access to fair, ethical financing while accelerating the transition to electric mobility, lowering carbon emissions, and building a more inclusive and sustainable future in close alignment with our investors.”

One of the investors, Mr Vladimir Dugin of E3 Capital, said, “The shortage of vehicles and the high cost of transportation remain two of the most pressing challenges across Africa. GoCab is addressing both head-on through a data- and technology-driven platform that expands access to mobility while improving efficiency at scale.

“Its rapidly growing EV fleet lowers costs for riders and drivers alike, while significantly reducing emissions. We are proud to support GoCab as it builds the leading pan-African mobility platform for the future.”

“We are proud to lead GoCab’s $15 million equity round, catalysing over $30 million in debt financing. We were impressed by their vision, their world-class team, and the quality of their execution.

“With this funding, GoCab now has the scale to deploy thousands of productive vehicles, each supporting a full-time income.

“With a clear operational roadmap toward 10,000 active assets and $100 million in recurring revenue, GoCab illustrates how ethical financing can translate into tens of thousands of decent jobs, household resilience, and sustainable growth at scale,” the chairman of Janngo Capital, Fatoumata Bâ, stated.

Also, a partner at KawiSafi Ventures, Mr Marcus Watson, said, “GoCab is building critical infrastructure for climate-smart mobility and the future of work in emerging markets. The combination of disciplined execution, strong unit economics, and a clear impact thesis makes GoCab a compelling platform for sustainable growth.”

-

Feature/OPED6 years ago

Feature/OPED6 years agoDavos was Different this year

-

Travel/Tourism10 years ago

Lagos Seals Western Lodge Hotel In Ikorodu

-

Showbiz3 years ago

Showbiz3 years agoEstranged Lover Releases Videos of Empress Njamah Bathing

-

Banking8 years ago

Banking8 years agoSort Codes of GTBank Branches in Nigeria

-

Economy3 years ago

Economy3 years agoSubsidy Removal: CNG at N130 Per Litre Cheaper Than Petrol—IPMAN

-

Banking3 years ago

Banking3 years agoSort Codes of UBA Branches in Nigeria

-

Banking3 years ago

Banking3 years agoFirst Bank Announces Planned Downtime

-

Sports3 years ago

Sports3 years agoHighest Paid Nigerian Footballer – How Much Do Nigerian Footballers Earn